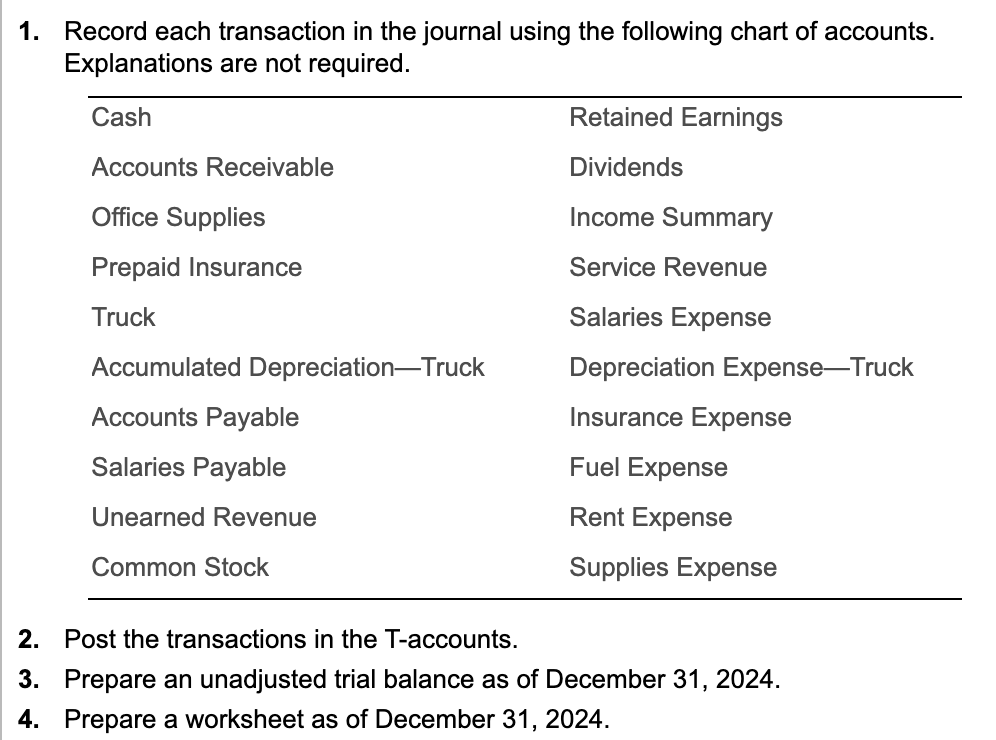

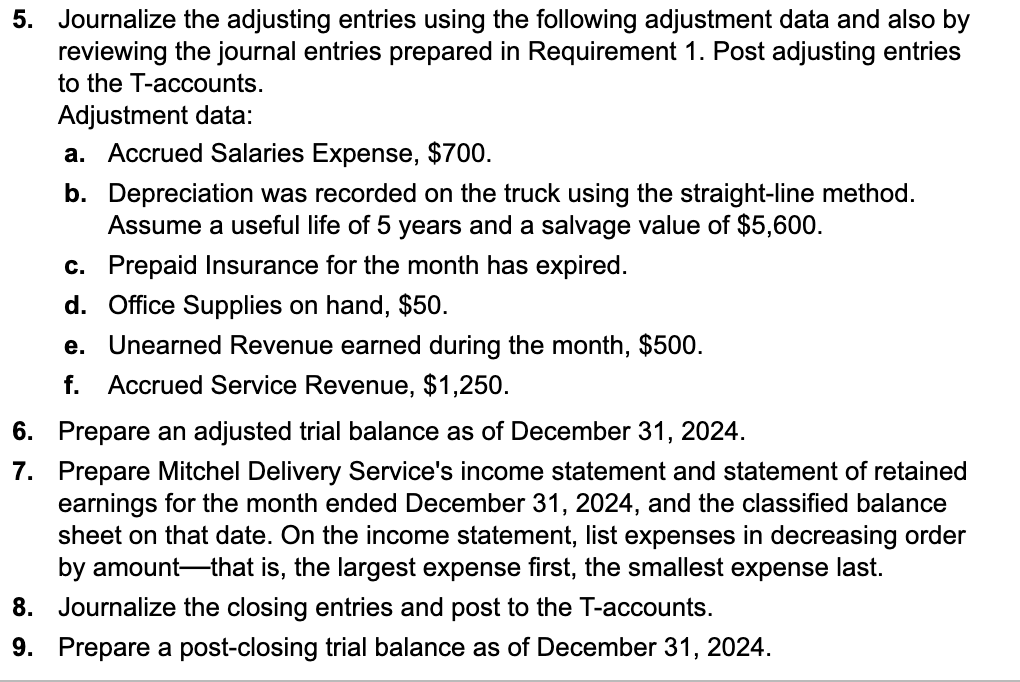

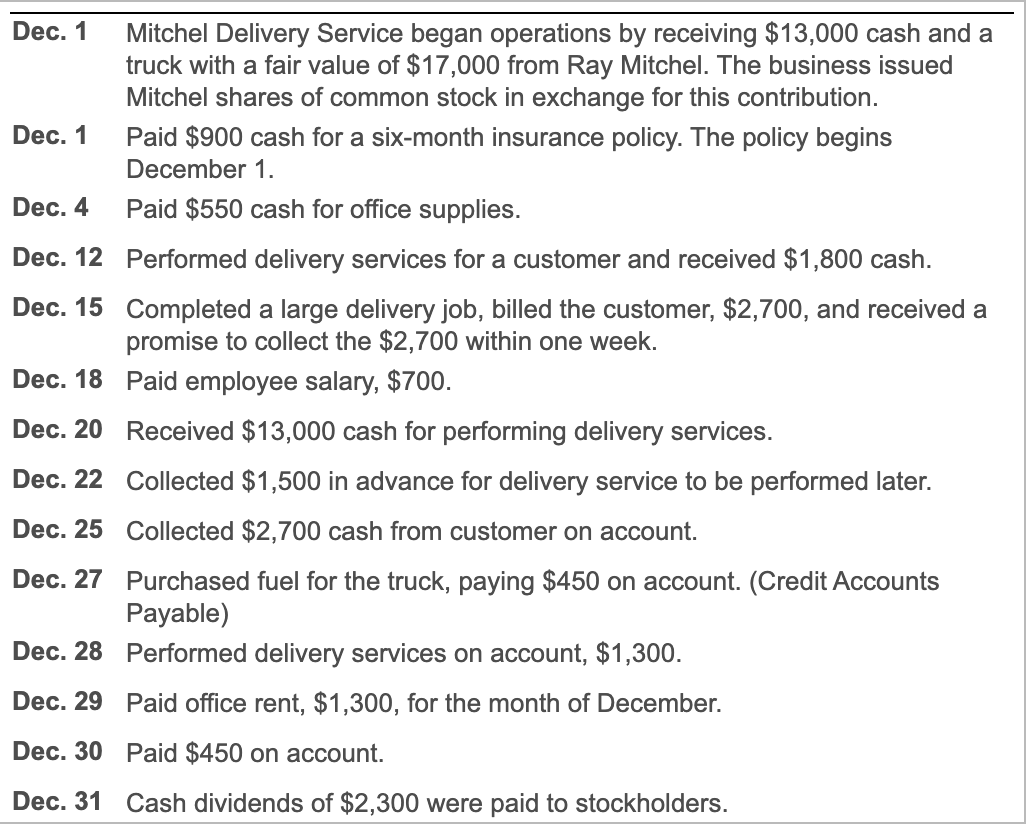

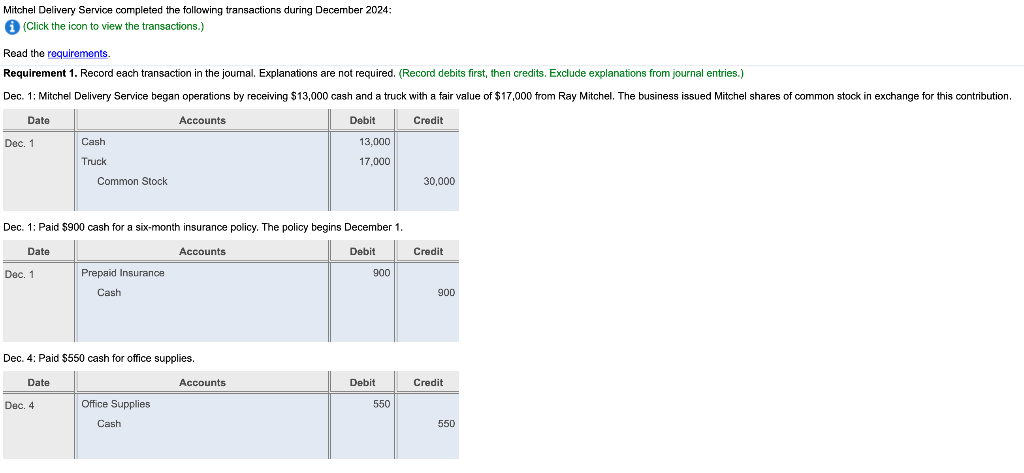

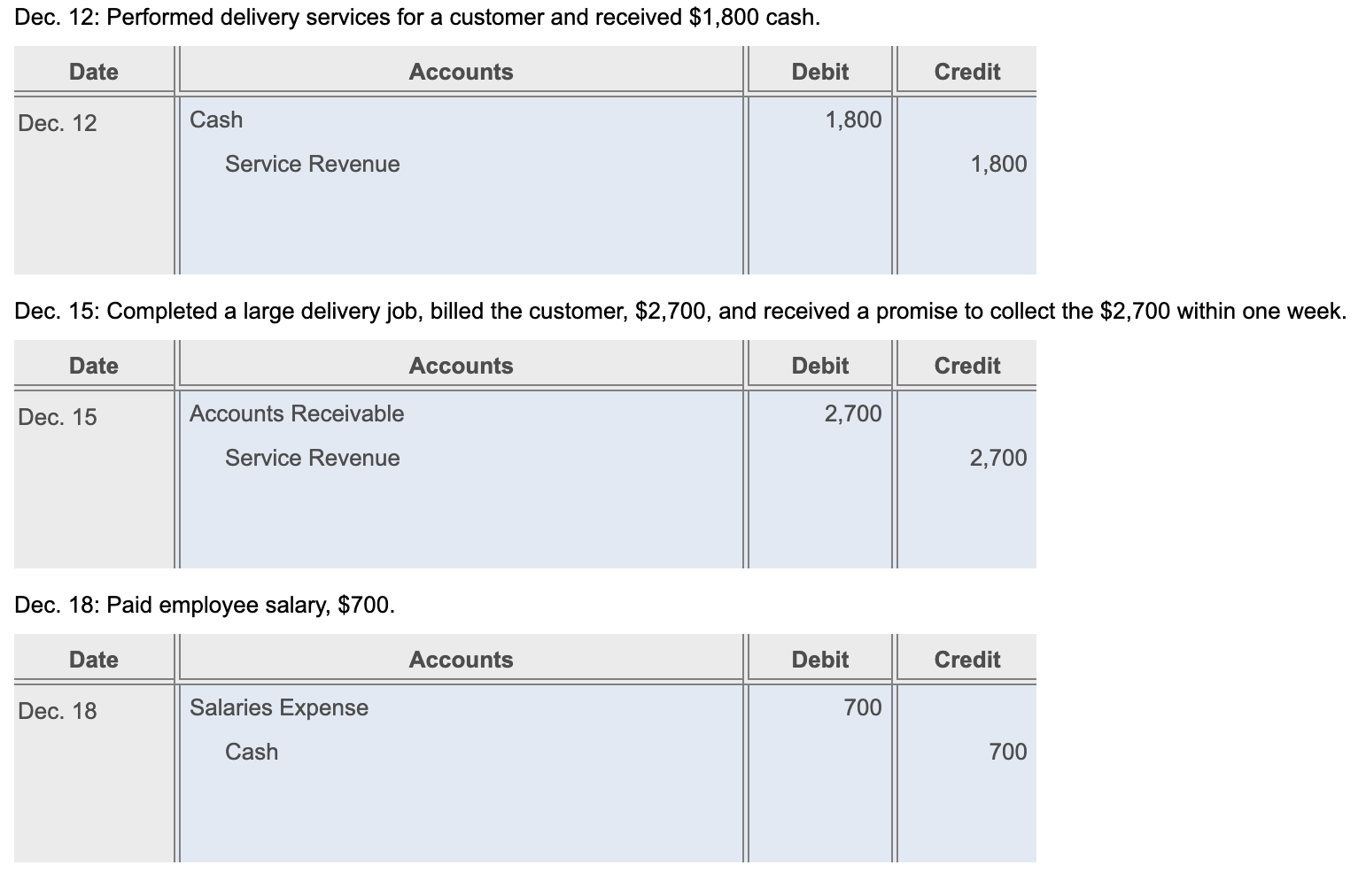

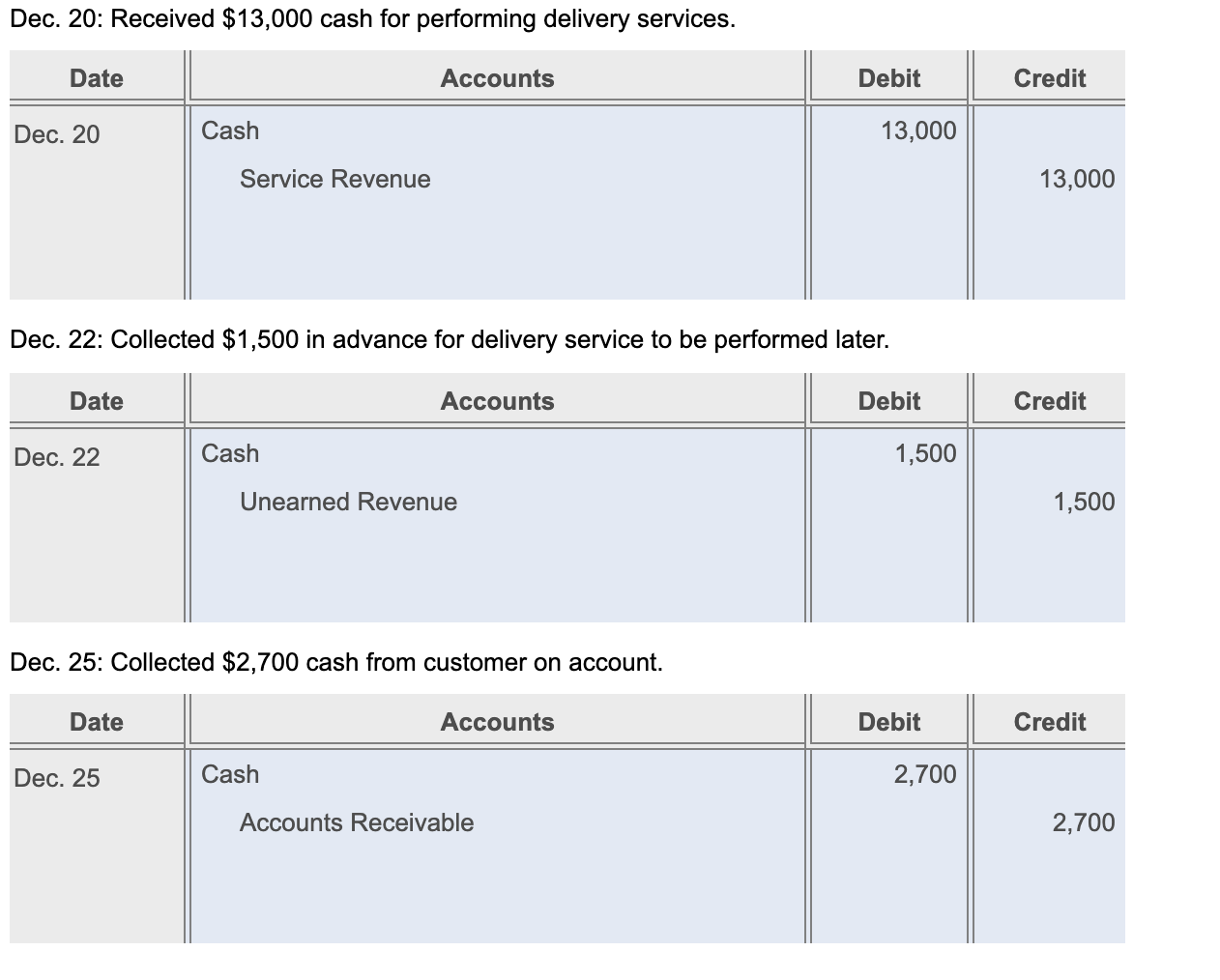

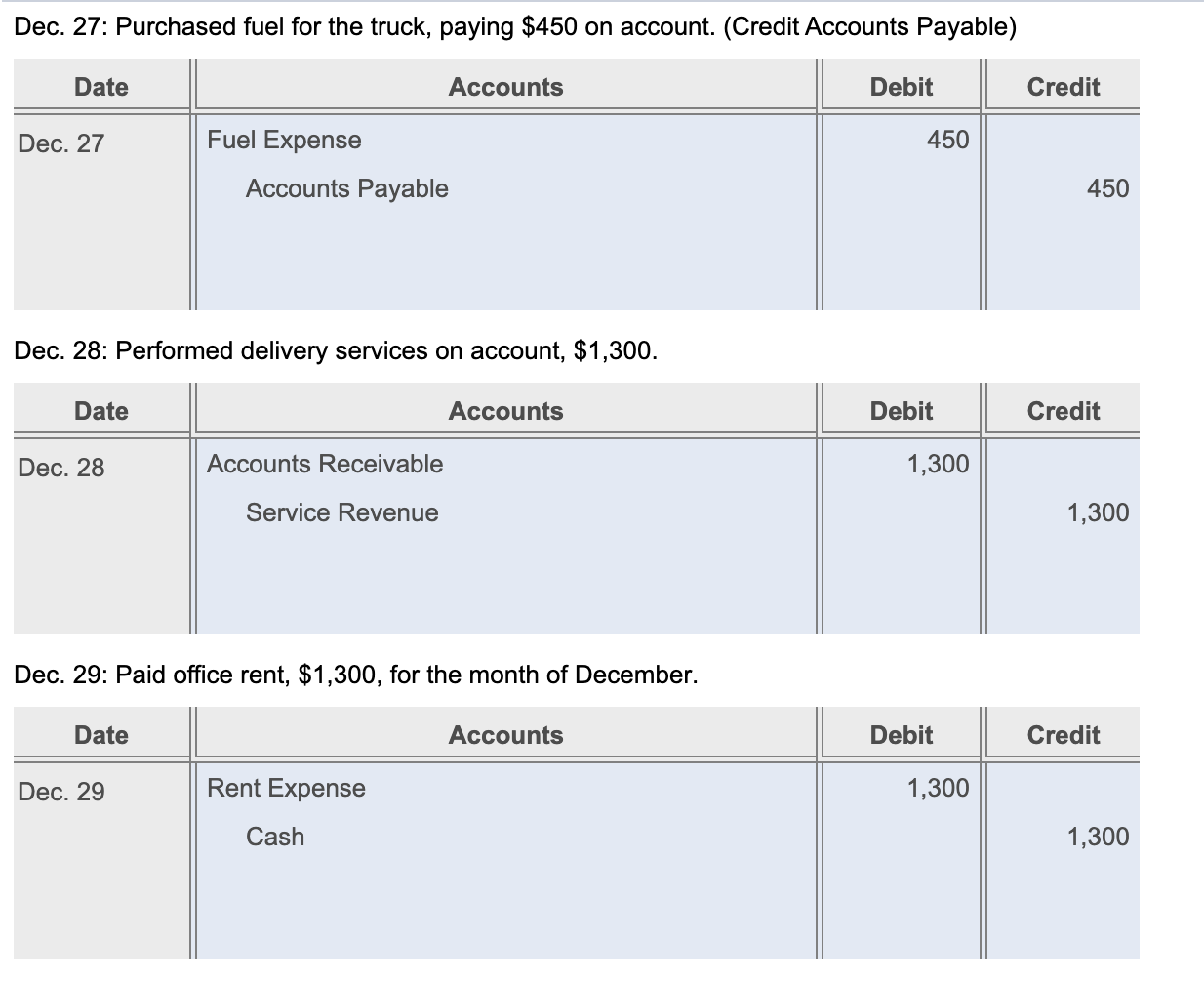

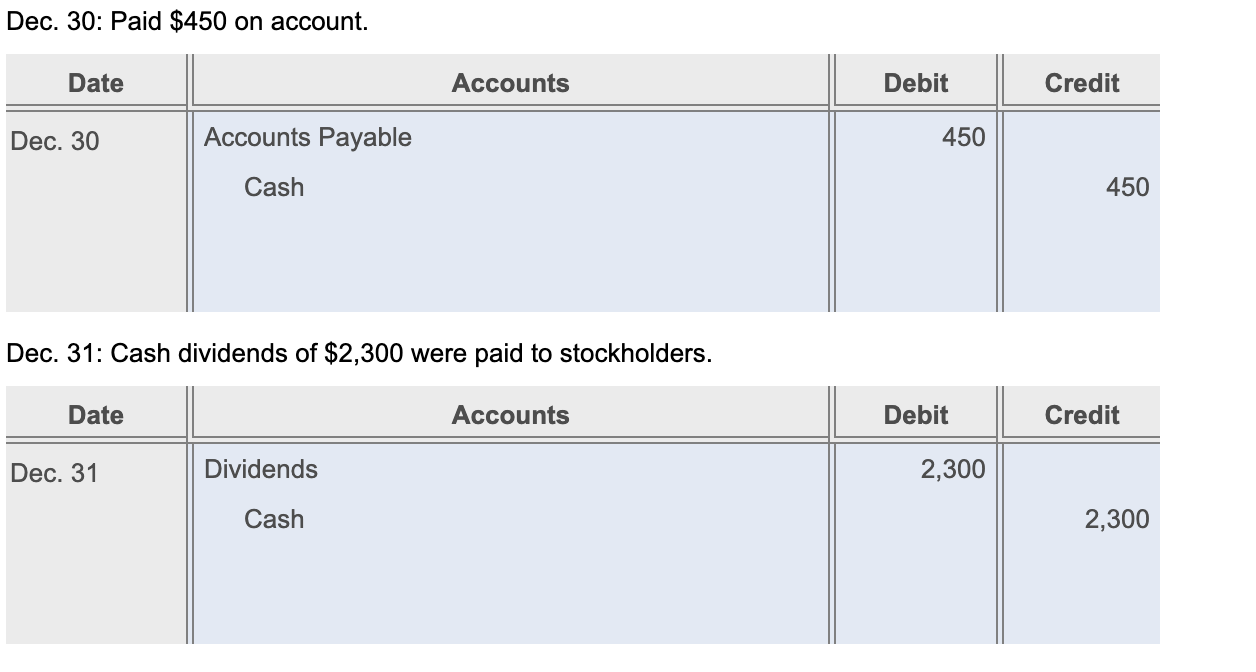

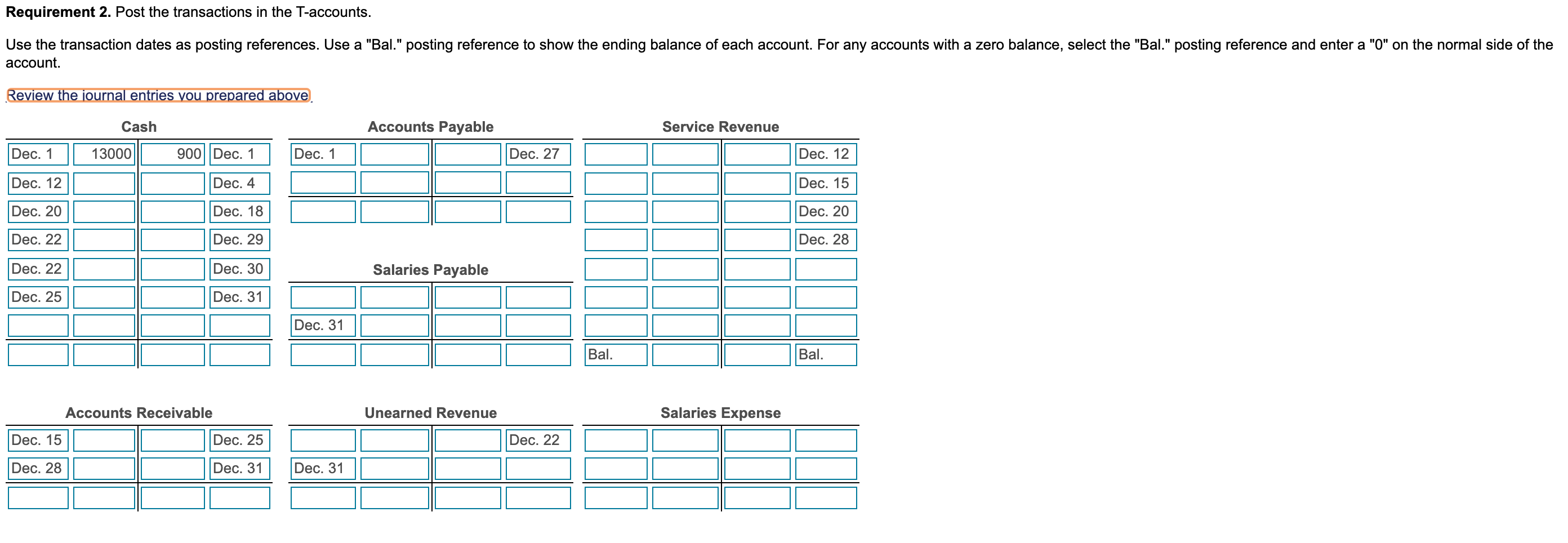

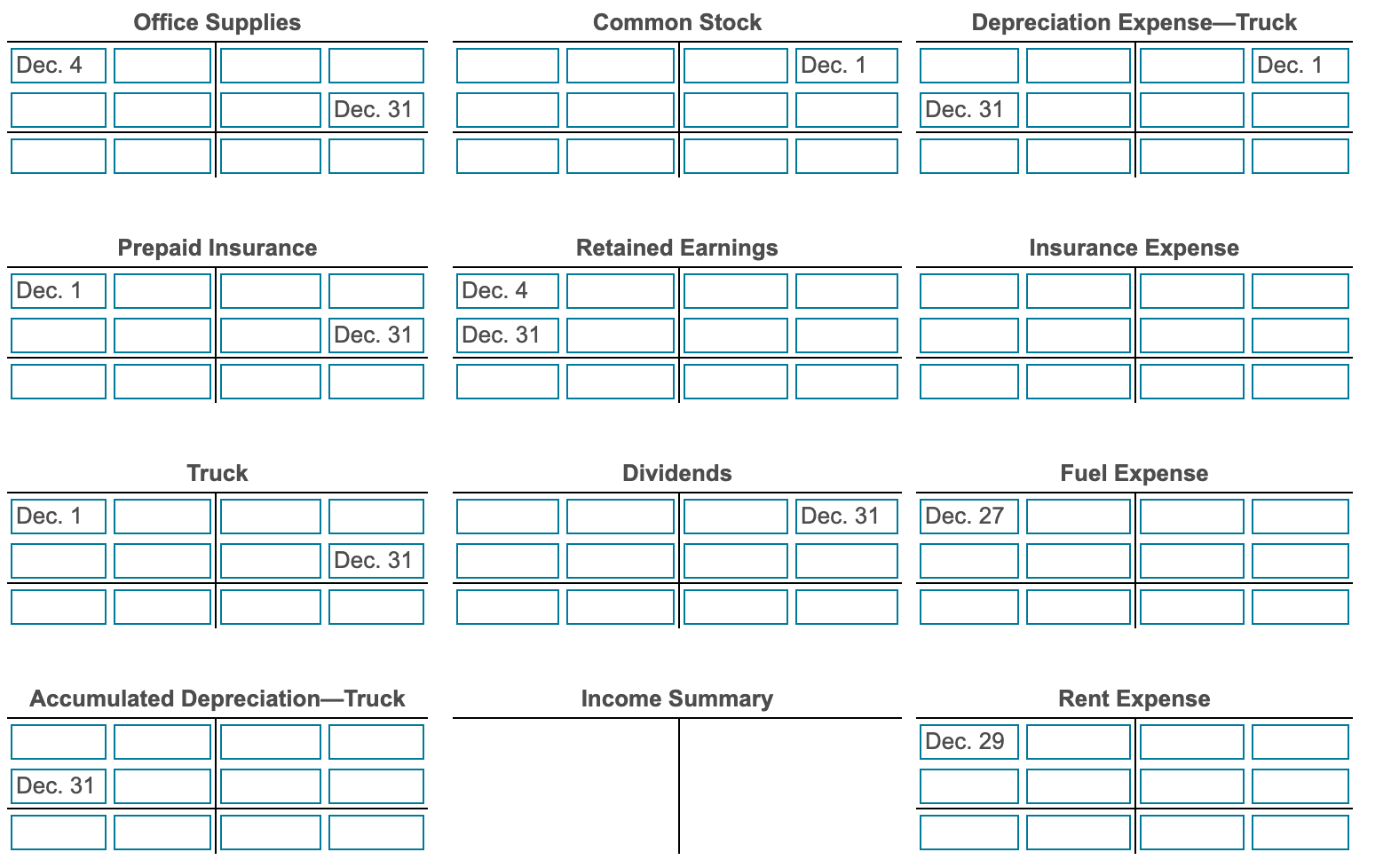

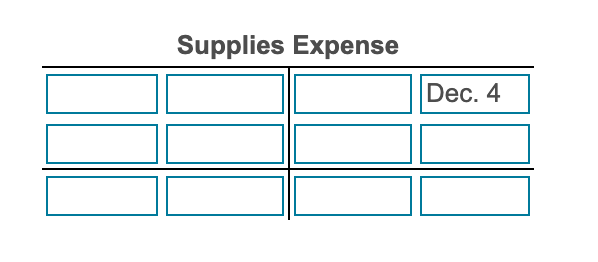

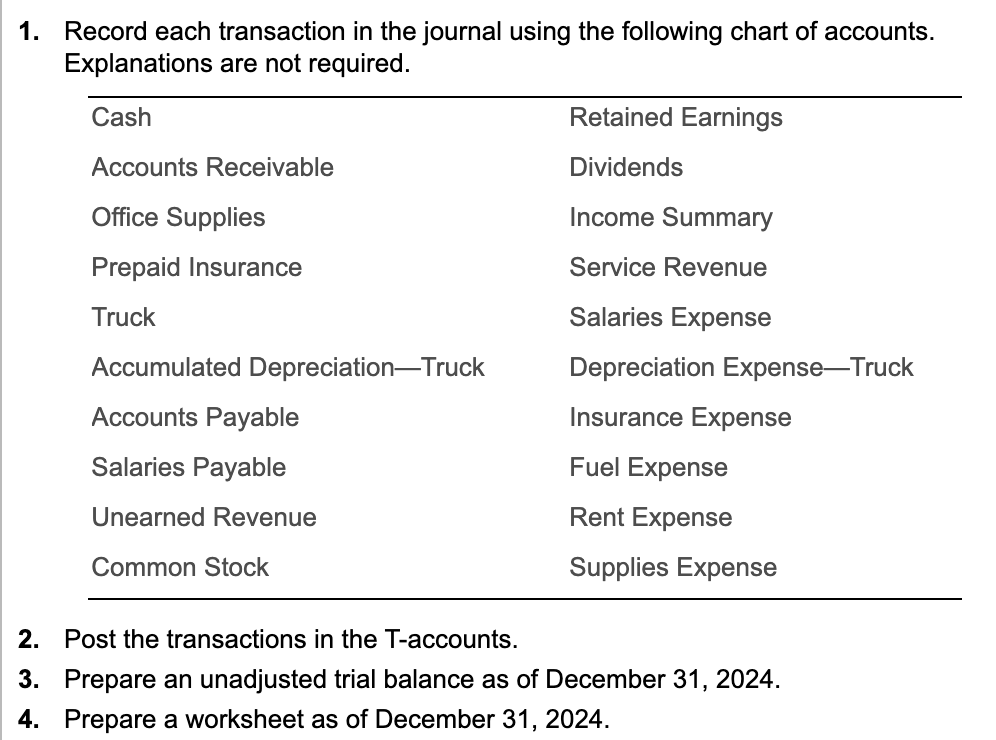

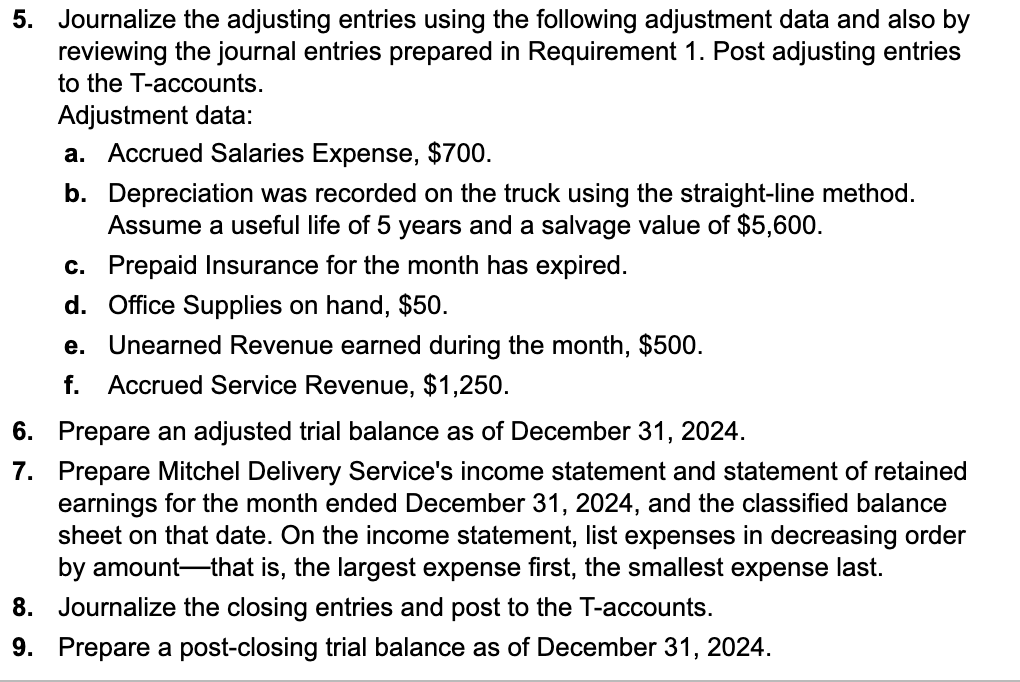

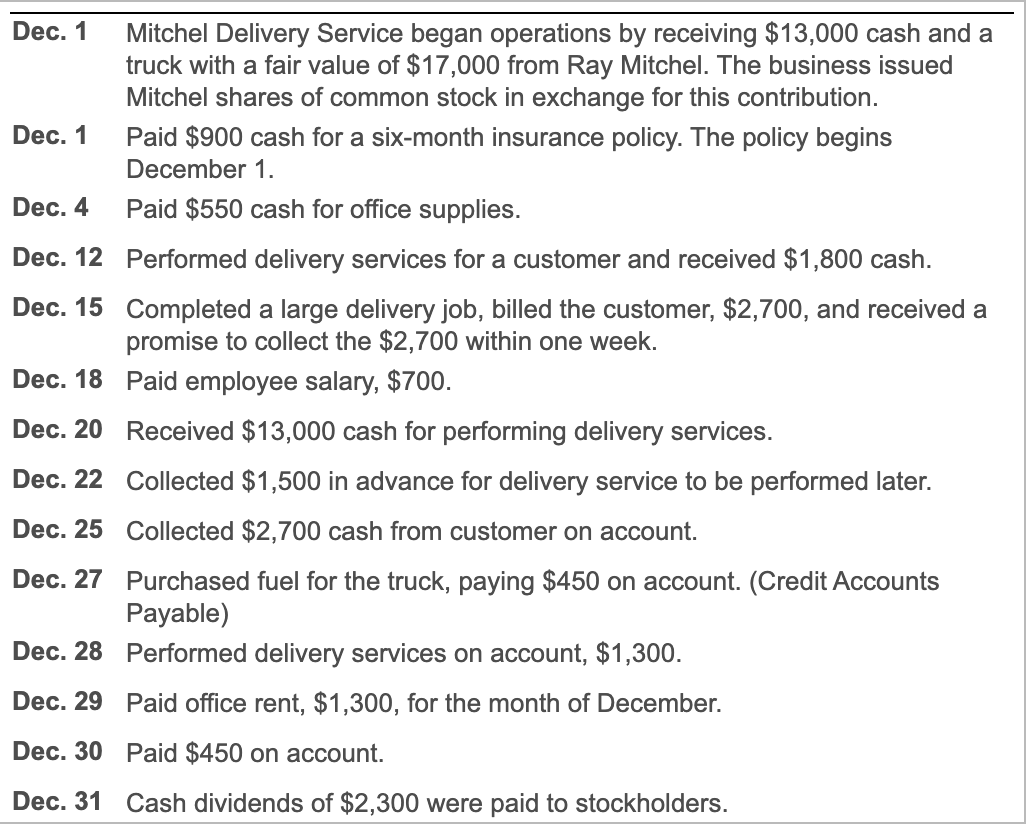

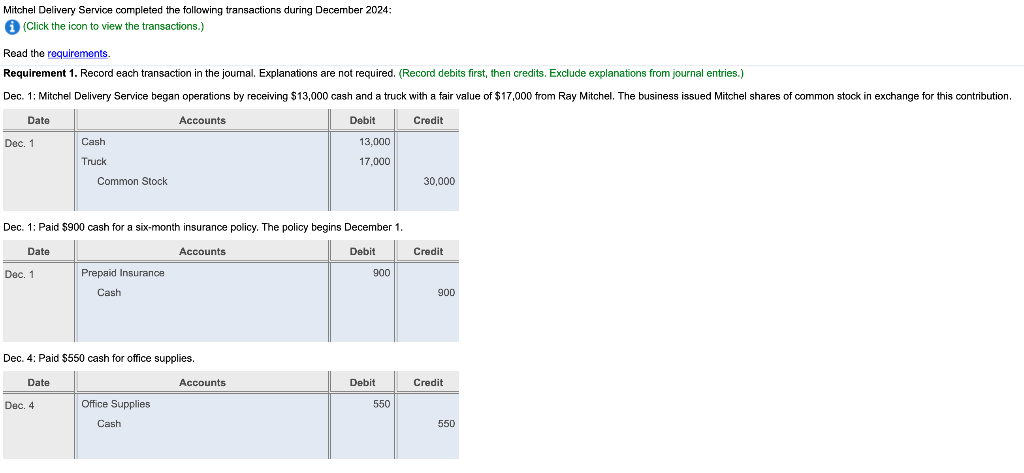

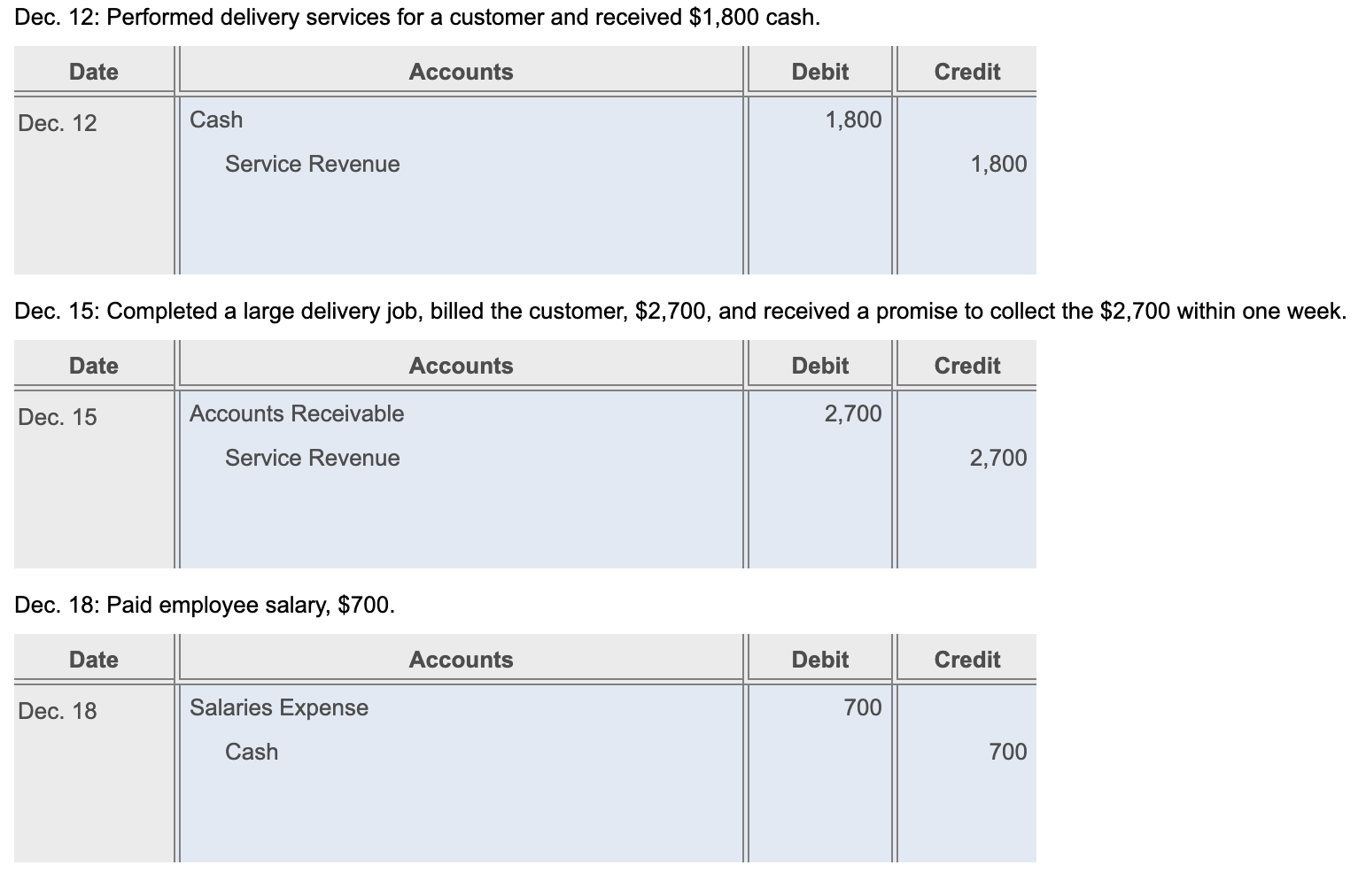

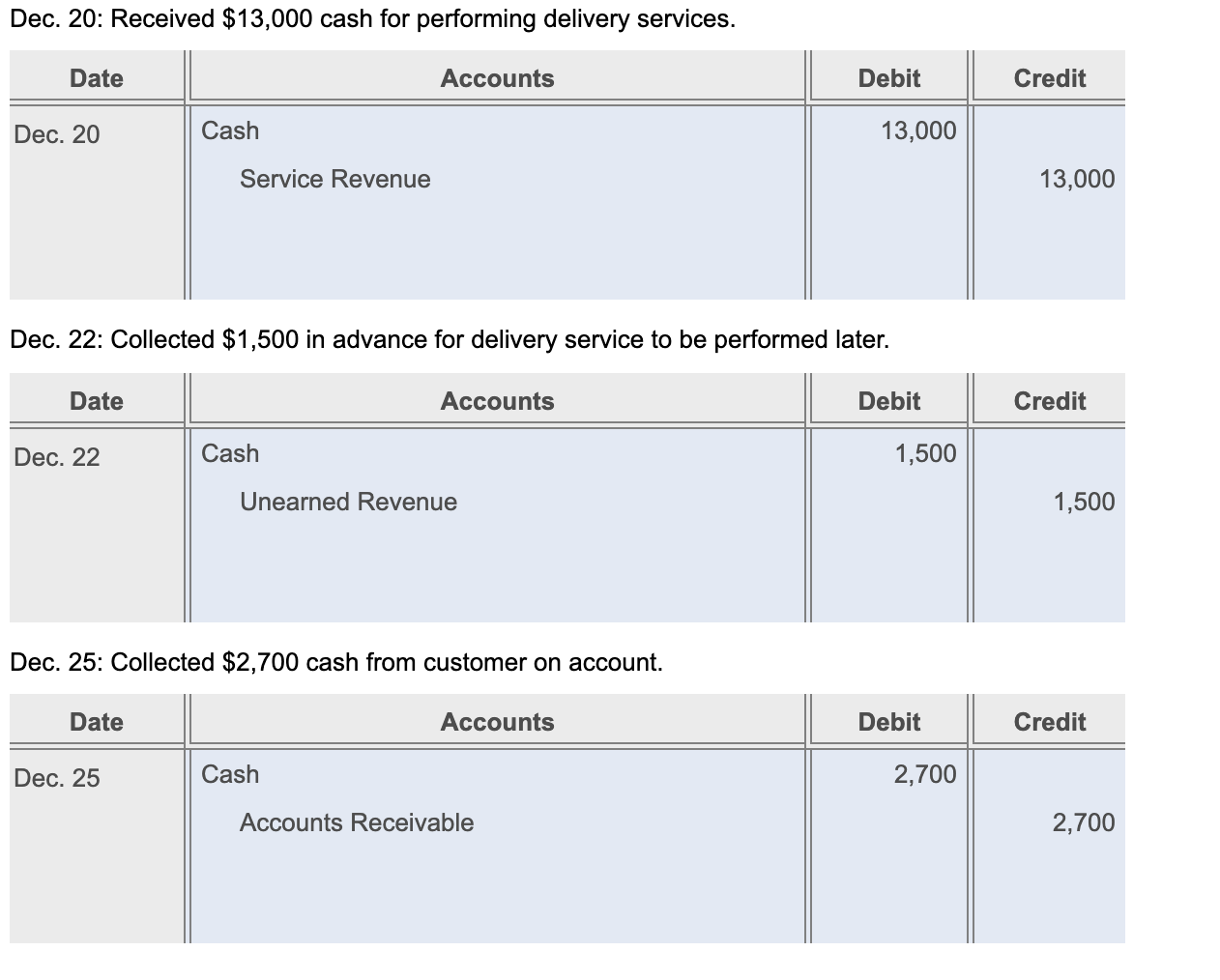

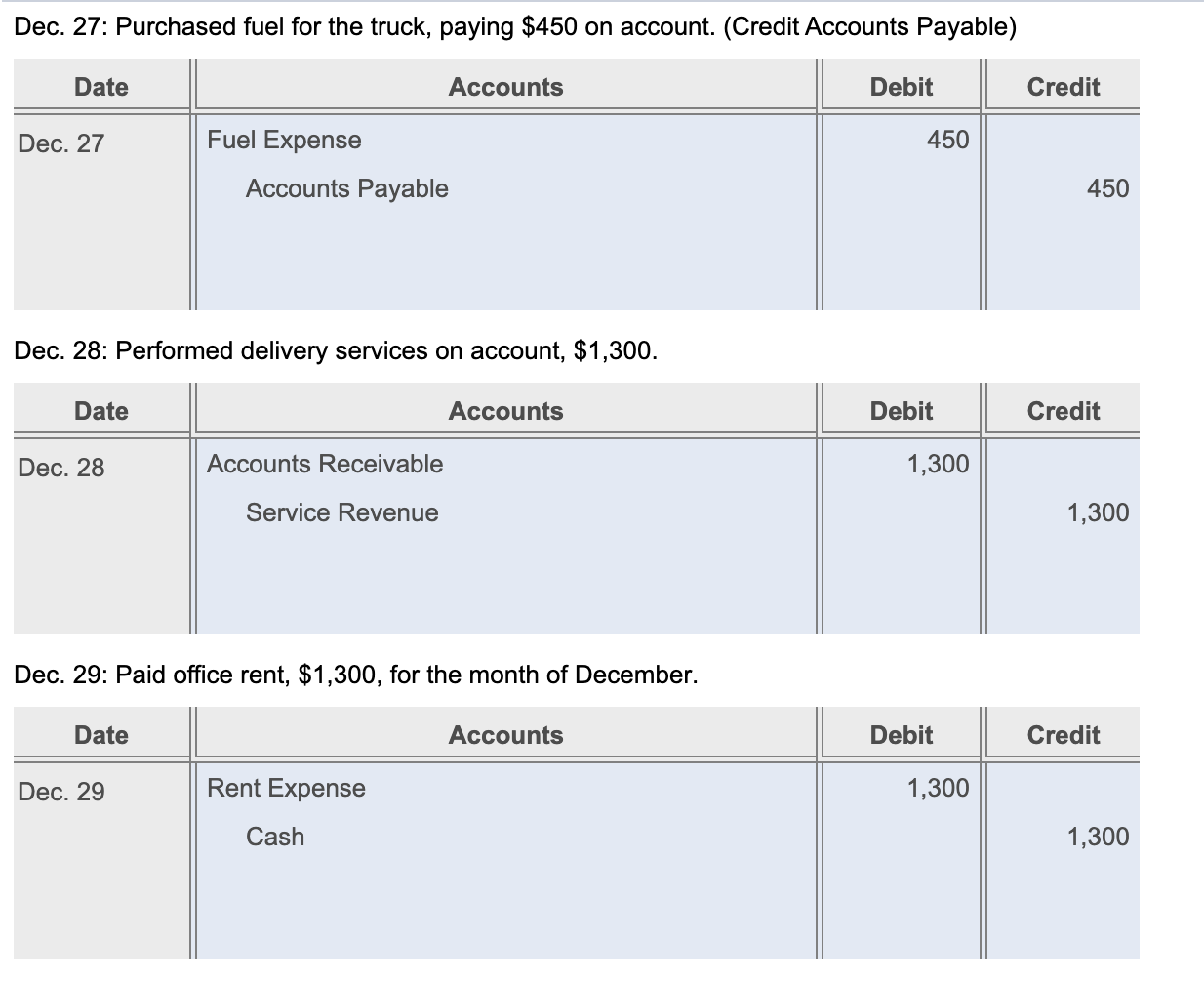

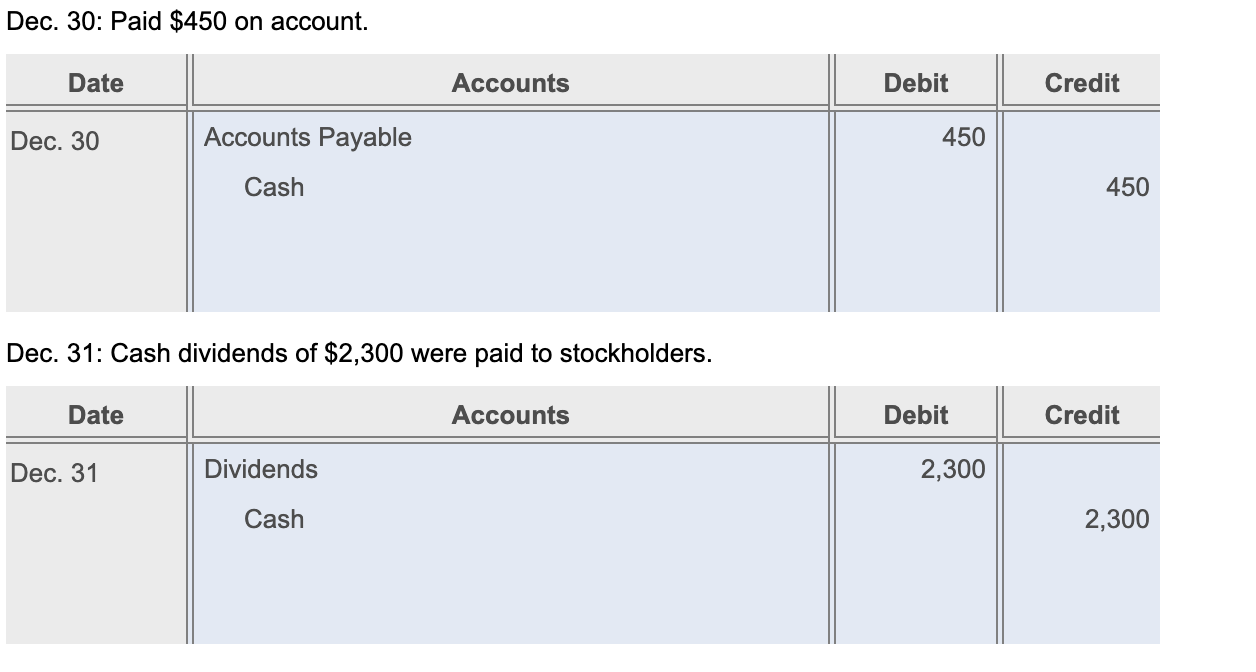

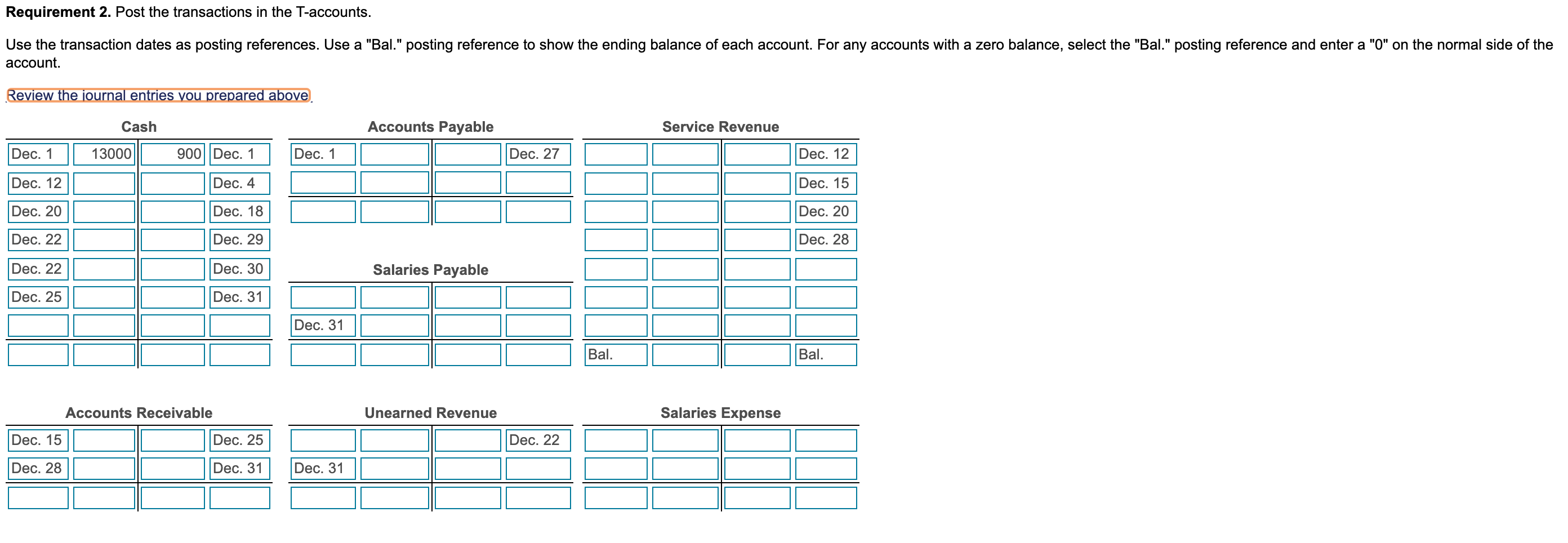

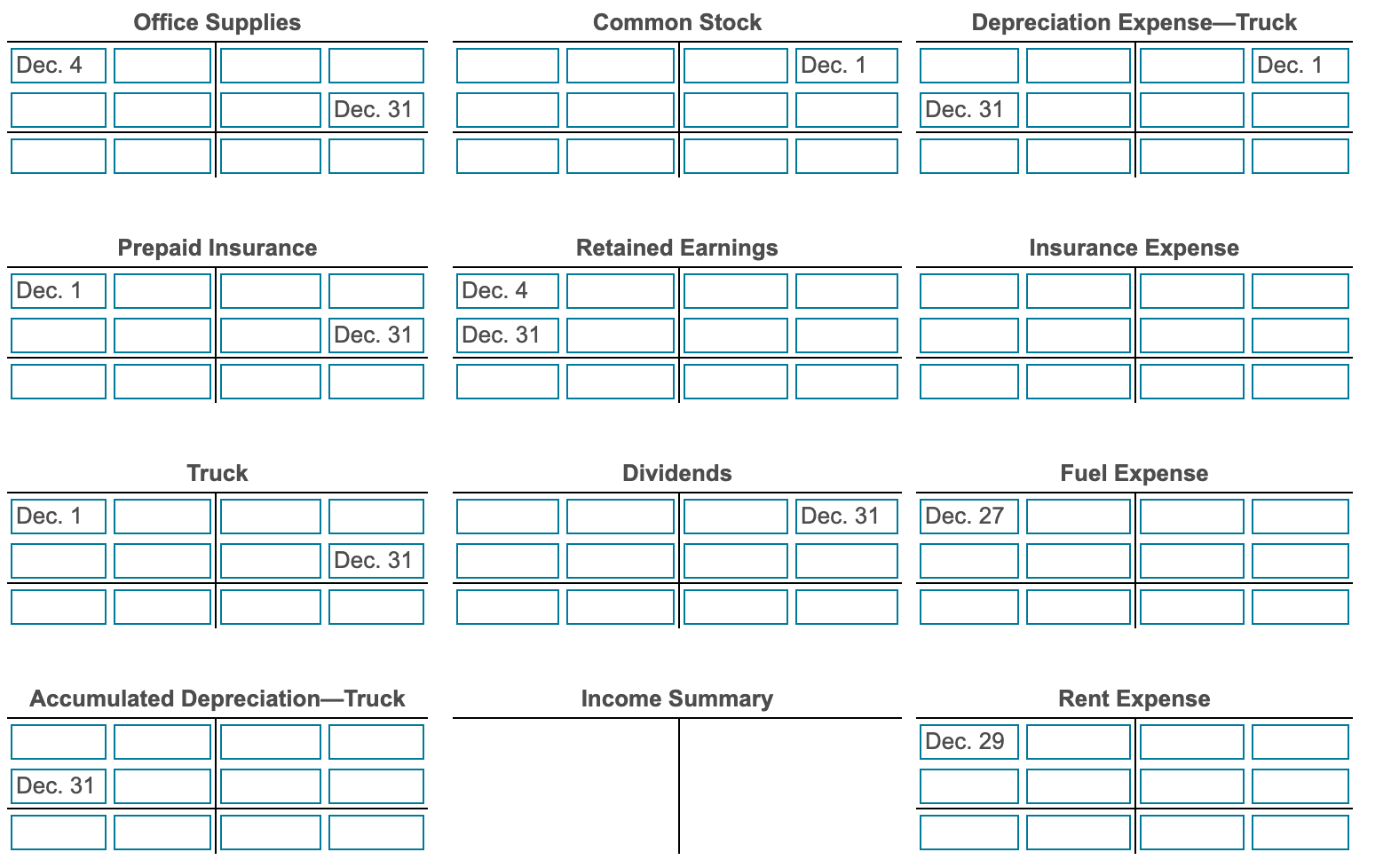

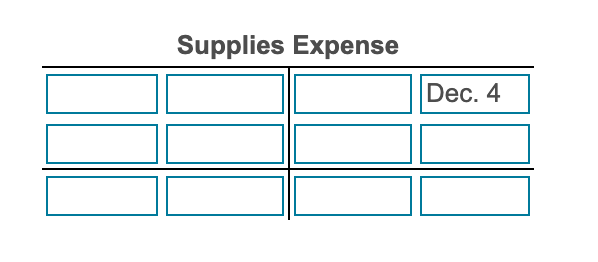

1. Record each transaction in the journal using the following chart of accounts. Explanations are not required. Cash Retained Earnings Accounts Receivable Dividends Income Summary Office Supplies Prepaid Insurance Truck Service Revenue Accumulated DepreciationTruck Salaries Expense Depreciation ExpenseTruck Insurance Expense Fuel Expense Accounts Payable Salaries Payable Unearned Revenue Rent Expense Common Stock Supplies Expense 2. Post the transactions in the T-accounts. 3. Prepare an unadjusted trial balance as of December 31, 2024. 4. Prepare a worksheet as of December 31, 2024. Dec. 1 Mitchel Delivery Service began operations by receiving $13,000 cash and a truck with a fair value of $17,000 from Ray Mitchel. The business issued Mitchel shares of common stock in exchange for this contribution. Dec. 1 Paid $900 cash for a six-month insurance policy. The policy begins December 1. Dec. 4 Paid $550 cash for office supplies. Dec. 12 Performed delivery services for a customer and received $1,800 cash. Dec. 15 Completed a large delivery job, billed the customer, $2,700, and received a promise to collect the $2,700 within one week. Dec. 18 Paid employee salary, $700. Dec. 20 Received $13,000 cash for performing delivery services. Dec. 22 Collected $1,500 in advance for delivery service to be performed later. Dec. 25 Collected $2,700 cash from customer on account. Dec. 27 Purchased fuel for the truck, paying $450 on account. (Credit Accounts Payable) Dec. 28 Performed delivery services on account, $1,300. Dec. 29 Paid office rent, $1,300, for the month of December. Dec. 30 Paid $450 on account. Dec. 31 Cash dividends of $2,300 were paid to stockholders. Mitchel Delivery Service completed the following transactions during December 2024: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Record each transaction in the journal. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) Dec. 1: Mitchel Delivery Service began operations by receiving $13,000 cash and a truck with a fair value of $17,000 from Ray Mitchel. The business issued Mitchel shares of common stock in exchange for this contribution. Date Accounts Debit Credit Dec. 1 Cash 13.000 Truck 17,000 Common Stock 30,000 Dec. 1: Paid $900 cash for a six-month insurance policy. The policy begins December 1. Date Accounts Debit Credit Dec. 1 900 Prepaid Insurance Cash 900 Dec 4: Paid $550 cash for office supplies. Date Accounts Debit Credit Dec. 4 550 Office Supplies Cash 550 Dec. 12: Performed delivery services for a customer and received $1,800 cash. Date Accounts Debit Credit Dec. 12 Cash 1,800 Service Revenue 1,800 Dec. 15: Completed a large delivery job, billed the customer, $2,700, and received a promise to collect the $2,700 within one week. Date Accounts Debit Credit Dec. 15 Accounts Receivable 2,700 Service Revenue 2,700 Dec. 18: Paid employee salary, $700. Date Accounts Debit Credit Dec. 18 Salaries Expense 700 Cash 700 Dec. 20: Received $13,000 cash for performing delivery services. Date Accounts Debit Credit Dec. 20 Cash 13,000 Service Revenue 13,000 Dec. 22: Collected $1,500 in advance for delivery service to be performed later. Date Accounts Debit Credit Dec. 22 Cash 1,500 Unearned Revenue 1,500 Dec. 25: Collected $2,700 cash from customer on account. Date Accounts Debit Credit Dec. 25 Cash 2,700 Accounts Receivable 2,700 Dec. 27: Purchased fuel for the truck, paying $450 on account. (Credit Accounts Payable) Date Accounts Debit Credit Dec. 27 450 Fuel Expense Accounts Payable 450 Dec. 28: Performed delivery services on account, $1,300. Date Accounts Debit Credit Dec. 28 Accounts Receivable 1,300 Service Revenue 1,300 Dec. 29: Paid office rent, $1,300, for the month of December. Date Accounts Debit Credit Dec. 29 Rent Expense 1,300 Cash 1,300 Dec. 30: Paid $450 on account. Date Accounts Debit Credit Dec. 30 Accounts Payable 450 Cash 450 Dec. 31: Cash dividends of $2,300 were paid to stockholders. Date Accounts Debit Credit Dec. 31 Dividends 2,300 Cash 2,300 Requirement 2. Post the transactions in the T-accounts. Use the transaction dates as posting references. Use a "Bal." posting reference to show the ending balance of each account. For any accounts with a zero balance, select the "Bal." posting reference and enter a "0" on the normal side of the account. Review the journal entries you prepared above Cash Accounts Payable Service Revenue Dec. 1 13000 900| Dec. 1 Dec. 1 Dec. 27 Dec. 12 Dec. 12 Dec. 4 Dec. 15 Dec. 20 Dec. 18 Dec. 20 Dec. 22 Dec. 29 Dec. 28 Dec. 22 Dec. 30 Salaries Payable Dec. 25 Dec. 31 Dec. 31 Bal. Bal. Accounts Receivable Unearned Revenue Salaries Expense Dec. 15 Dec. 25 Dec. 22 Dec. 28 Dec. 31 Dec. 31 Office Supplies Common Stock Depreciation Expense-Truck Dec. 4 Dec. 1 Dec. 1 Dec. 31 Dec. 31 Prepaid Insurance Retained Earnings Insurance Expense Dec. 1 Dec. 4 Dec. 31 Dec. 31 Truck Dividends Fuel Expense Dec. 1 Dec. 31 Dec. 27 Dec. 31 Accumulated DepreciationTruck Income Summary Rent Expense Dec. 29 Dec. 31 Supplies Expense Dec. 4