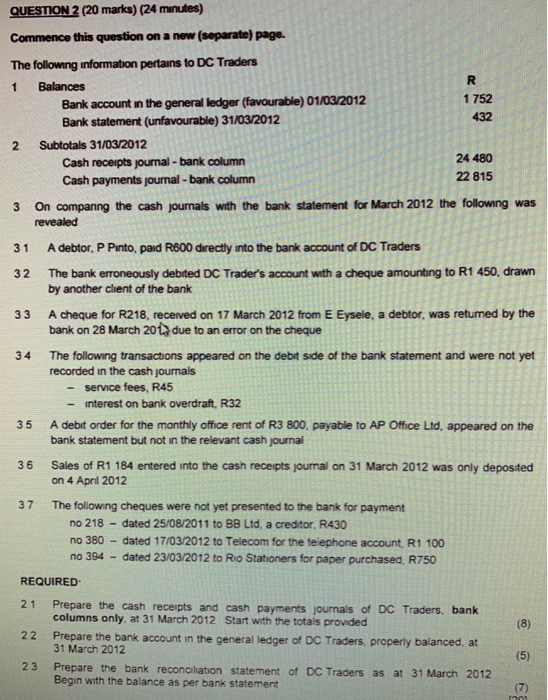

1 QUESTION 2 (20 marks) (24 minutes) Commence this question on a new (separate) page. The following information pertains to DC Traders Balances R Bank account in the general ledger (favourable) 01/03/2012 1 752 Bank statement (unfavourable) 31/03/2012 432 2 Subtotals 31/03/2012 Cash receipts journal - bank column 24 480 Cash payments journal - bank column 22 815 3 On comparing the cash journals with the bank statement for March 2012 the following was revealed 31 A debtor, P Pinto, paid R600 directly into the bank account of DC Traders 32 The bank erroneously debited DC Trader's account with a cheque amounting to R1 450, drawn by another client of the bank A cheque for R218, received on 17 March 2012 from E Eysele, a debtor, was returned by the bank on 28 March 2017 due to an error on the cheque 34 The following transactions appeared on the debt side of the bank statement and were not yet recorded in the cash journals - service fees, R45 interest on bank overdraft, R32 35 A debit order for the monthly office rent of R3 800. payable to AP Office Ltd, appeared on the bank statement but not in the relevant cash journal 36 Sales of R1 184 entered into the cash receipts journal on 31 March 2012 was only deposited on 4 April 2012 33 37 The following cheques were not yet presented to the bank for payment no 218 - dated 25/08/2011 to BB Ltd, a creditor, R430 no 380 dated 17/03/2012 to Telecom for the telephone account, R1 100 no 394 - dated 23/03/2012 to Rio Stationers for paper purchased, R750 REQUIRED 21 (8) 22 Prepare the cash receipts and cash payments journals of DC Traders, bank columns only, at 31 March 2012 Start with the totals provided Prepare the bank account in the general ledger of DC Traders, properly balanced, at 31 March 2012 Prepare the bank reconciliation statement of DC Traders as at 31 March 2012 Begin with the balance as per bank statement (5) 23 1 QUESTION 2 (20 marks) (24 minutes) Commence this question on a new (separate) page. The following information pertains to DC Traders Balances R Bank account in the general ledger (favourable) 01/03/2012 1 752 Bank statement (unfavourable) 31/03/2012 432 2 Subtotals 31/03/2012 Cash receipts journal - bank column 24 480 Cash payments journal - bank column 22 815 3 On comparing the cash journals with the bank statement for March 2012 the following was revealed 31 A debtor, P Pinto, paid R600 directly into the bank account of DC Traders 32 The bank erroneously debited DC Trader's account with a cheque amounting to R1 450, drawn by another client of the bank A cheque for R218, received on 17 March 2012 from E Eysele, a debtor, was returned by the bank on 28 March 2017 due to an error on the cheque 34 The following transactions appeared on the debt side of the bank statement and were not yet recorded in the cash journals - service fees, R45 interest on bank overdraft, R32 35 A debit order for the monthly office rent of R3 800. payable to AP Office Ltd, appeared on the bank statement but not in the relevant cash journal 36 Sales of R1 184 entered into the cash receipts journal on 31 March 2012 was only deposited on 4 April 2012 33 37 The following cheques were not yet presented to the bank for payment no 218 - dated 25/08/2011 to BB Ltd, a creditor, R430 no 380 dated 17/03/2012 to Telecom for the telephone account, R1 100 no 394 - dated 23/03/2012 to Rio Stationers for paper purchased, R750 REQUIRED 21 (8) 22 Prepare the cash receipts and cash payments journals of DC Traders, bank columns only, at 31 March 2012 Start with the totals provided Prepare the bank account in the general ledger of DC Traders, properly balanced, at 31 March 2012 Prepare the bank reconciliation statement of DC Traders as at 31 March 2012 Begin with the balance as per bank statement (5) 23