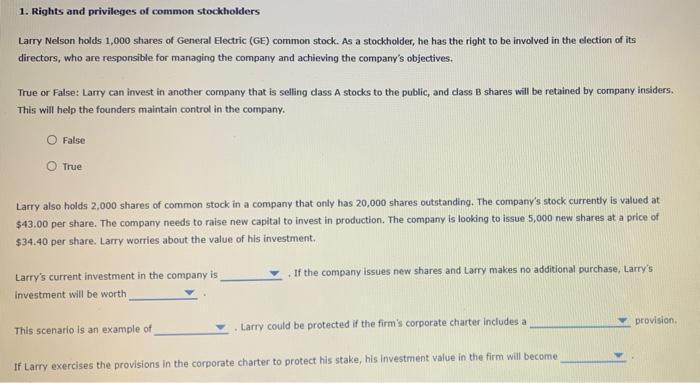

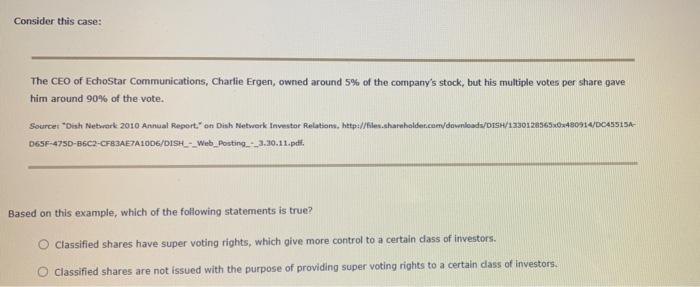

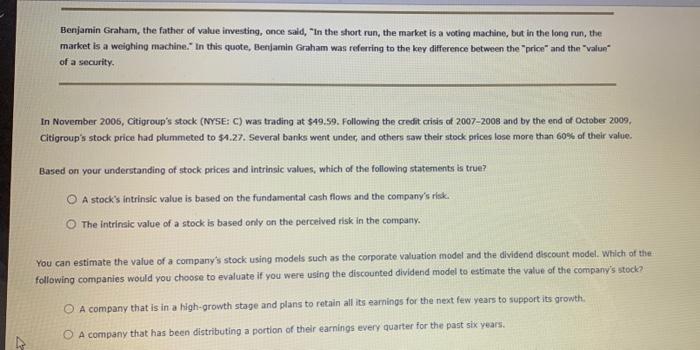

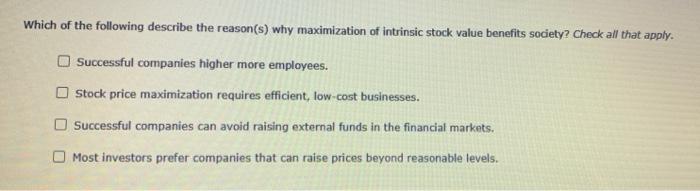

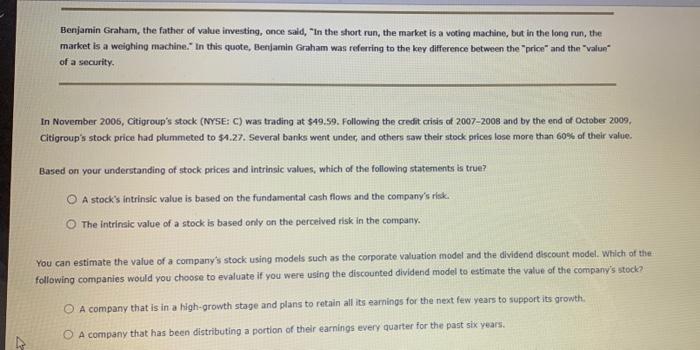

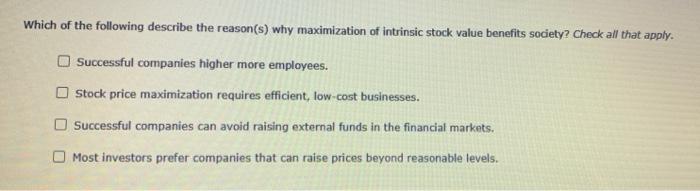

1. Rights and privileges of common stockholders Larry Nelson holds 1,000 shares of General Electric (GE) common stock. As a stockholder, he has the right to be involved in the election of its directors, who are responsible for managing the company and achieving the company's objectives. True or False: Larry can invest in another company that is selling dass A stocks to the public, and dass B shares will be retained by company insiders. This will help the founders maintain control in the company. False True Larry also holds 2,000 shares of common stock in a company that only has 20,000 shares outstanding. The company's stock currently is valued at $43.00 per share. The company needs to raise new capital to invest in production. The company is looking to issue 5,000 new shares at a price of $34.40 per share. Larry worries about the value of his investment. If the company issues new shares and Larry makes no additional purchase, Larry's Larry's current investment in the company is investment will be worth provision This scenario is an example of Larry could be protected if the firm's corporate charter includes a If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will become Consider this case: The CEO of Echostar Communications, Charlie Ergen, owned around 5% of the company's stock, but his multiple votes per share gave him around 90% of the vote. Sourcei "Dish Network 2010 Annual Report on Dish Network Investor Relations, http://files.shareholder.com/downloada/DISH/12301283650-480914/DCASSISA- DESF-475D-16C2-CFBAEZA1006/DISHL-Web Posting - 3.30.11.pdf Based on this example, which of the following statements is true? O Classified shares have super voting rights, which give more control to a certain class of investors. O Classified shares are not issued with the purpose of providing super voting rights to a certain dass of Investors. Benjamin Graham, the father of value investing, once said, "In the short run, the market is a voting machine, but in the long run, the market is a weighing machine. In this quote, Benjamin Graham was referring to the key difference between the price and the valun of a security In November 2006, Citigroup's stock (NYSE: C) was trading at $49.99. Following the credit crisis of 2007-2008 and by the end of October 2009, Citigroup's stock price had plummeted to 54.27. Several banks went under and others saw their stock prices lose more than 60% of their value. Based on your understanding of stock prices and intrinsic values, which of the following statements is true? A stock's intrinsic value is based on the fundamental cash flows and the company's risk. The intrinsic value of a stock is based only on the perceived risk in the company. You can estimate the value of a company's stock using models such as the corporate valuation model and the dividend discount model. Which of the following companies would you choose to evaluate if you were using the discounted dividend model to estimate the value of the company's stock? O A company that is in a high-growth stage and plans to retain all its earnings for the next few years to support its growth A company that has been distributing a portion of their earnings every quarter for the past six years Which of the following describe the reason(s) why maximization of intrinsic stock value benefits society? Check all that apply. Successful companies higher more employees. Stock price maximization requires efficient, low-cost businesses. Successful companies can avoid raising external funds in the financial markets. Most investors prefer companies that can raise prices beyond reasonable levels