Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Relate the following document's facts to the U.S. government's current desire to reduce the deficit and reduce taxes (or just to eliminating the AMT)

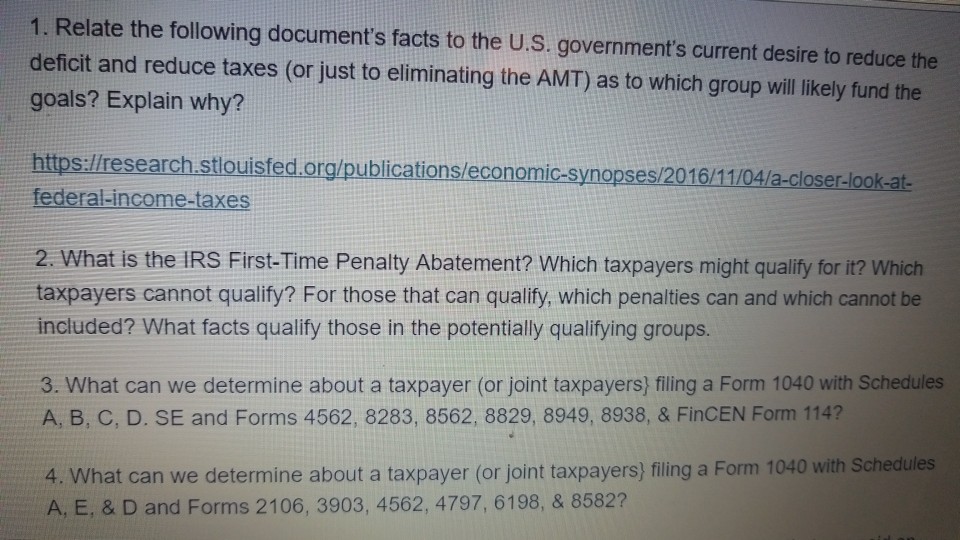

1. Relate the following document's facts to the U.S. government's current desire to reduce the deficit and reduce taxes (or just to eliminating the AMT) as to which group will likely fund the goals? Explain why? https:/researchstlouisfed.org/publications/economic-synopses/2016/11/04/a-closer-look-at federal-income-taxes 2. What is the IRS First-Time Penalty Abatement? Which taxpayers might qualify for it? Whicth taxpayers cannot qualify? For those that can qualify, which penalties can and which cannot be included? What facts qualify those in the potentially qualifying groups. 3. What can we determine about a taxpayer (or joint taxpayers) filing a Form 1040 with Schedules A, B, C, D. SE and Forms 4562, 8283, 8562, 8829, 8949, 8938, & FinCEN Form 114? 4. What can we determine about a taxpayer (or joint taxpayers) filing a Form 1040 with Schedules A, E, & D and Forms 2106, 3903, 4562, 4797, 6198, & 8582

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started