Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Read the business snapshot of 3.2 on page 69. Assume the German company sold a 10 billion barrels of oil future (June 2018)

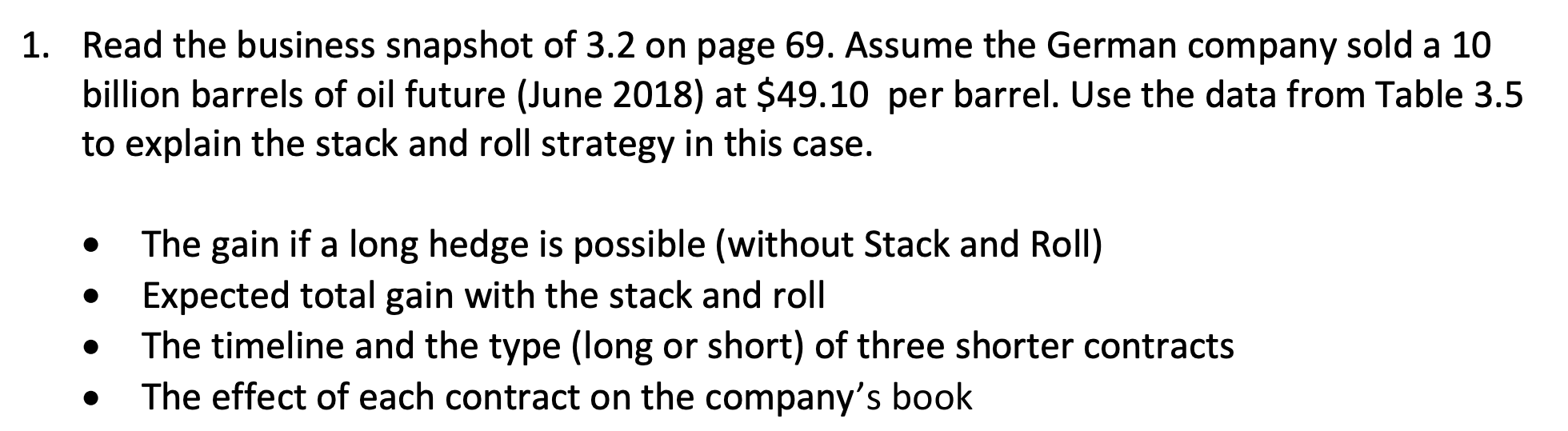

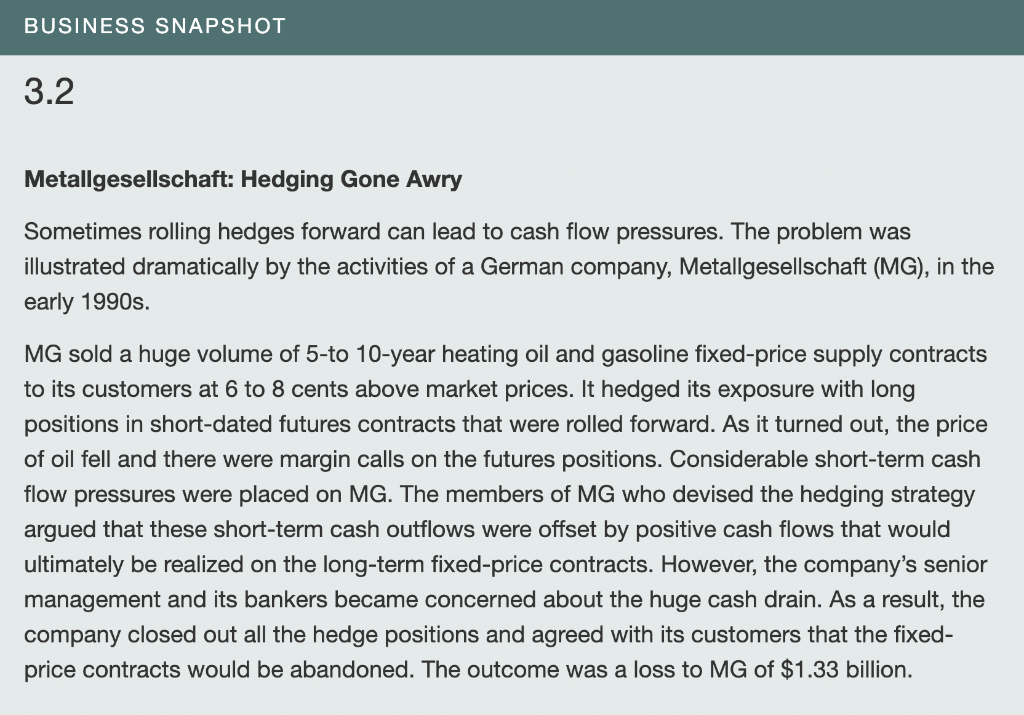

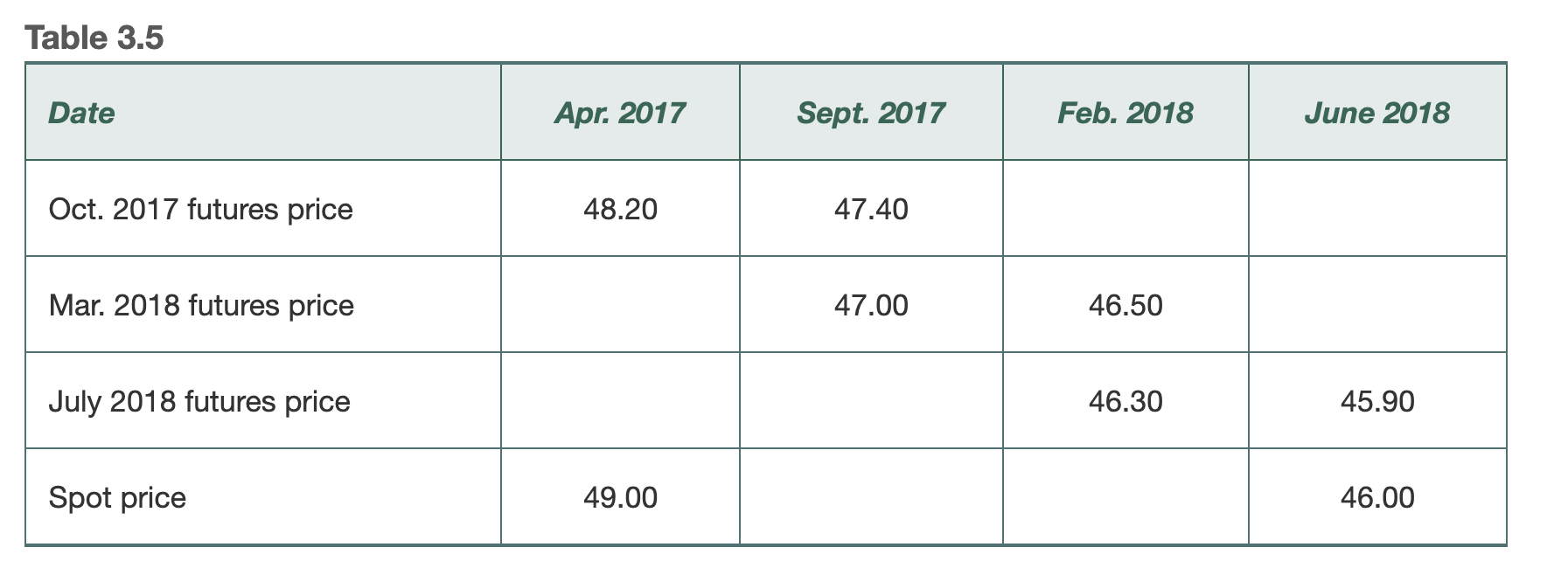

1. Read the business snapshot of 3.2 on page 69. Assume the German company sold a 10 billion barrels of oil future (June 2018) at $49.10 per barrel. Use the data from Table 3.5 to explain the stack and roll strategy in this case. The gain if a long hedge is possible (without Stack and Roll) Expected total gain with the stack and roll The timeline and the type (long or short) of three shorter contracts The effect of each contract on the company's book BUSINESS SNAPSHOT 3.2 Metallgesellschaft: Hedging Gone Awry Sometimes rolling hedges forward can lead to cash flow pressures. The problem was illustrated dramatically by the activities of a German company, Metallgesellschaft (MG), in the early 1990s. MG sold a huge volume of 5-to 10-year heating oil and gasoline fixed-price supply contracts to its customers at 6 to 8 cents above market prices. It hedged its exposure with long positions in short-dated futures contracts that were rolled forward. As it turned out, the price of oil fell and there were margin calls on the futures positions. Considerable short-term cash flow pressures were placed on MG. The members of MG who devised the hedging strategy argued that these short-term cash outflows were offset by positive cash flows that would ultimately be realized on the long-term fixed-price contracts. However, the company's senior management and its bankers became concerned about the huge cash drain. As a result, the company closed out all the hedge positions and agreed with its customers that the fixed- price contracts would be abandoned. The outcome was a loss to MG of $1.33 billion. Table 3.5 Date Oct. 2017 futures price Mar. 2018 futures price July 2018 futures price Spot price Apr. 2017 48.20 49.00 Sept. 2017 47.40 47.00 Feb. 2018 46.50 46.30 June 2018 45.90 46.00

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are detailed answers to the questions 1 What hedging strategy did MG employ MG employed a hedging strategy where they took long positions in shor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started