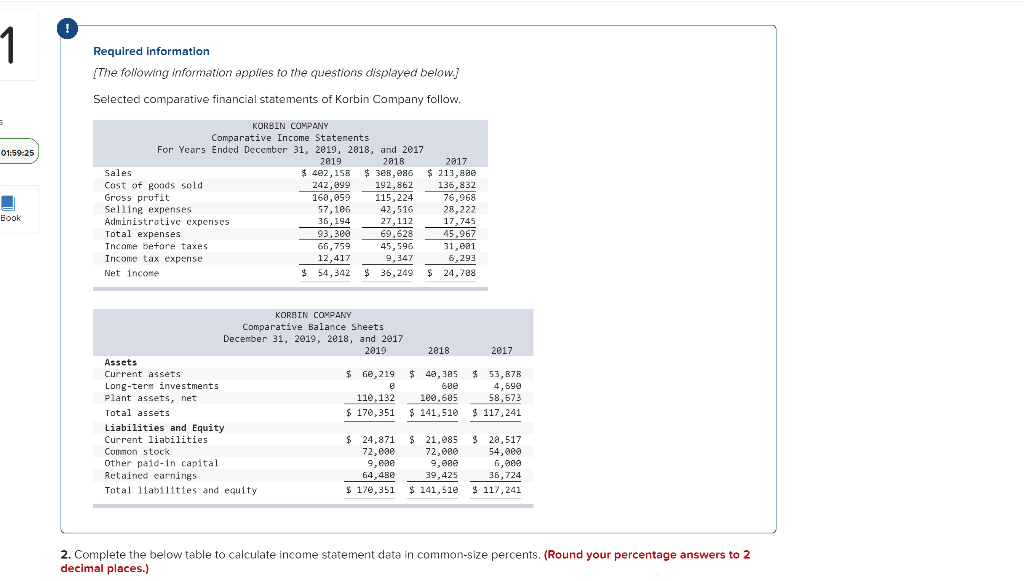

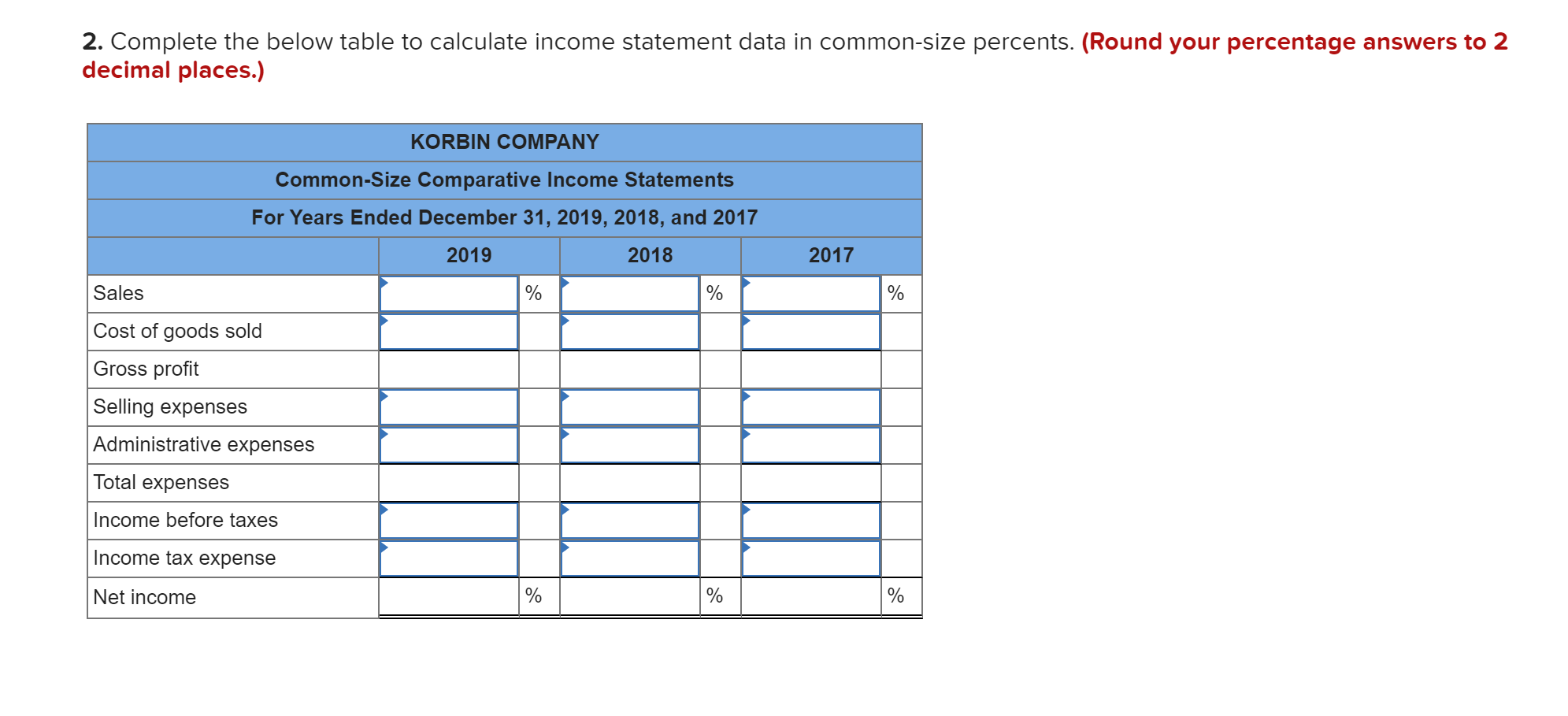

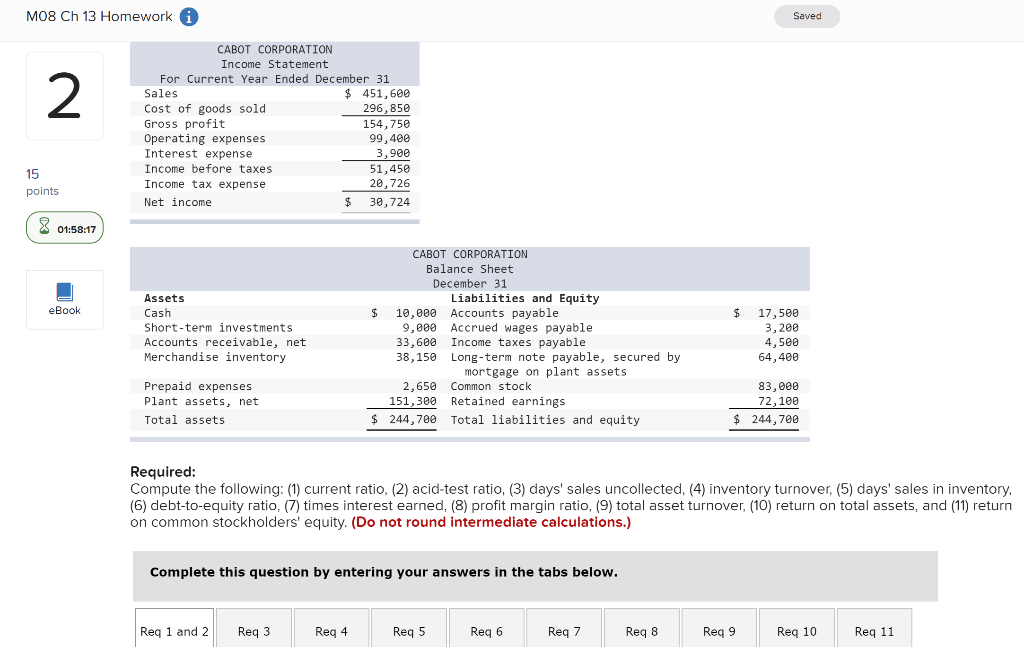

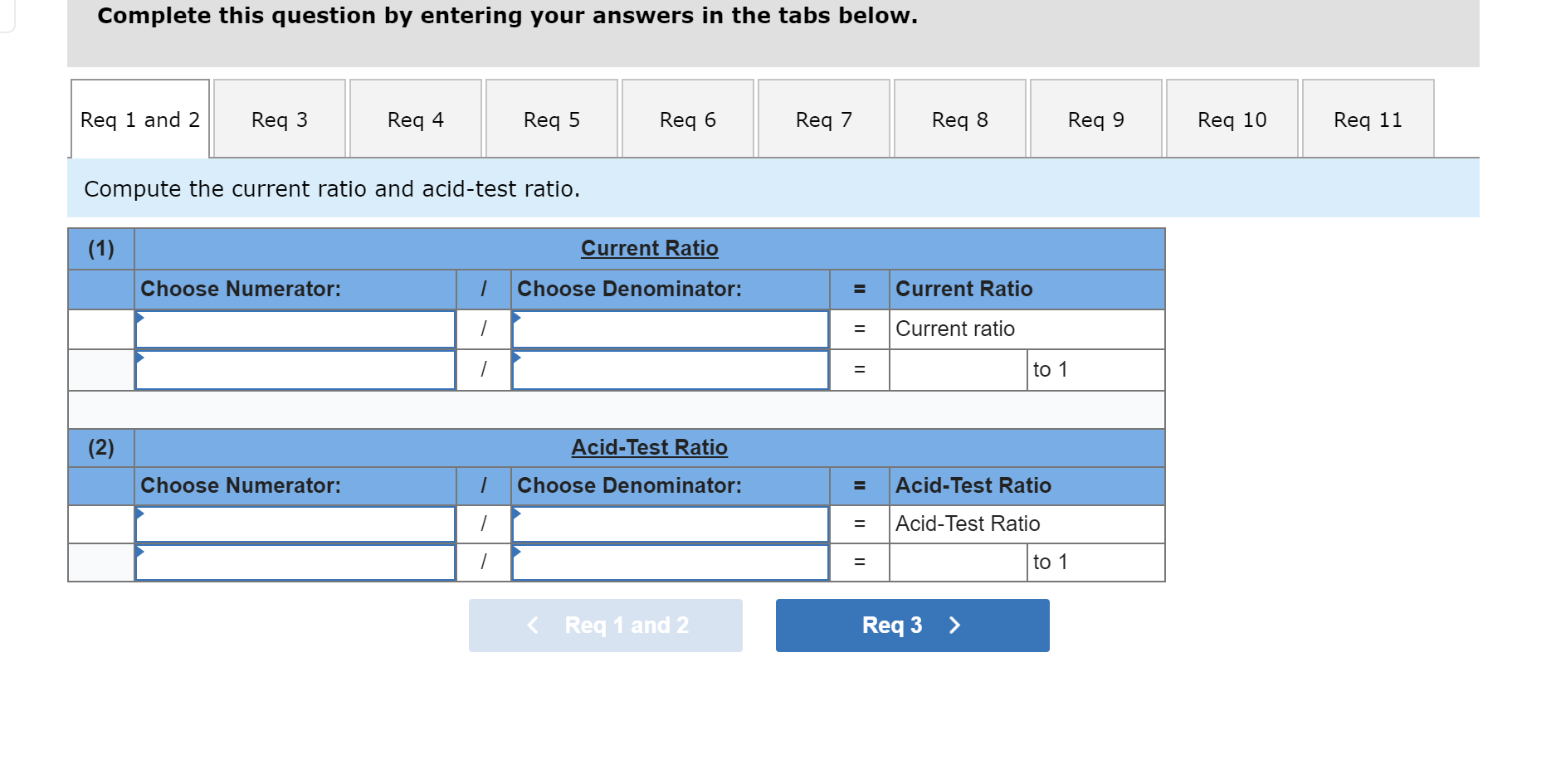

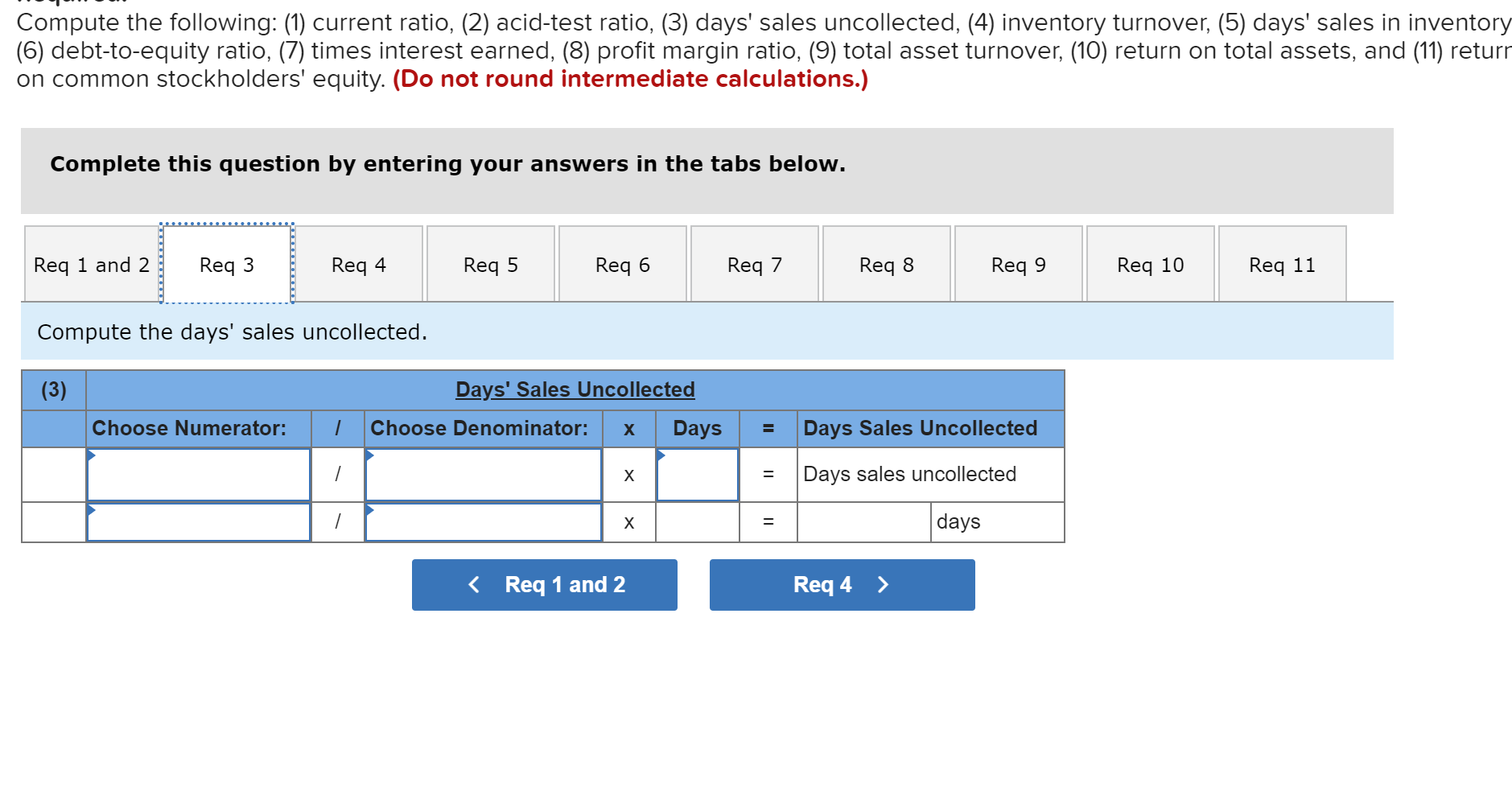

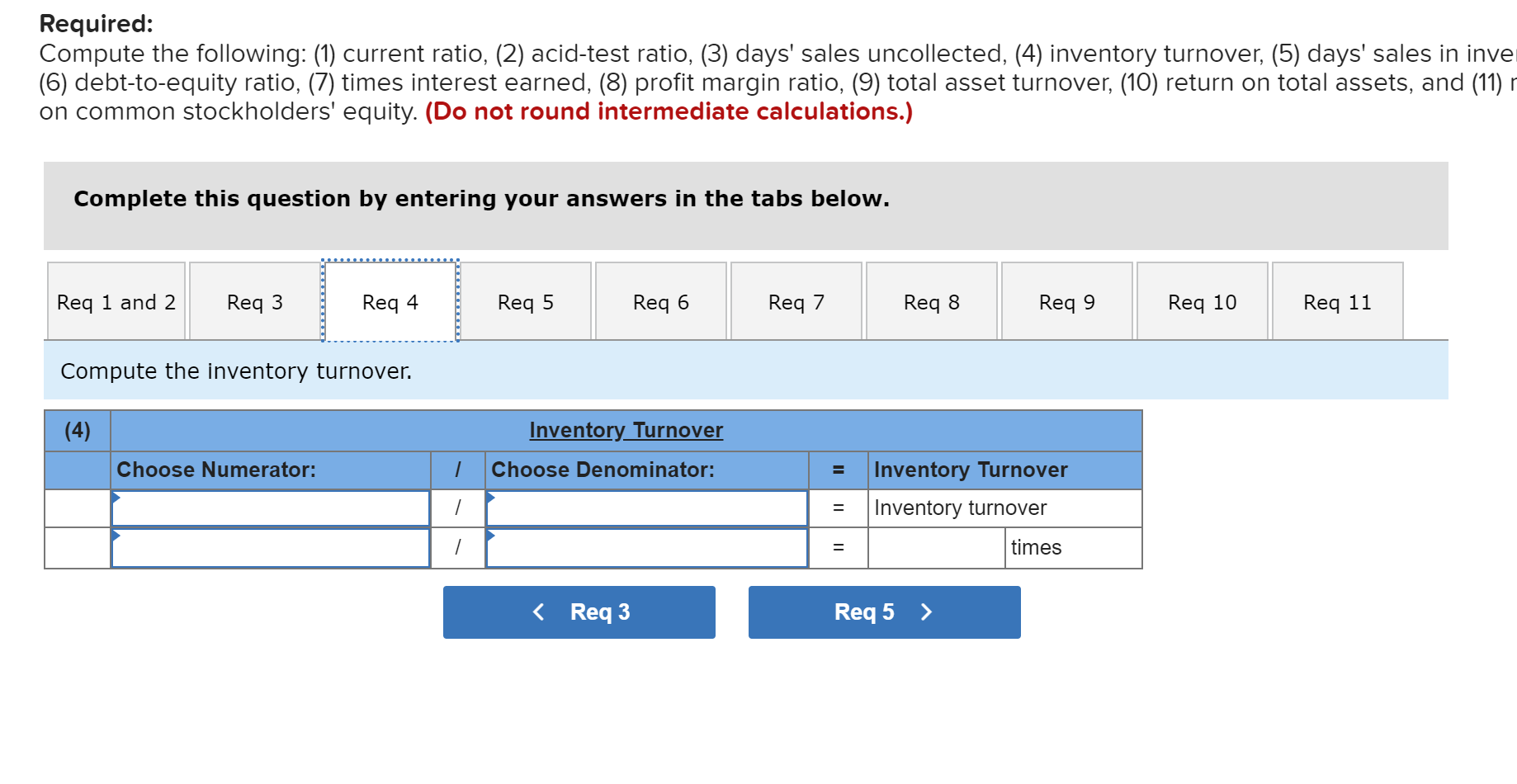

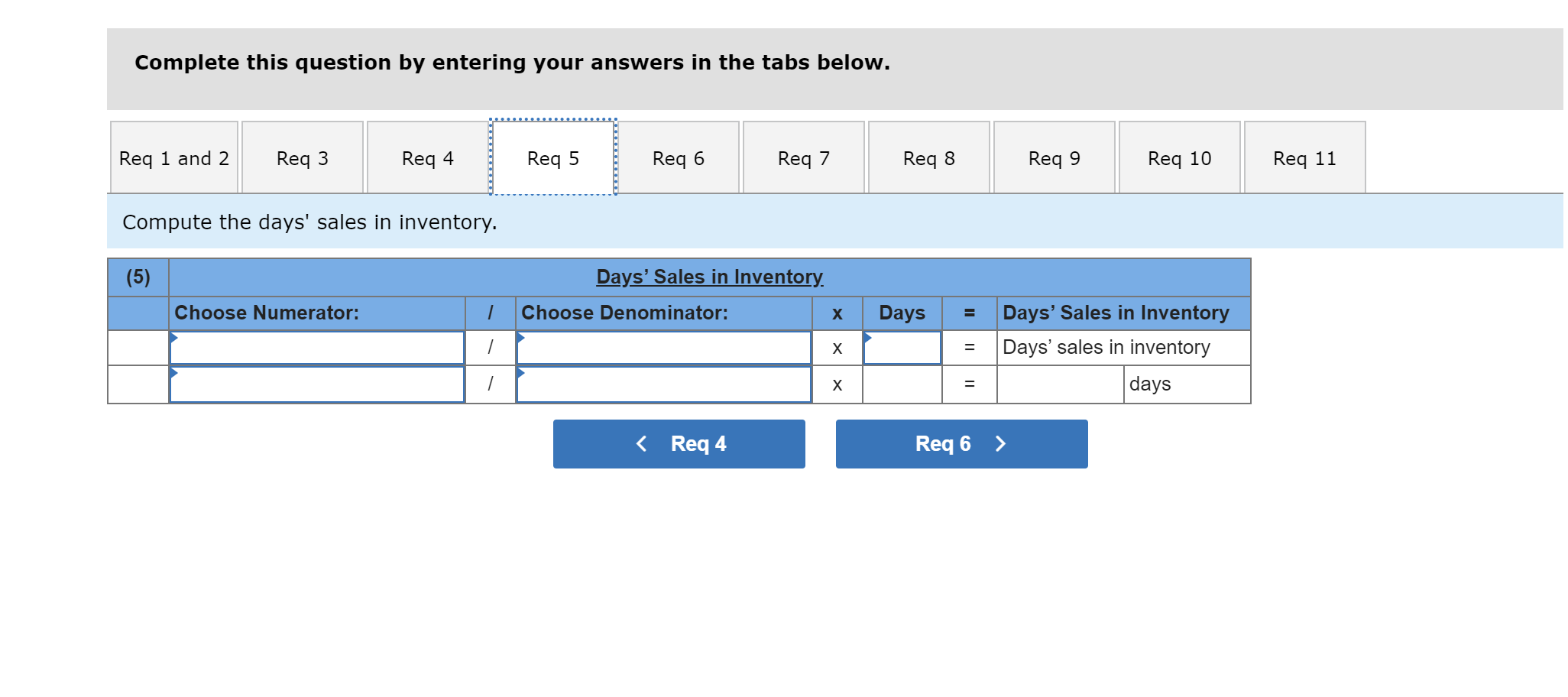

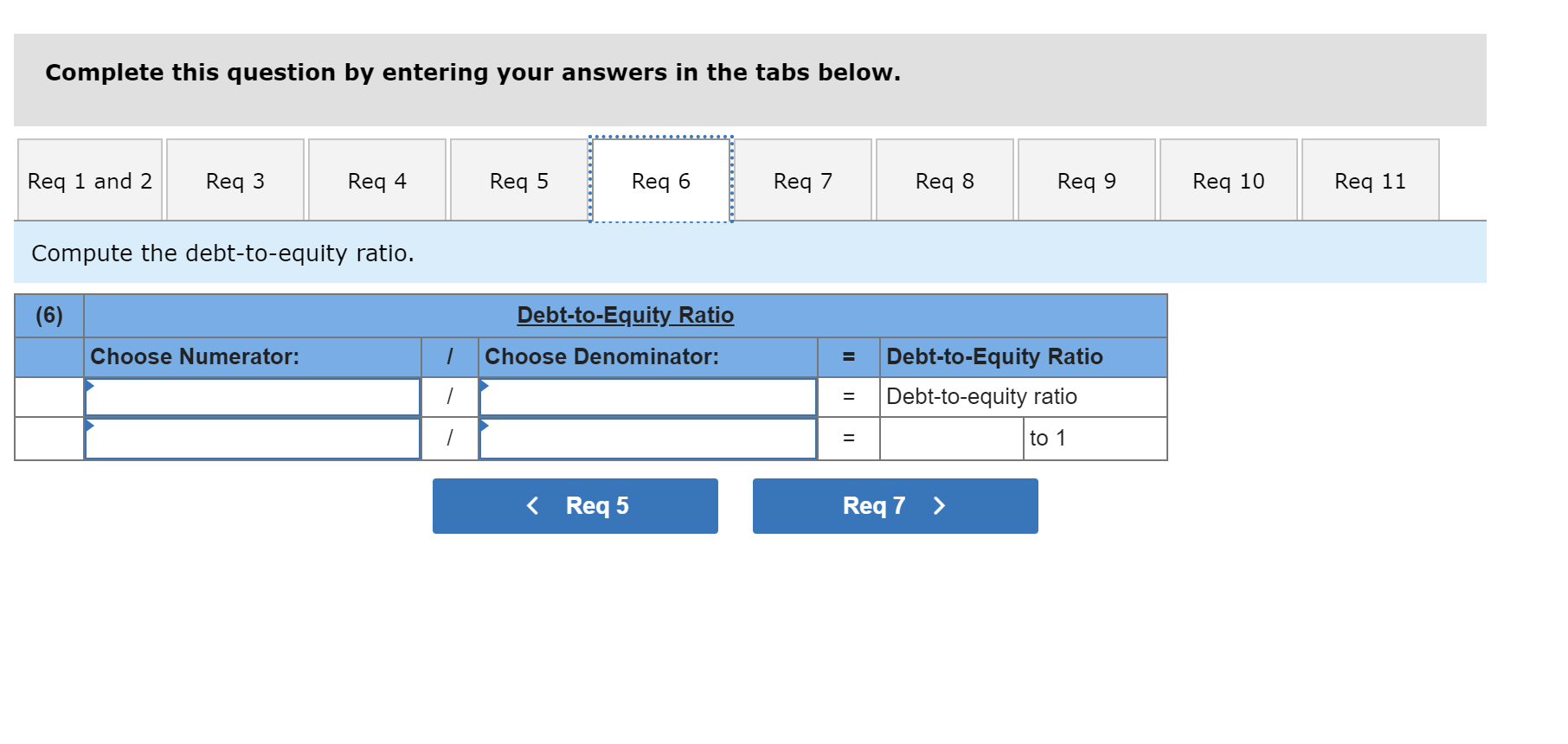

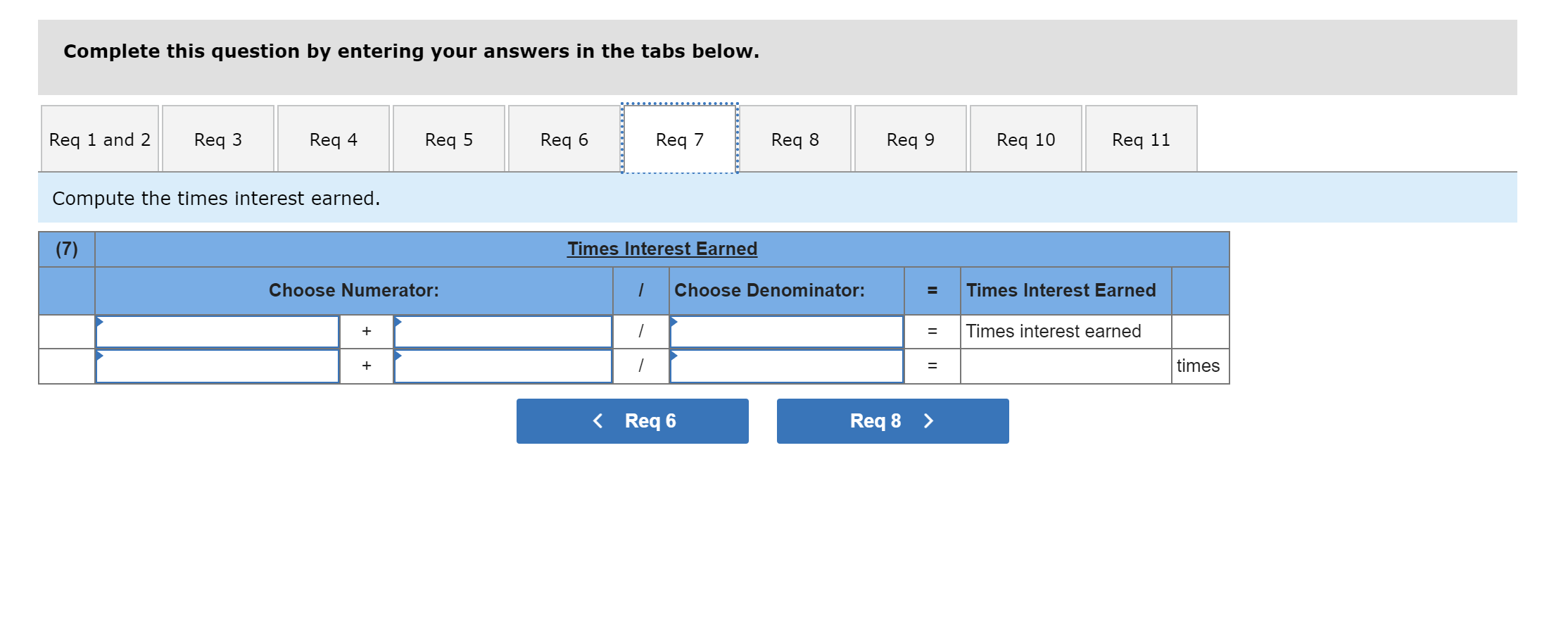

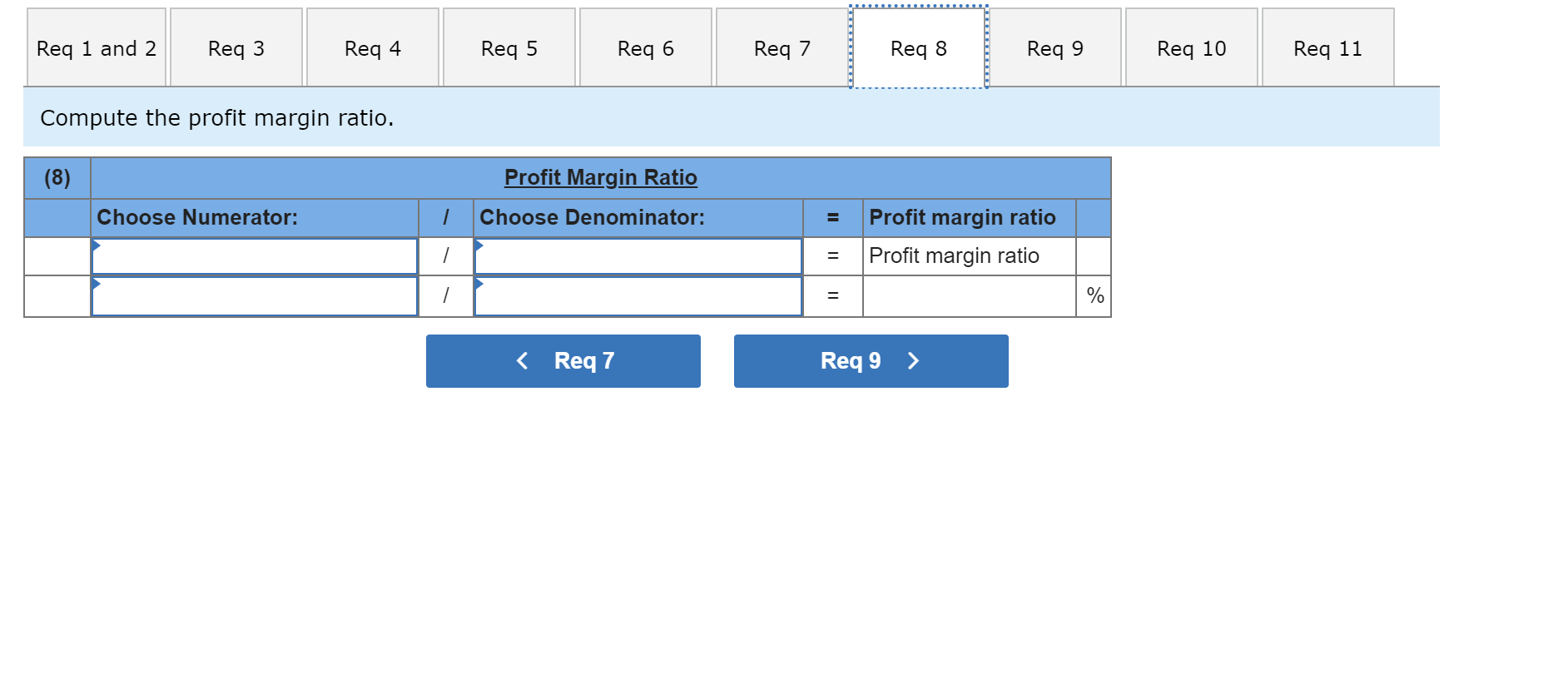

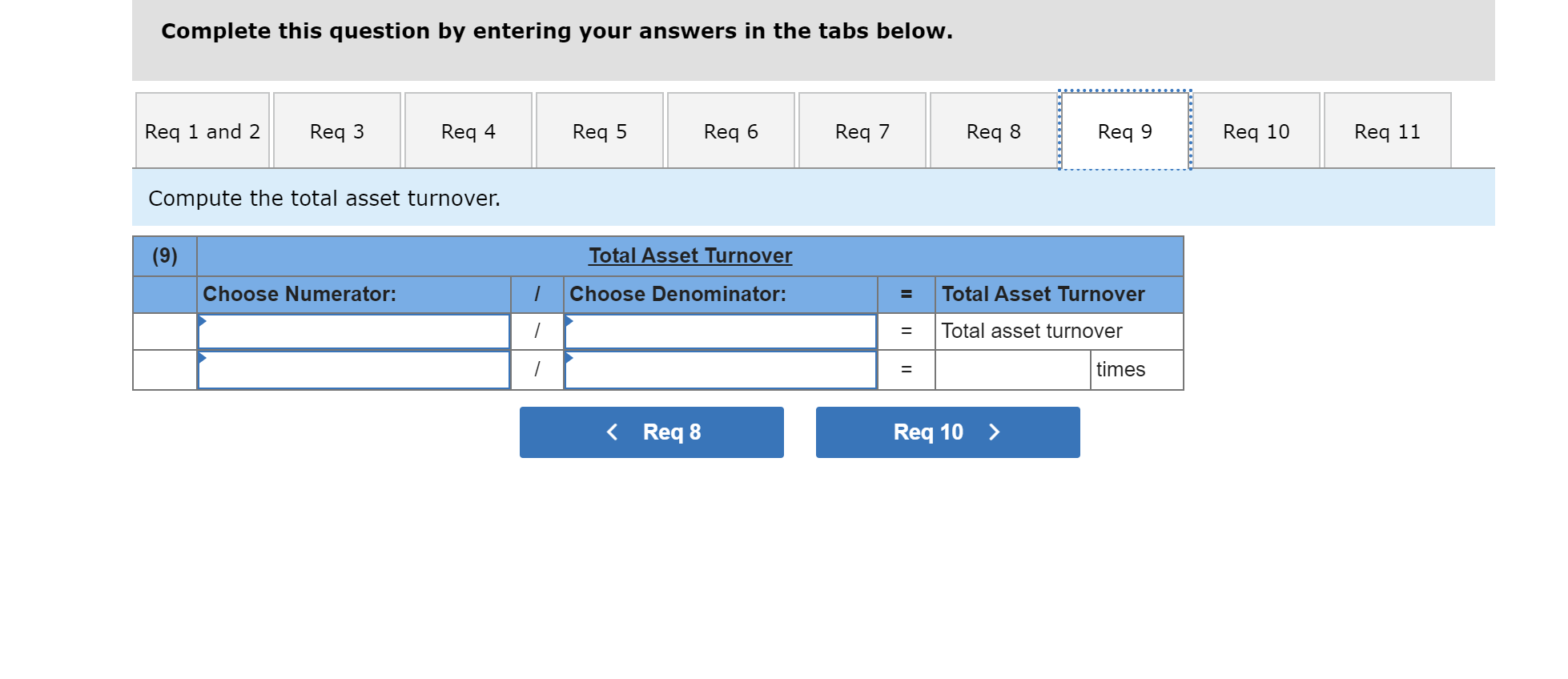

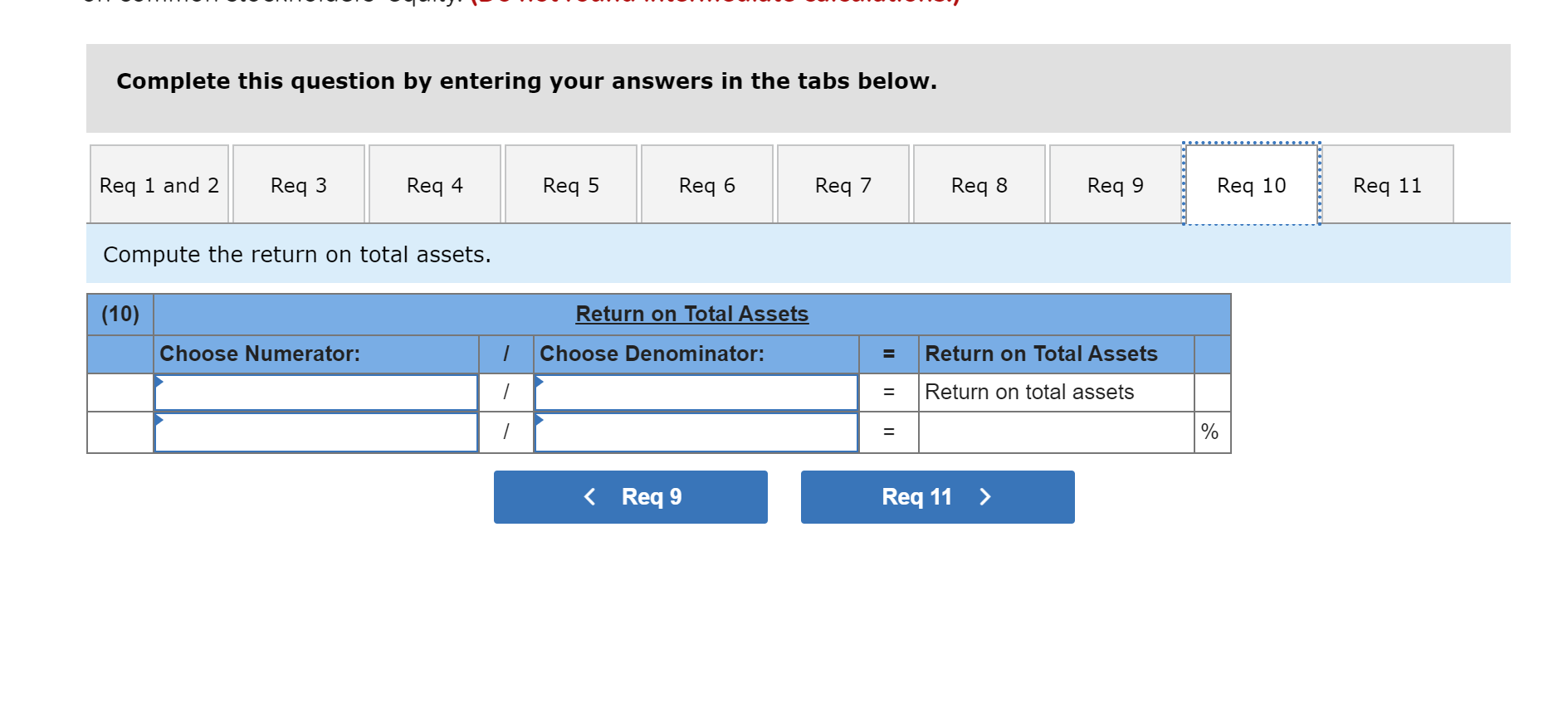

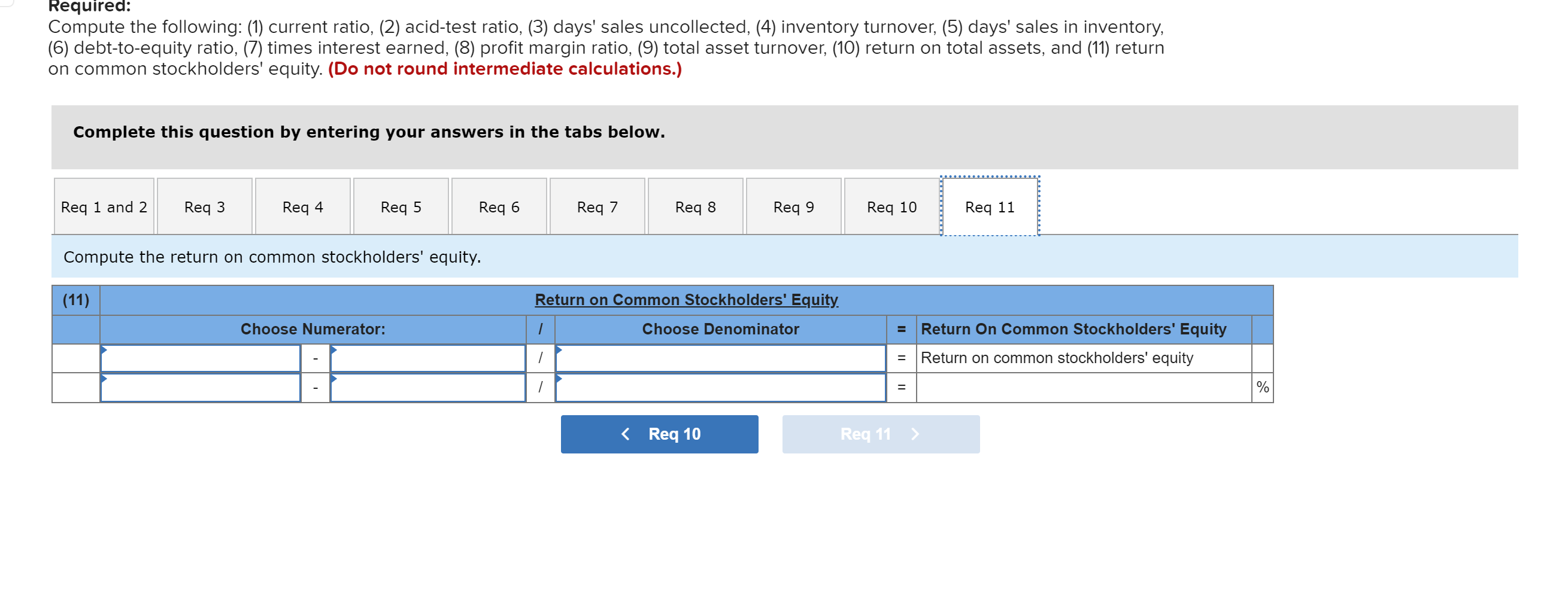

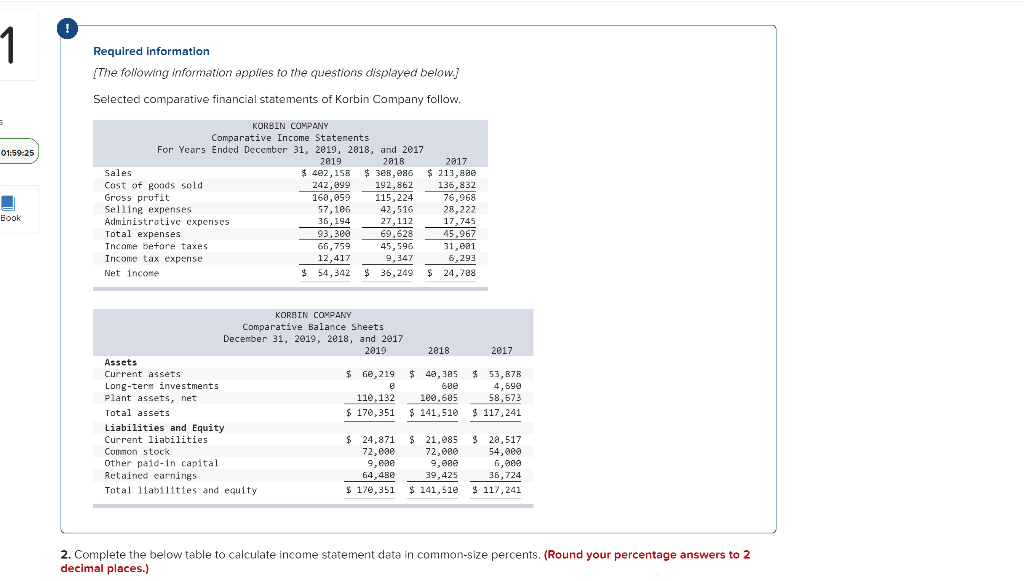

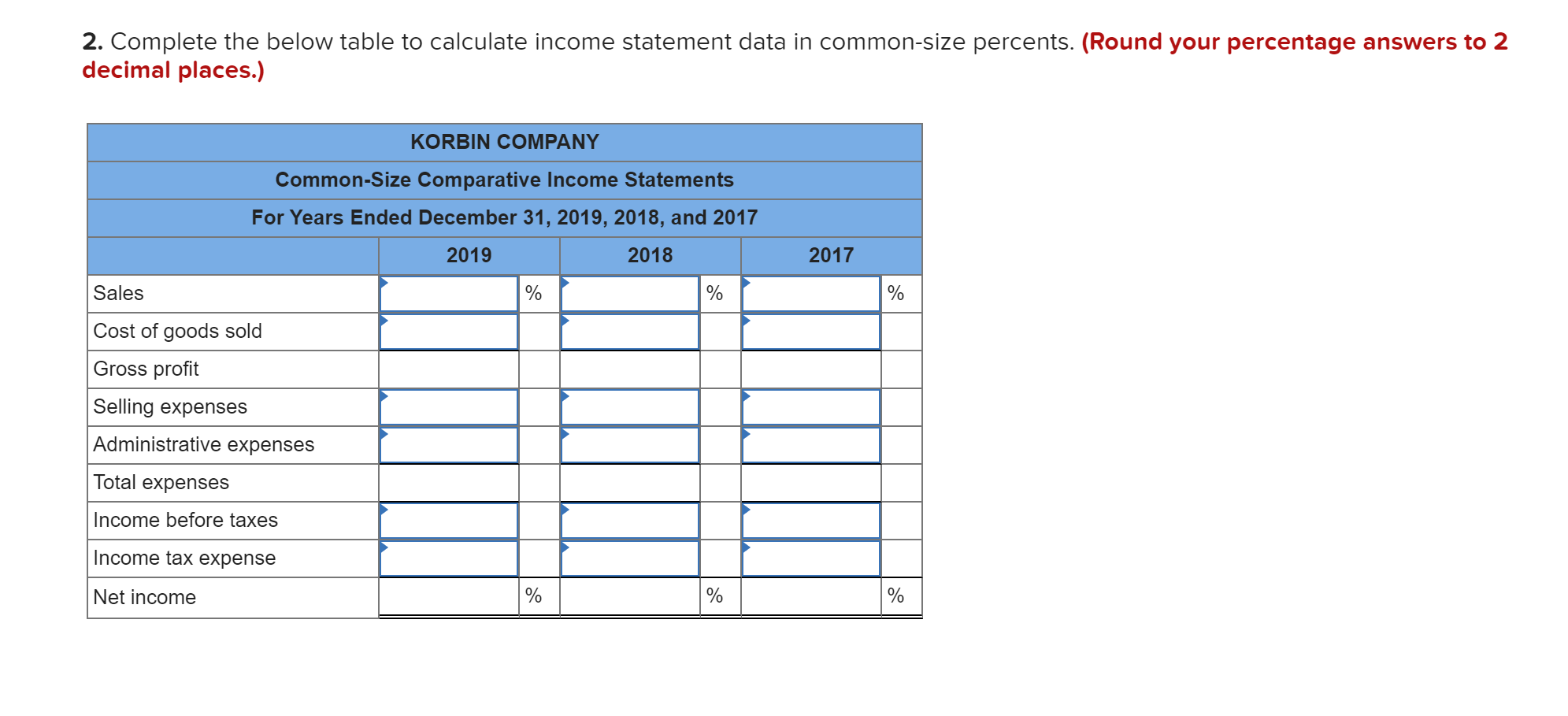

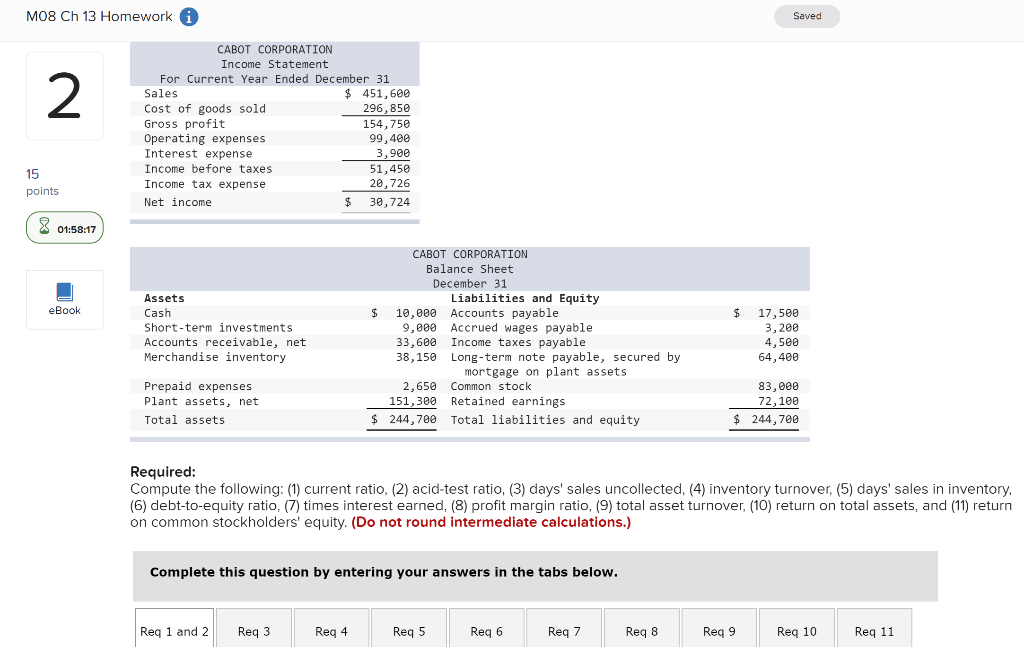

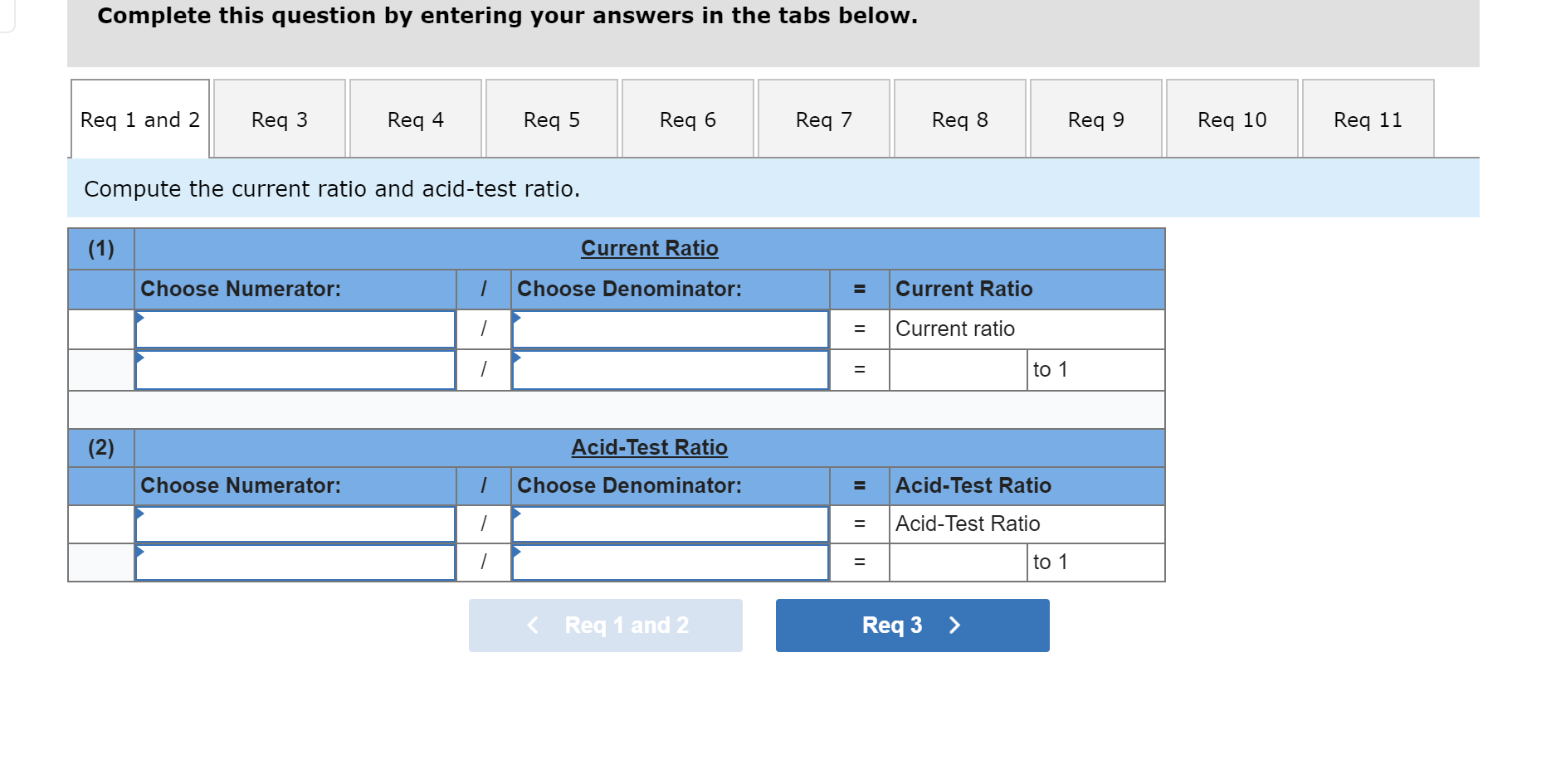

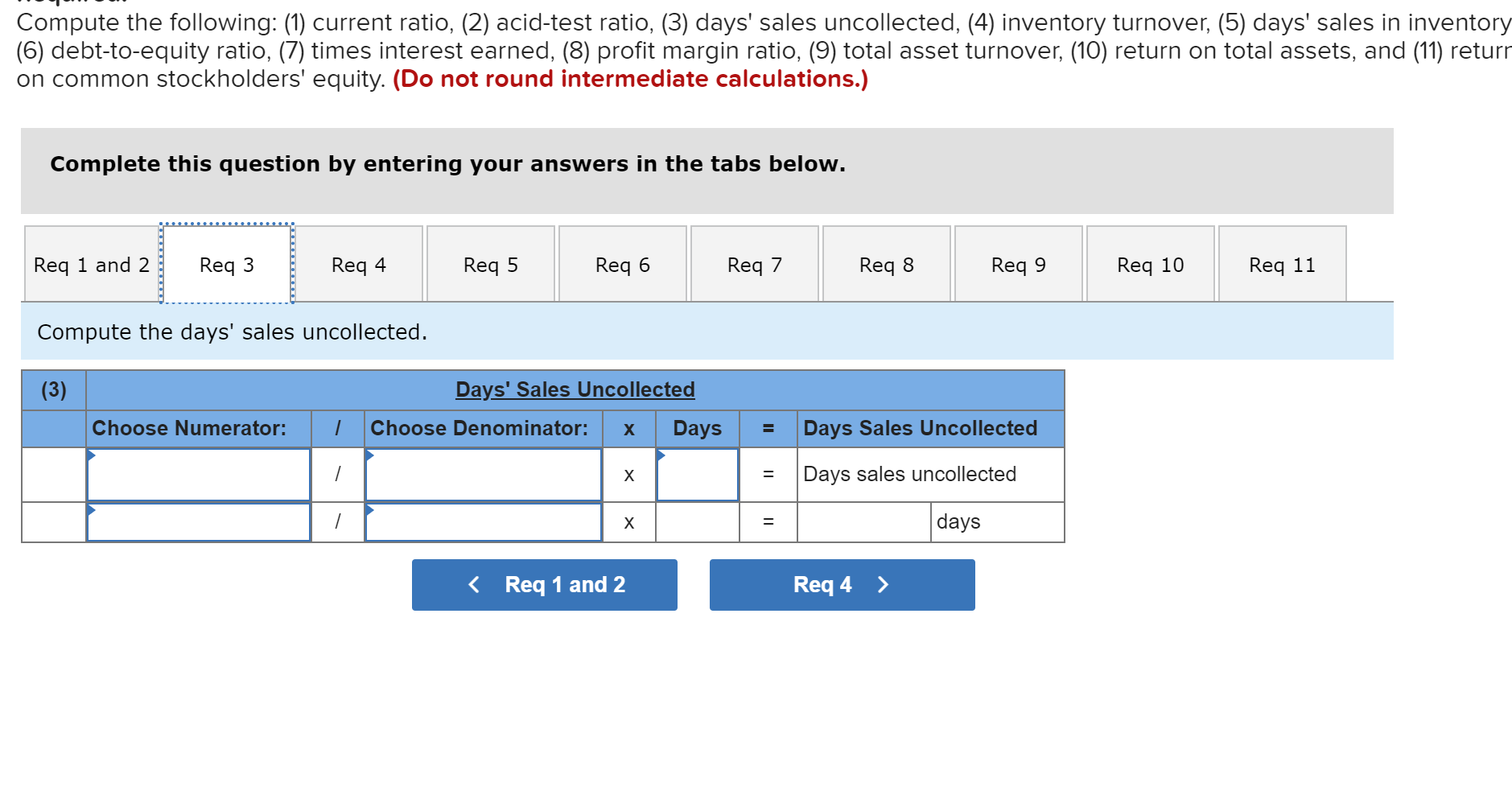

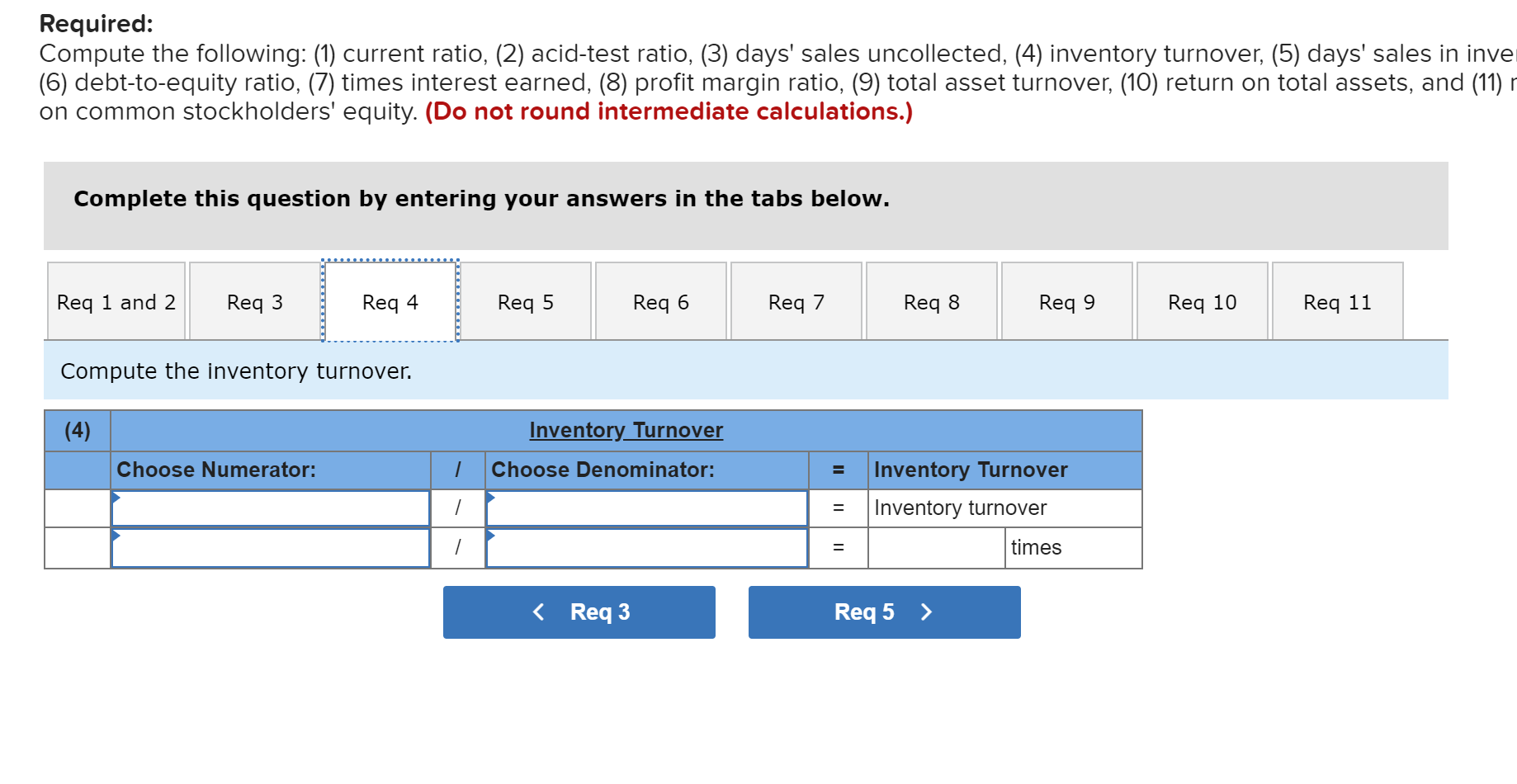

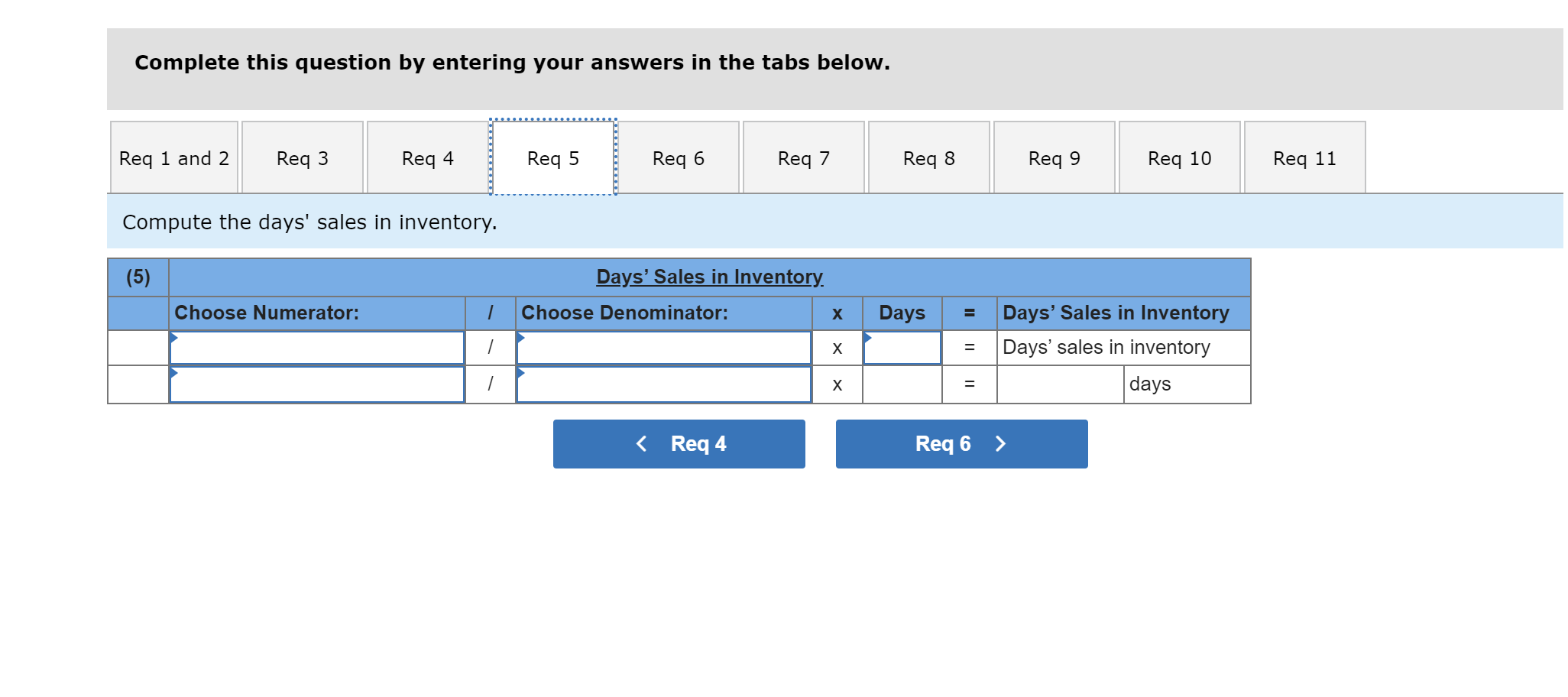

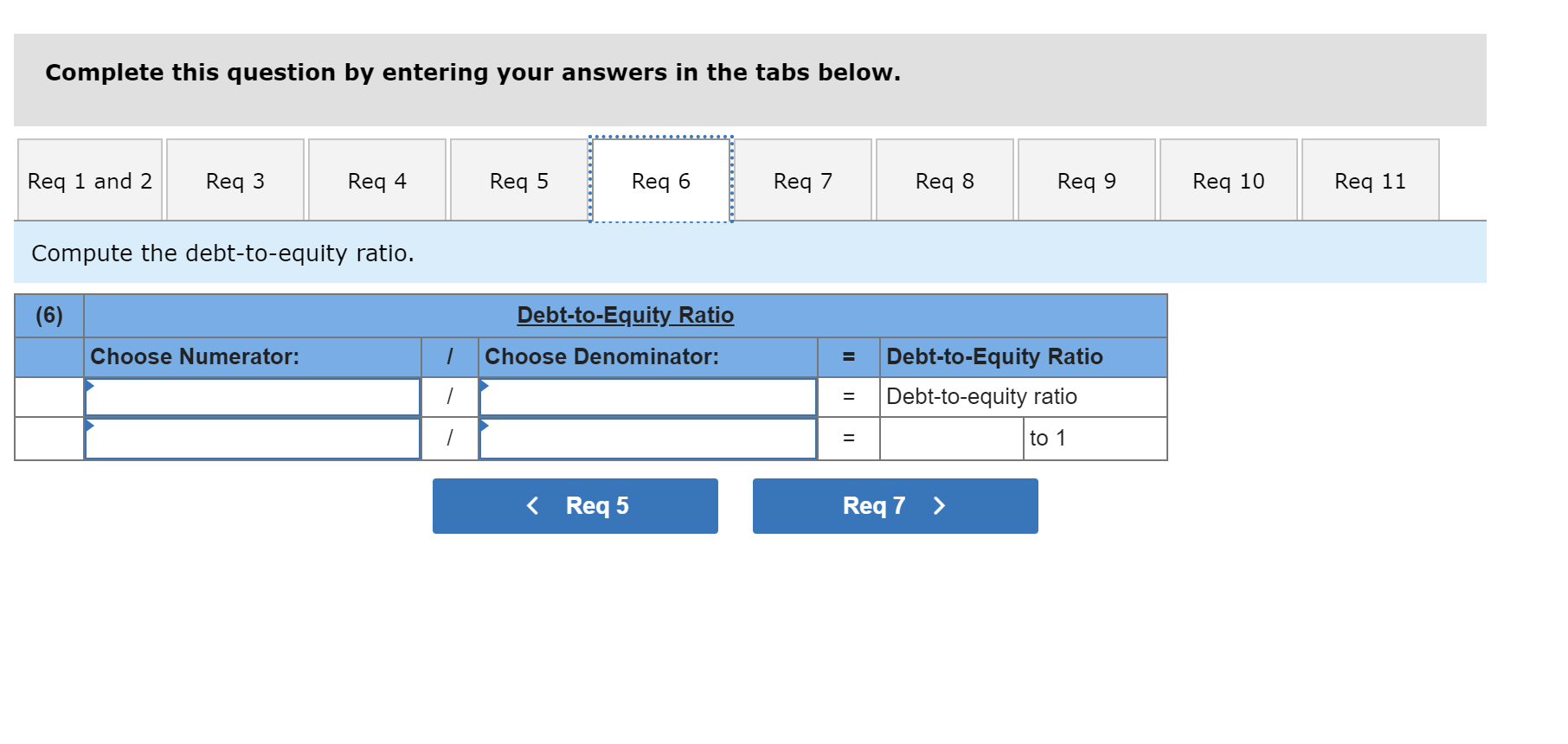

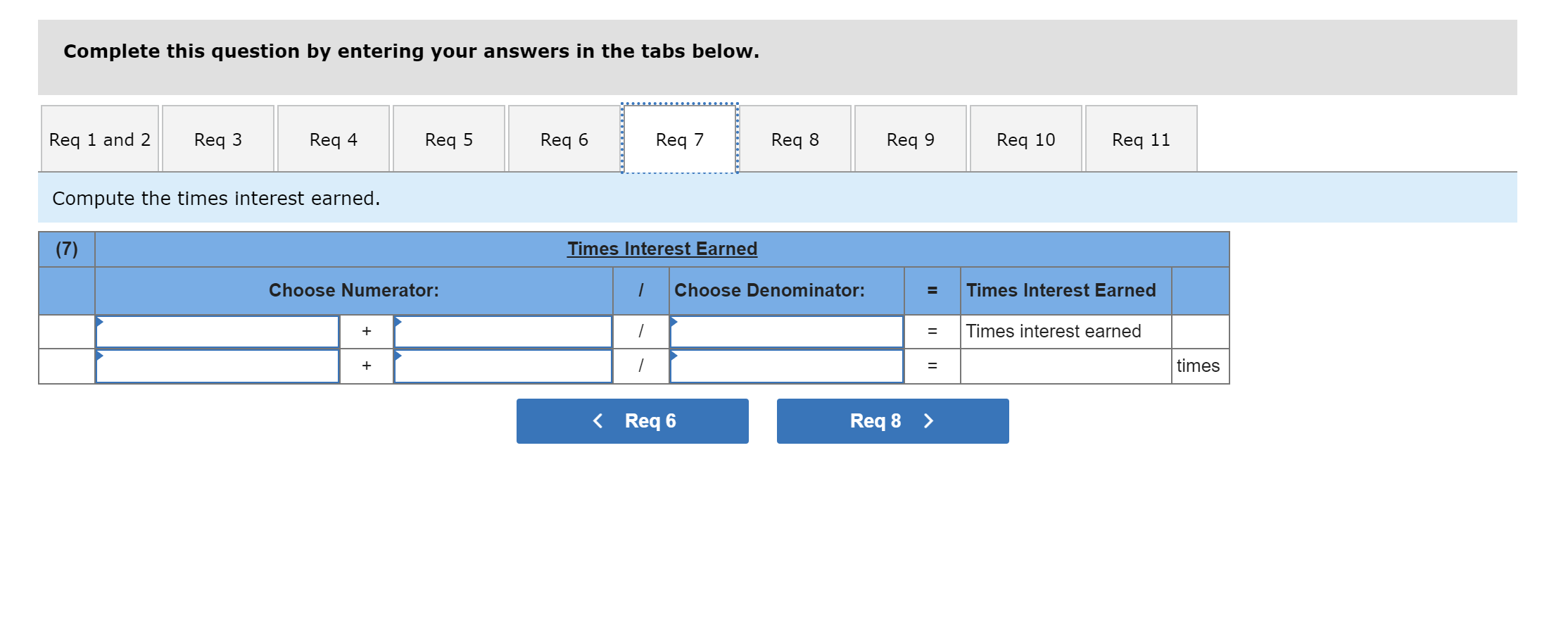

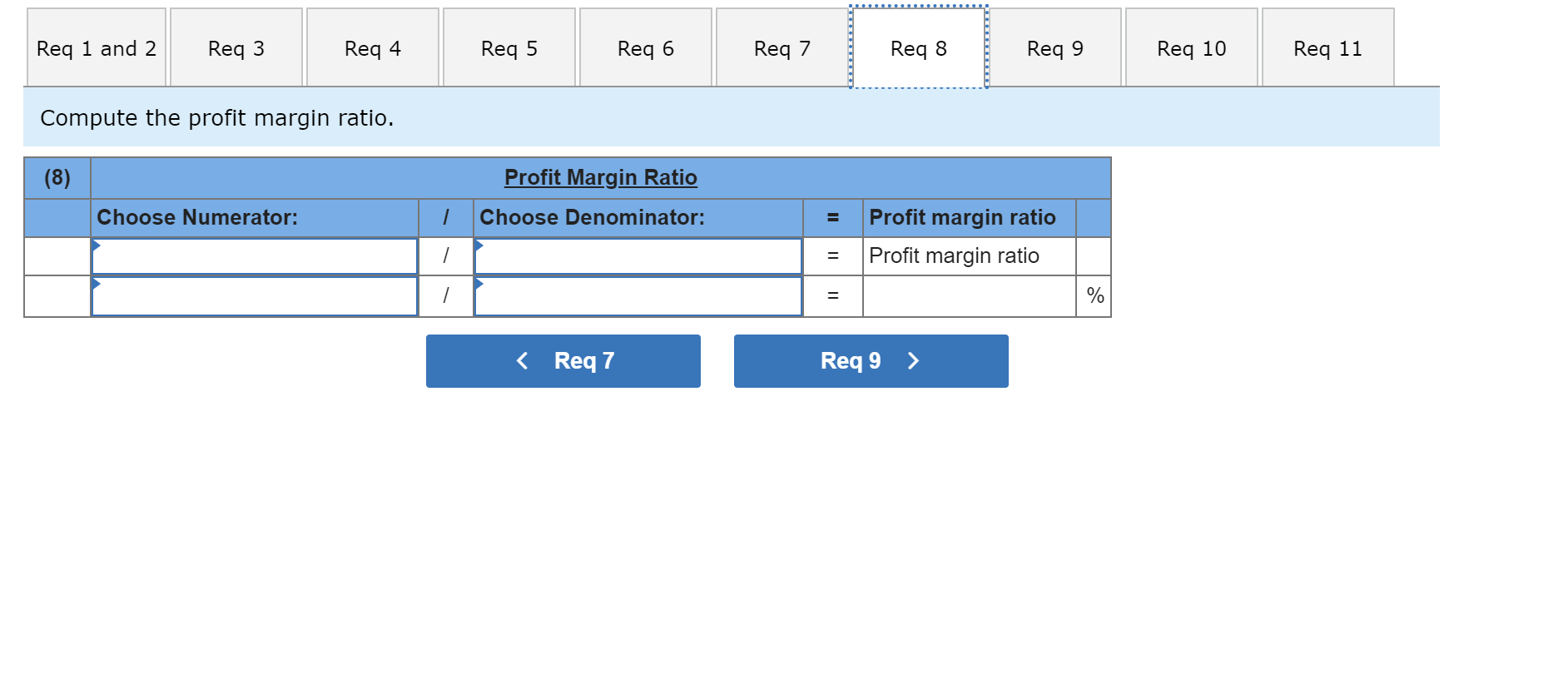

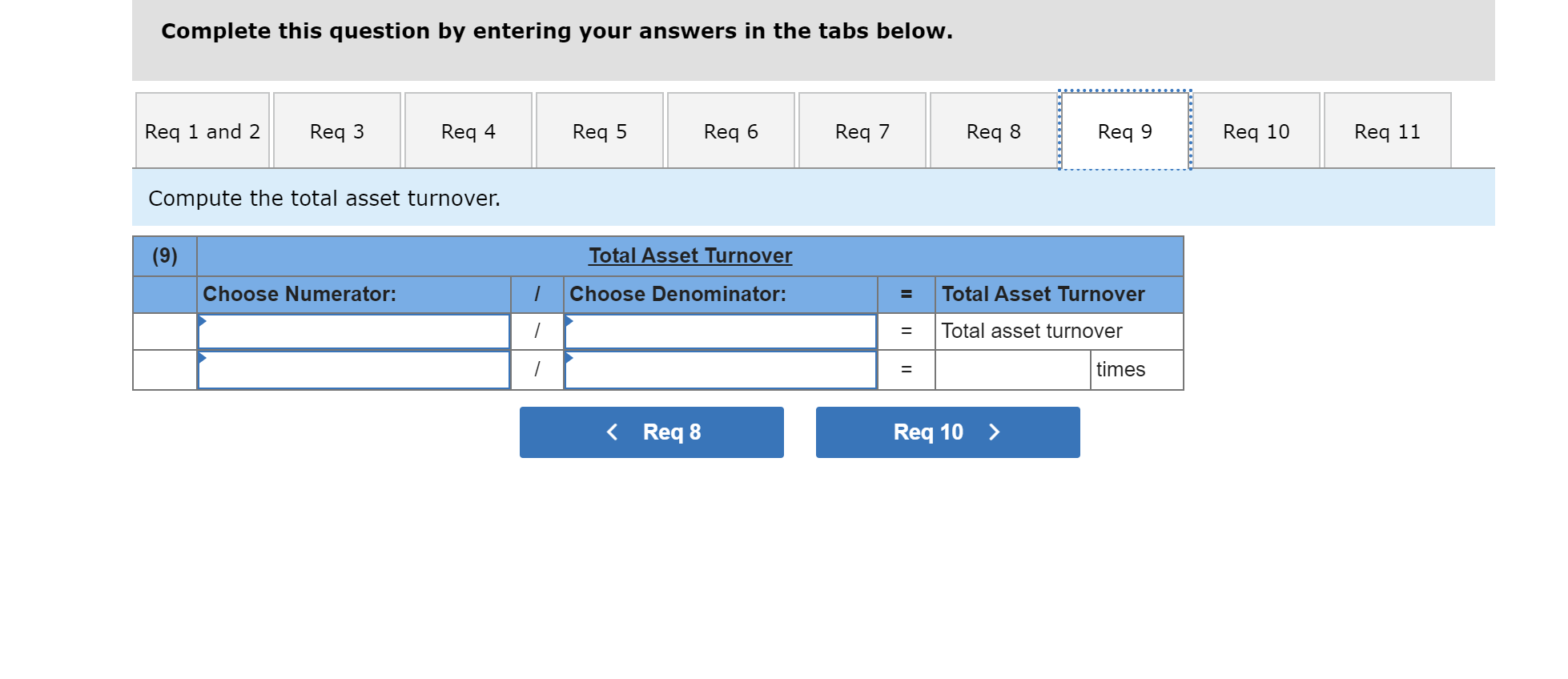

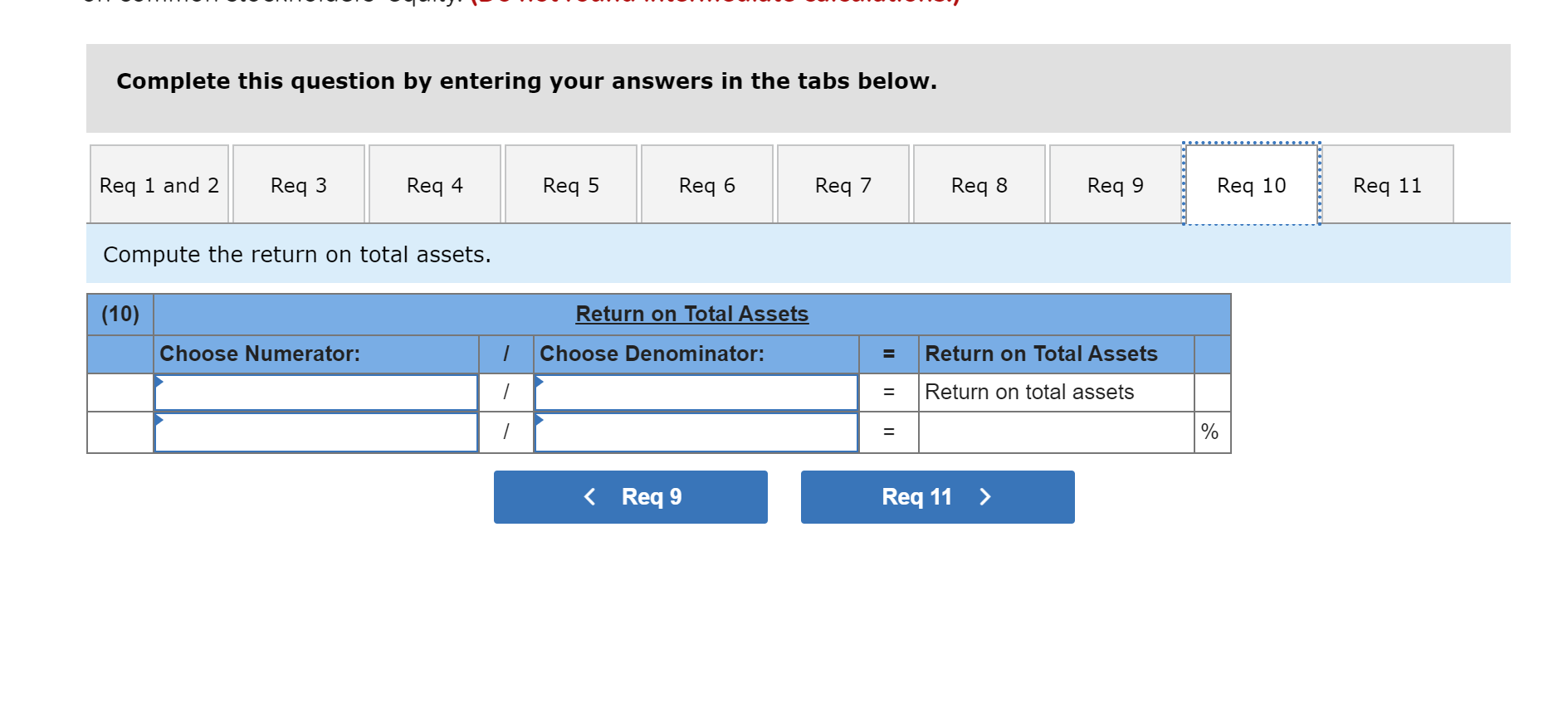

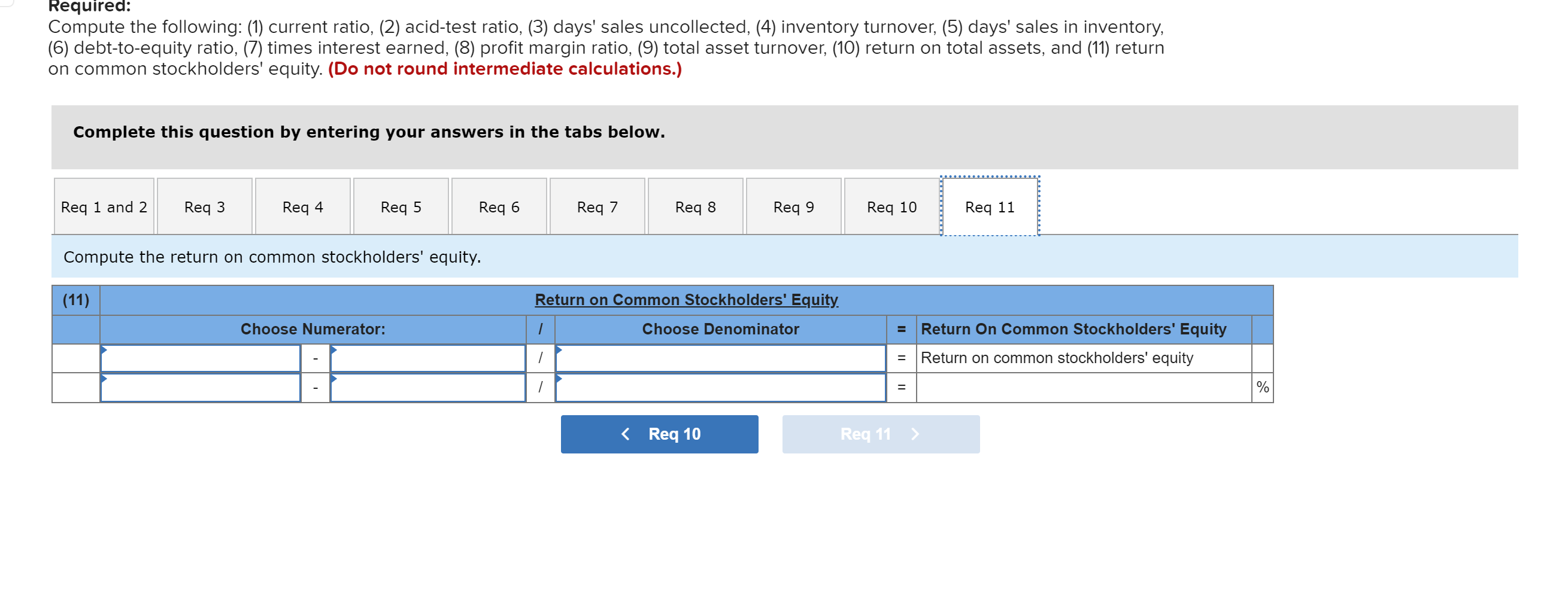

! 1 Required information [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. 5 01:59-25 . Book KORBIN COMPANY Comparative Income Statements For Year's Ended December 31, 2019, 2018, and 2017 2019 2016 2017 Sales $ 462,158 $ 3e8,086 $ 213,880 Cost of goods sold 242,899 192,862 136,832 Gross profit 168,059 115,224 76,968 Selling expenses 57,186 42,516 28,222 Administrative expenses 36,194 27,112 17,745 Total expenses 93,300 69.628 45,967 Income before taxes 66,759 45,596 31,091 Income tax expense 12,417 9,347 6,293 Net income $ 54, 342 $ 35,249 $ 24,788 2018 2017 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 Assets Current assets $ 60,219 Long-term investments @ Plant assets, net 110,132 Total assets $ 170, 351 Liabilities and Equity Current liabilities $ 24,871 Common stock 72, eae ther paid-in capital 9, eae Retained earnings 64,480 Total liabilities and equity $ $ 170,351 $ 40,385 680 180.685 $ 141,510 $ 53,878 4,590 58,672 $ 117,241 $ 21,085 $ 20,517 72,080 54,00 9,000 6,080 39,425 36,724 $ 141,510 $ 117,241 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales % % % Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income % % % M08 Ch 13 Homework Saved 2 CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 451,600 Cost of goods sold 296,850 Gross profit 154,750 Operating expenses 99,400 Interest expense 3,900 Income before taxes 51,450 Income tax expense 20,726 Net income $ 30, 724 15 points 8 01:58:17 eBook $ Assets Cash Short-term investments Accounts receivable, net Merchandise inventory CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 10,000 Accounts payable 9,000 Accrued wages payable 33,600 Income taxes payable 38,150 Long-term note payable, secured by mortgage on plant assets 2,650 Common stock 151,300 Retained earnings $ 244,700 Total liabilities and equity 17,500 3,200 4,500 64,400 Prepaid expenses Plant assets, net Total assets 83,000 72,100 $ 244,700 Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Req and 2 Req3 Reg 4 Req 5 Req 6 Req 7 Req 8 Req9 Req 10 Req 11 Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Reg 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the current ratio and acid-test ratio. (1) Current Ratio Choose Numerator: 1 Choose Denominator: Current Ratio / Current ratio 1 to 1 (2) Acid-Test Ratio Choose Denominator: Choose Numerator: 1 Acid-Test Ratio 1 II Acid-Test Ratio 1 Il to 1 Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Req 4 Req 5 Req 6 Req 7 Req 8 Reg 9 Req 10 Req 11 Compute the days' sales uncollected. (3) Days' Sales Uncollected Choose Numerator: 1 Choose Denominator: Days Days Sales Uncollected / Days sales uncollected / days Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inve (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) r on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the inventory turnover. (4) Inventory Turnover Choose Denominator: Choose Numerator: 1 Inventory Turnover Inventory turnover / / times Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 Reg 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the days' sales in inventory. (5) Days' Sales in Inventory. Choose Denominator: Choose Numerator: 1 Days / = Days' Sales in Inventory Days' sales in inventory days X Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Reg 5 Reg 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the debt-to-equity ratio. (6) Debt-to-Equity Ratio Choose Numerator: 1 Choose Denominator: Debt-to-Equity Ratio Debt-to-equity ratio / to 1 Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the times interest earned. (7) Times Interest Earned Choose Numerator: / Choose Denominator: Times Interest Earned + 11 Times interest earned + = times Req 1 and 2 Reg 3 Req 4 Req 5 Req 6 Req 7 Reg 8 Req 9 Req 10 Req 11 Compute the profit margin ratio. (8) Profit Margin Ratio Choose Numerator: 1 Choose Denominator: = Profit margin ratio Profit margin ratio 1 % Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the total asset turnover. (9) Total Asset Turnover Choose Numerator: 1 Choose Denominator: II Total Asset Turnover / = Total asset turnover / times Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Reg 4 Req 5 Reg 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the return on total assets. (10) Return on Total Assets Choose Numerator: 1 Choose Denominator: Return on Total Assets 1 II Return on total assets 7 = %