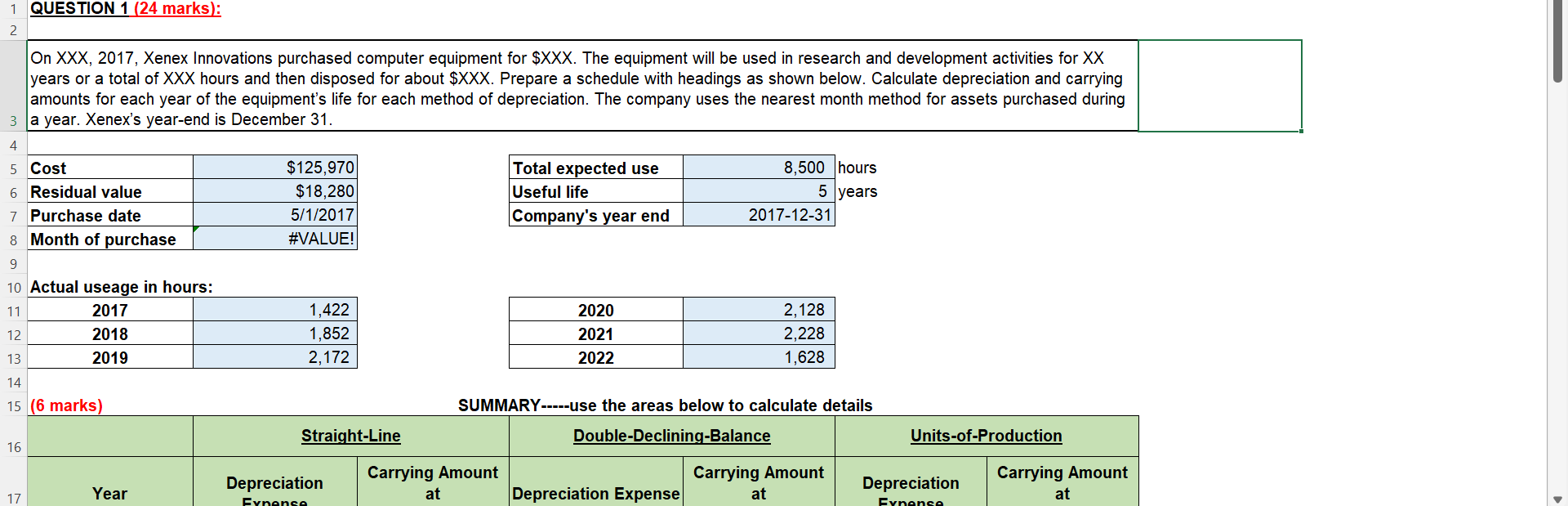

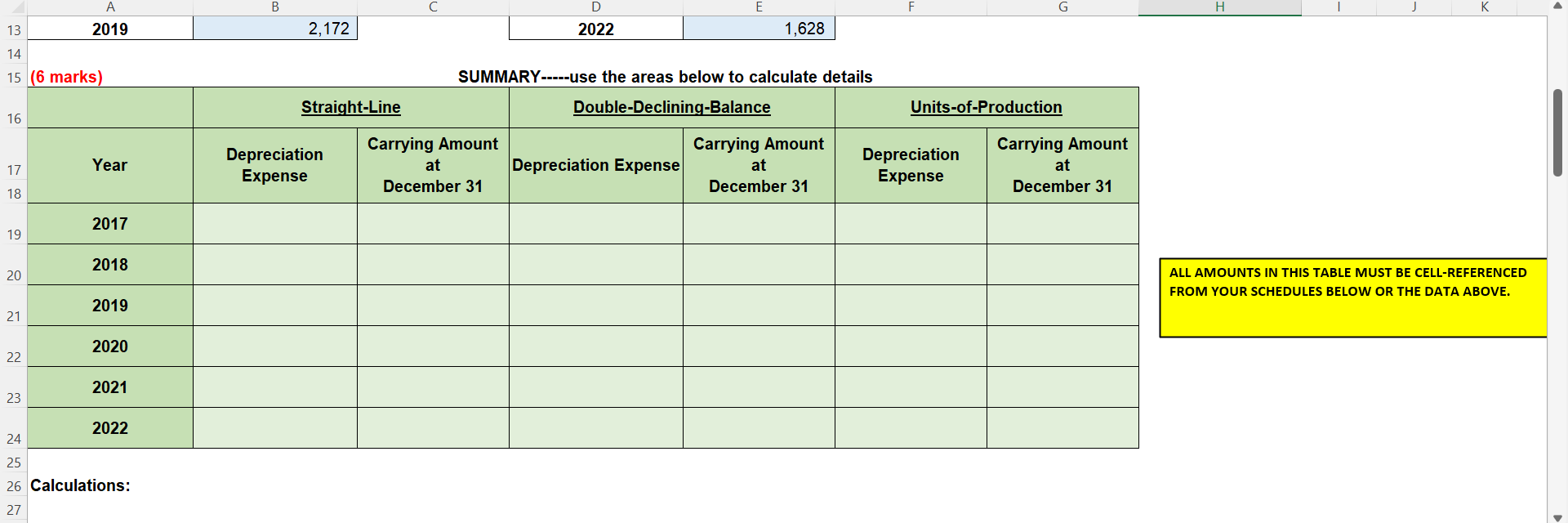

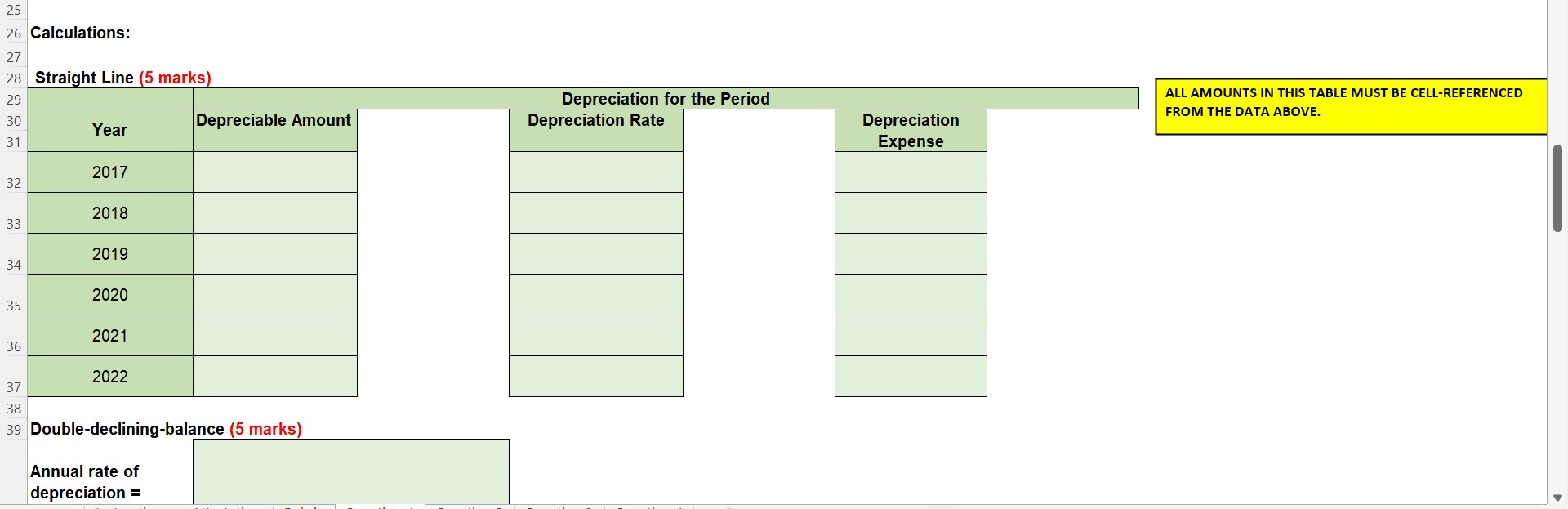

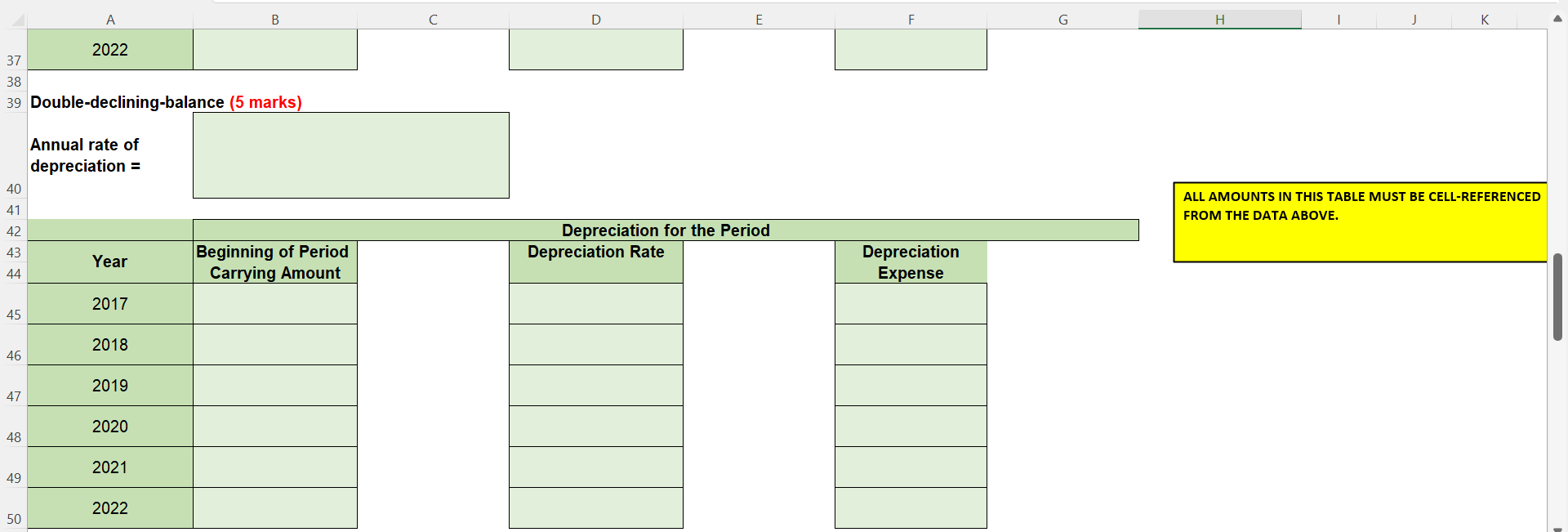

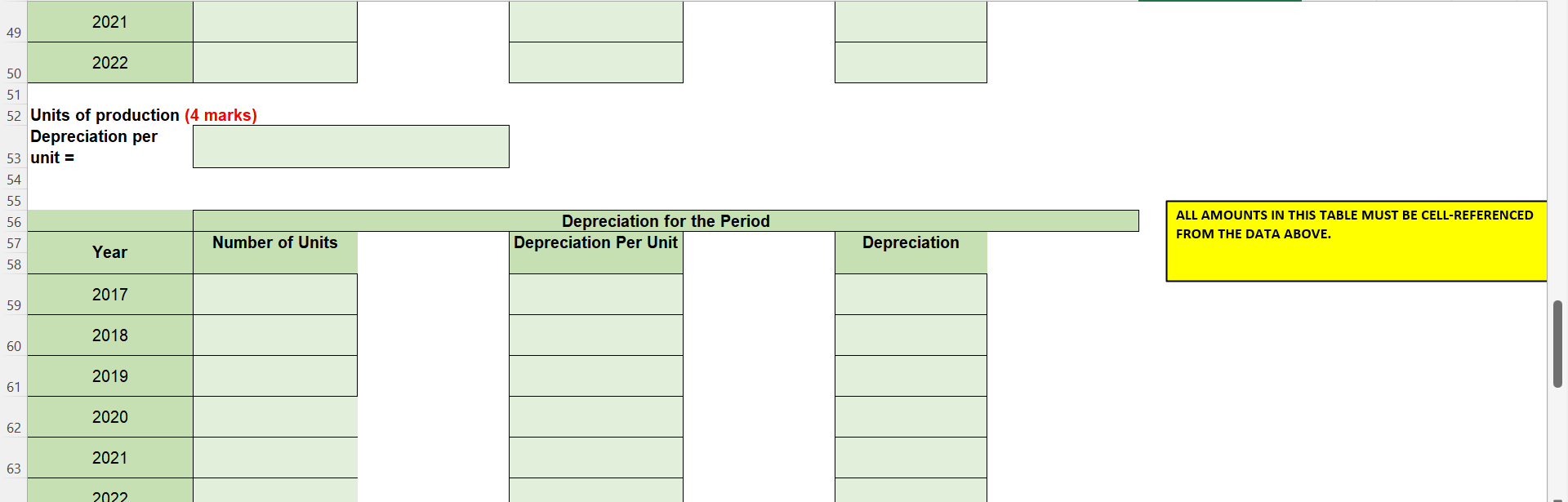

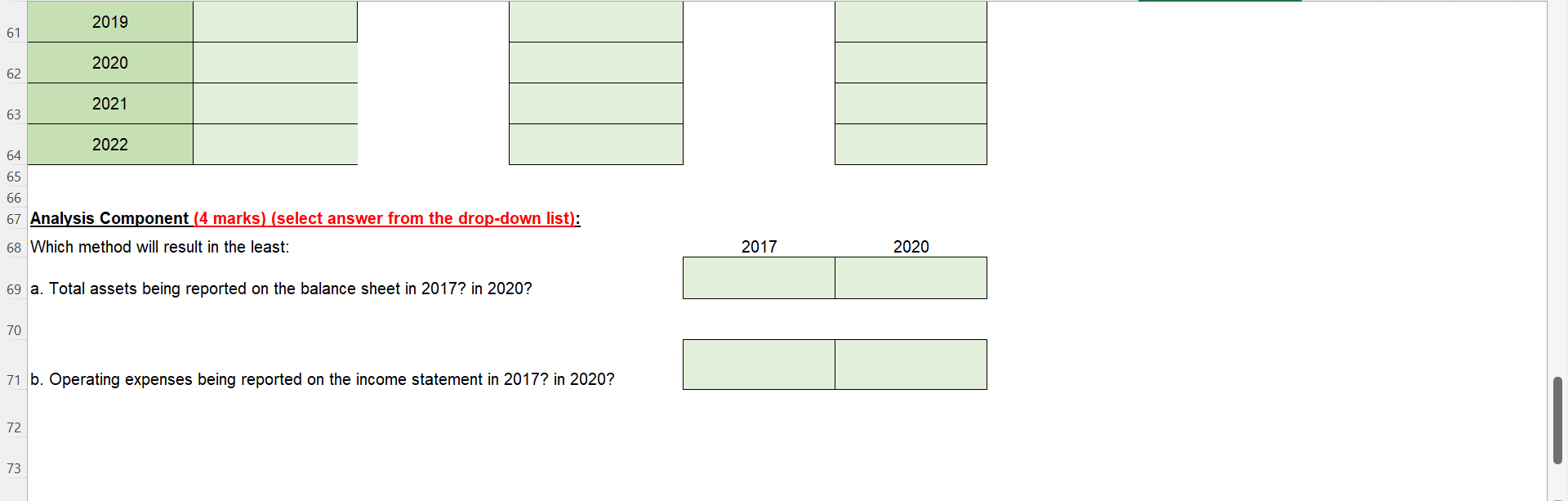

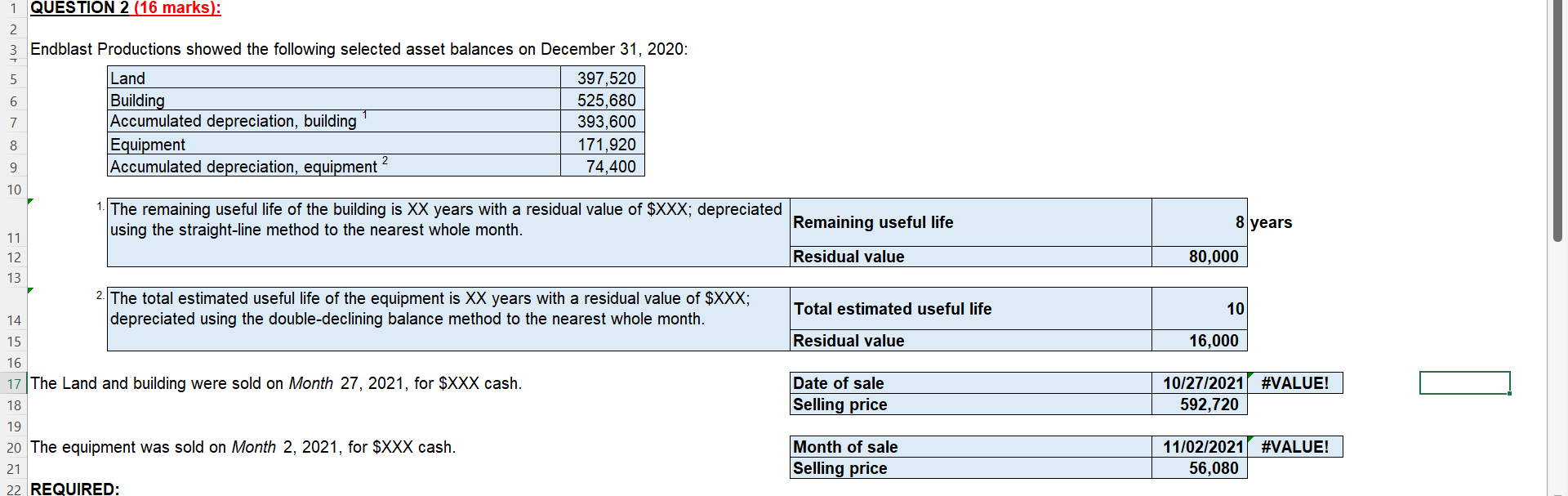

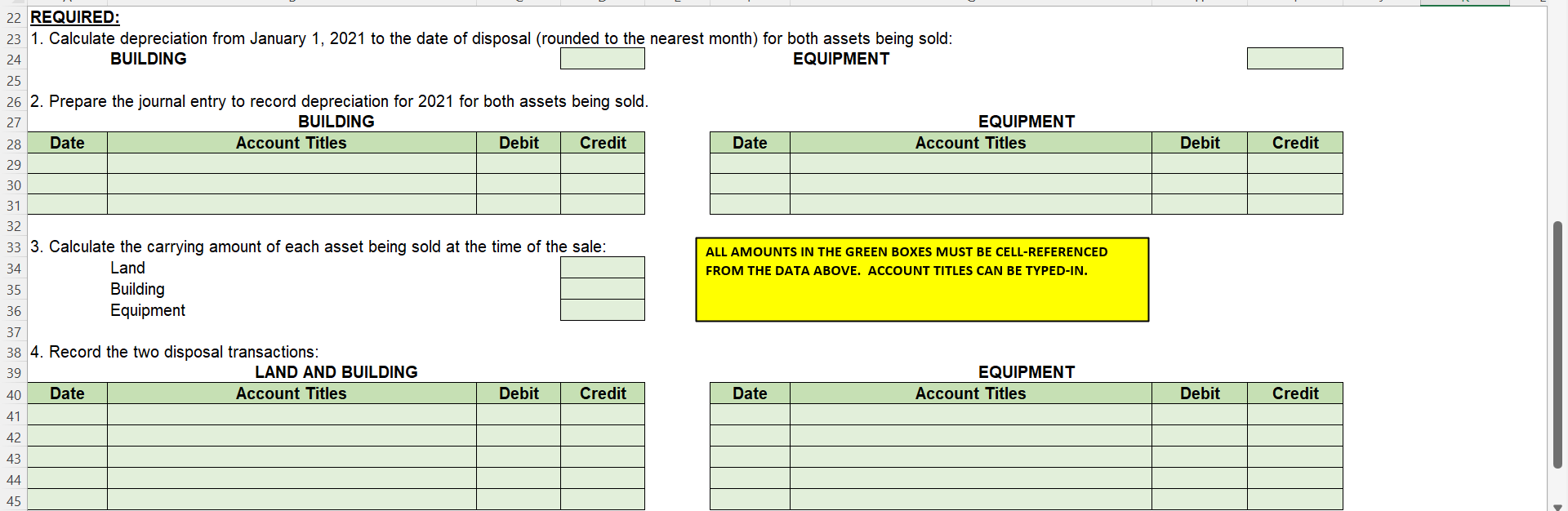

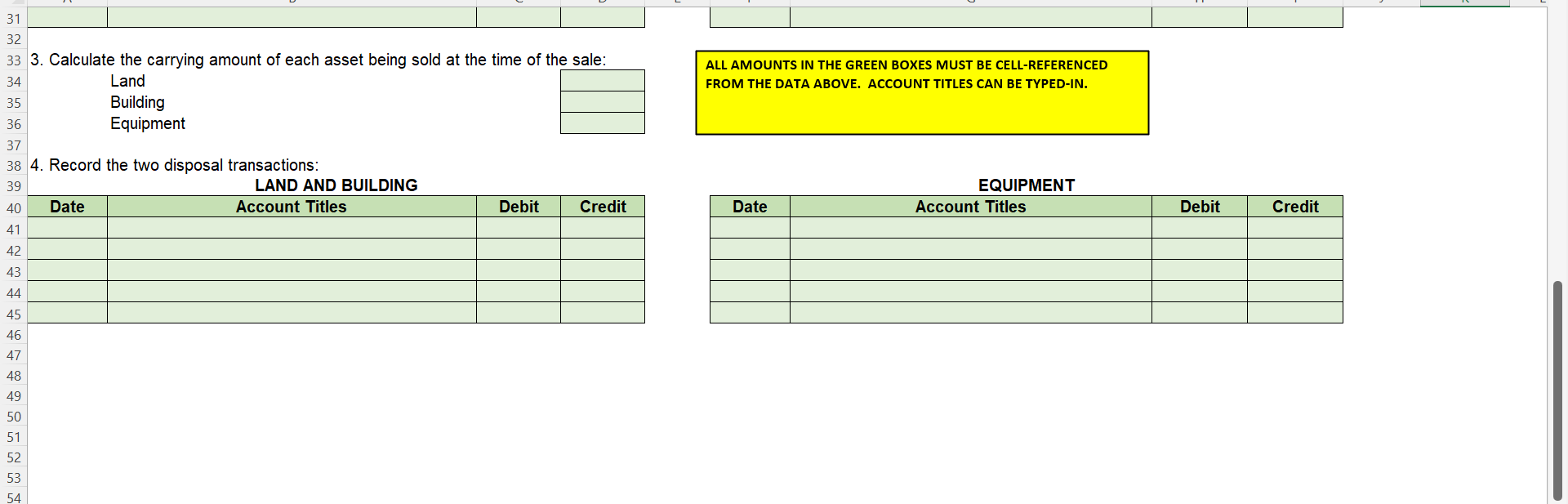

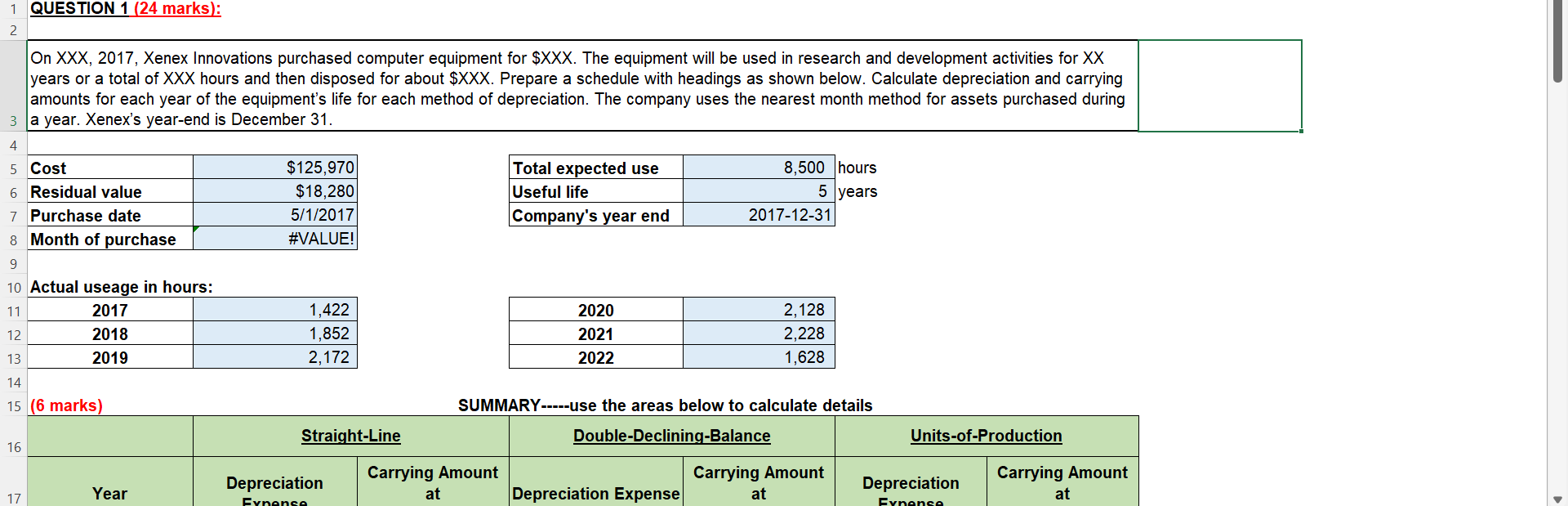

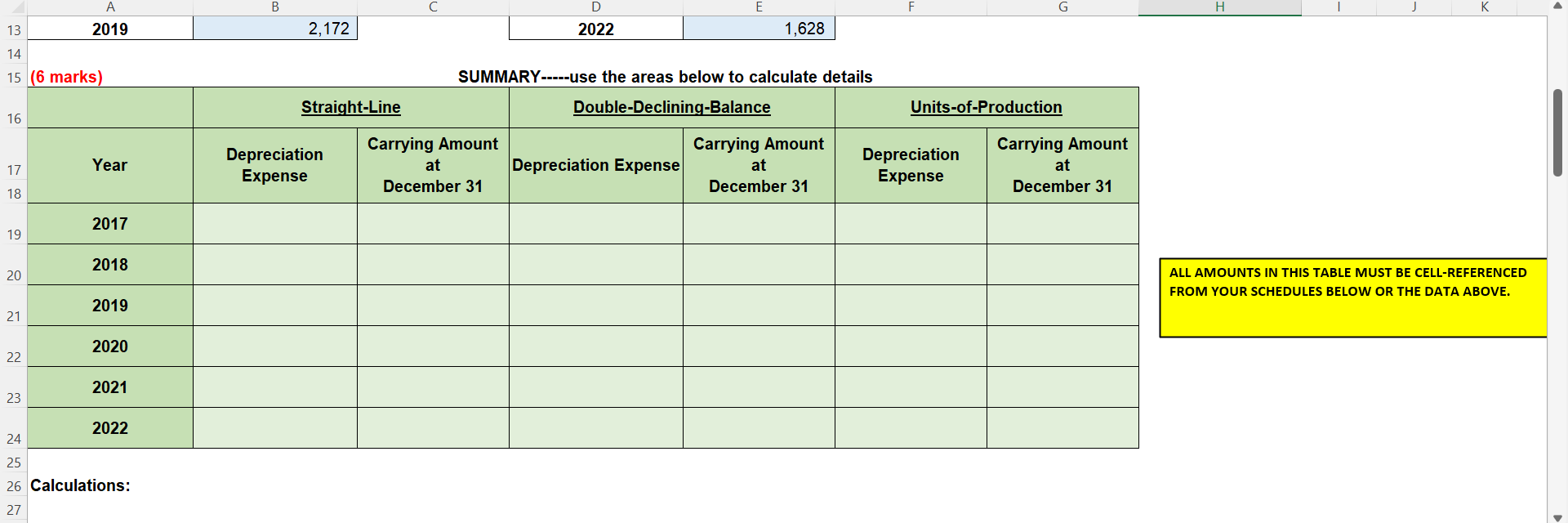

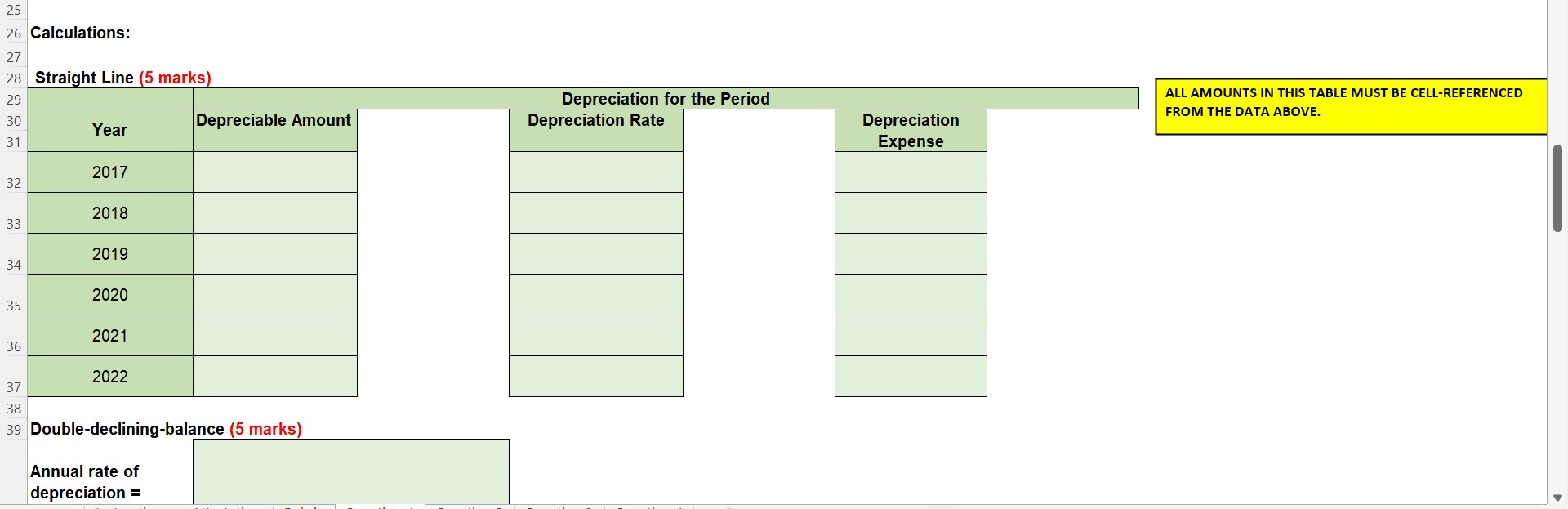

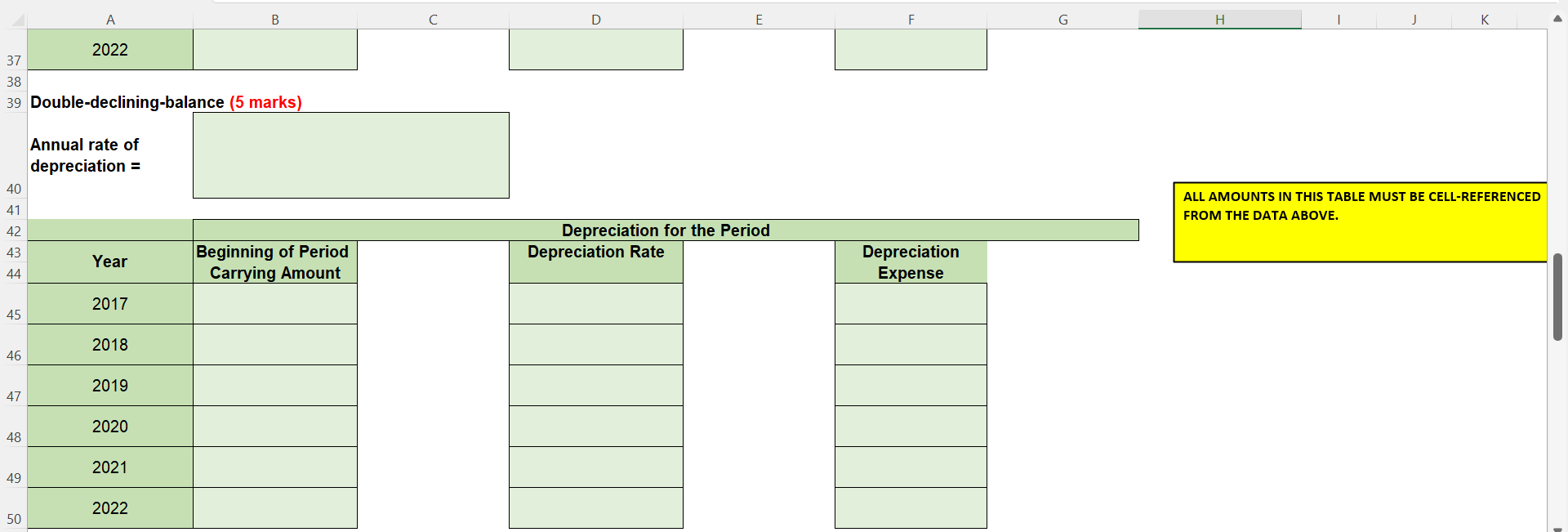

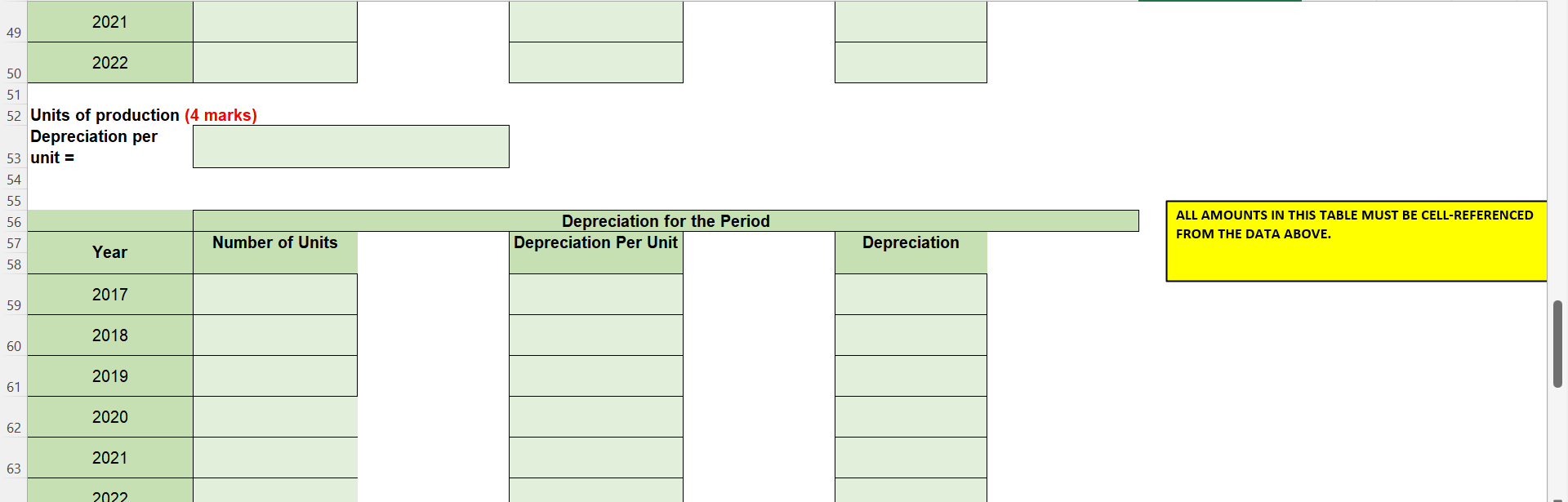

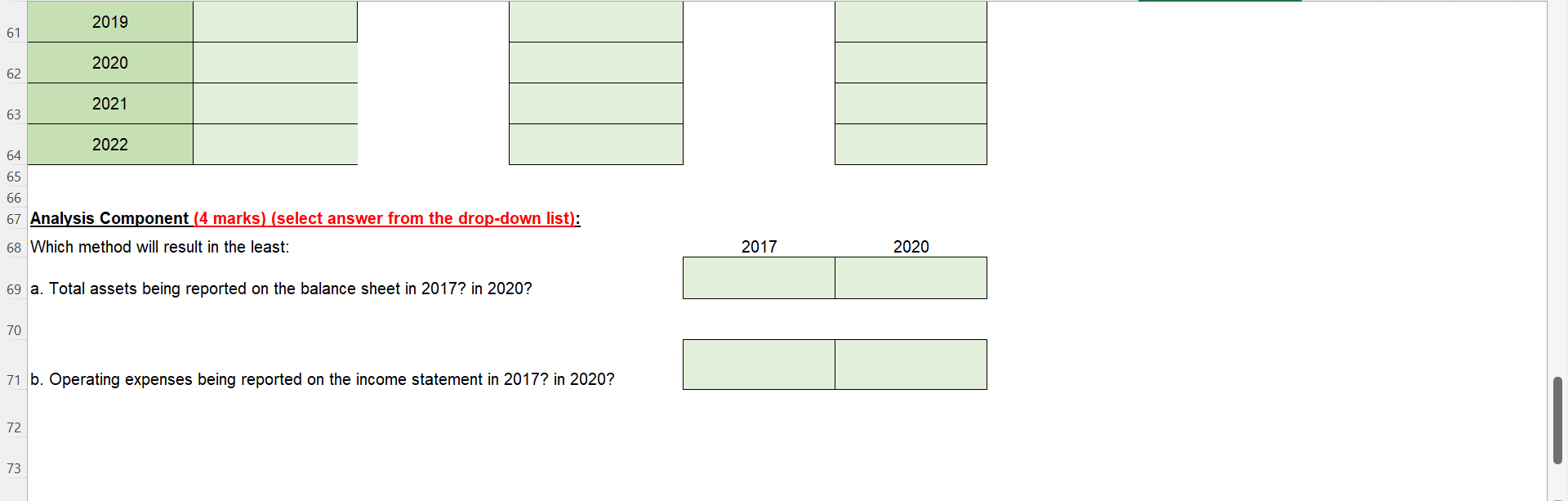

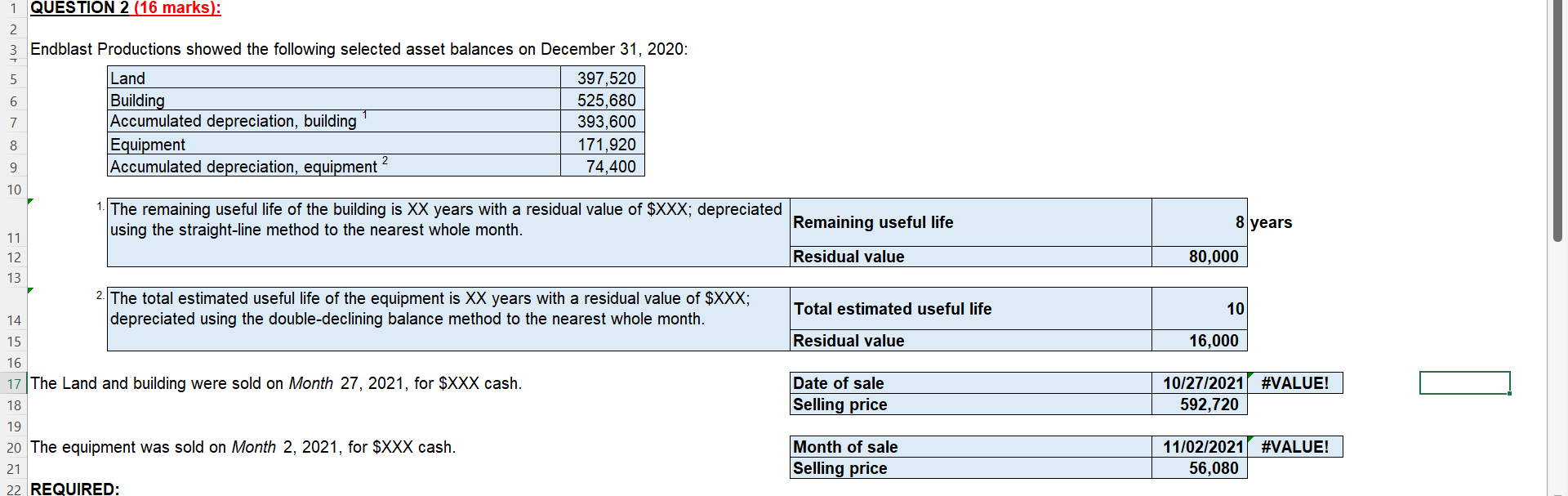

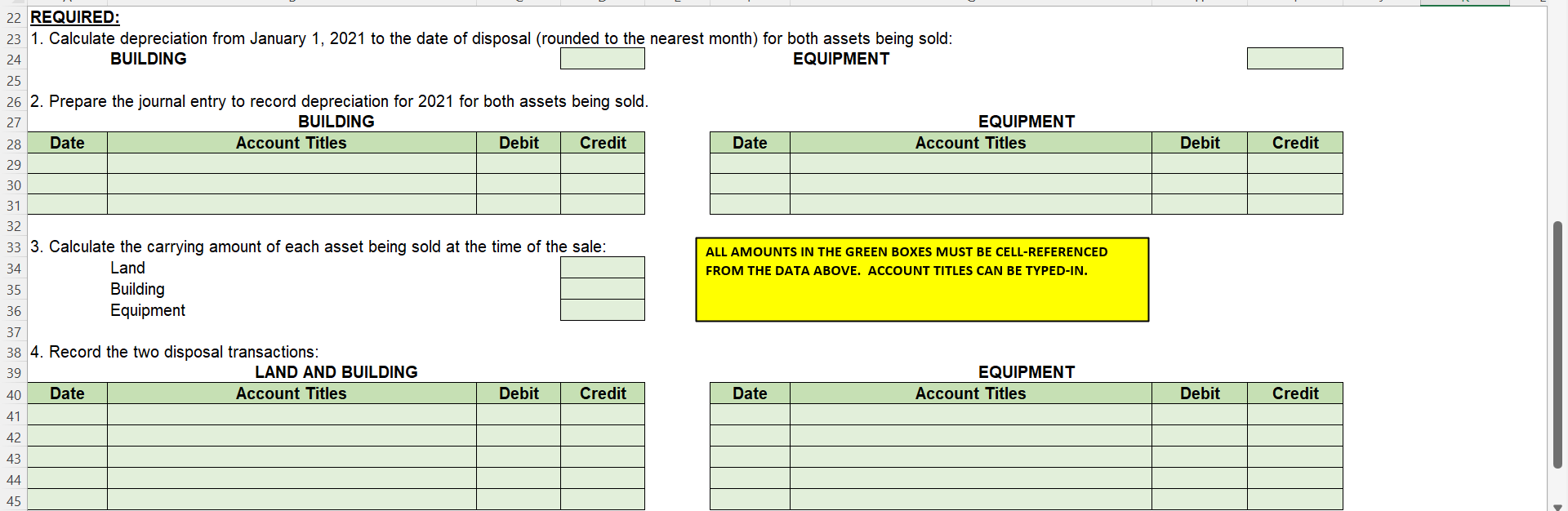

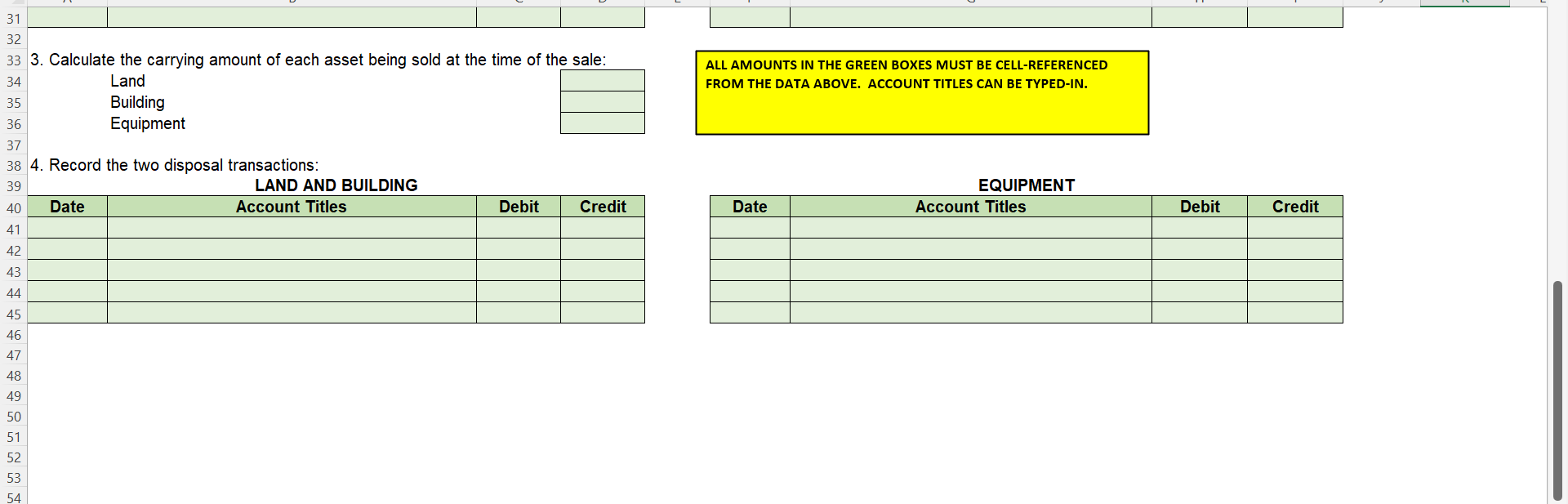

1 QUESTION 1 (24 marks): 2 On XXX, 2017, Xenex Innovations purchased computer equipment for $XXX. The equipment will be used in research and development activities for XX years or a total of XXX hours and then disposed for about $XXX. Prepare a schedule with headings as shown below. Calculate depreciation and carrying amounts for each year of the equipment's life for each method of depreciation. The company uses the nearest month method for assets purchased during 3 a year. Xenex's year-end is December 31. 4 5 Cost $125,970 Total expected use 8,500 hours 6 Residual value $18,280 Useful life 5 years 7 Purchase date 5/1/2017 Company's year end 2017-12-31 8 Month of purchase #VALUE! 00 10 Actual useage in hours: 11 2017 12 2018 13 2019 14 15 (6 marks) 1,422 1,852 2,172 2020 2021 2022 2,128 2,228 1,628 SUMMARY-.--use the areas below to calculate details Straight-Line Double-Declining-Balance Units-of-Production 16 Depreciation Carrying Amount Carrying Amount at Depreciation Carrying Amount at 17 Year at Depreciation Expense Synense Fynense B E F G H K D 2022 2,172 1,628 A 13 2019 14 15 (6 marks) SUMMARY -----use the areas below to calculate details Straight-Line Double-Declining-Balance Units-of-Production 16 17 Year Depreciation Expense Carrying Amount at December 31 Depreciation Expense Carrying Amount at December 31 Depreciation Expense Carrying Amount at December 31 18 2017 19 2018 20 ALL AMOUNTS IN THIS TABLE MUST BE CELL-REFERENCED FROM YOUR SCHEDULES BELOW OR THE DATA ABOVE. 2019 21 2020 22 2021 23 2022 24 25 26 Calculations: 27 25 26 Calculations: 27 28 Straight Line (5 marks) 29 30 Depreciable Amount Year 31 Depreciation for the Period Depreciation Rate ALL AMOUNTS IN THIS TABLE MUST BE CELL-REFERENCED FROM THE DATA ABOVE. Depreciation Expense 2017 32 2018 33 2019 34 2020 35 2021 36 2022 37 38 39 Double-declining-balance (5 marks) Annual rate of depreciation = A B D E F G H J K 2022 37 38 39 Double-declining-balance (5 marks) Annual rate of depreciation = 40 41 42 43 Year 44 ALL AMOUNTS IN THIS TABLE MUST BE CELL-REFERENCED FROM THE DATA ABOVE. Depreciation for the Period Depreciation Rate Beginning of Period Carrying Amount Depreciation Expense 2017 45 2018 46 2019 47 2020 48 2021 49 2022 50 2021 49 2022 50 51 52 Units of production (4 marks) Depreciation per 53 unit = 54 55 56 57 Number of Units Year 58 Depreciation for the Period Depreciation Per Unit ALL AMOUNTS IN THIS TABLE MUST BE CELL-REFERENCED FROM THE DATA ABOVE. Depreciation 2017 59 2018 60 2019 61 2020 62 2021 63 2022 2019 61 2020 62 2021 63 2022 64 65 66 67 Analysis Component (4 marks) (select answer from the drop-down list): 68 Which method will result in the least: 2017 2020 69 a. Total assets being reported on the balance sheet in 2017? in 2020? 70 71 b. Operating expenses being reported on the income statement in 2017? in 2020? 72 73 T 6 2 8 years 1 QUESTION 2 (16 marks): 2 Endblast Productions showed the following selected asset balances on December 31, 2020: 5 Land 397,520 Building 525,680 7 Accumulated depreciation, building 393,600 8 Equipment 171,920 9 Accumulated depreciation, equipment 74,400 10 1. The remaining useful life of the building is XX years with a residual value of $XXX; depreciated using the straight-line method to the nearest whole month. Remaining useful life 11 12 Residual value 13 2. The total estimated useful life of the equipment is XX years with a residual value of $XXX; Total estimated useful life 14 depreciated using the double-declining balance method to the nearest whole month. 15 Residual value 16 17 The Land and building were sold on Month 27, 2021, for $XXX cash. Date of sale Selling price 19 20 The equipment was sold on Month 2, 2021, for $XXX cash. Month of sale 21 Selling price 22 REQUIRED: 80,000 10 16,000 10/27/2021 #VALUE! 592,720 18 11/02/2021 #VALUE! 56,080 28 Debit Credit 22 REQUIRED: 23 1. Calculate depreciation from January 1, 2021 to the date of disposal (rounded to the nearest month) for both assets being sold: 24 BUILDING EQUIPMENT 25 26 2. Prepare the journal entry to record depreciation for 2021 for both assets being sold. 27 BUILDING EQUIPMENT Date Account Titles Debit Credit Date Account Titles 29 30 31 32 33 3. Calculate the carrying amount of each asset being sold at the time of the sale: ALL AMOUNTS IN THE GREEN BOXES MUST BE CELL-REFERENCED 34 Land FROM THE DATA ABOVE. ACCOUNT TITLES CAN BE TYPED-IN. 35 Building 36 Equipment 37 38 4. Record the two disposal transactions: 39 LAND AND BUILDING EQUIPMENT 40 Date Account Titles Debit Credit Date Account Titles Debit Credit 41 42 43 44 45 ALL AMOUNTS IN THE GREEN BOXES MUST BE CELL-REFERENCED FROM THE DATA ABOVE. ACCOUNT TITLES CAN BE TYPED-IN. 31 32 33 3. Calculate the carrying amount of each asset being sold at the time of the sale: 34 Land 35 Building 36 Equipment 37 38 4. Record the two disposal transactions: 39 LAND AND BUILDING 40 Date Account Titles Debit Credit 41 EQUIPMENT Account Titles Date Debit Credit 42 43 44 45 46 47 48 49 50 51 52 53 54