Answered step by step

Verified Expert Solution

Question

1 Approved Answer

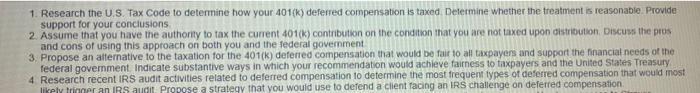

1. Research the U.S. Tax Code to determine how your 401(k) deferred compensation is taxed. Determine whether the treatment is reasonable. Provide support for

1. Research the U.S. Tax Code to determine how your 401(k) deferred compensation is taxed. Determine whether the treatment is reasonable. Provide support for your conclusions. 2. Assume that you have the authority to tax the current 401(k) contribution on the condition that you are not taxed upon distribution. Discuss the pros and cons of using this approach on both you and the federal government 3. Propose an alternative to the taxation for the 401(k) deferred compensation that would be fair to all taxpayers and support the financial needs of the federal government Indicate substantive ways in which your recommendation would achieve fairness to taxpayers and the United States Treasury 4 Research recent IRS audit activities related to deferred compensation to determine the most frequent types of deferred compensation that would most likely trigger an IRS augit. Propose a strategy that you would use to defend a client facing an IRS challenge on deferred compensation.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 The US Tax Code states that deferred compensation is taxed as ordinary income when it is distribut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started