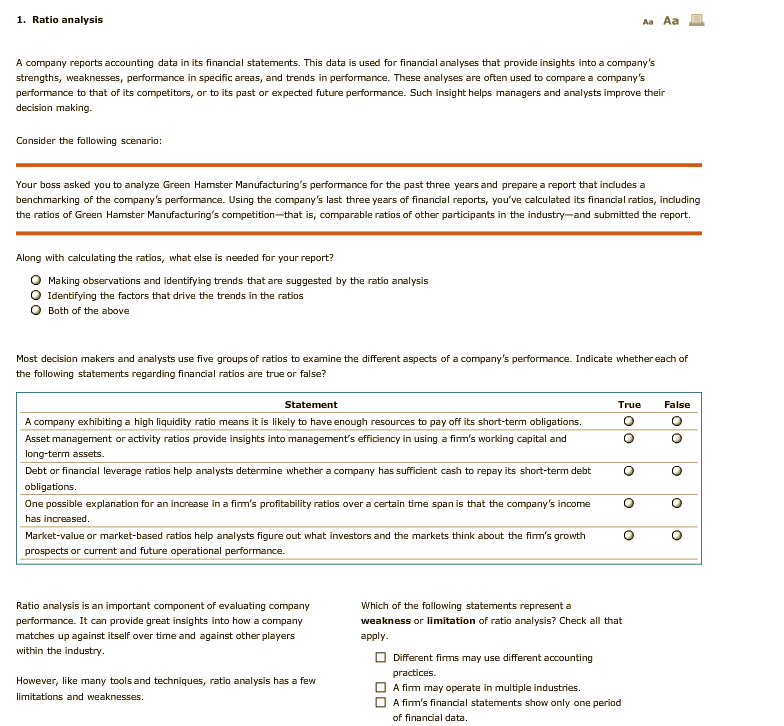

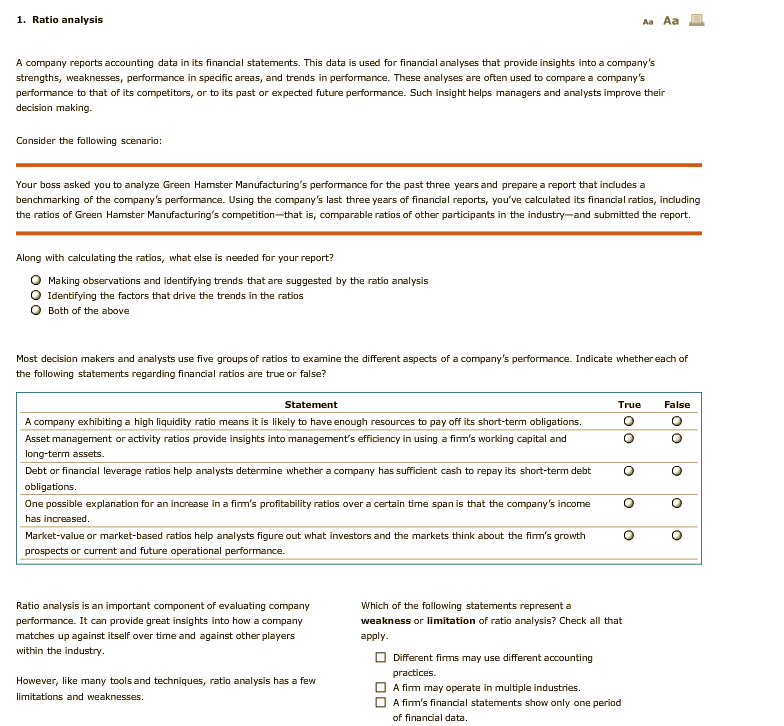

1. Ratio analysis Aa Aa A company reports accounting data in its financial statements. This data is used for financial analyses that provide insights into a company's strengths, weaknesses, performance in specific areas, and trends in performance. These analyses are often used to compare a company's performance to that of its competitors, or to its past or expected future performance. Such insight helps managers and analysts improve thein decision making. Consider the following scenario: Your boss asked you to analyze Green Hamster Manufacturing's performance for the past three years and prepare a report that indludes a benchmarking of the company's performance. Using the company's last three years of financial reports, you ve calculated its financial ratios, including the ratios of Green Hamster Manufacturing's competition-that is, comparable ratios of other participants in the industry-and submitted the report. Along with calculating the ratios, what else is needed for your report? O Making observations and identifying trends that are suggested by the ratio analysis O Identifying the factors that drive the trends in the ratios O Both of the above Most decision makers and analysts use five groups of ratios to examine the different aspects of a company's performance. Indicate whether each of the following statements regarding financial ratios are true or false? Statement False A company exhibiting a high liquidity ratio means it is likely to have enough resources to pay off its short-term obligations Asset management or activity ratios provide insights into management's efficiency in using a firm's working capital and long-term assets. Debt or financial leverage ratios help analysts determine whether a company has sufficient cash to repay its short-term debt obligations. One possible explanation for an increase in a firm's profitability ratios over a certain time span is that the company's income has increased Market-value or market-based ratios help analysts figure out what investors and the markets think about the firm's growth prospects or current and future operational performance. Ratio analysis is an important component of evaluating company performance. It can provide great insights into how a company matches up again within the industry Which of the following statements represent a weakness or limitation of ratio analysis? Check all that apply st itself over tim e and against other players Different firms may use different accountin However, like many tools and techniques, ratio analysis has a fevw limitations and weaknesses. A firm may operate in multiple industries. A firm's financial statements show only one period of financial data