Answered step by step

Verified Expert Solution

Question

1 Approved Answer

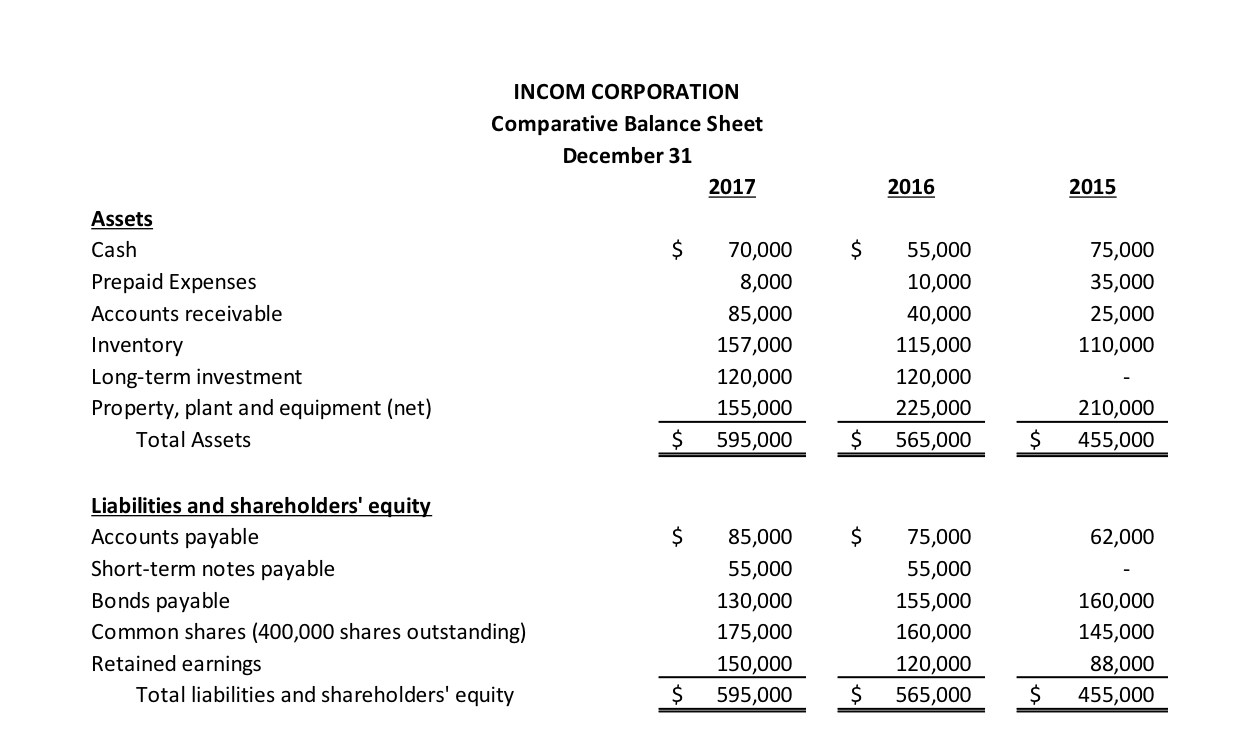

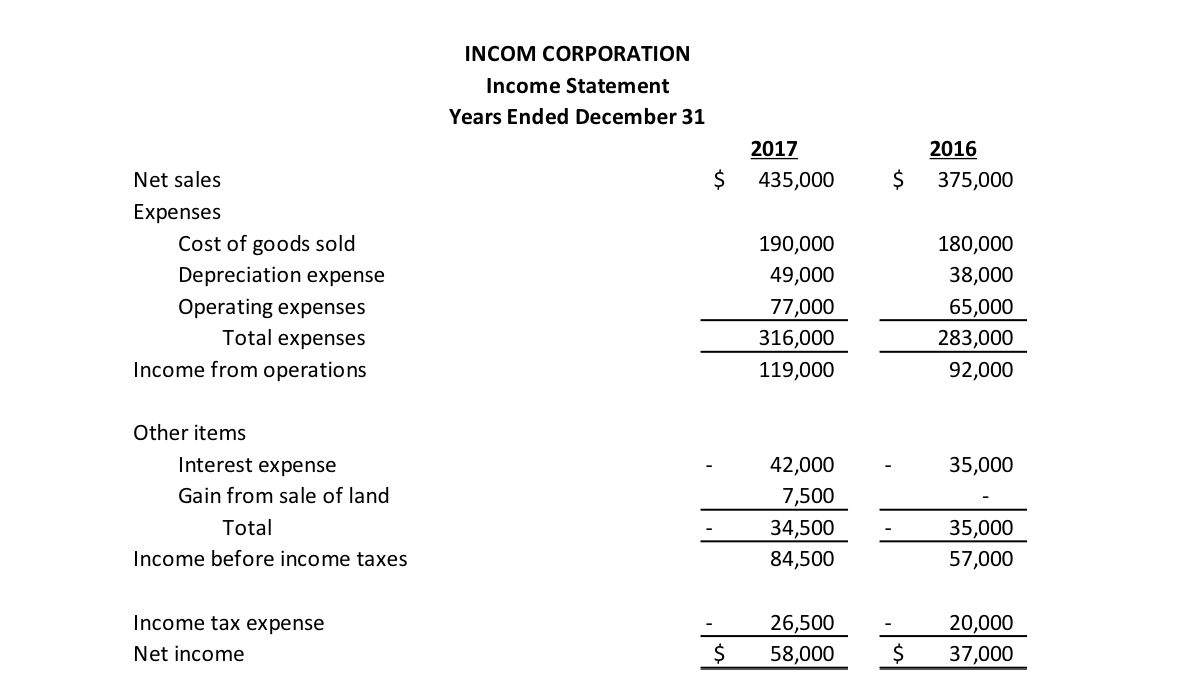

1) Refer to the financial statements of Incom Corporation at the end of the exam. All sales of the company were credit sales. REQUIRED: Using

1)

Refer to the financial statements of Incom Corporation at the end of the exam. All sales of the company were credit sales.

REQUIRED:

Using ratio analysis, review the financial condition of the company for the two years of 2017 and 2016 as follows:

- Assess the liquidity (ability to pay current liabilities) of Incom by calculating two ratios that are measures of liquidity (exclude inventory and accounts receivable ratios see d below).

- Assess the profitability of Incom by calculating two ratios that are measures of profitability.

- Assess the solvency of Incom by calculating two ratios that are measures of solvency.

- Assess the efficiency of Incoms inventory and accounts receivable by calculating two ratios (one for inventory and one for accounts receivable) that are measures of their efficiency.

- Overall, what can you conclude about the performance of Incom over the two years of 2016 and 2017?

2) Refer to the financial statements of Incom Corporation at the end of the exam.

Additional information for the year ended December 31, 2017:

- Incom acquired manufacturing equipment of $11,500 during the year. No equipment was sold during the year.

- Cash received from sale of land was $40,000, for a gain of $7,500 on the sale.

- Incom declared and completed a stock dividend valued at $15,000 during 2017, and declared and paid a cash dividend of $13,000 during 2017.

- Incom redeemed $25,000 of bonds during 2017. The bonds were originally issued at par (there is no premium or discount attached to these bonds).

- During 2017, Incom renewed the short-term note payable for another year at the same amount.

REQUIRED:

Prepare a Statement of Cash Flows for the year ended December 31, 2017 in good form using the indirect method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started