Answered step by step

Verified Expert Solution

Question

1 Approved Answer

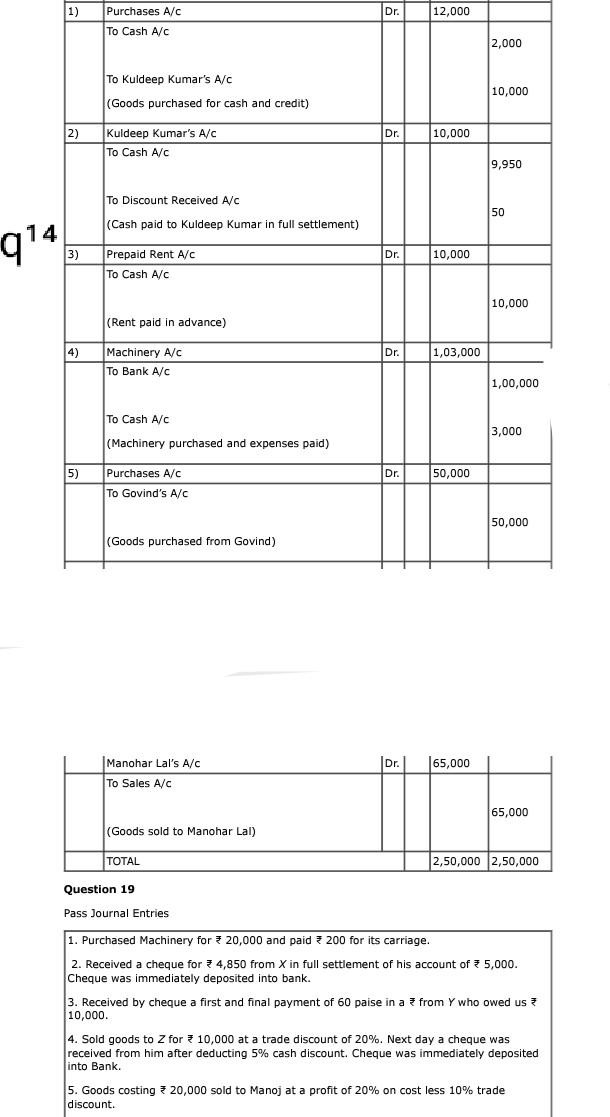

1) Purchases A/C Dr. 12,000 To Cash A/C 2,000 To Kuldeep Kumar's A/C 10,000 (Goods purchased for cash and credit) 2) 2 Dr. 10,000 Kuldeep

1) Purchases A/C Dr. 12,000 To Cash A/C 2,000 To Kuldeep Kumar's A/C 10,000 (Goods purchased for cash and credit) 2) 2 Dr. 10,000 Kuldeep Kumar's A/C To Cash A/C C 9,950 To Discount Received A/C 50 (Cash paid to Kuldeep Kumar in full settlement) 914 4 3) Dr. 10,000 Prepaid Rent A/C To Cash A/C 10,000 (Rent paid in advance) ( 4) Dr. 1,03,000 Machinery A/C To Bank A/C 1,00,000 1,00,00 To Cash A/C 3,000 (Machinery purchased and expenses paid) 5) Dr. 50,000 Purchases A/C To Govind's A/C 50,000 (Goods purchased from Govind) Dr. 165,000 Manohar Lal's A/C To Sales A/C AC 65,000 (Goods sold to Manohar Lal) TOTAL 2,50,000 2,50,000 Question 19 Pass Journal Entries 1. Purchased Machinery for 20,000 and paid 200 for its carriage. 2. Received a cheque for 4,850 from X in full settlement of his account of 5,000. Cheque was immediately deposited into bank. 3. Received by cheque a first and final payment of 60 paise in a 3 from Y who owed us 3 10,000. 4. Sold goods to Z for 10,000 at a trade discount of 20%. Next day a cheque was received from him after deducting 5% cash discount Cheque was immediately deposited into Bank. 5. Goods costing 20,000 sold to Manoj at a profit of 20% on cost less 10% trade discount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started