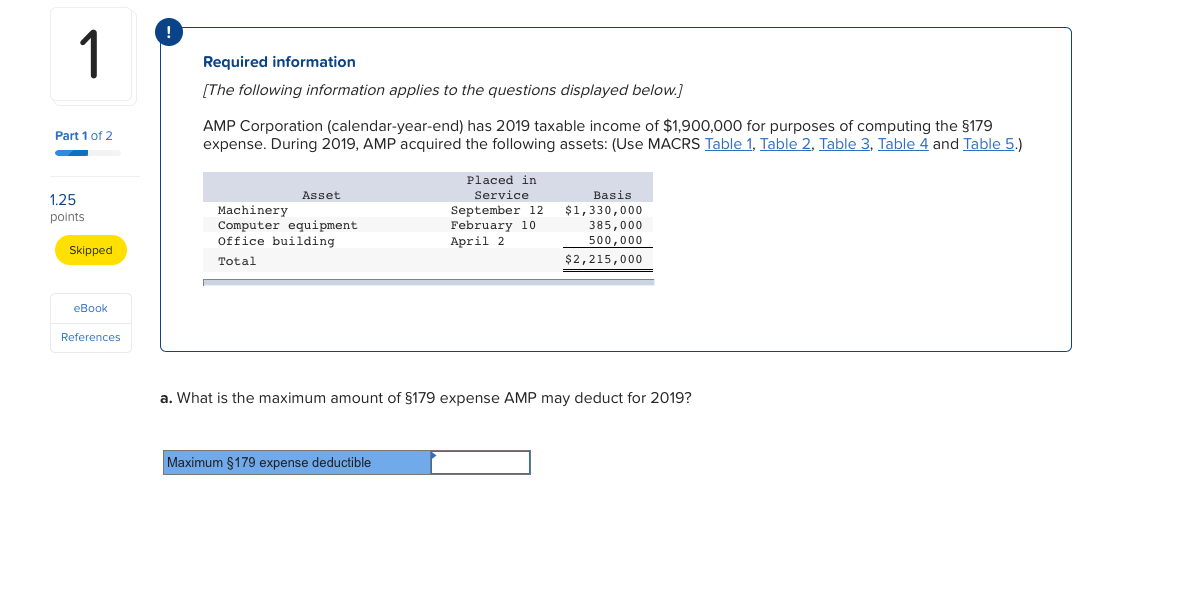

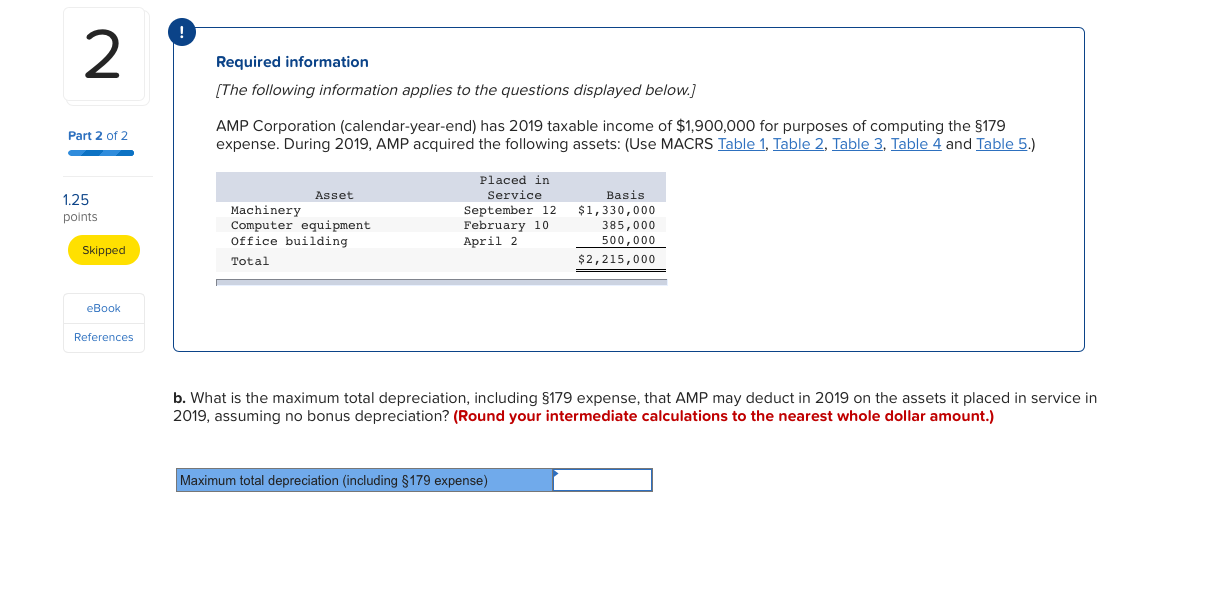

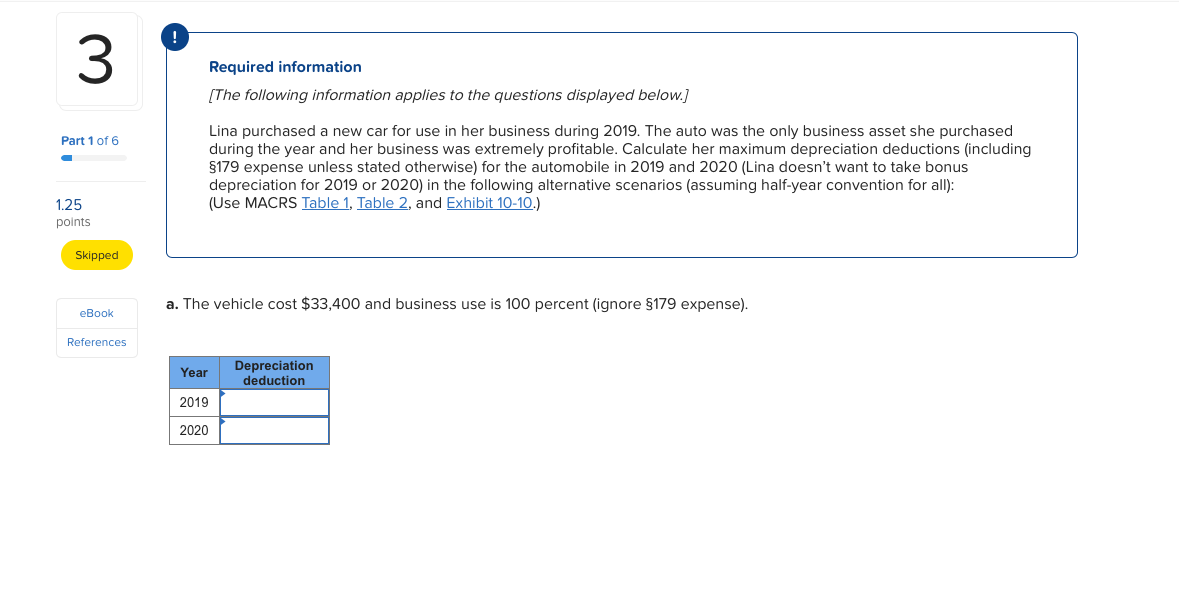

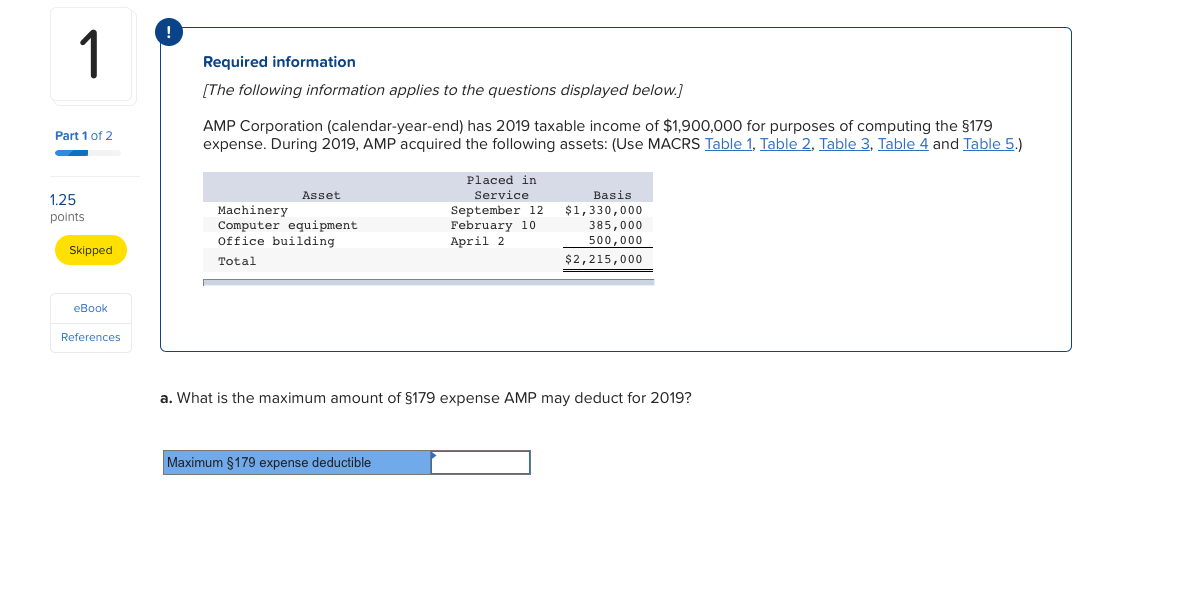

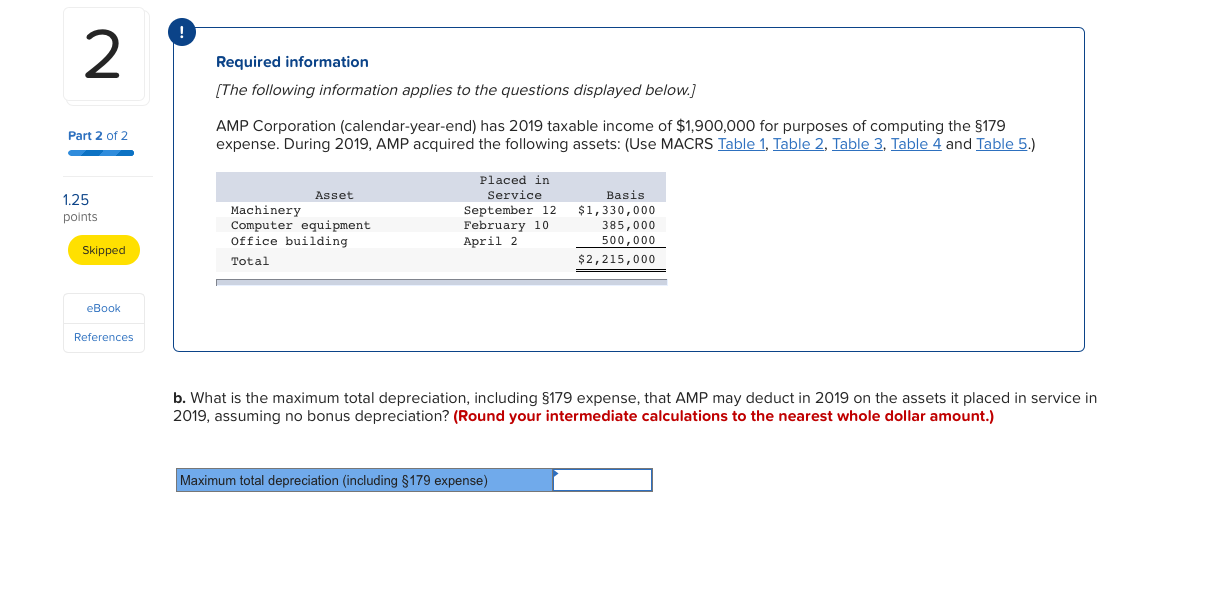

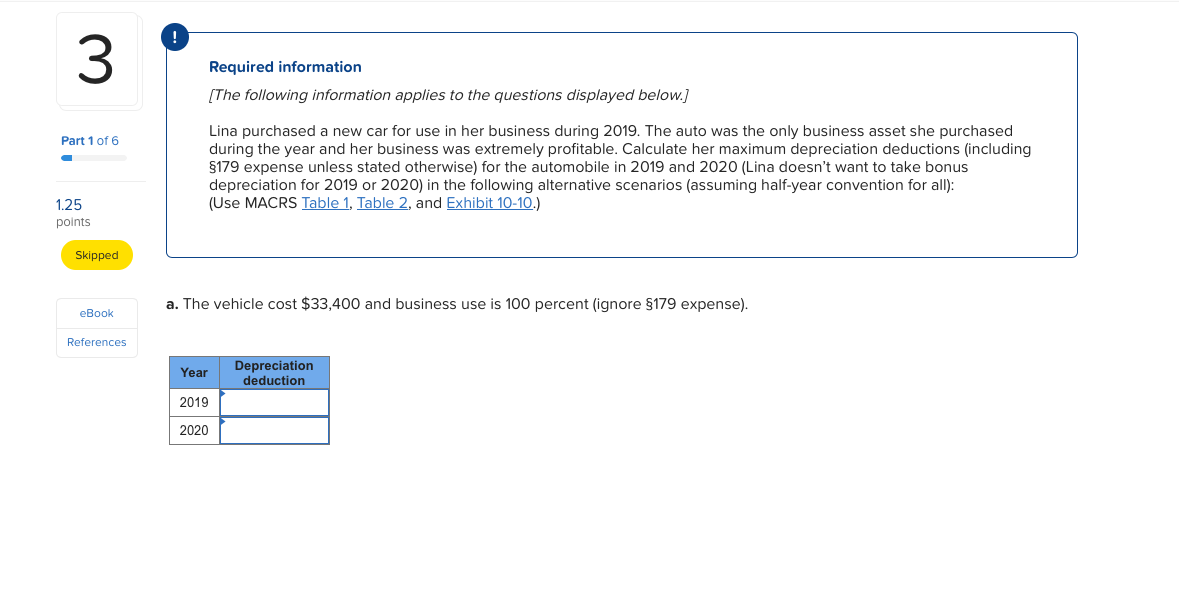

1 Required information [The following information applies to the questions displayed below. Part 1 of 2 AMP Corporation (calendar-year-end) has 2019 taxable income of $1,900,000 for purposes of computing the $179 expense. During 2019, AMP acquired the following assets: (Use MACRS Table 1, Table 2. Table 3, Table 4 and Table 5.) 1.25 points Asset Machinery Computer equipment Office building Total Placed in Service September 12 February 10 April 2 Basis $1,330,000 385,000 500,000 $2,215,000 Skipped eBook References a. What is the maximum amount of $179 expense AMP may deduct for 2019? Maximum $179 expense uctible 2 Required information [The following information applies to the questions displayed below.] Part 2 of 2 AMP Corporation (calendar-year-end) has 2019 taxable income of $1,900,000 for purposes of computing the $179 expense. During 2019, AMP acquired the following assets: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) 1.25 points Asset Machinery Computer equipment Office building Total Placed in Service September 12 February 10 April 2 Basis $1,330,000 385,000 500,000 $2,215,000 Skipped eBook References b. What is the maximum total depreciation, including $179 expense, that AMP may deduct in 2019 on the assets it placed in service in 2019, assuming no bonus depreciation? (Round your intermediate calculations to the nearest whole dollar amount.) Maximum total depreciation (including $179 expense) 3 Required information [The following information applies to the questions displayed below.] Part 1 of 6 Lina purchased a new car for use in her business during 2019. The auto was the only business asset she purchased during the year and her business was extremely profitable. Calculate her maximum depreciation deductions (including $179 expense unless stated otherwise) for the automobile in 2019 and 2020 (Lina doesn't want to take bonus depreciation for 2019 or 2020) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1, Table 2, and Exhibit 10-10.) 1.25 points Skipped a. The vehicle cost $33,400 and business use is 100 percent (ignore $179 expense). eBook References Year Depreciation deduction 2019 2020