Answered step by step

Verified Expert Solution

Question

1 Approved Answer

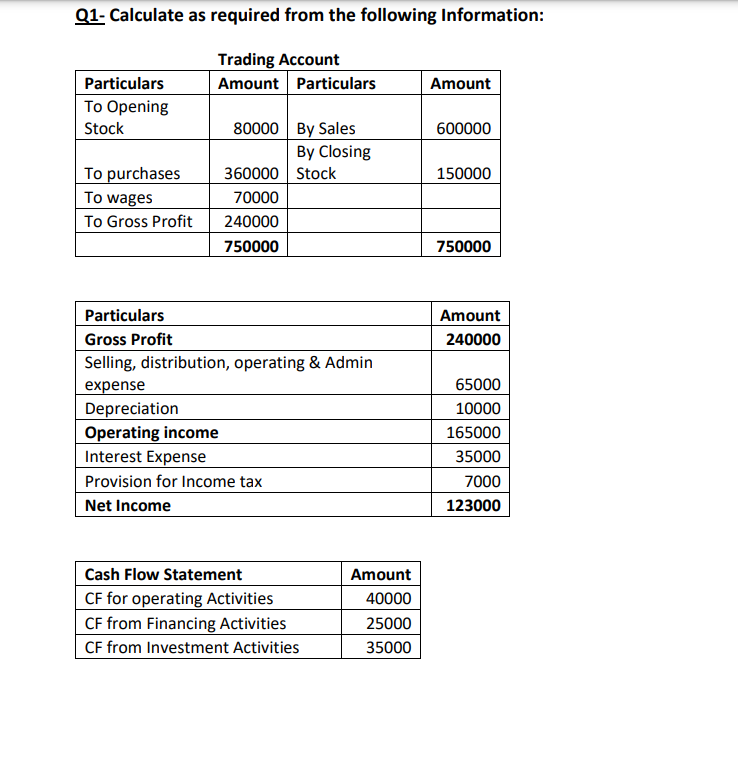

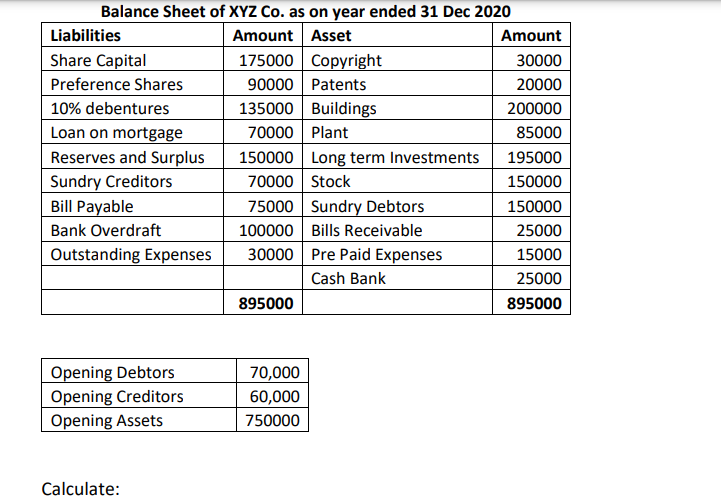

1) Return on Equity 2) Inventory Turnover Ratio 3) Asset Turnover Ratio 4) Receivables Turnover Ratio (both times and days) 5) Payables Turnover Ratio (both

1) Return on Equity

2) Inventory Turnover Ratio

3) Asset Turnover Ratio

4) Receivables Turnover Ratio (both times and days)

5) Payables Turnover Ratio (both times and days)

Q1- Calculate as required from the following Information: Trading Account Amount Particulars Amount Particulars To Opening Stock 600000 150000 To purchases To wages To Gross Profit 80000 By Sales By Closing 360000 Stock 70000 240000 750000 750000 Amount 240000 Particulars Gross Profit Selling, distribution, operating & Admin expense Depreciation Operating income Interest Expense Provision for Income tax Net Income 65000 10000 165000 35000 7000 123000 Cash Flow Statement CF for operating Activities CF from Financing Activities CF from Investment Activities Amount 40000 25000 35000 Balance Sheet of XYZ Co. as on year ended 31 Dec 2020 Liabilities Amount Asset Amount Share Capital 175000 Copyright 30000 Preference Shares 90000 Patents 20000 10% debentures 135000 Buildings 200000 Loan on mortgage 70000 Plant 85000 Reserves and Surplus 150000 Long term Investments 195000 Sundry Creditors 70000 Stock 150000 Bill Payable 75000 Sundry Debtors 150000 Bank Overdraft 100000 Bills Receivable 25000 Outstanding Expenses 30000 Pre Paid Expenses 15000 Cash Bank 25000 895000 895000 Opening Debtors Opening Creditors Opening Assets 70,000 60,000 750000 CalculateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started