Answered step by step

Verified Expert Solution

Question

1 Approved Answer

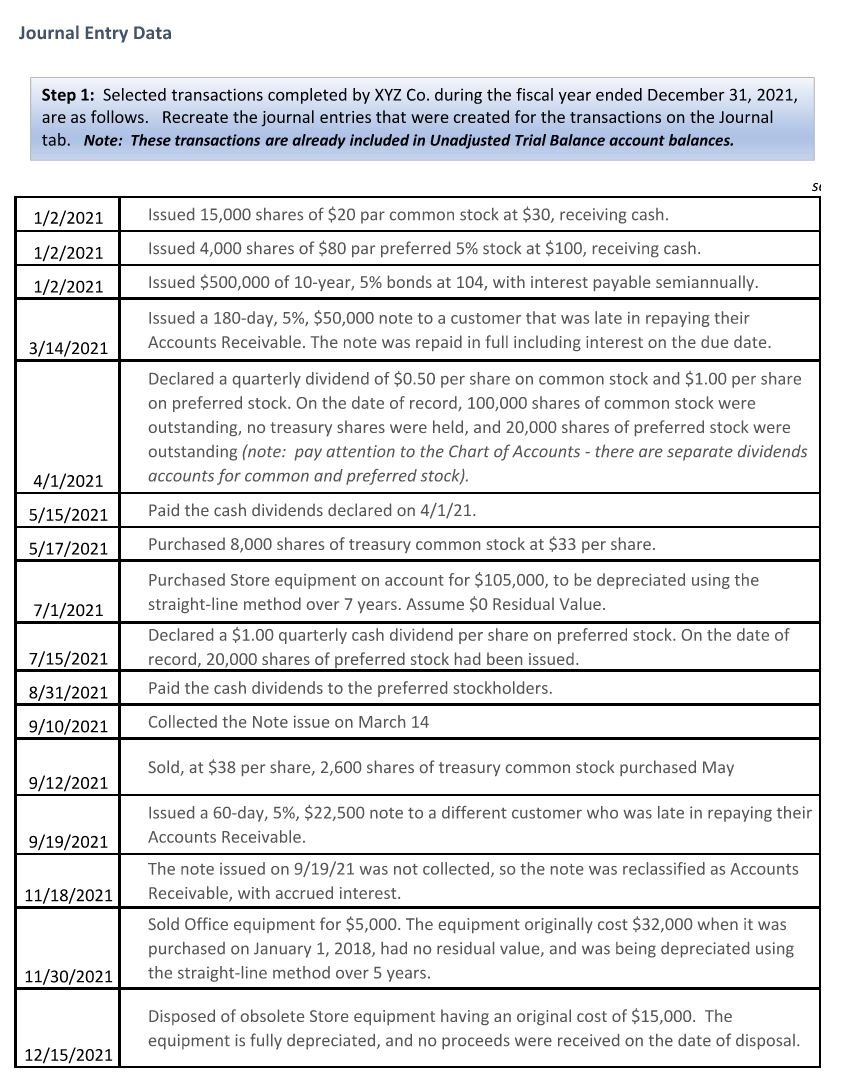

1. Recreate the journal for the selected transactions, using the correct debit and credit accounts, presented on the Journal Entry Data tab. Note: These transactions

1. Recreate the journal for the selected transactions, using the correct debit and credit accounts, presented on the Journal Entry Data tab. Note: These transactions are already included in Unadjusted Trial Balance account balances.

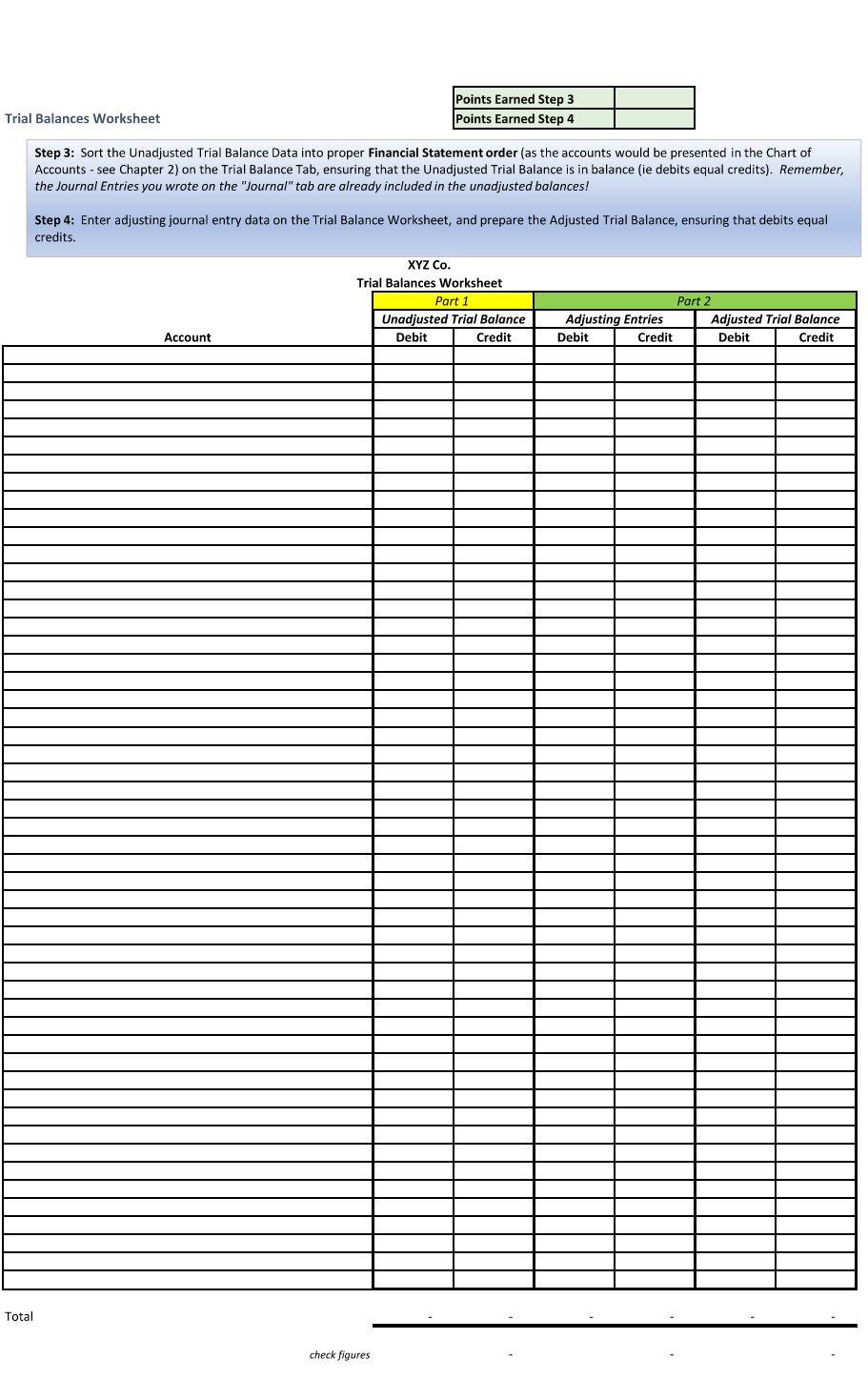

2. Sort the Unadjusted Trial Balance Data into proper Financial Statement order (as the accounts would be presented in the Chart of Accounts) on the Trial Balance Tab, ensuring that the Unadjusted Trial Balance is in balance (i.e., total debits equal total credits).

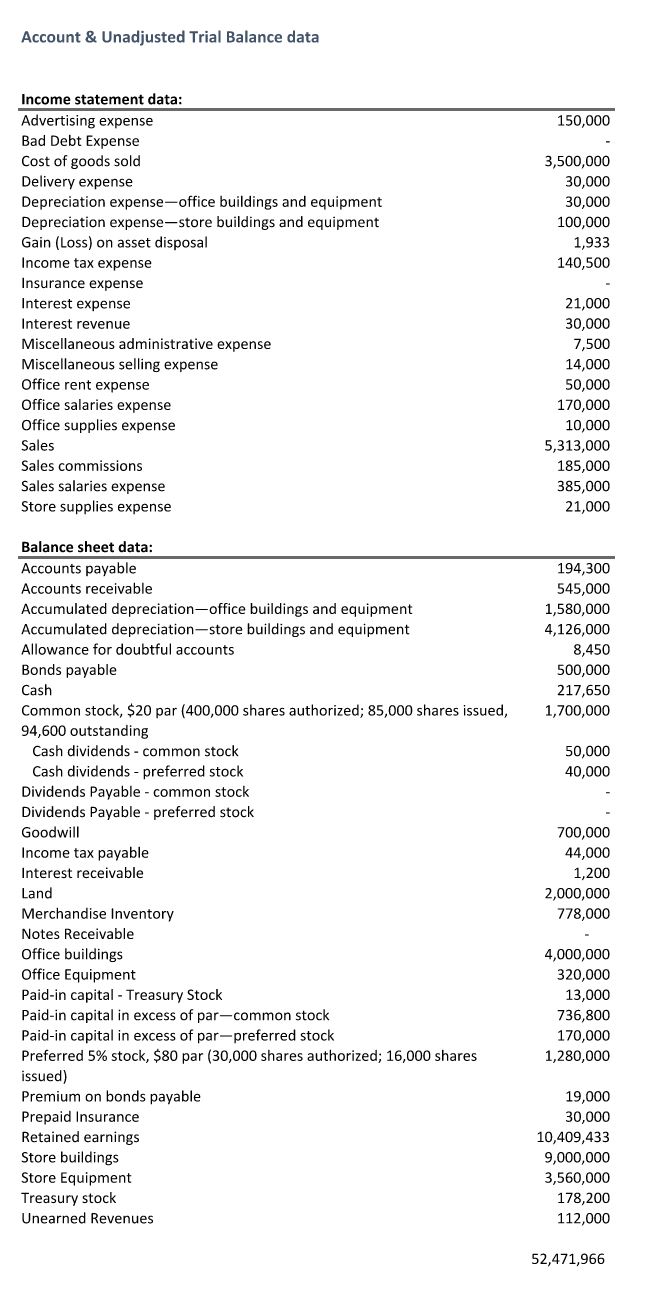

Account \& Unadjusted Trial Balance data \begin{tabular}{lr} Income statement data: & \\ \hline Advertising expense & 150,000 \\ Bad Debt Expense & - \\ Cost of goods sold & 3,500,000 \\ Delivery expense & 30,000 \\ Depreciation expense-office buildings and equipment & 30,000 \\ Depreciation expense-store buildings and equipment & 100,000 \\ Gain (Loss) on asset disposal & 1,933 \\ Income tax expense & 140,500 \\ Insurance expense & - \\ Interest expense & 21,000 \\ Interest revenue & 30,000 \\ Miscellaneous administrative expense & 7,500 \\ Miscellaneous selling expense & 14,000 \\ Office rent expense & 50,000 \\ Office salaries expense & 170,000 \\ Office supplies expense & 10,000 \\ Sales & 5,313,000 \\ Sales commissions & 185,000 \\ Sales salaries expense & 385,000 \\ Store supplies expense & 21,000 \end{tabular} Balance sheet data: Accounts payable Accounts receivable Accumulated depreciation-office buildings and equipment Accumulated depreciation-store buildings and equipment Allowance for doubtful accounts Bonds payable Cash Common stock, $20 par (400,000 shares authorized; 85,000 shares issued, 94,600 outstanding Cash dividends - common stock Cash dividends - preferred stock Dividends Payable - common stock Dividends Payable - preferred stock Goodwill Income tax payable Interest receivable Land Merchandise Inventory Notes Receivable Office buildings Office Equipment Paid-in capital - Treasury Stock Paid-in capital in excess of par-common stock Paid-in capital in excess of par-preferred stock Preferred 5% stock, $80 par (30,000 shares authorized; 16,000 shares issued) Premium on bonds payable Prepaid Insurance Retained earnings Store buildings Store Equipment Treasury stock Unearned Revenues 52,471,966 Journal Entry Data Step 1: Selected transactions completed by XYZ Co. during the fiscal year ended December 31, 2021, are as follows. Recreate the journal entries that were created for the transactions on the Journal tab. Note: These transactions are already included in Unadjusted Trial Balance account balances. XYZ Co. Journal Journal Step 3: Sort the Unadjusted Trial Balance Data into proper Financial Statement order (as the accounts would be presented in the Chart of Accounts - see Chapter 2) on the Trial Balance Tab, ensuring that the Unadjusted Trial Balance is in balance (ie debits equal credits). Remember, the Journal Entries you wrote on the "Journal" tab are already included in the unadjusted balances! Step 4: Enter adjusting journal entry data on the Trial Balance Worksheet, and prepare the Adjusted Trial Balance, ensuring that debits equal credits

Account \& Unadjusted Trial Balance data \begin{tabular}{lr} Income statement data: & \\ \hline Advertising expense & 150,000 \\ Bad Debt Expense & - \\ Cost of goods sold & 3,500,000 \\ Delivery expense & 30,000 \\ Depreciation expense-office buildings and equipment & 30,000 \\ Depreciation expense-store buildings and equipment & 100,000 \\ Gain (Loss) on asset disposal & 1,933 \\ Income tax expense & 140,500 \\ Insurance expense & - \\ Interest expense & 21,000 \\ Interest revenue & 30,000 \\ Miscellaneous administrative expense & 7,500 \\ Miscellaneous selling expense & 14,000 \\ Office rent expense & 50,000 \\ Office salaries expense & 170,000 \\ Office supplies expense & 10,000 \\ Sales & 5,313,000 \\ Sales commissions & 185,000 \\ Sales salaries expense & 385,000 \\ Store supplies expense & 21,000 \end{tabular} Balance sheet data: Accounts payable Accounts receivable Accumulated depreciation-office buildings and equipment Accumulated depreciation-store buildings and equipment Allowance for doubtful accounts Bonds payable Cash Common stock, $20 par (400,000 shares authorized; 85,000 shares issued, 94,600 outstanding Cash dividends - common stock Cash dividends - preferred stock Dividends Payable - common stock Dividends Payable - preferred stock Goodwill Income tax payable Interest receivable Land Merchandise Inventory Notes Receivable Office buildings Office Equipment Paid-in capital - Treasury Stock Paid-in capital in excess of par-common stock Paid-in capital in excess of par-preferred stock Preferred 5% stock, $80 par (30,000 shares authorized; 16,000 shares issued) Premium on bonds payable Prepaid Insurance Retained earnings Store buildings Store Equipment Treasury stock Unearned Revenues 52,471,966 Journal Entry Data Step 1: Selected transactions completed by XYZ Co. during the fiscal year ended December 31, 2021, are as follows. Recreate the journal entries that were created for the transactions on the Journal tab. Note: These transactions are already included in Unadjusted Trial Balance account balances. XYZ Co. Journal Journal Step 3: Sort the Unadjusted Trial Balance Data into proper Financial Statement order (as the accounts would be presented in the Chart of Accounts - see Chapter 2) on the Trial Balance Tab, ensuring that the Unadjusted Trial Balance is in balance (ie debits equal credits). Remember, the Journal Entries you wrote on the "Journal" tab are already included in the unadjusted balances! Step 4: Enter adjusting journal entry data on the Trial Balance Worksheet, and prepare the Adjusted Trial Balance, ensuring that debits equal credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started