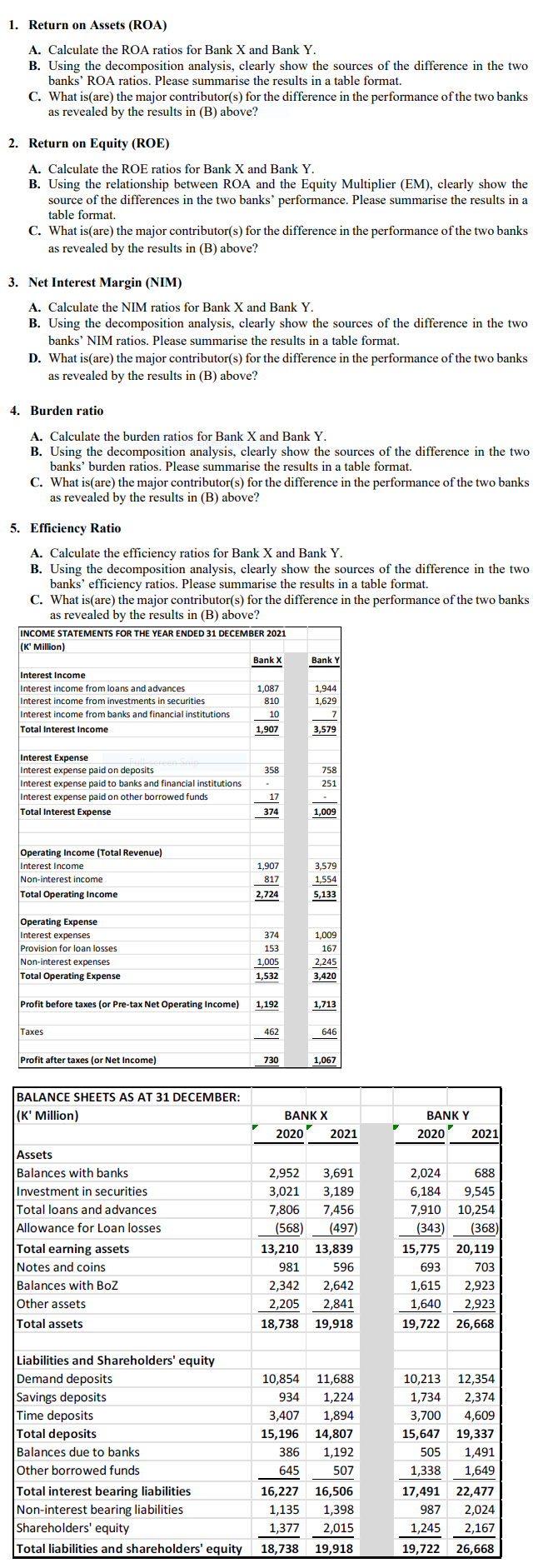

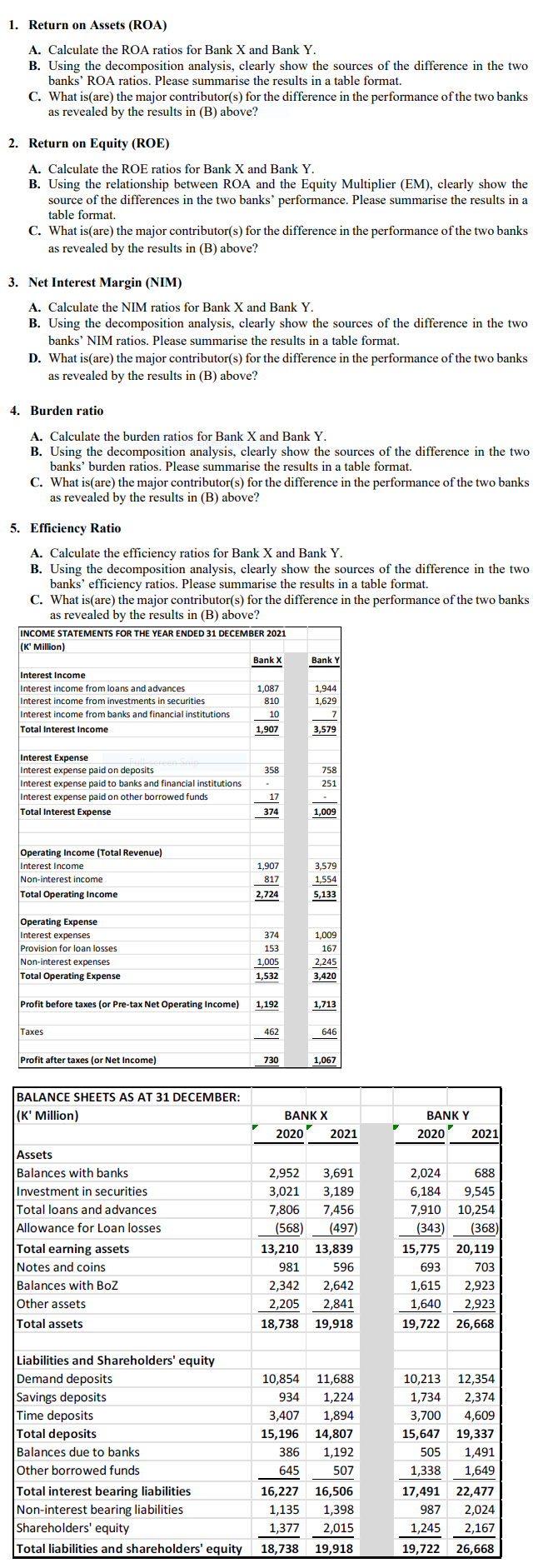

1. Return on Assets (ROA) A. Calculate the ROA ratios for Bank X and Bank Y. B. Using the decomposition analysis, clearly show the sources of the difference in the two banks' ROA ratios. Please summarise the results in a table format. C. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? 2. Return on Equity (ROE) A. Calculate the ROE ratios for Bank X and Bank Y. B. Using the relationship between ROA and the Equity Multiplier (EM), clearly show the source of the differences in the two banks' performance. Please summarise the results in a table format. C. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? 3. Net Interest Margin (NIM) A. Calculate the NIM ratios for Bank X and Bank Y. B. Using the decomposition analysis, clearly show the sources of the difference in the two banks' NIM ratios. Please summarise the results in a table format. D. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? 4. Burden ratio A. Calculate the burden ratios for Bank X and Bank Y. B. Using the decomposition analysis, clearly show the sources of the difference in the two banks' burden ratios. Please summarise the results in a table format. C. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? 5. Efficiency Ratio A. Calculate the efficiency ratios for Bank X and Bank Y. B. Using the decomposition analysis, clearly show the sources of the difference in the two banks' efficiency ratios. Please summarise the results in a table format. C. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? INCOME STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (K' Million) Bank X Bank Y Interest Income Interest income from loans and advances Interest income from investments in securities Interest income from banks and financial institutions Total Interest Income 1,087 810 10 1,907 1,944 1,629 7 3,579 358 Interest Expense Interest expense paid on deposits Interest expense paid to banks and financial institutions Interest expense paid on other borrowed funds Total Interest Expense 758 251 17 374 1,009 Operating Income (Total Revenue) Interest Income Non-interest income Total Operating Income 1,907 817 3,579 1,554 5,133 2,724 Operating Expense Interest expenses Provision for loan losses Non-interest expenses Total Operating Expense 374 153 1,005 1,532 1,009 167 2,245 3,420 Profit before taxes (or Pre-tax Net Operating Income) 1,192 1,713 Taxes 462 646 Profit after taxes (or Net Income) 730 1,067 BALANCE SHEETS AS AT 31 DECEMBER: (K' Million) BANK X 2020 2021 BANKY 2020 2021 Assets Balances with banks Investment in securities Total loans and advances Allowance for Loan losses Total earning assets Notes and coins Balances with BOZ Other assets Total assets 2,952 3,691 3,021 3,189 7,806 7,456 (568) (497) 13,210 13,839 981 596 2,342 2,642 2,205 2,841 18,738 19,918 2,024 688 6,184 9,545 7,910 10,254 (343) (368) 15,775 20,119 693 703 1,615 2,923 1,640 2,923 19,722 26,668 Liabilities and Shareholders' equity Demand deposits Savings deposits Time deposits Total deposits Balances due to banks Other borrowed funds Total interest bearing liabilities Non-interest bearing liabilities Shareholders' equity Total liabilities and shareholders' equity 10,854 11,688 934 1,224 3,407 1,894 15,196 14,807 386 1,192 645 507 16,227 16,506 1,135 1,398 1,377 2,015 18,738 19,918 10,213 12,354 1,734 2,374 3,700 4,609 15,647 19,337 505 1,491 1,338 1,649 17,491 22,477 987 2,024 1,245 2,167 19,722 26,668 1. Return on Assets (ROA) A. Calculate the ROA ratios for Bank X and Bank Y. B. Using the decomposition analysis, clearly show the sources of the difference in the two banks' ROA ratios. Please summarise the results in a table format. C. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? 2. Return on Equity (ROE) A. Calculate the ROE ratios for Bank X and Bank Y. B. Using the relationship between ROA and the Equity Multiplier (EM), clearly show the source of the differences in the two banks' performance. Please summarise the results in a table format. C. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? 3. Net Interest Margin (NIM) A. Calculate the NIM ratios for Bank X and Bank Y. B. Using the decomposition analysis, clearly show the sources of the difference in the two banks' NIM ratios. Please summarise the results in a table format. D. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? 4. Burden ratio A. Calculate the burden ratios for Bank X and Bank Y. B. Using the decomposition analysis, clearly show the sources of the difference in the two banks' burden ratios. Please summarise the results in a table format. C. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? 5. Efficiency Ratio A. Calculate the efficiency ratios for Bank X and Bank Y. B. Using the decomposition analysis, clearly show the sources of the difference in the two banks' efficiency ratios. Please summarise the results in a table format. C. What isare) the major contributor(s) for the difference in the performance of the two banks as revealed by the results in (B) above? INCOME STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (K' Million) Bank X Bank Y Interest Income Interest income from loans and advances Interest income from investments in securities Interest income from banks and financial institutions Total Interest Income 1,087 810 10 1,907 1,944 1,629 7 3,579 358 Interest Expense Interest expense paid on deposits Interest expense paid to banks and financial institutions Interest expense paid on other borrowed funds Total Interest Expense 758 251 17 374 1,009 Operating Income (Total Revenue) Interest Income Non-interest income Total Operating Income 1,907 817 3,579 1,554 5,133 2,724 Operating Expense Interest expenses Provision for loan losses Non-interest expenses Total Operating Expense 374 153 1,005 1,532 1,009 167 2,245 3,420 Profit before taxes (or Pre-tax Net Operating Income) 1,192 1,713 Taxes 462 646 Profit after taxes (or Net Income) 730 1,067 BALANCE SHEETS AS AT 31 DECEMBER: (K' Million) BANK X 2020 2021 BANKY 2020 2021 Assets Balances with banks Investment in securities Total loans and advances Allowance for Loan losses Total earning assets Notes and coins Balances with BOZ Other assets Total assets 2,952 3,691 3,021 3,189 7,806 7,456 (568) (497) 13,210 13,839 981 596 2,342 2,642 2,205 2,841 18,738 19,918 2,024 688 6,184 9,545 7,910 10,254 (343) (368) 15,775 20,119 693 703 1,615 2,923 1,640 2,923 19,722 26,668 Liabilities and Shareholders' equity Demand deposits Savings deposits Time deposits Total deposits Balances due to banks Other borrowed funds Total interest bearing liabilities Non-interest bearing liabilities Shareholders' equity Total liabilities and shareholders' equity 10,854 11,688 934 1,224 3,407 1,894 15,196 14,807 386 1,192 645 507 16,227 16,506 1,135 1,398 1,377 2,015 18,738 19,918 10,213 12,354 1,734 2,374 3,700 4,609 15,647 19,337 505 1,491 1,338 1,649 17,491 22,477 987 2,024 1,245 2,167 19,722 26,668