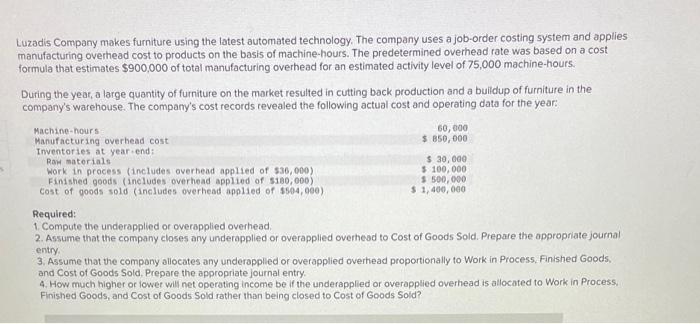

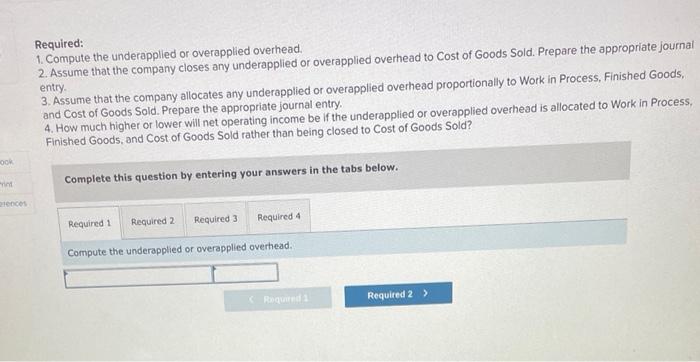

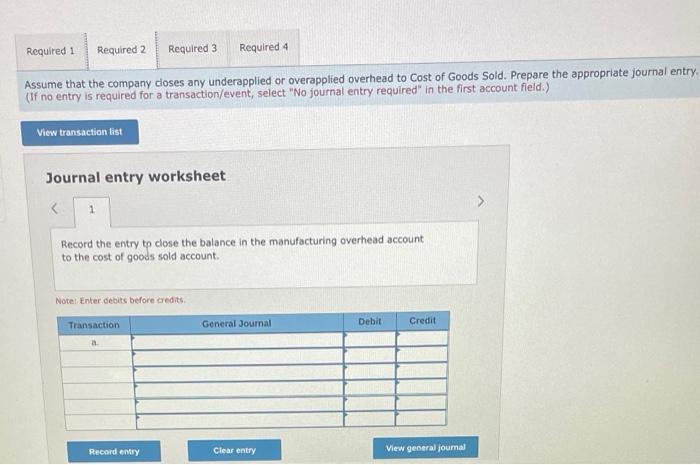

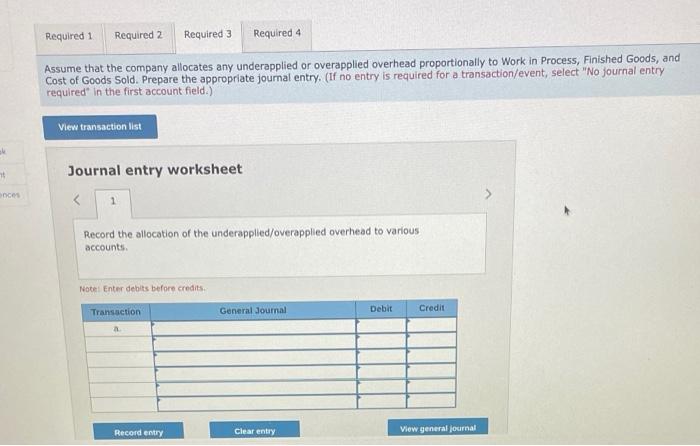

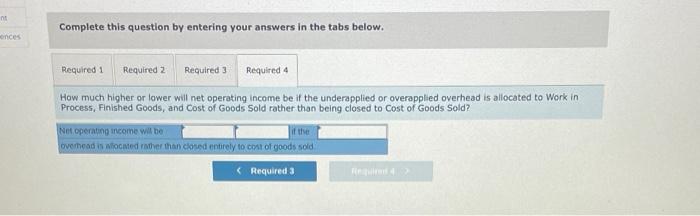

Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $900,000 of total manufacturing overhead for an estimated activity level of 75,000 machine-hours. During the yeat, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company's warehouse. The company's cost records revealed the following actual cost and operating data for the year: Required: 1. Compute the underapplied or overopplied overhead. 2. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the oppropriate journal entry. 3. Assume that the compony allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. 4. How much higher or lowet wili net operating income be if the underapplied or overapplied overhead is allocated to Work in Process. Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Required: 1. Compute the underapplied or overapplied overhead. 2. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journai entry. 3. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. 4. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process. Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Complete this question by entering your answers in the tabs below. Compute the underapplied or overapplied overhead. Assume that the company doses any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry, (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry to close the balance in the manufacturing overhead account. to the cost of goous sold account. Notel Enter debits before icredits. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate joumal entry. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Journal entry worksheet Record the allocation of the underapplied/overapplied overhead to various accounts. Fotel Enter debits before crodits. Complete this question by entering your answers in the tabs below. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold