Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. read queston carefully 2. SHOW YOUR WORK The intangible assets and goodwill reported by Wildhorse Company at December 31, 2020, follow: Patent #1 $

1. read queston carefully

2. SHOW YOUR WORK

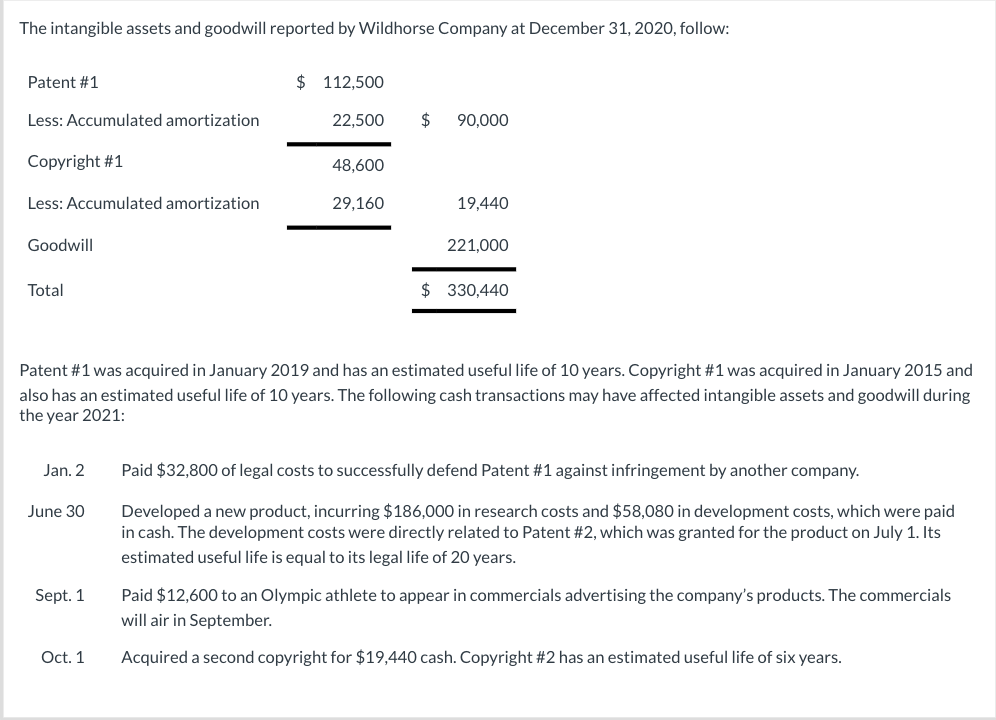

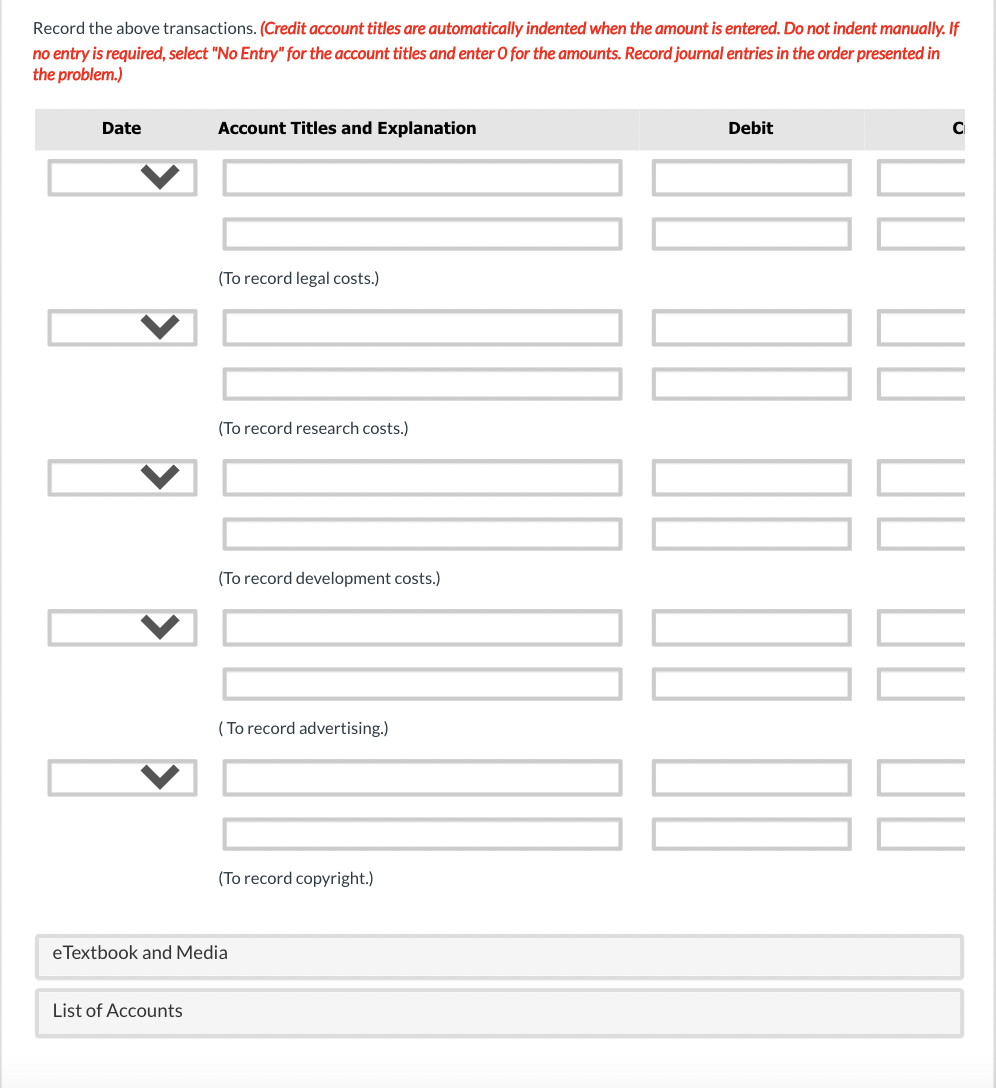

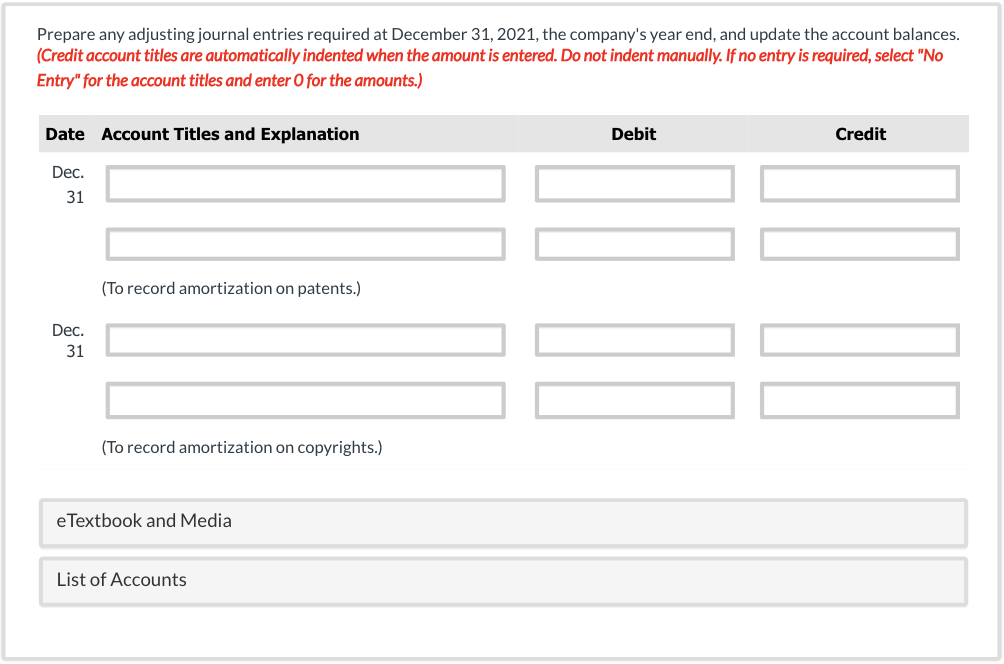

The intangible assets and goodwill reported by Wildhorse Company at December 31, 2020, follow: Patent #1 $ 112,500 Less: Accumulated amortization 22,500 $ 90,000 Copyright #1 48,600 Less: Accumulated amortization 29,160 19,440 Goodwill 221,000 Total $ 330,440 Patent #1 was acquired in January 2019 and has an estimated useful life of 10 years. Copyright #1 was acquired in January 2015 and also has an estimated useful life of 10 years. The following cash transactions may have affected intangible assets and goodwill during the year 2021 Jan. 2 Paid $32,800 of legal costs to successfully defend Patent #1 against infringement by another company. June 30 Developed a new product, incurring $186,000 in research costs and $58,080 in development costs, which were paid in cash. The development costs were directly related to Patent #2, which was granted for the product on July 1. Its estimated useful life is equal to its legal life of 20 years. Sept. 1 Paid $12,600 to an Olympic athlete to appear in commercials advertising the company's products. The commercials will air in September. Oct. 1 Acquired a second copyright for $19,440 cash. Copyright #2 has an estimated useful life of six years. Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit (To record legal costs.) (To record research costs.) I MI MI DO TE (To record development costs.) BB (To record advertising.) (To record copyright.) e Textbook and Media List of Accounts Prepare any adjusting journal entries required at December 31, 2021, the company's year end, and update the account balances. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 (To record amortization on patents.) Dec. 31 (To record amortization on copyrights.) e Textbook and Media List of AccountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started