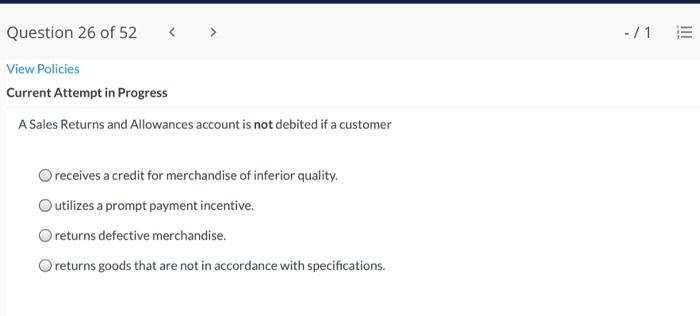

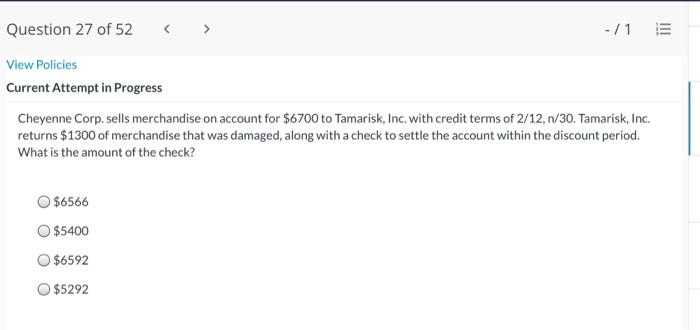

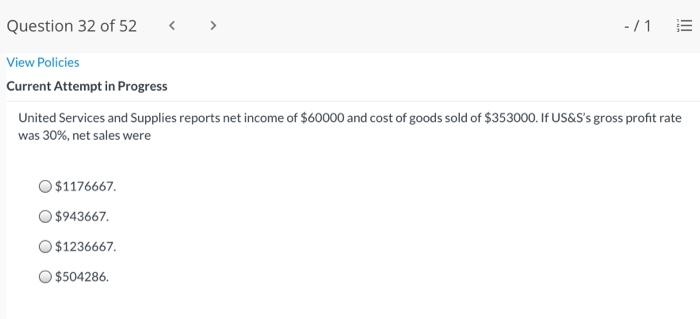

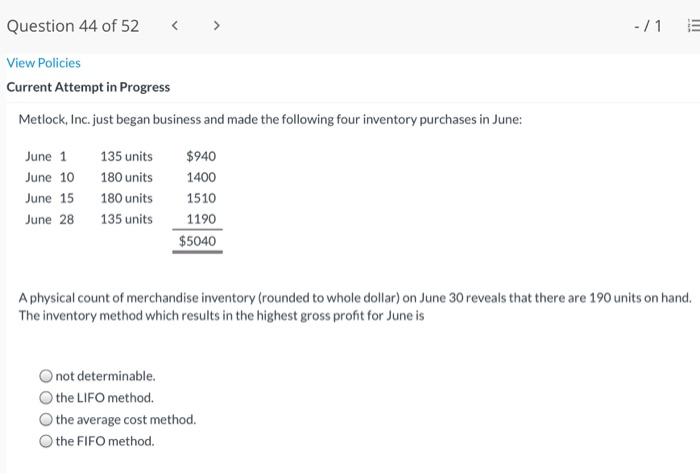

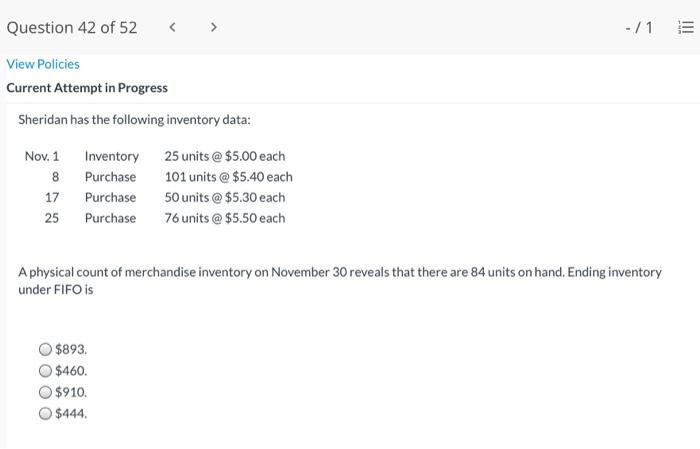

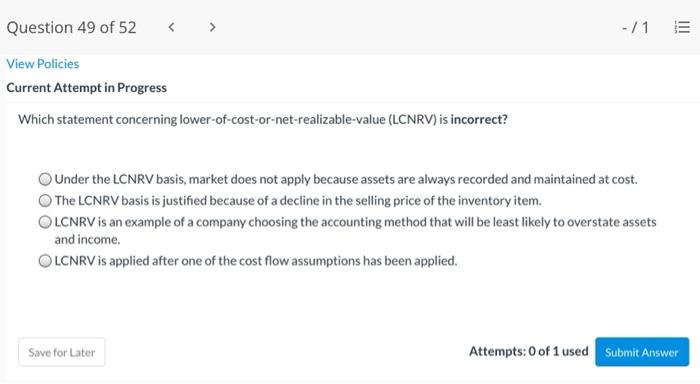

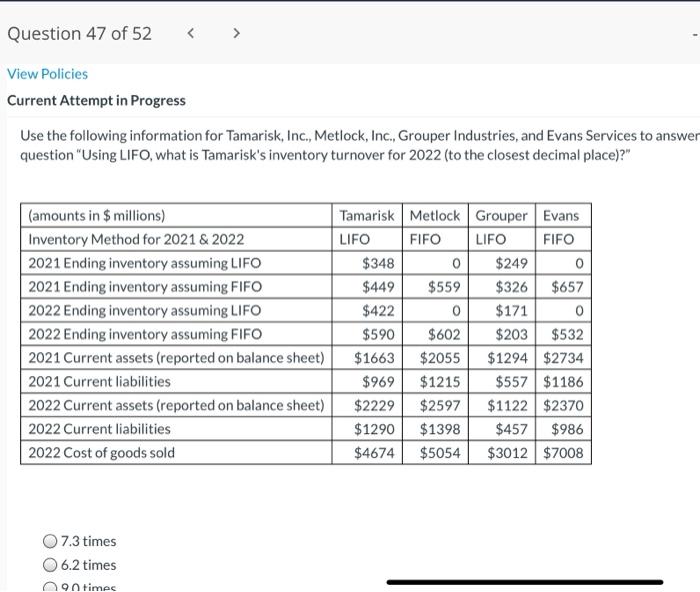

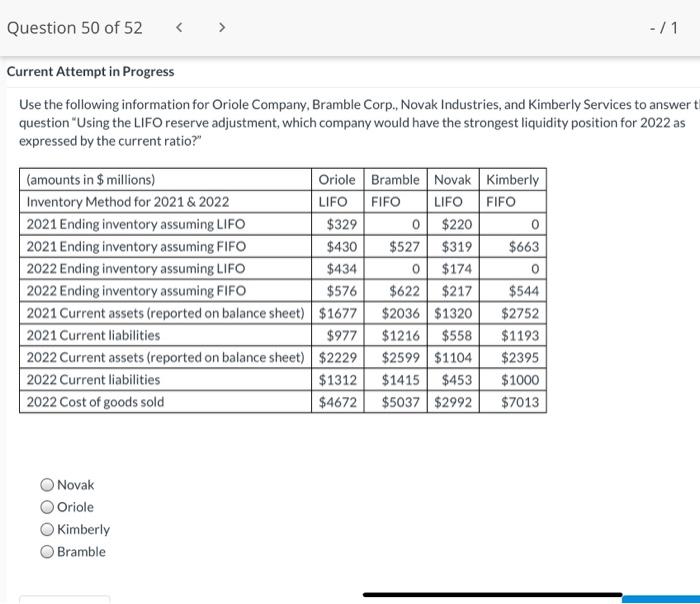

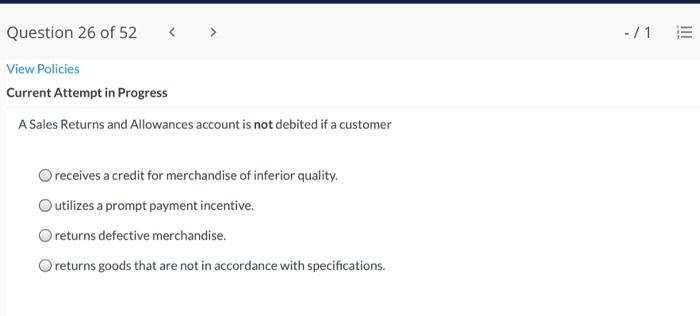

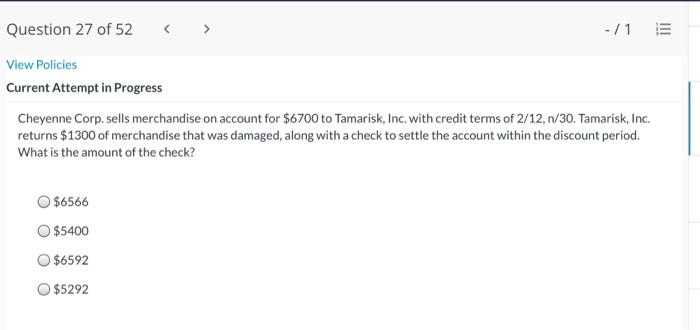

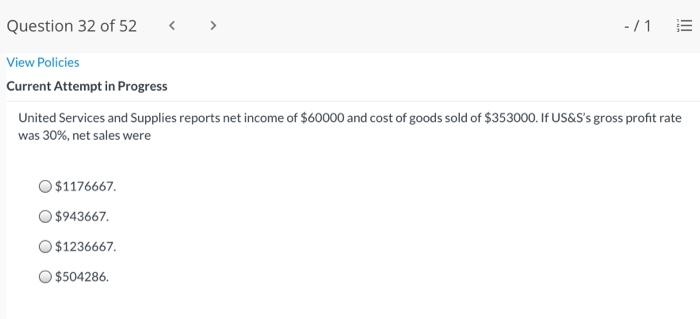

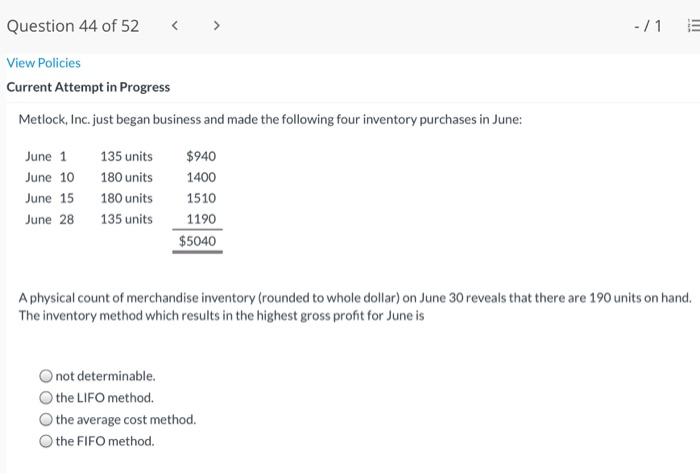

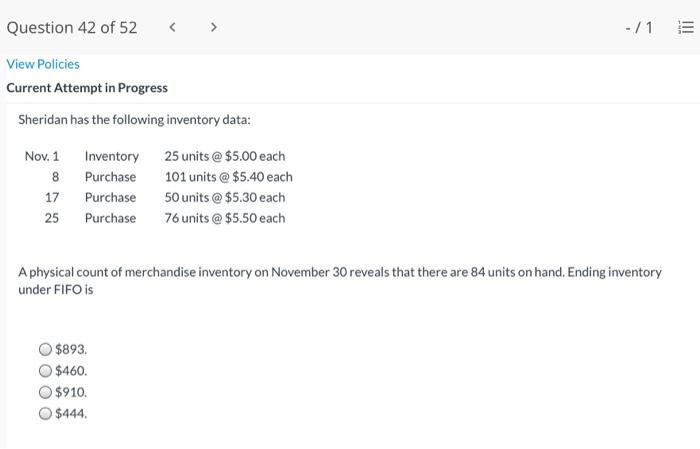

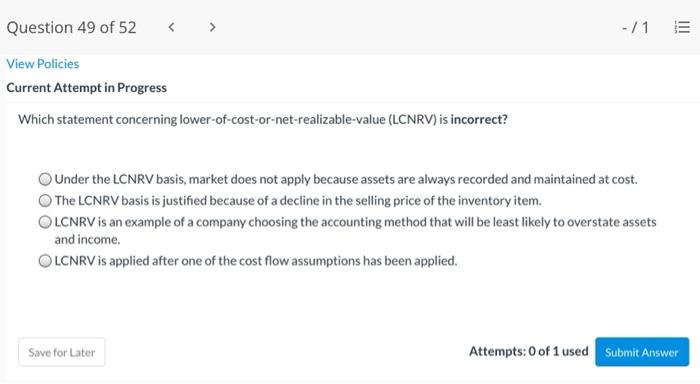

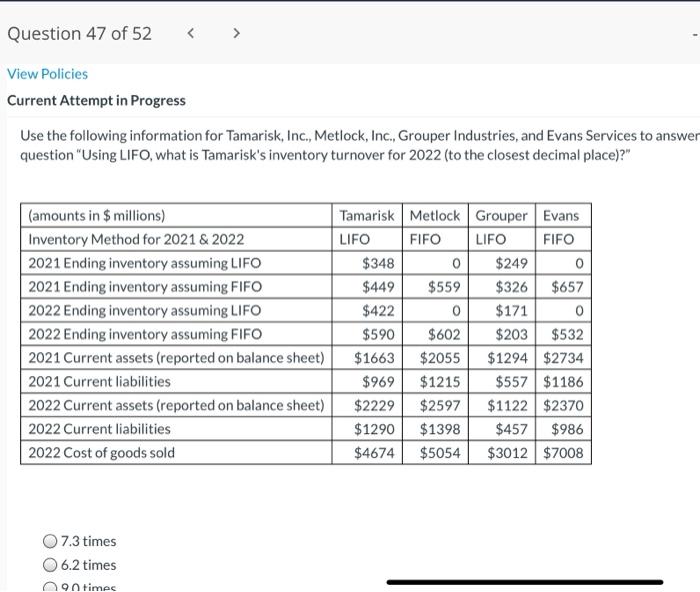

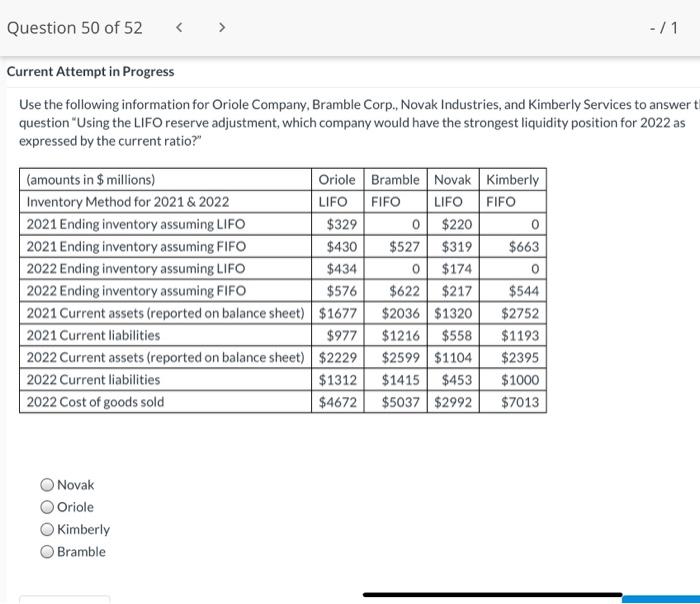

- /1 Question 26 of 52 View Policies Current Attempt in Progress A Sales Returns and Allowances account is not debited if a customer receives a credit for merchandise of inferior quality. Outilizes a prompt payment incentive. returns defective merchandise. O returns goods that are not in accordance with specifications. Question 27 of 52 -/1 E View Policies Current Attempt in Progress Cheyenne Corp.sells merchandise on account for $6700 to Tamarisk, Inc. with credit terms of 2/12, n/30. Tamarisk, Inc. returns $1300 of merchandise that was damaged, along with a check to settle the account within the discount period. What is the amount of the check? $6566 O $5400 O $6592 $5292 Question 32 of 52 -/1 View Policies Current Attempt in Progress United Services and Supplies reports net income of $60000 and cost of goods sold of $353000. If US&S's gross profit rate was 30%, net sales were $1176667 $943667 $1236667 $504286 Question 44 of 52 - / 1 !!! View Policies Current Attempt in Progress Metlock, Inc. just began business and made the following four inventory purchases in June: June 1 June 10 June 15 June 28 135 units 180 units 180 units 135 units $940 1400 1510 1190 $5040 A physical count of merchandise inventory (rounded to whole dollar) on June 30 reveals that there are 190 units on hand. The inventory method which results in the highest gross profit for June is not determinable. the LIFO method. the average cost method. O the FIFO method. Question 42 of 52 -/1 III View Policies Current Attempt in Progress Sheridan has the following inventory data: Nov. 1 8 17 25 Inventory Purchase Purchase Purchase 25 units @ $5.00 each 101 units @ $5.40 each 50 units @ $5.30 each 76 units @ $5.50 each A physical count of merchandise inventory on November 30 reveals that there are 84 units on hand. Ending inventory under FIFO is $893 $460. $910 $444 Question 49 of 52 - / 1 III View Policies Current Attempt in Progress Which statement concerning lower-of-cost-or-net-realizable-value (LCNRV) is incorrect? Under the LCNRV basis, market does not apply because assets are always recorded and maintained at cost. The LCNRV basis is justified because of a decline in the selling price of the inventory item. OLCNRV is an example of a company choosing the accounting method that will be least likely to overstate assets and income. OLCNRV is applied after one of the cost flow assumptions has been applied. Save for Later Attempts: 0 of 1 used Submit Answer Question 47 of 52 View Policies Current Attempt in Progress Use the following information for Tamarisk, Inc., Metlock, Inc., Grouper Industries, and Evans Services to answer question "Using LIFO, what is Tamarisk's inventory turnover for 2022 (to the closest decimal place)?" (amounts in $ millions) Inventory Method for 2021 & 2022 2021 Ending inventory assuming LIFO 2021 Ending inventory assuming FIFO 2022 Ending inventory assuming LIFO 2022 Ending inventory assuming FIFO 2021 Current assets (reported on balance sheet) 2021 Current liabilities 2022 Current assets (reported on balance sheet) 2022 Current liabilities 2022 Cost of goods sold Tamarisk Metlock Grouper Evans LIFO FIFO LIFO FIFO $348 0 $249 0 $449 $559 $326 $657 $422 0 $171 0 $590 $602 $203 $532 $1663 $2055 $1294 $2734 $969 $1215 $557 $1186 $2229 $2597 $1122 $2370 $1290 $1398 $457 $986 $4674 $5054 $3012 $7008 07.3 times 6.2 times times Question 50 of 52 -/1 Current Attempt in Progress Use the following information for Oriole Company, Bramble Corp., Novak Industries, and Kimberly Services to answert question "Using the LIFO reserve adjustment, which company would have the strongest liquidity position for 2022 as expressed by the current ratio?" 0 (amounts in $ millions) Oriole Bramble Novak Kimberly Inventory Method for 2021& 2022 LIFO FIFO LIFO FIFO 2021 Ending inventory assuming LIFO $329 0 $220 0 2021 Ending inventory assuming FIFO $430 $527 $319 $663 2022 Ending inventory assuming LIFO $434 0 $174 2022 Ending inventory assuming FIFO $576 $622 $217 $544 2021 Current assets (reported on balance sheet) $1677 $2036 $1320 $2752 2021 Current liabilities $977 $1216 $558 $1193 2022 Current assets (reported on balance sheet) $2229 $2599 $1104 $2395 2022 Current liabilities $1312 $1415 $453 $1000 2022 Cost of goods sold $4672 $5037 $2992 $7013 Novak Oriole Kimberly O Bramble