Answered step by step

Verified Expert Solution

Question

1 Approved Answer

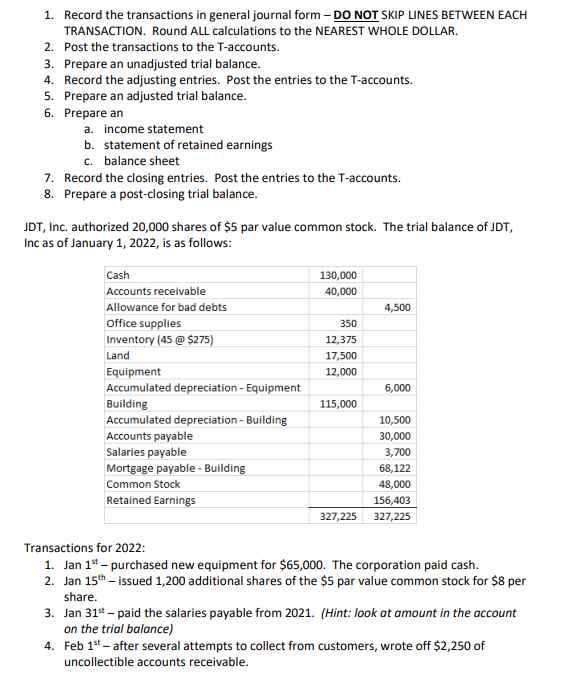

1. Record the transactions in general journal form - DO NOT SKIP LINES BETWEEN EACH TRANSACTION. Round ALL calculations to the NEAREST WHOLE DOLLAR.

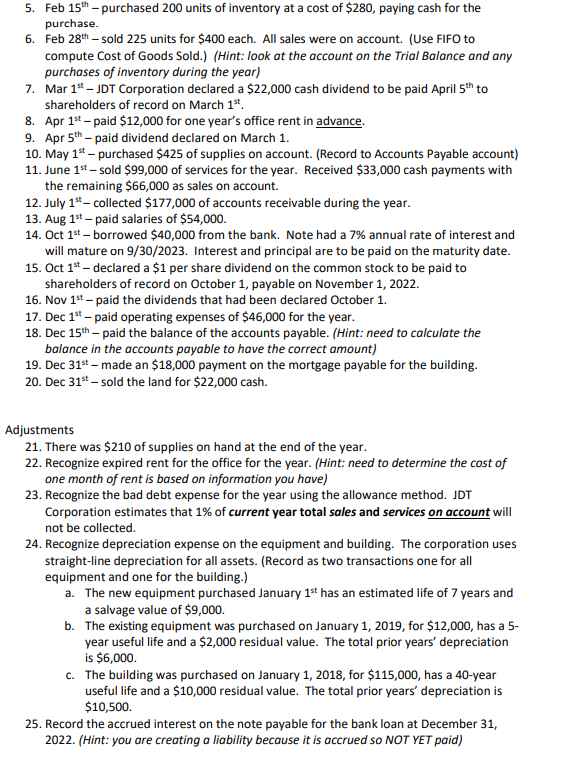

1. Record the transactions in general journal form - DO NOT SKIP LINES BETWEEN EACH TRANSACTION. Round ALL calculations to the NEAREST WHOLE DOLLAR. 2. Post the transactions to the T-accounts. 3. Prepare an unadjusted trial balance. 4. Record the adjusting entries. Post the entries to the T-accounts. 5. Prepare an adjusted trial balance. 6. Prepare an a. income statement b. statement of retained earnings c. balance sheet 7. Record the closing entries. Post the entries to the T-accounts. 8. Prepare a post-closing trial balance. JDT, Inc. authorized 20,000 shares of $5 par value common stock. The trial balance of JDT, Inc as of January 1, 2022, is as follows: Cash 130,000 Accounts receivable 40,000 Allowance for bad debts 4,500 Office supplies 350 Inventory (45 @ $275) 12,375 Land 17,500 Equipment 12,000 Accumulated depreciation - Equipment 6,000 Building 115,000 Accumulated depreciation-Building 10,500 Accounts payable 30,000 Salaries payable 3,700 Mortgage payable - Building 68,122 Common Stock 48,000 Retained Earnings 156,403 327,225 327,225 Transactions for 2022: 1. Jan 1-purchased new equipment for $65,000. The corporation paid cash. 2. Jan 15th-issued 1,200 additional shares of the $5 par value common stock for $8 per share. 3. Jan 31-paid the salaries payable from 2021. (Hint: look at amount in the account on the trial balance) 4. Feb 1st-after several attempts to collect from customers, wrote off $2,250 of uncollectible accounts receivable. 5. Feb 15th-purchased 200 units of inventory at a cost of $280, paying cash for the purchase. 6. Feb 28th-sold 225 units for $400 each. All sales were on account. (Use FIFO to compute Cost of Goods Sold.) (Hint: look at the account on the Trial Balance and any purchases of inventory during the year) 7. Mar 1 - JDT Corporation declared a $22,000 cash dividend to be paid April 5th to shareholders of record on March 1". 8. Apr 1st-paid $12,000 for one year's office rent in advance. 9. Apr 5th-paid dividend declared on March 1. 10. May 1st purchased $425 of supplies on account. (Record to Accounts Payable account) 11. June 1st-sold $99,000 of services for the year. Received $33,000 cash payments with the remaining $66,000 as sales on account. 12. July 1*- collected $177,000 of accounts receivable during the year. 13. Aug 1st-paid salaries of $54,000. 14. Oct 1st- borrowed $40,000 from the bank. Note had a 7% annual rate of interest and will mature on 9/30/2023. Interest and principal are to be paid on the maturity date. 15. Oct 1-declared a $1 per share dividend on the common stock to be paid to shareholders of record on October 1, payable on November 1, 2022. 16. Nov 1st-paid the dividends that had been declared October 1. 17. Dec 1st-paid operating expenses of $46,000 for the year. 18. Dec 15th-paid the balance of the accounts payable. (Hint: need to calculate the balance in the accounts payable to have the correct amount) 19. Dec 31st-made an $18,000 payment on the mortgage payable for the building. 20. Dec 31st-sold the land for $22,000 cash. Adjustments 21. There was $210 of supplies on hand at the end of the year. 22. Recognize expired rent for the office for the year. (Hint: need to determine the cost of one month of rent is based on information you have) 23. Recognize the bad debt expense for the year using the allowance method. JDT Corporation estimates that 1% of current year total sales and services on account will not be collected. 24. Recognize depreciation expense on the equipment and building. The corporation uses straight-line depreciation for all assets. (Record as two transactions one for all equipment and one for the building.) a. The new equipment purchased January 1st has an estimated life of 7 years and a salvage value of $9,000. b. The existing equipment was purchased on January 1, 2019, for $12,000, has a 5- year useful life and a $2,000 residual value. The total prior years' depreciation is $6,000. c. The building was purchased on January 1, 2018, for $115,000, has a 40-year useful life and a $10,000 residual value. The total prior years' depreciation is $10,500. 25. Record the accrued interest on the note payable for the bank loan at December 31, 2022. (Hint: you are creating a liability because it is accrued so NOT YET paid)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started