Question

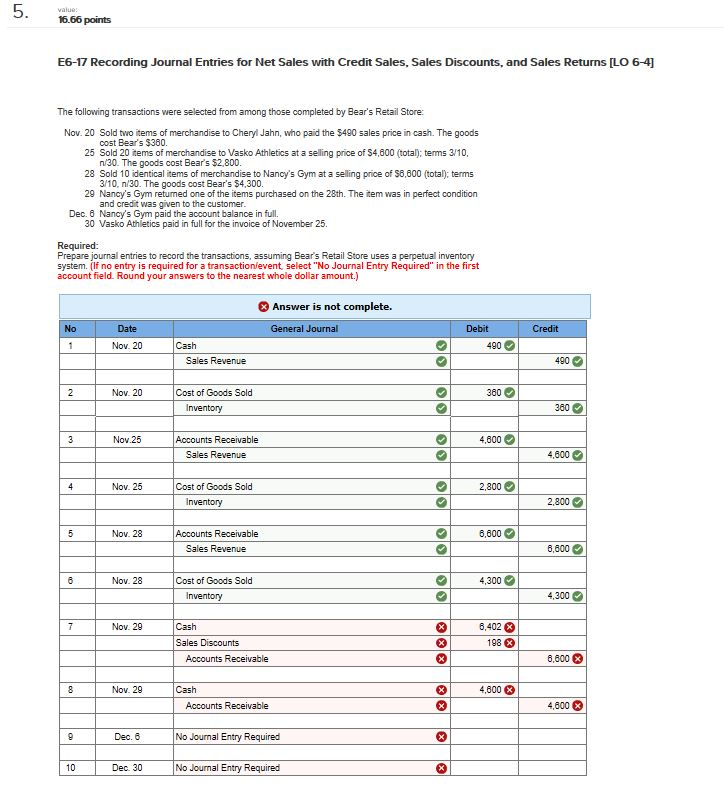

1. Record the cash sales of $490 to Cheryl Jahn. 2. Record the cost of goods sold of $360. 3. Record the sales on account

1. Record the cash sales of $490 to Cheryl Jahn.

2. Record the cost of goods sold of $360.

3. Record the sales on account of 20 items for $4,600 to Vasko Athletics on terms 3/10, n/30.Record the sales on account of 20 items for $4,600 to Vasko Athletics on terms 3/10, n/30.

4. Record the cost of goods sold of $2,800.

5. Record the sales on account of 10 items for $6,600 to Nancys Gym on terms 3/10, n/30.

6. Record the cost of goods sold of $4,300.

7. Record the return of 1 item by Nancys Gym in perfect condition for which credit was given to the customer.

8. Record the reversal of the cost of goods sold for the sales return.

9. Record the receipt of payment in full from Nancys Gym.

10. Record the receipt of payment in full from Vasko Athletics.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started