Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Referring to Exhibit 4, compute the annual percentage change in net income per common share-diluted (second numerical line from the bottom) for 1998-1999, 1999-2000,

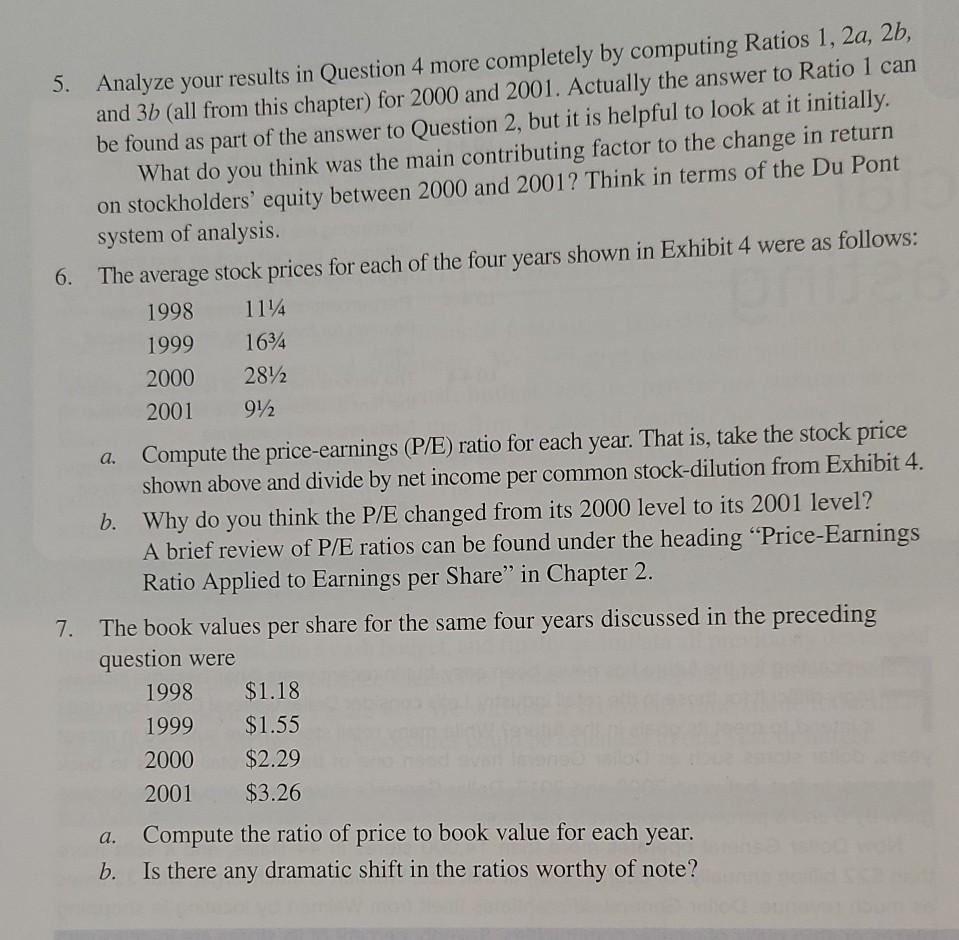

1. Referring to Exhibit 4, compute the annual percentage change in net income per common share-diluted (second numerical line from the bottom) for 1998-1999, 1999-2000, and 20002001. 5. Analyze your results in Question 4 more completely by computing Ratios 1, 2a, 2b, and 3b (all from this chapter) for 2000 and 2001. Actually the answer to Ratio 1 can be found as part of the answer to Question 2, but it is helpful to look at it initially. What do you think was the main contributing factor to the change in return on stockholders' equity between 2000 and 2001? Think in terms of the Du Pont system of analysis. 6. The average stock prices for each of the four years shown in Exhibit 4 were as follows: 1998 1114 1999 1634 2000 2812 2001 912 a. Compute the price-earnings (P/E) ratio for each year. That is, take the stock price shown above and divide by net income per common stock-dilution from Exhibit 4. b. Why do you think the P/E changed from its 2000 level to its 2001 level? A brief review of P/E ratios can be found under the heading "Price-Earnings Ratio Applied to Earnings per Share" in Chapter 2. 7. The book values per share for the same four years discussed in the preceding question were 1998 $1.18 1999 $1.55 2000 $2.29 2001 $3.26 a. Compute the ratio of price to book value for each year. b. Is there any dramatic shift in the ratios worthy of note? 1. Referring to Exhibit 4, compute the annual percentage change in net income per common share-diluted (second numerical line from the bottom) for 1998-1999, 1999-2000, and 20002001. 5. Analyze your results in Question 4 more completely by computing Ratios 1, 2a, 2b, and 3b (all from this chapter) for 2000 and 2001. Actually the answer to Ratio 1 can be found as part of the answer to Question 2, but it is helpful to look at it initially. What do you think was the main contributing factor to the change in return on stockholders' equity between 2000 and 2001? Think in terms of the Du Pont system of analysis. 6. The average stock prices for each of the four years shown in Exhibit 4 were as follows: 1998 1114 1999 1634 2000 2812 2001 912 a. Compute the price-earnings (P/E) ratio for each year. That is, take the stock price shown above and divide by net income per common stock-dilution from Exhibit 4. b. Why do you think the P/E changed from its 2000 level to its 2001 level? A brief review of P/E ratios can be found under the heading "Price-Earnings Ratio Applied to Earnings per Share" in Chapter 2. 7. The book values per share for the same four years discussed in the preceding question were 1998 $1.18 1999 $1.55 2000 $2.29 2001 $3.26 a. Compute the ratio of price to book value for each year. b. Is there any dramatic shift in the ratios worthy of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started