Answered step by step

Verified Expert Solution

Question

1 Approved Answer

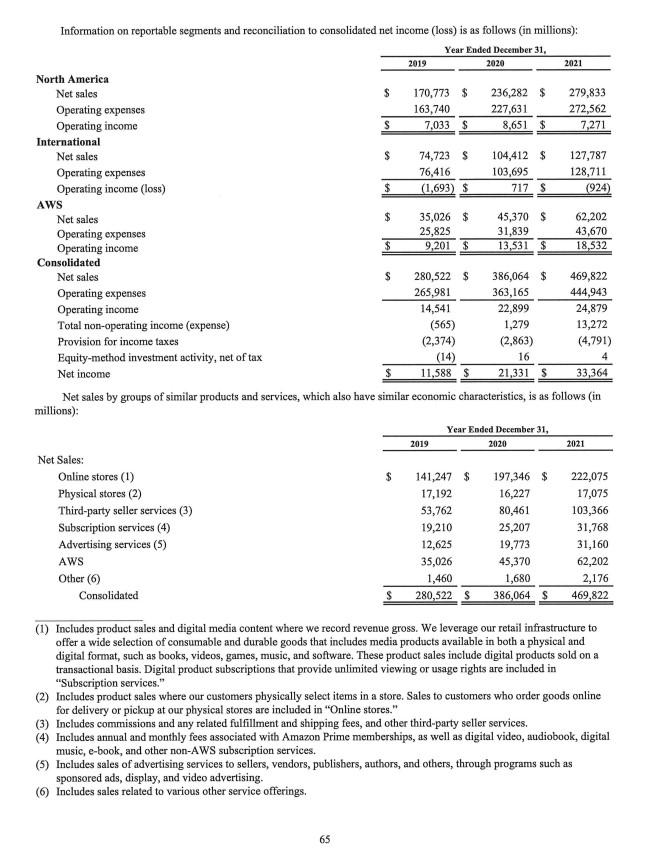

1. Review page 65 of the report: Which business segment was most profitable during 2021? Should the International segment be eliminated? Why or Why not.

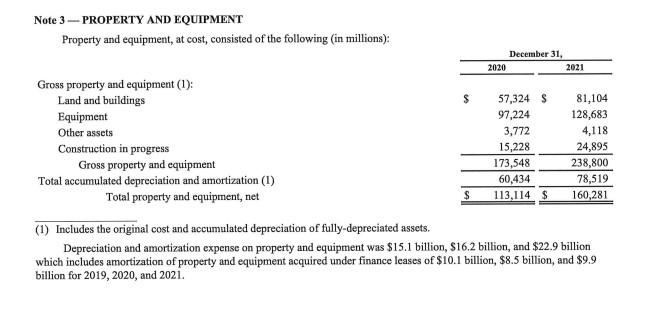

1. Review page 65 of the report: Which business segment was most profitable during 2021? Should the International segment be eliminated? Why or Why not. 2. Looking at Note 3, what is the gross amount of Property and Equipment? What is the amount of accumulated depreciation and amortization?

Information on reportable segments and reconciliation to consolidated net income (loss) is as follows (in millions): Net sales by groups of similar products and services, which also have similar economic characteristics, is as follows (in millions): (1) Includes product sales and digital media content where we record revenue gross. We leverage our retail infrastructure to offer a wide selection of consumable and durable goods that includes media products available in both a physical and digital format, such as books, videos, games, music, and software. These product sales include digital products sold on a transactional basis. Digital product subscriptions that provide unlimited viewing or usage rights are included in "Subscription services." (2) Includes product sales where our customers physically select items in a store. Sales to customers who order goods online for delivery or pickup at our physical stores are included in "Online stores." (3) Includes commissions and any related fulfillment and shipping fees, and other third-party seller services. (4) Includes annual and monthly fees associated with Amazon Prime memberships, as well as digital video, audiobook, digital music, e-book, and other non-AWS subscription services. (5) Includes sales of advertising services to sellers, vendors, publishers, authors, and others, through programs such as sponsored ads, display, and video advertising. (6) Includes sales related to various other service offerings. Note 3 - PROPERTY AND EQUTPMENT (1) Includes the original cost and accumulated depreciation of fully-depreciated assets. Depreciation and amortization expense on property and equipment was $15.1 billion, $16.2 billion, and $22.9 billion which includes amortization of property and equipment acquired under finance leases of $10.1 billion, $8.5 billion, and $9.9 billion for 2019,2020 , and 2021 . Information on reportable segments and reconciliation to consolidated net income (loss) is as follows (in millions): Net sales by groups of similar products and services, which also have similar economic characteristics, is as follows (in millions): (1) Includes product sales and digital media content where we record revenue gross. We leverage our retail infrastructure to offer a wide selection of consumable and durable goods that includes media products available in both a physical and digital format, such as books, videos, games, music, and software. These product sales include digital products sold on a transactional basis. Digital product subscriptions that provide unlimited viewing or usage rights are included in "Subscription services." (2) Includes product sales where our customers physically select items in a store. Sales to customers who order goods online for delivery or pickup at our physical stores are included in "Online stores." (3) Includes commissions and any related fulfillment and shipping fees, and other third-party seller services. (4) Includes annual and monthly fees associated with Amazon Prime memberships, as well as digital video, audiobook, digital music, e-book, and other non-AWS subscription services. (5) Includes sales of advertising services to sellers, vendors, publishers, authors, and others, through programs such as sponsored ads, display, and video advertising. (6) Includes sales related to various other service offerings. Note 3 - PROPERTY AND EQUTPMENT (1) Includes the original cost and accumulated depreciation of fully-depreciated assets. Depreciation and amortization expense on property and equipment was $15.1 billion, $16.2 billion, and $22.9 billion which includes amortization of property and equipment acquired under finance leases of $10.1 billion, $8.5 billion, and $9.9 billion for 2019,2020 , and 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started