Answered step by step

Verified Expert Solution

Question

1 Approved Answer

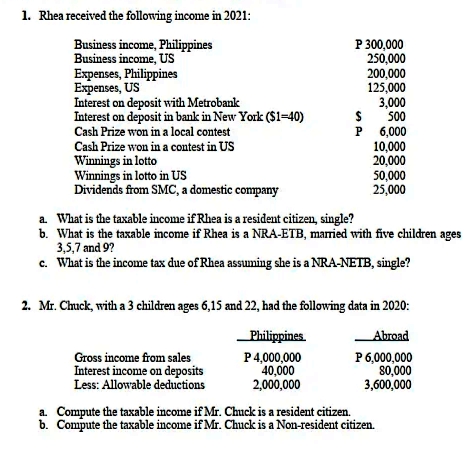

1. Rhea received the following income in 2021: Business income, Philippines Business income, US P 300,000 250,000 Expenses, Philippines 200,000 Expenses, US 125,000 Interest

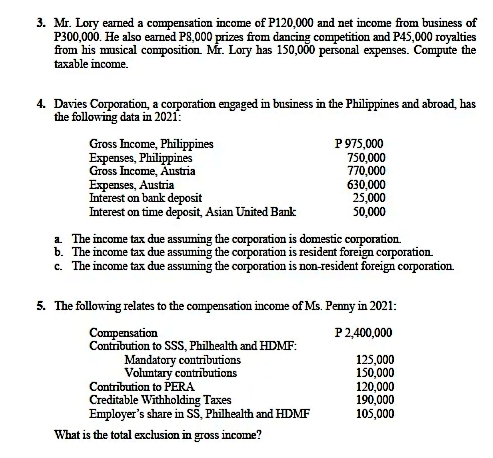

1. Rhea received the following income in 2021: Business income, Philippines Business income, US P 300,000 250,000 Expenses, Philippines 200,000 Expenses, US 125,000 Interest on deposit with Metrobank 3,000 Interest on deposit in bank in New York ($1=40) $ 500 Cash Prize won in a local contest P 6,000 Cash Prize won in a contest in US 10,000 Winnings in lotto 20,000 Winnings in lotto in US 50,000 Dividends from SMC, a domestic company 25,000 a. What is the taxable income if Rhea is a resident citizen, single? b. What is the taxable income if Rhea is a NRA-ETB, married with five children ages 3,5,7 and 9? c. What is the income tax due of Rhea assuming she is a NRA-NETB, single? 2. Mr. Chuck, with a 3 children ages 6,15 and 22, had the following data in 2020: Philippines Gross income from sales Interest income on deposits Less: Allowable deductions P 4,000,000 40,000 Abroad P 6,000,000 80,000 2,000,000 3,600,000 a. Compute the taxable income if Mr. Chuck is a resident citizen. b. Compute the taxable income if Mr. Chuck is a Non-resident citizen. 3. Mr. Lory earned a compensation income of P120,000 and net income from business of P300,000. He also earned P8,000 prizes from dancing competition and P45,000 royalties from his musical composition. Mr. Lory has 150,000 personal expenses. Compute the taxable income. 4. Davies Corporation, a corporation engaged in business in the Philippines and abroad, has the following data in 2021: Gross Income, Philippines Expenses, Philippines Gross Income, Austria Expenses, Austria Interest on bank deposit P 975,000 750,000 770,000 630,000 25,000 50,000 Interest on time deposit, Asian United Bank a. The income tax due assuming the corporation is domestic corporation. b. The income tax due assuming the corporation is resident foreign corporation. c. The income tax due assuming the corporation is non-resident foreign corporation. 5. The following relates to the compensation income of Ms. Penny in 2021: Compensation Contribution to SSS, Philhealth and HDMF: Mandatory contributions P 2,400,000 125,000 Voluntary contributions 150,000 Contribution to PERA 120,000 Creditable Withholding Taxes 190,000 Employer's share in SS, Philhealth and HDMF 105,000 What is the total exclusion in gross income?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Taxable income if Rhea is a resident citizen single Business income Philippines P300000 Business income US P250000 converted to Philippine Peso at the prevailing exchange rate Interest on deposit wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started