Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Real Property Gains Tax (RPGT) 1(a) Teh bought a shophouse in Mont Kinabalu in Ipoh for RM500,000 on 20 April 2016. He incurred stamp

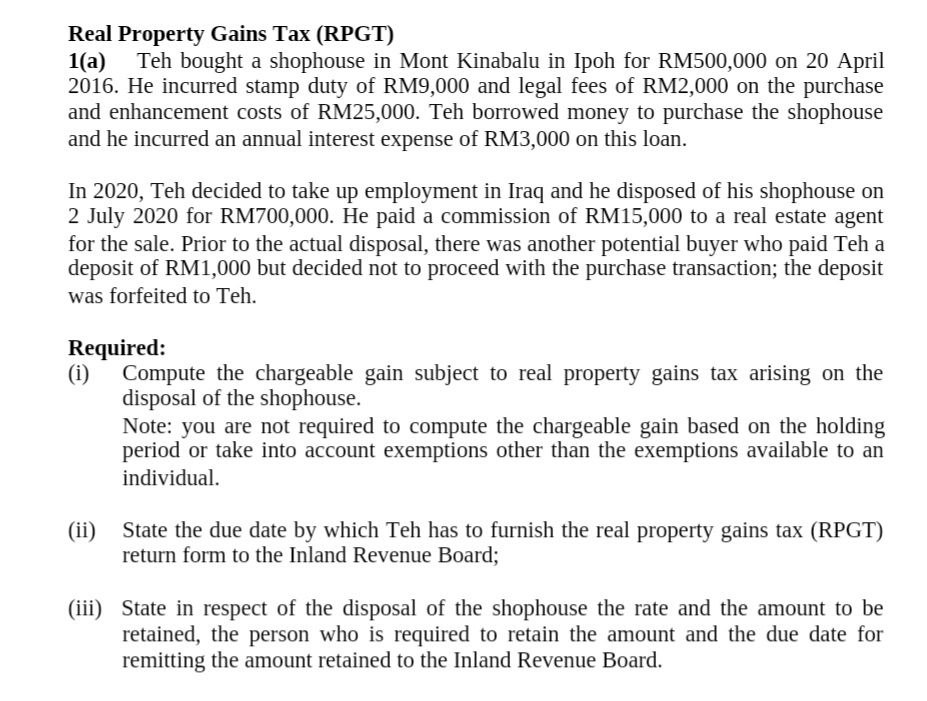

Real Property Gains Tax (RPGT) 1(a) Teh bought a shophouse in Mont Kinabalu in Ipoh for RM500,000 on 20 April 2016. He incurred stamp duty of RM9,000 and legal fees of RM2,000 on the purchase and enhancement costs of RM25,000. Teh borrowed money to purchase the shophouse and he incurred an annual interest expense of RM3,000 on this loan. In 2020, Teh decided to take up employment in Iraq and he disposed of his shophouse on 2 July 2020 for RM700,000. He paid a commission of RM15,000 to a real estate agent for the sale. Prior to the actual disposal, there was another potential buyer who paid Teh a deposit of RM1,000 but decided not to proceed with the purchase transaction; the deposit was forfeited to Teh. Required: (i) (ii) Compute the chargeable gain subject to real property gains tax arising on the disposal of the shophouse. Note: you are not required to compute the chargeable gain based on the holding period or take into account exemptions other than the exemptions available to an individual. State the due date by which Teh has to furnish the real property gains tax (RPGT) return form to the Inland Revenue Board; (iii) State in respect of the disposal of the shophouse the rate and the amount to be retained, the person who is required to retain the amount and the due date for remitting the amount retained to the Inland Revenue Board.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started