Question

(13) There are three stocks, X, Y, and Z. Your portfolio has 30% of its wealth in X, 20% in Y, and 50% in

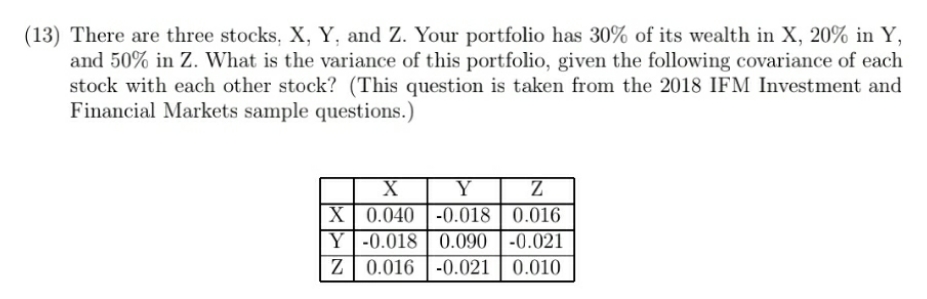

(13) There are three stocks, X, Y, and Z. Your portfolio has 30% of its wealth in X, 20% in Y, and 50% in Z. What is the variance of this portfolio, given the following covariance of each stock with each other stock? (This question is taken from the 2018 IFM Investment and Financial Markets sample questions.) X Y Z 0.016 X 0.040 -0.018 Y-0.018 0.090 -0.021 Z 0.016 -0.021 0.010

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the variance of the portfolio we need to consider the weights of each stock in the port...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investments

Authors: Gordon J. Alexander, William F. Sharpe, Jeffery V. Bailey

3rd edition

132926172, 978-0132926171

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App