| 1. Redo all the journal entries using the backflush accounting, but assume the second trigger point is the sales of goods. | |

| 2. Redo all the journal entries using the backflush accounting, but assume there is one trigger point and that trigger point is sales of goods. |

| 3. Explain why a company would use the backflush approach in #4 where there is only one trigger point. | | |

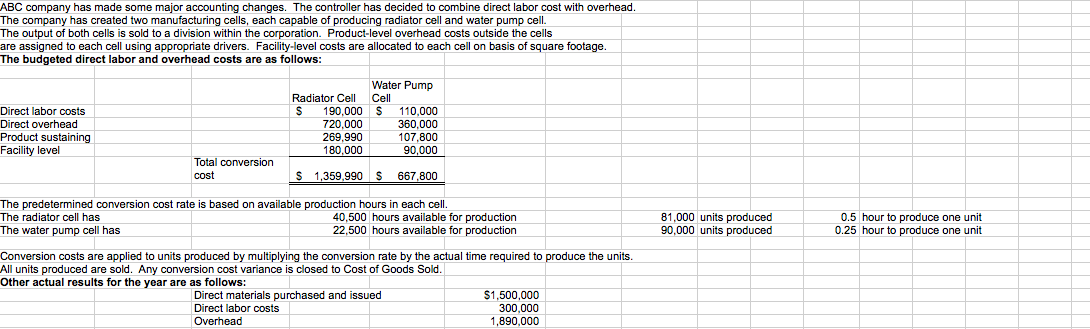

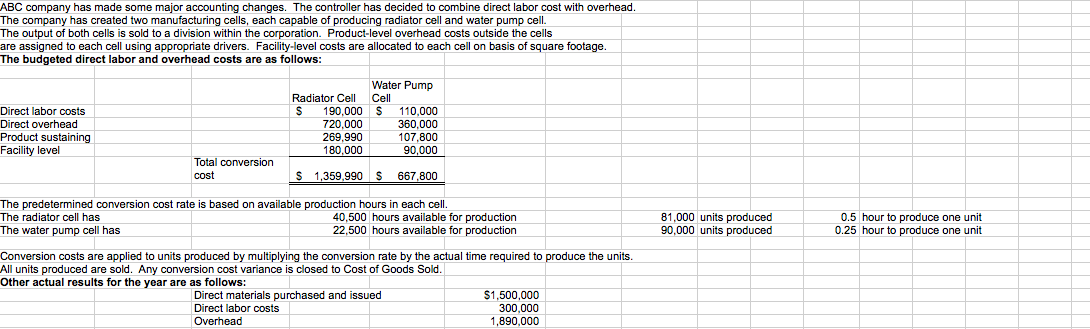

ABC company has made some major accounting changes. The controller has decided to combine direct labor cost with overhead. The company has created two manufacturing cells, each capable of producing radiator cell and water pump cell. The output of both cells is sold to a division within the corporation. Product-level overhead costs outside the cells are assigned to each cell using appropriate drivers. Facility-level costs are allocated to each cell on basis of square footage. The budgeted direct labor and overhead costs are as follows: Direct labor costs Direct overhead Product sustaining Facility level Radiator Cell $ 190,000 720,000 269,990 180,000 Water Pump Cell $ 110,000 360,000 107.800 90,000 Total conversion cost $ 1,359,990 S 667,800 The predetermined conversion cost rate is based on available production hours in each cell. The radiator cell has 40,500 hours available for production The water pump cell has 22,500 hours available for production 81,000 units produced 90,000 units produced 0.5 hour to produce one unit 0.25 hour to produce one unit Conversion costs are applied to units produced by multiplying the conversion rate by the actual time required to produce the units. All units produced are sold. Any conversion cost variance is closed to Cost of Goods Sold. Other actual results for the year are as follows: Direct materials purchased and issued $1,500,000 Direct labor costs 300,000 Overhead 1,890,000 ABC company has made some major accounting changes. The controller has decided to combine direct labor cost with overhead. The company has created two manufacturing cells, each capable of producing radiator cell and water pump cell. The output of both cells is sold to a division within the corporation. Product-level overhead costs outside the cells are assigned to each cell using appropriate drivers. Facility-level costs are allocated to each cell on basis of square footage. The budgeted direct labor and overhead costs are as follows: Direct labor costs Direct overhead Product sustaining Facility level Radiator Cell $ 190,000 720,000 269,990 180,000 Water Pump Cell $ 110,000 360,000 107.800 90,000 Total conversion cost $ 1,359,990 S 667,800 The predetermined conversion cost rate is based on available production hours in each cell. The radiator cell has 40,500 hours available for production The water pump cell has 22,500 hours available for production 81,000 units produced 90,000 units produced 0.5 hour to produce one unit 0.25 hour to produce one unit Conversion costs are applied to units produced by multiplying the conversion rate by the actual time required to produce the units. All units produced are sold. Any conversion cost variance is closed to Cost of Goods Sold. Other actual results for the year are as follows: Direct materials purchased and issued $1,500,000 Direct labor costs 300,000 Overhead 1,890,000