Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Replacement of the computerized inventory system with a new system: The current system is 3 years old, originally cost $1,000,000, is being depreciated

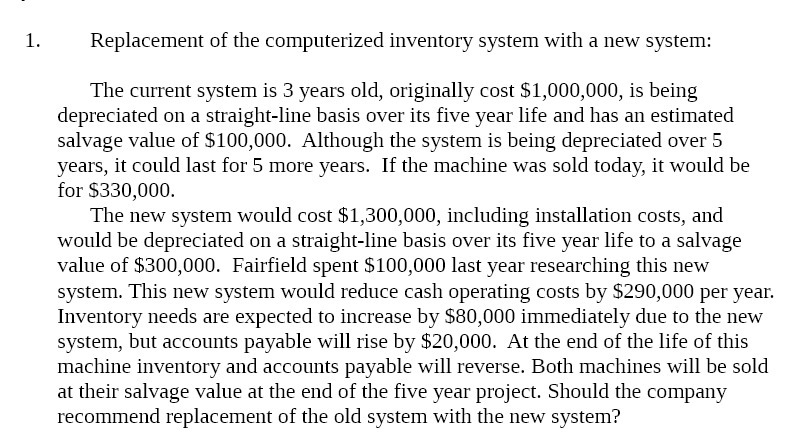

1. Replacement of the computerized inventory system with a new system: The current system is 3 years old, originally cost $1,000,000, is being depreciated on a straight-line basis over its five year life and has an estimated salvage value of $100,000. Although the system is being depreciated over 5 years, it could last for 5 more years. If the machine was sold today, it would be for $330,000. The new system would cost $1,300,000, including installation costs, and would be depreciated on a straight-line basis over its five year life to a salvage value of $300,000. Fairfield spent $100,000 last year researching this new system. This new system would reduce cash operating costs by $290,000 per year. Inventory needs are expected to increase by $80,000 immediately due to the new system, but accounts payable will rise by $20,000. At the end of the life of this machine inventory and accounts payable will reverse. Both machines will be sold at their salvage value at the end of the five year project. Should the company recommend replacement of the old system with the new system?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine whether the company should recommend replacing the old inventory system with the new system we need to compare the cash flows and costs a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started