Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.) Record the ending balance for Accounts Receivable, Allowance for Doubtful Accounts and Allowance for Sales Returns at 8/31/17. 2.) Calculate Bad Debt Expense for

1.) Record the ending balance for Accounts Receivable, Allowance for Doubtful Accounts and Allowance for Sales Returns at 8/31/17.

2.) Calculate Bad Debt Expense for August using the balance sheet method.

3.) Calculate the net realizable value for Accounts Receivable and net credit sales for the period. Assume sales discounts amount to $22,000.

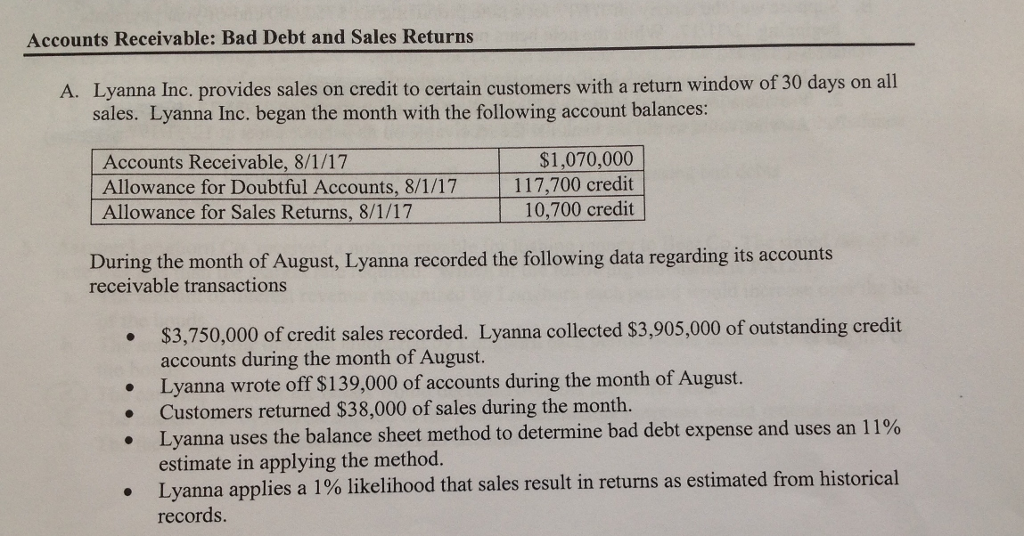

Accounts Receivable: Bad Debt and Sales Returns A. Lyanna Ine. provides sales on credit to certain customers with a return window of 30 days on all sales. Lyanna Inc. began the month with the following account balances: Accounts Receivable, 8/1/17 Allowance for Doubtful Accounts, 8/1/17 Allowance for Sales Returns, 8/1/17 $1,070,000 117,700 credit 10,700 credit During the month of August, Lyanna recorded the following data regarding its accounts receivable transactions $3,750,000 of credit sales recorded. Lyanna collected $3,905,000 of outstanding credit accounts during the month of August. Lyanna wrote off $139,000 of accounts during the month of August. Customers returned $38,000 of sales during the month. Lyanna uses the balance sheet method to determine bad debt expense and uses an 11% estimate in applying the method. Lyanna applies a 1% likelihood records. . that sales result in returns as estimated from historicalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started