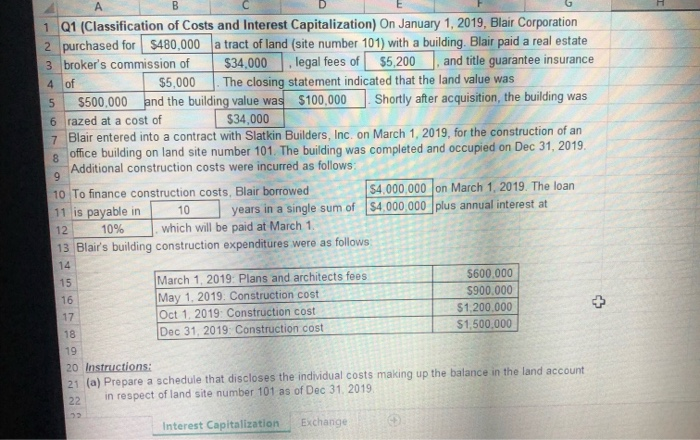

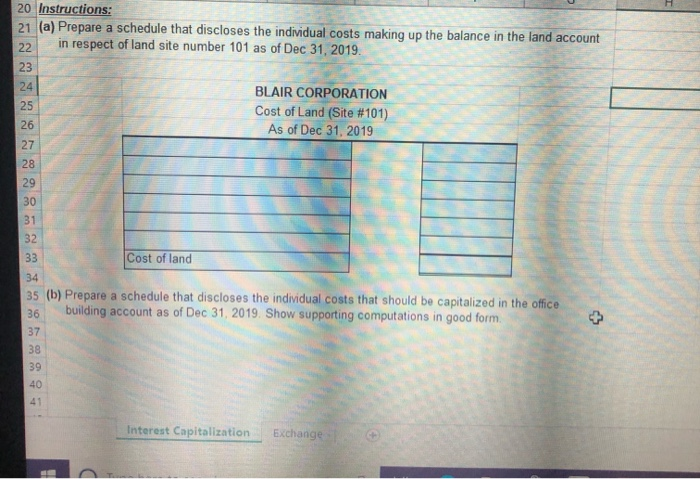

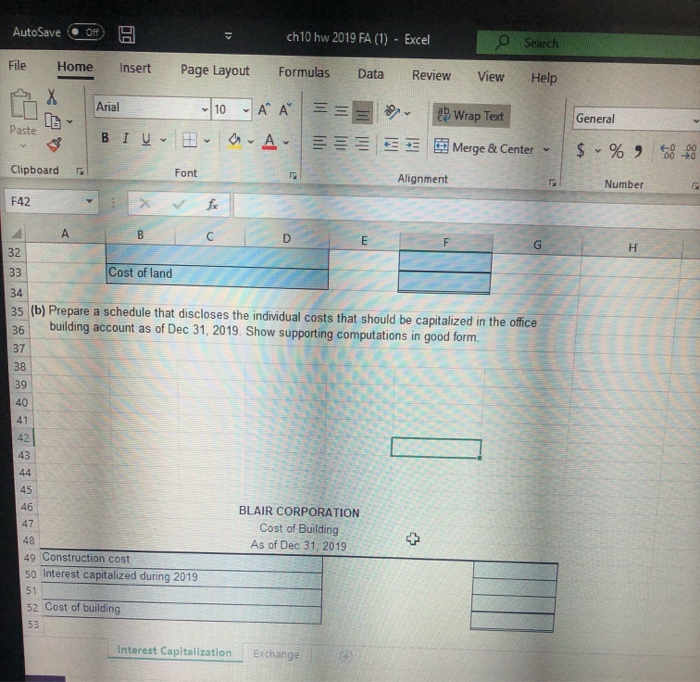

1 Q1 (Classification of Costs and Interest Capitalization) On January 1, 2019, Blair Corporation 2 purchased for $480,000 a tract of land (site number 101) with a building. Blair paid a real estate 3 broker's commission of $34.000 . legal fees of $5,200 and title guarantee insurance 4 of $5,000 The closing statement indicated that the land value was 5 $500,000 and the building value was $100,000 Shortly after acquisition, the building was 6 razed at a cost of $34.000 7 Blair entered into a contract with Slatkin Builders, Inc. on March 1, 2019, for the construction of an 8 office building on land site number 101. The building was completed and occupied on Dec 31, 2019 Additional construction costs were incurred as follows: 10 To finance construction costs, Blair borrowed $4.000.000 on March 1, 2019. The loan 11 is payable in 10 years in a single sum of $4,000,000 plus annual interest at 12 10% which will be paid at March 1 13 Blair's building construction expenditures were as follows March 1, 2019: Plans and architects fees May 1, 2019: Construction cost Oct 1, 2019: Construction cost Dec 31, 2019: Construction cost $600.000 $900.000 $1,200.000 $1,500,000 20 Instructions: 21 (a) Prepare a schedule that discloses the individual costs making up the balance in the land account 22 in respect of land site number 101 as of Dec 31, 2019 Interest Capitalization Exchange 20 Instructions: 21. (a) Prepare a schedule that discloses the individual costs making up the balance in the land account 22 in respect of land site number 101 as of Dec 31, 2019. BLAIR CORPORATION Cost of Land (Site #101) As of Dec 31, 2019 Cost of land 35 (b) Prepare a schedule that discloses the individual costs that should be capitalized in the office building account as of Dec 31, 2019. Show supporting computations in good form 37 38 Interest Capitalization Exchange AutoSave Ol ch 10 hw 2019 FA (1) - Excel O Search File Home Insert Page Layout Formulas Data Review View Help Arial -10 AA == General 23 Wrap Text Merge & Center Paste BIU $ -% - Clipboard Font Alignment Number F42 Cost of land 35 (b) Prepare a schedule that discloses the individual costs that should be capitalized in the office 36 building account as of Dec 31, 2019. Show supporting computations in good form. BLAIR CORPORATION Cost of Building As of Dec 31, 2019 49 Construction cost 50 Interest capitalized during 2019 52 Cost of building Interest Capitalization Exchange