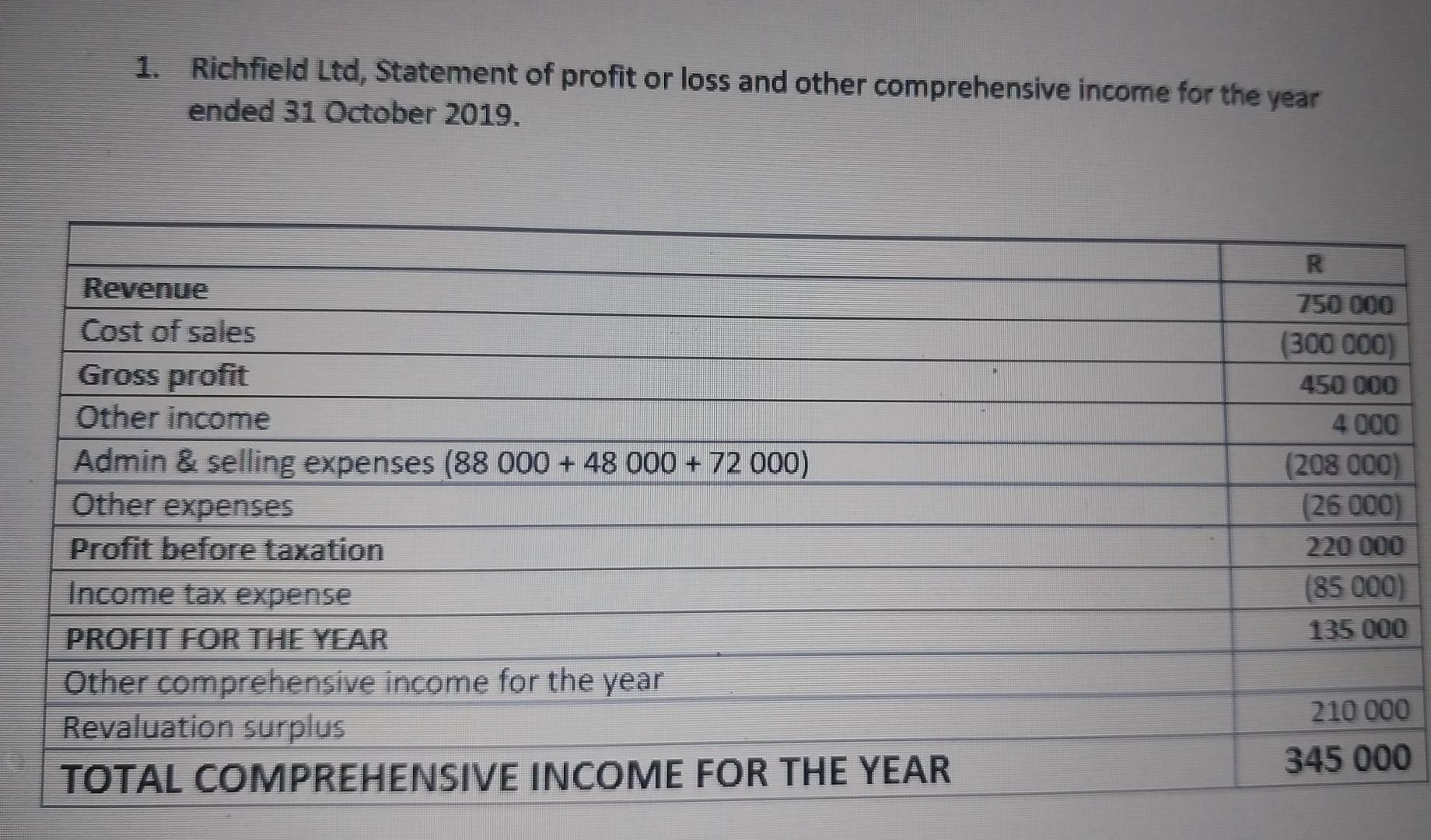

1. Richfield Ltd, Statement of profit or loss and other comprehensive income for the year ended 31 October 2019. Revenue Cost of sales Gross

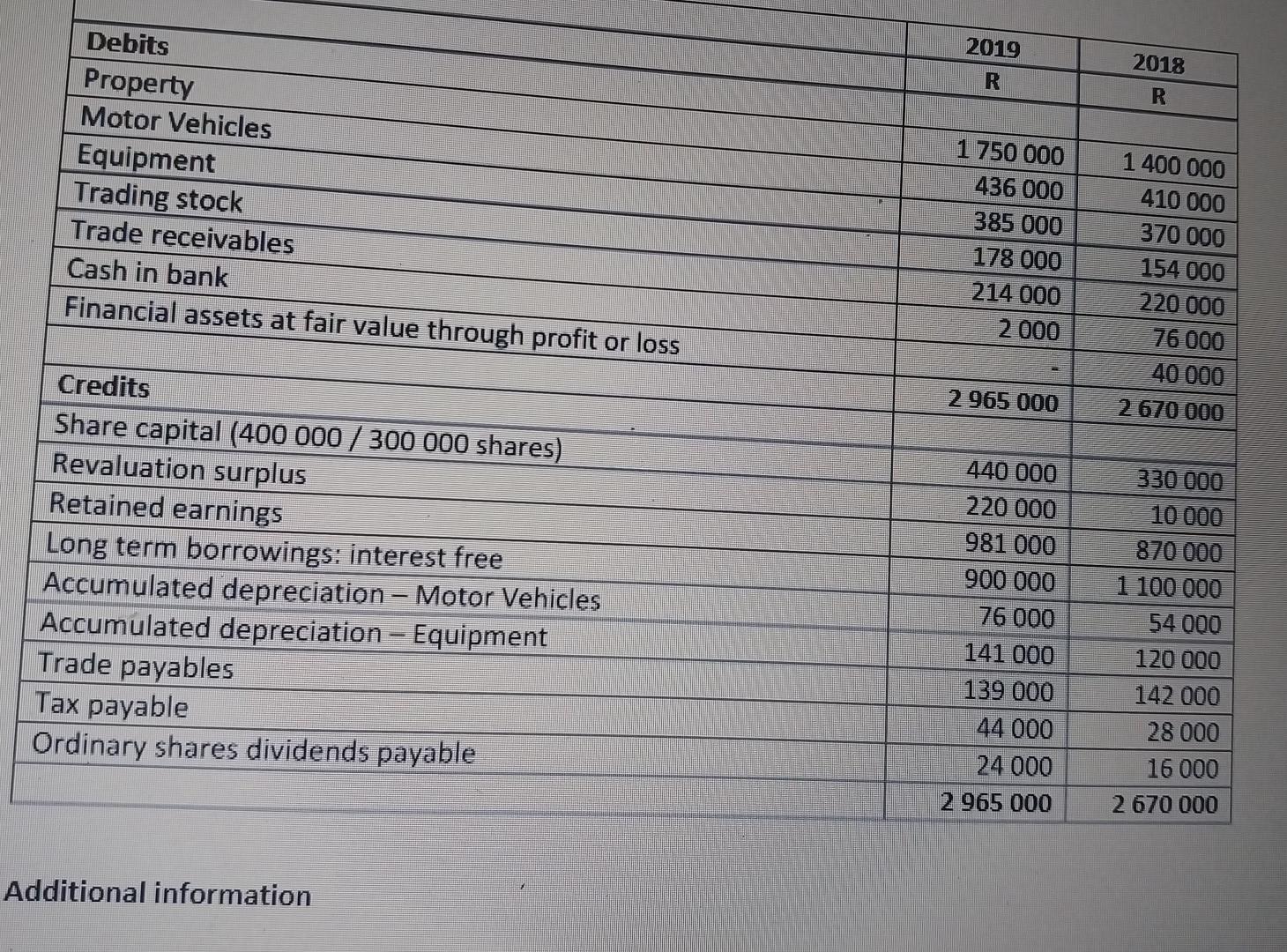

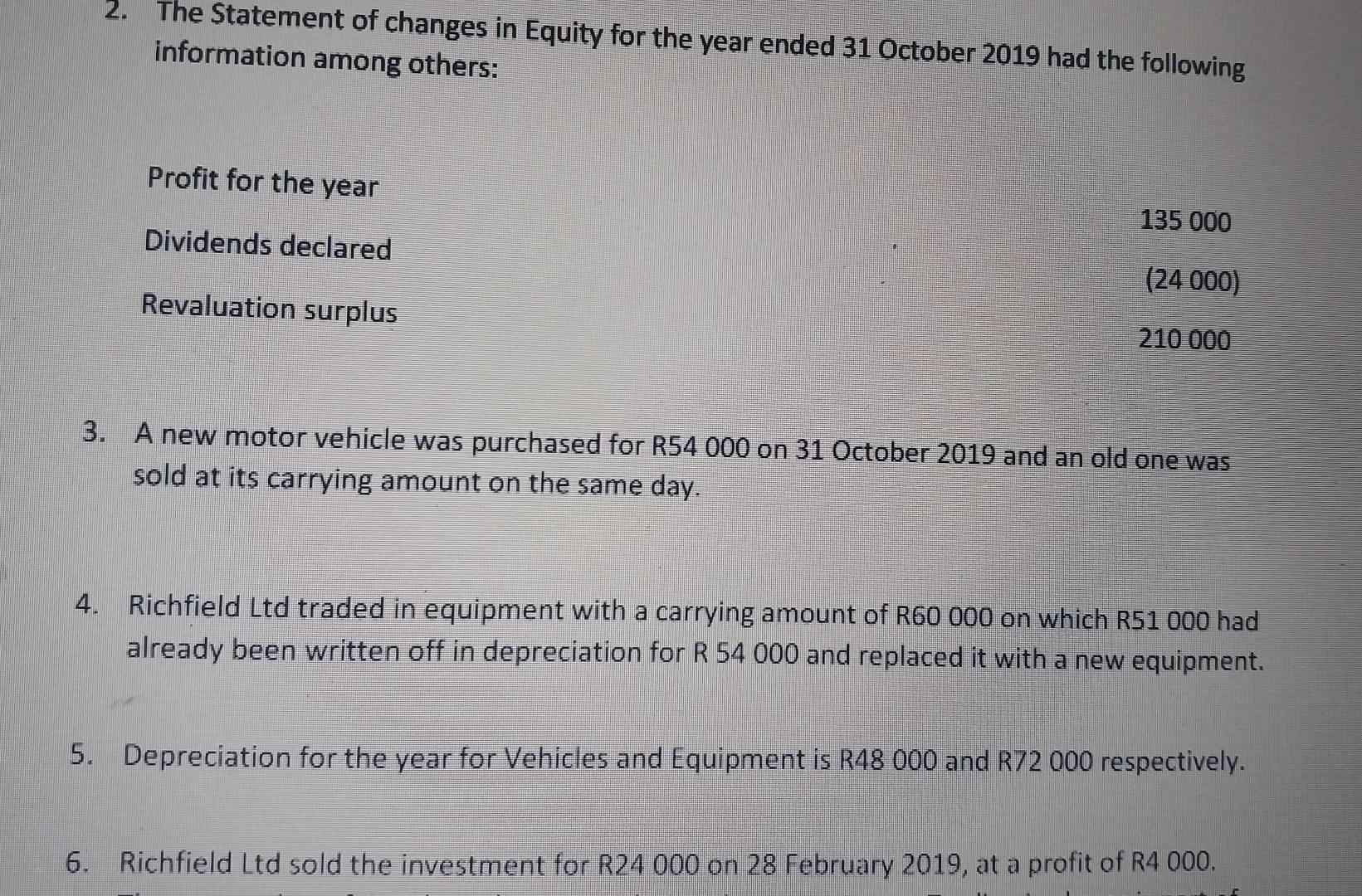

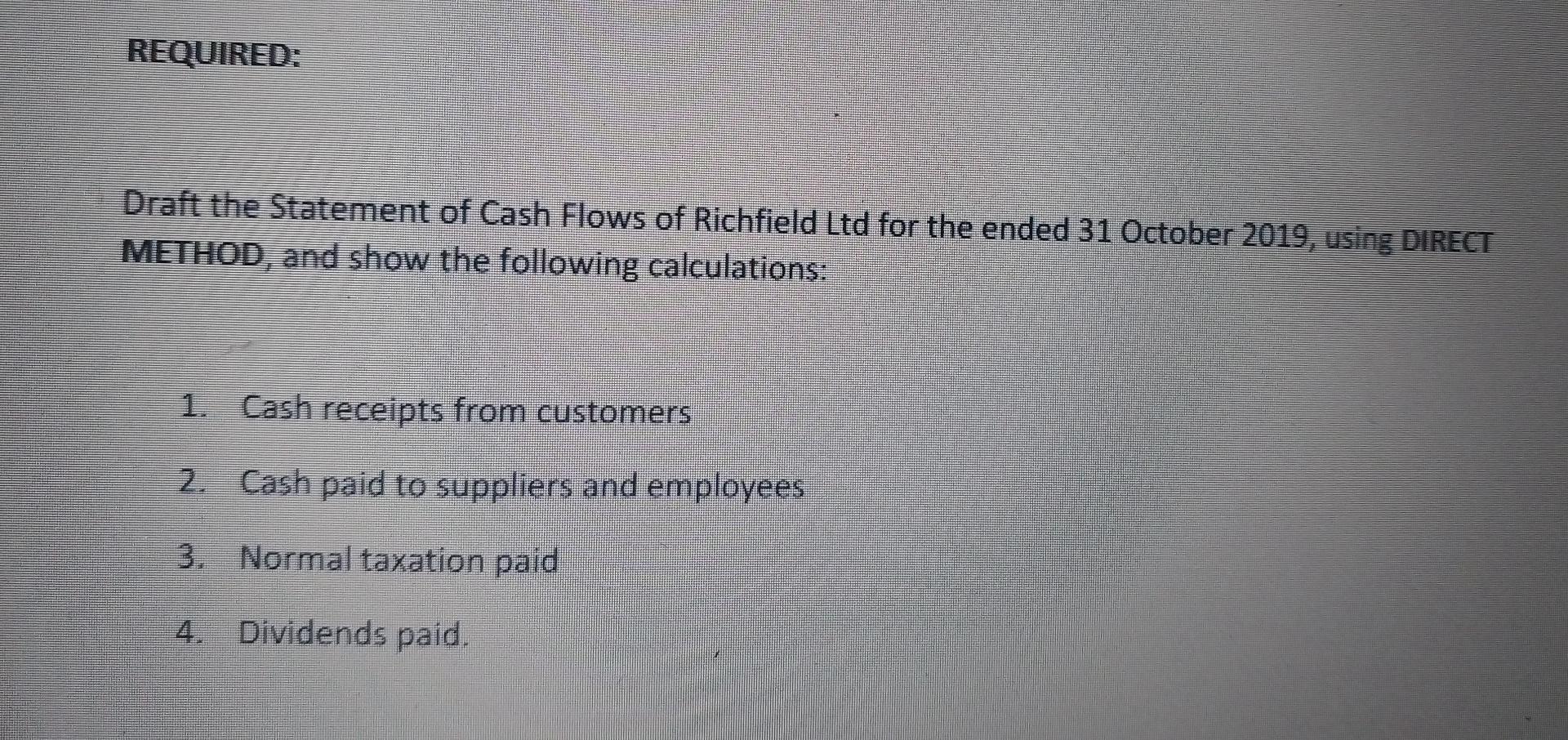

1. Richfield Ltd, Statement of profit or loss and other comprehensive income for the year ended 31 October 2019. Revenue Cost of sales Gross profit Other income Admin & selling expenses (88 000 + 48 000 + 72 000) Other expenses Profit before taxation Income tax expense PROFIT FOR THE YEAR Other comprehensive income for the year Revaluation surplus TOTAL COMPREHENSIVE INCOME FOR THE YEAR R 750 000 (300 000) 450 000 4000 (208 000) (26 000) 220 000 (85 000) 135 000 210 000 345 000 Debits Property Motor Vehicles Equipment Trading stock Trade receivables Cash in bank Financial assets at fair value through profit or loss Credits Share capital (400 000 / 300 000 shares) Revaluation surplus Retained earnings Long term borrowings: interest free Accumulated depreciation - Motor Vehicles Accumulated depreciation Equipment C Trade payables Tax payable Ordinary shares dividends payable Additional information 2019 R 1 750 000 436 000 385 000 178 000 214 000 2 000 2 965 000 440 000 220 000 981 000 900 000 76 000 141 000 139 000 44 000 24 000 2 965 000 2018 R 1 400 000 410 000 370 000 154 000 220 000 76 000 40 000 2 670 000 330 000 10 000 870 000 1 100 000 54 000 120 000 142 000 28 000 16 000 2 670 000 2. The Statement of changes in Equity for the year ended 31 October 2019 had the following information among others: Profit for the year Dividends declared Revaluation surplus 135 000 (24 000) 210 000 3. A new motor vehicle was purchased for R54 000 on 31 October 2019 and an old one was sold at its carrying amount on the same day. 4. Richfield Ltd traded in equipment with a carrying amount of R60 000 on which R51 000 had already been written off in depreciation for R 54 000 and replaced it with a new equipment. 5. Depreciation for the year for Vehicles and Equipment is R48 000 and R72 000 respectively. 6. Richfield Ltd sold the investment for R24 000 on 28 February 2019, at a profit of R4 000. REQUIRED: Draft the Statement of Cash Flows of Richfield Ltd for the ended 31 October 2019, using DIRECT METHOD, and show the following calculations: 1. Cash receipts from customers 2. Cash paid to suppliers and employees 3. Normal taxation paid 4. Dividends paid.

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To draft the Statement of Cash Flows for Richfield Ltd for the year ended 31 October 2019 using the direct method we need to calculate the following i...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started