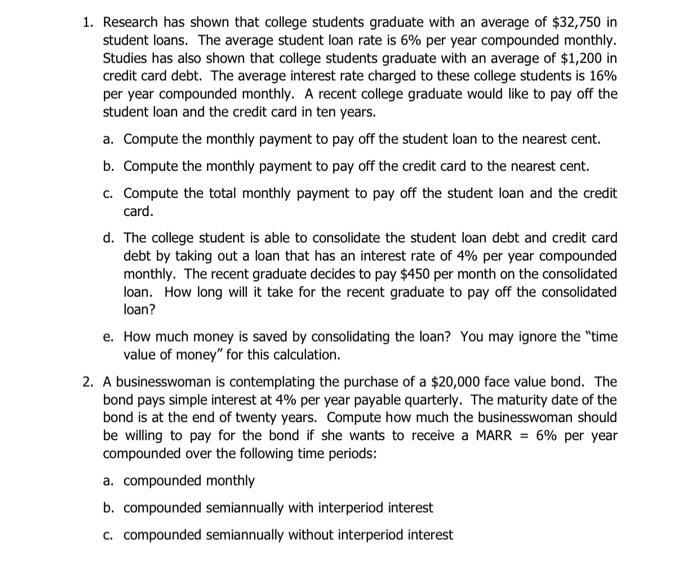

1. Research has shown that college students graduate with an average of $32,750 in student loans. The average student loan rate is 6% per year compounded monthly. Studies has also shown that college students graduate with an average of $1,200 in credit card debt. The average interest rate charged to these college students is 16% per year compounded monthly. A recent college graduate would like to pay off the student loan and the credit card in ten years. a. Compute the monthly payment to pay off the student loan to the nearest cent. b. Compute the monthly payment to pay off the credit card to the nearest cent. c. Compute the total monthly payment to pay off the student loan and the credit card. d. The college student is able to consolidate the student loan debt and credit card debt by taking out a loan that has an interest rate of 4% per year compounded monthly. The recent graduate decides to pay $450 per month on the consolidated loan. How long will it take for the recent graduate to pay off the consolidated loan? e. How much money is saved by consolidating the loan? You may ignore the "time value of money" for this calculation. 2. A businesswoman is contemplating the purchase of a $20,000 face value bond. The bond pays simple interest at 4% per year payable quarterly. The maturity date of the bond is at the end of twenty years. Compute how much the businesswoman should be willing to pay for the bond if she wants to receive a MARR = 6% per year compounded over the following time periods: a. compounded monthly b. compounded semiannually with interperiod interest C. compounded semiannually without interperiod interest 1. Research has shown that college students graduate with an average of $32,750 in student loans. The average student loan rate is 6% per year compounded monthly. Studies has also shown that college students graduate with an average of $1,200 in credit card debt. The average interest rate charged to these college students is 16% per year compounded monthly. A recent college graduate would like to pay off the student loan and the credit card in ten years. a. Compute the monthly payment to pay off the student loan to the nearest cent. b. Compute the monthly payment to pay off the credit card to the nearest cent. c. Compute the total monthly payment to pay off the student loan and the credit card. d. The college student is able to consolidate the student loan debt and credit card debt by taking out a loan that has an interest rate of 4% per year compounded monthly. The recent graduate decides to pay $450 per month on the consolidated loan. How long will it take for the recent graduate to pay off the consolidated loan? e. How much money is saved by consolidating the loan? You may ignore the "time value of money" for this calculation. 2. A businesswoman is contemplating the purchase of a $20,000 face value bond. The bond pays simple interest at 4% per year payable quarterly. The maturity date of the bond is at the end of twenty years. Compute how much the businesswoman should be willing to pay for the bond if she wants to receive a MARR = 6% per year compounded over the following time periods: a. compounded monthly b. compounded semiannually with interperiod interest C. compounded semiannually without interperiod interest