Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Record journal entries, including adjusting entries when needed, for each of the ten transactions above. Use the account names from the trial balance above.

1. Record journal entries, including adjusting entries when needed, for each of the ten transactions above. Use the account names from the trial balance above.

2. Post the journal entries in the T-accounts below.

3. Record the closing entry (to reset income statement accounts).

4. Prepare a balance sheet and income statement for the year ended December 31, 2017. Start with

the income statement. Remember that the retained earnings already incorporate the closing entry.

on the ending balance sheet should

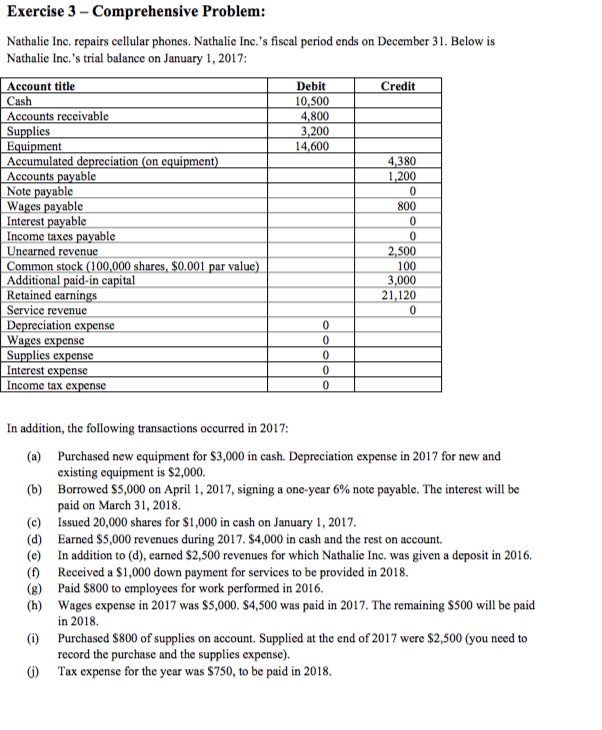

Exercise 3- Comprehensive Problem: Nathalie Inc. repairs cellular phones. Nathalic Inc.'s fiscal period ends on December 31. Below is Nathalie Inc.'s trial balance on January 1, 2017 Account title Accounts receivable Debit 0,500 4,800 3,200 14,600 Credit 4,380 Accumulated Accounts payable Note payable ation (on equi Wages payable 800 Interest payable Income taxes payable 500 100 3,000 21,120 nearned revenue Common stock (100,000 shares, $0.001 par value) Additional paid-in capital Retained carnings Scrvice revenue Depreciation expense Wages ex Supplies ex Interest expense ncome tax cxpense In addition, the following transactions occurred in 2017: Purchased new equipment for $3,000 in cash. Depreciation expense in 2017 for new and existing equipment is $2,000. Borrowed $5,000 on April 1, 2017, signing a one-year 6% note payable. The interest will be paid on March 31, 2018. (a) (b) (c) Issued 20,000 shares for $1,000 in cash on January ,2017 (d) Earned $5,000 revenues during 2017. $4,000 in cash and the rest on account. (e) In addition to (d), earned S2,500 revenues for which Nathalie Inc. was given a deposit in 2016. (f) Received a S1,000 down payment for services to be provided in 2018 (g) Paid S800 to employees for work performed in 2016 (h) Wages expense in 2017 was $5,000. $4,500 was paid in 2017. The remaining S500 will be paid in 2018. Purchased $800 of supplies on account. Supplied at the end of 2017 were $2,500 (you need to record the purchase and the supplies expense). (i) G) Tax expense for the year was $750, to be paid in 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started