Question

1. Regarding the one year PP-ELN described in the case, how should the bank allocate the $1 million to deliver this note with 40% of

1. Regarding the one year PP-ELN described in the case, how should the bank allocate the $1 million to deliver this note with 40% of the upside return in the S&P 500 Index for the client? [Note: 6% p.a. continuously compounded = 6.1837% on an annualized basis.]

1. Regarding the one year PP-ELN described in the case, how should the bank allocate the $1 million to deliver this note with 40% of the upside return in the S&P 500 Index for the client? [Note: 6% p.a. continuously compounded = 6.1837% on an annualized basis.]

2. You see the following prices of 1-year call options on $1,000 (notional amount) of the S&P 500 Index:

Strike Price Call @ 20% Vol. Call @ 25% Vol.

1,900 $142.53 $178.00

2,090 $76.80 $110.77

2,280 $38.42 $66.31

Assuming the volatility cost to the Bank is 25% p.a., is the PP-ELN described in the case a fair deal for the client? What if the volatility cost was 20% p.a.? Explain your answers.

3. a) How could the Bank structure the PP-ELN to give the client 50% of the upside of the S&P 500 Index above 1,900, but cap the return of the note at 10%?

b) Draw (i) the individual payoff diagrams of the options required to create that structure, and (ii) the payoff diagram of the option combination.

c) Using the prices in the 25% volatility column from the Table in Question 2 above, would this structure be profitable for the Bank? Why or why not?

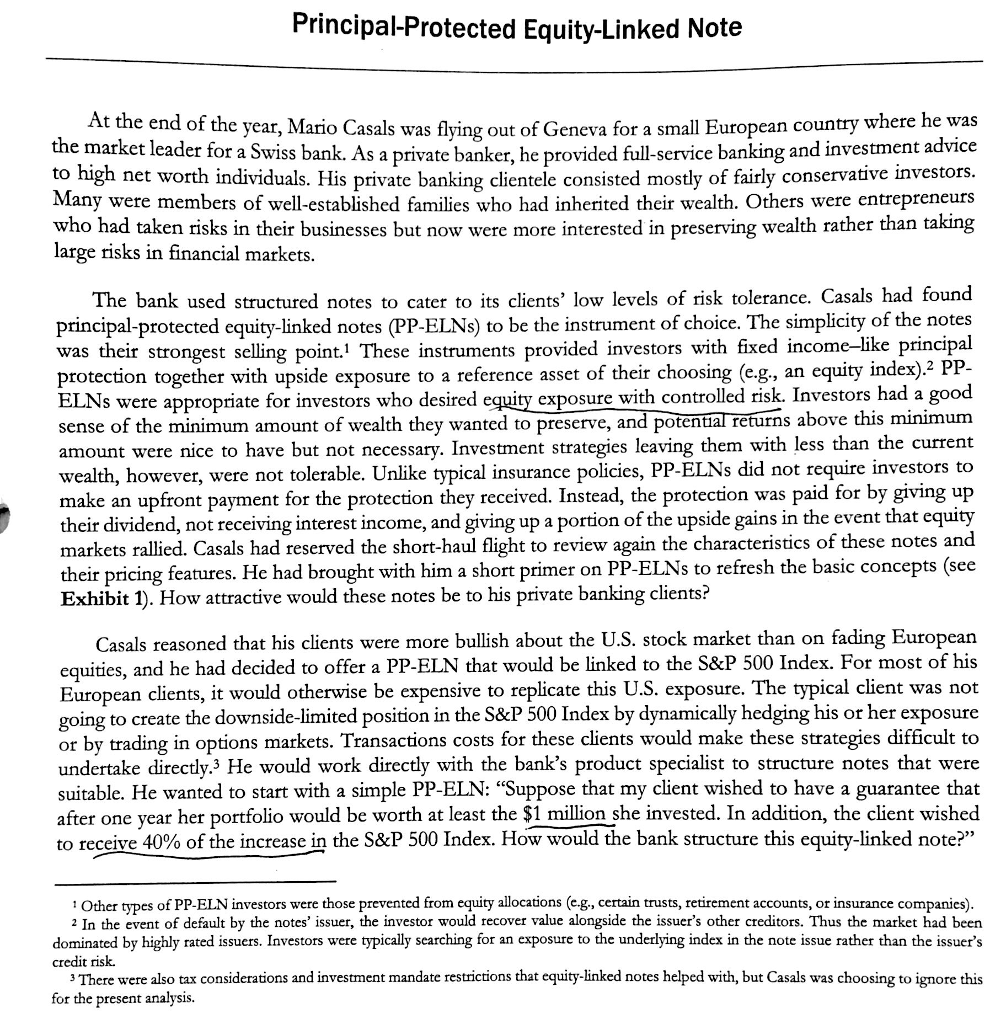

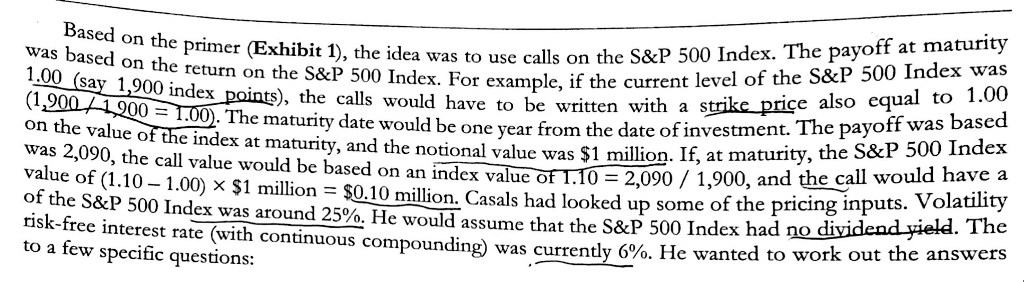

Principal-Protected Equity-Linked Note At the end of the year, Mario Casals was flying out of Geneva for a small European country where he was the market leader for a Swiss bank. As a private banker, he provided full-service banking and investment advice to high net worth individuals. His private banking clientele consisted mostly of fairly conservative investors Many were members of well-established families who had inherited their wealth. Others were entrepreneurs who had taken risks in their businesses but now were more interested in preserving wealth rather than taking large risks in financial markets The bank used structured notes to cater to its clients' low levels of risk tolerance. Casals had found principal-protected equity-linked notes (PP-ELNs) to be the instrument of choice. The simplicity of the notes was their strongest selling point.1 These instruments provided investors with fixed income-like principal protection together with upside exposure to a reference asset of their choosing (e.g, an equity index).2 PP- ELNs were appropriate for investors who desired equity exposure with controlled risk. Investors had a good sense of the minimum amount of wealth they wanted to preserve, and potental returns above this minimum amount were nice to have but not necessary. Investment strategies leaving them with less than the current wealth, however, were not tolerable. Unlike typical insurance policies, PP-ELNs did not require investors to make an upfront payment for the protection they received. Instead, the protection was paid for by giving up their dividend, not receiving interest income, and giving up a portion of the upside gains in the event that equity arkets rallied. Casals had reserved the short-haul flight to review again the characteristics of these notes and their pricing features. He had brought with him a short primer on PP-ELNs to refresh the basic concepts (see Exhibit 1). How attractive would these notes be to his private banking clients? Casals reasoned that his clients were more bullish about the U.S. stock market than on fading European equities, and he had decided to offer a PP-ELN that would be linked to the S&P 500 Index. For most of his European clients, it would otherwise be expensive to replicate this U.S. exposure. The typical client was not going to create the downside-limited position in the S&P 500 Index by dynamically hedging his or her exposure or by trading in options markets. Transactions costs for these clients would make these strategies difficult to undertake directly.3 He would work directly with the bank's product specialist to structure notes that were suitable. He wanted to start with a simple PP-ELN: "Suppose that my client wished to have a guarantee that after one year her portfolio would be worth at least the $1 million she invested. In addition, the client wished to receive 40% of the increase in the S&P 500 Index. How would the bank structure this equity-linked note?" Other types of PP-ELN investors were those prevented from equity allocations (eg-, certain trusts, retirement accounts, or insurance companies) 2 In the event of default by the notes' issuer, the investor would recover value alongside the issuer's other creditors. Thus the market had been dominated by highly rated issuers. Investors were typically searching for an exposure to the underlying index in the note issue rather than the issuer's credit risk. There were also tax considerations and investment mandate restrictions that equity-linked notes helped with, but Casals was choosing to ignore this for the present analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started