Question

1. Record receipt of federal grant amount for specified research project. 2. Record the expenses for the specified research program during the year. 3. Record

1. Record receipt of federal grant amount for specified research project. 2. Record the expenses for the specified research program during the year. 3. Record the adjustment required in the net assets released from restriction account. 4. Ira Beaker, a renowned chemist and alumnus, donated $7,000,000 to be used for the construction of new chemistry building to be named Beaker Hall. The gift is to be paid to the university in equal installments over a two-year period; the sum for the current year was received in cash. 5. Record the cash outlays purchases were made during the year for construction in progress on the new chemistry building. 6. Record the adjustment required in the net assets released from restriction account. 7. During the year bonds with a face value of $180,000 were retired.

1. Record receipt of federal grant amount for specified research project. 2. Record the expenses for the specified research program during the year. 3. Record the adjustment required in the net assets released from restriction account. 4. Ira Beaker, a renowned chemist and alumnus, donated $7,000,000 to be used for the construction of new chemistry building to be named Beaker Hall. The gift is to be paid to the university in equal installments over a two-year period; the sum for the current year was received in cash. 5. Record the cash outlays purchases were made during the year for construction in progress on the new chemistry building. 6. Record the adjustment required in the net assets released from restriction account. 7. During the year bonds with a face value of $180,000 were retired.

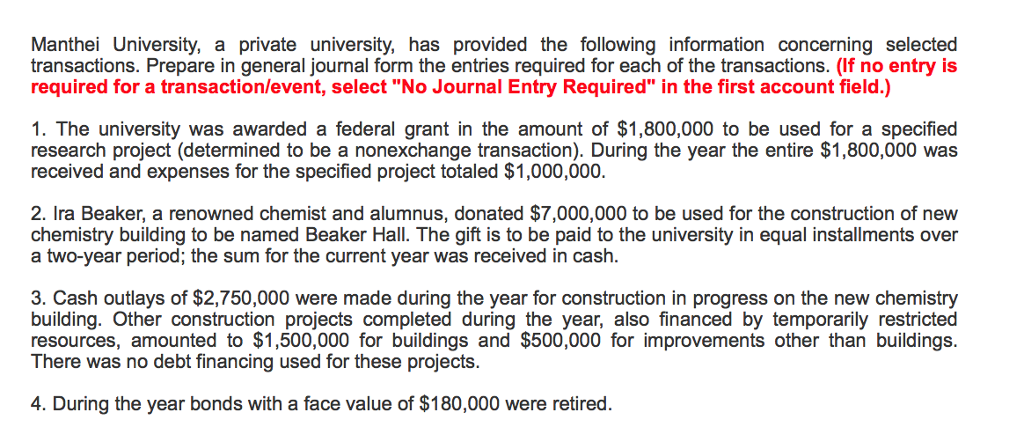

Manthei University, a private university, has provided the following information concerning selected transactions. Prepare in general journal form the entries required for each of the transactions. (If no entry is required for a transactionlevent, select "No Journal Entry Required" in the first account field.) 1. The university was awarded a federal grant in the amount of $1,800,000 to be used for a specified research project (determined to be a nonexchange transaction). During the year the entire $1,800,000 was received and expenses for the specified project totaled $1,000,000 2. Ira Beaker, a renowned chemist and alumnus, donated $7,000,000 to be used for the construction of new chemistry building to be named Beaker Hall. The gift is to be paid to the university in equal installments over a two-year period; the sum for the current year was received in cash 3. Cash outlays of $2,750,000 were made during the year for construction in progress on the new chemistry building. Other construction projects completed during the year, also financed by temporarily restricted resources, amounted to $1,500,000 for buildings and $500,000 for improvements other than buildings There was no debt financing used for these projects 4. During the year bonds with a face value of $180,000 were retired

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started