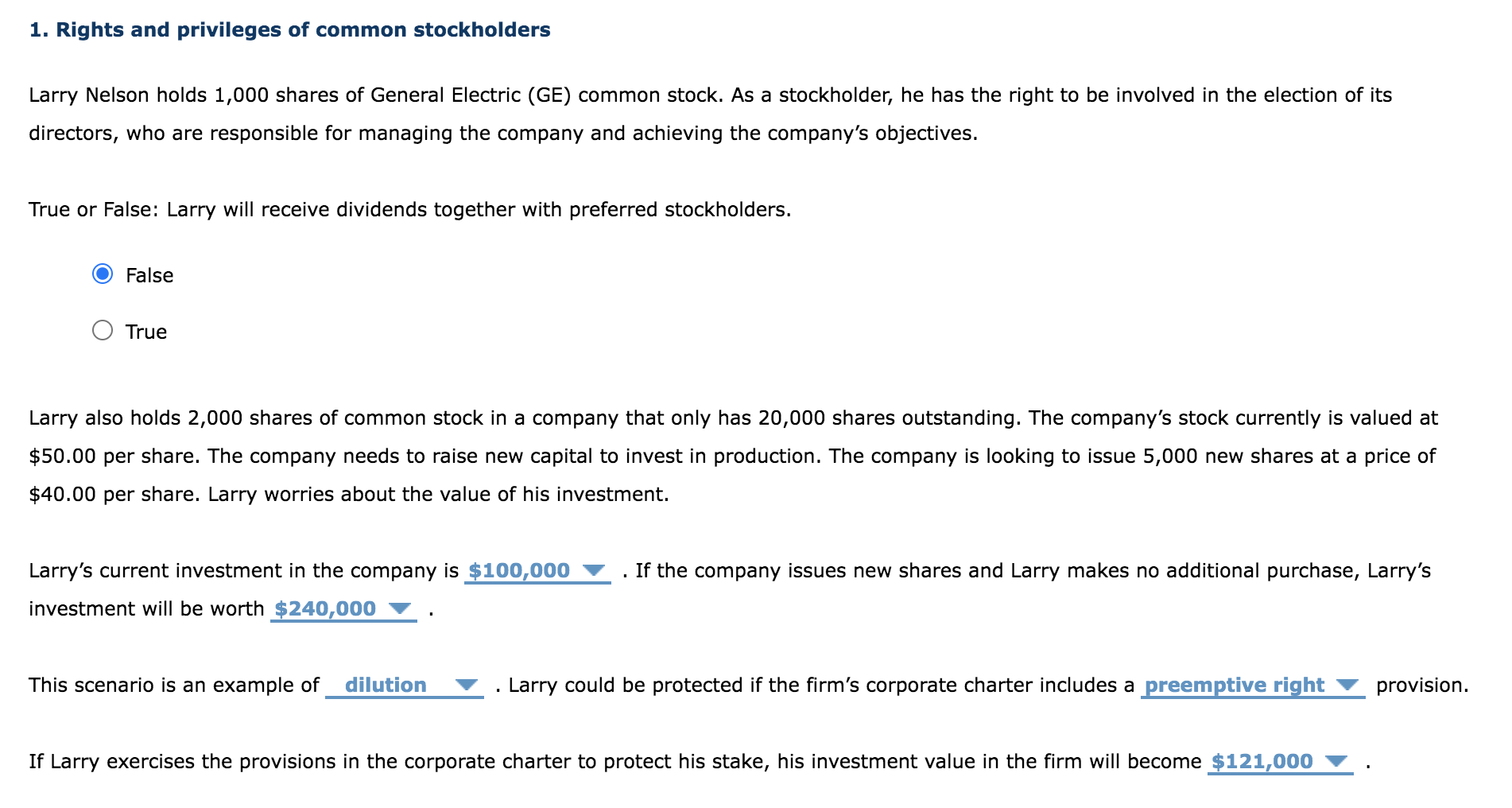

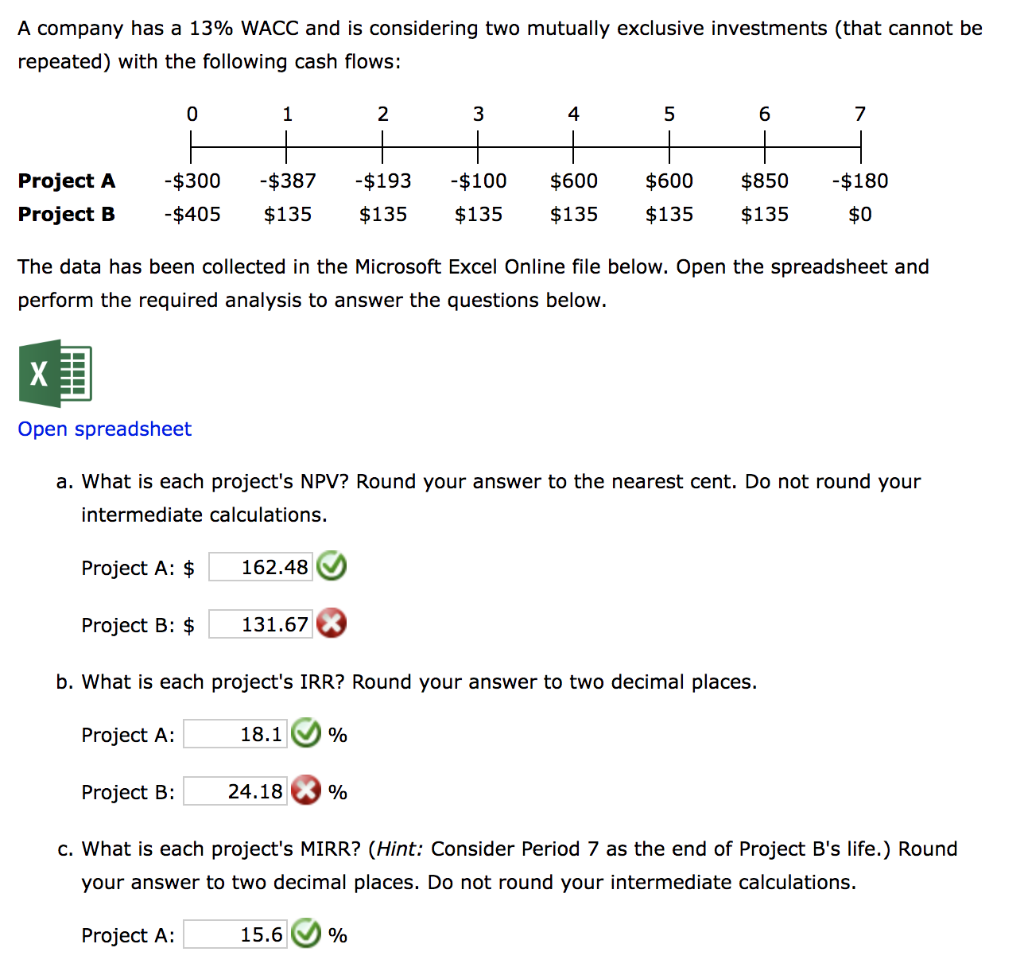

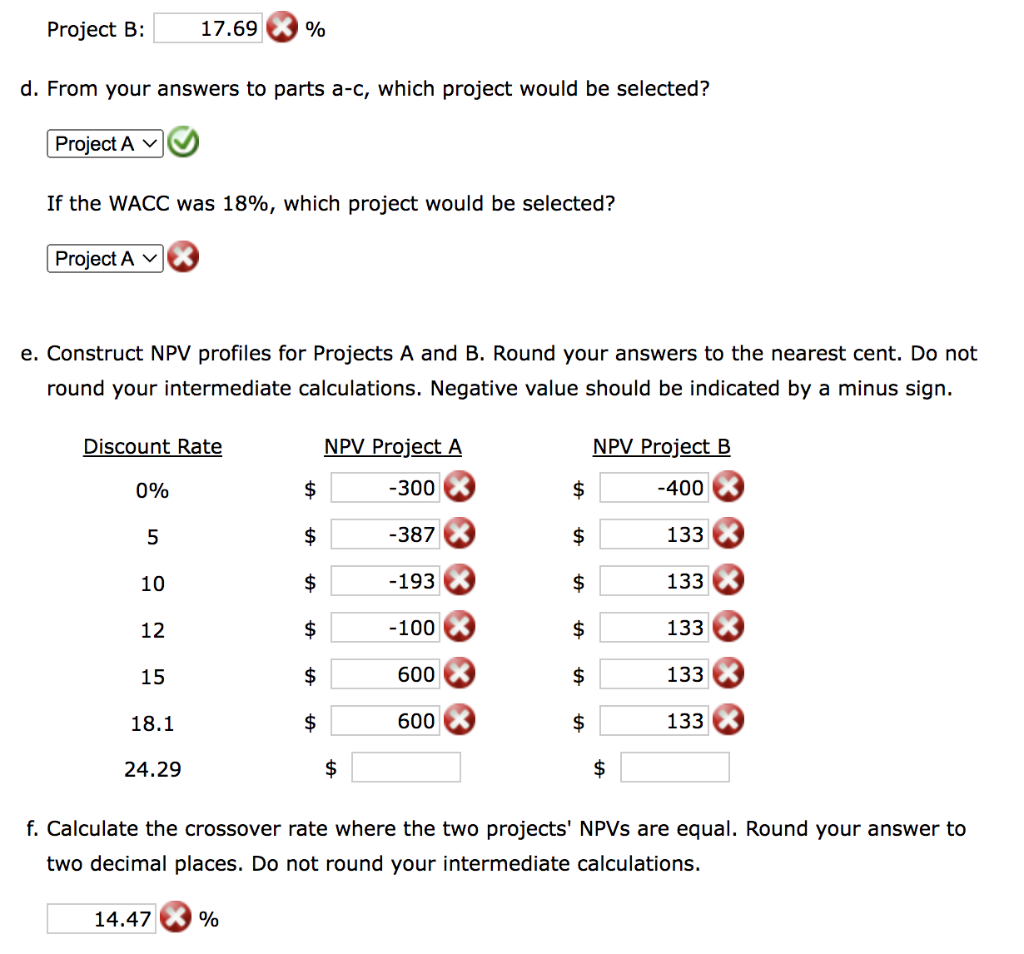

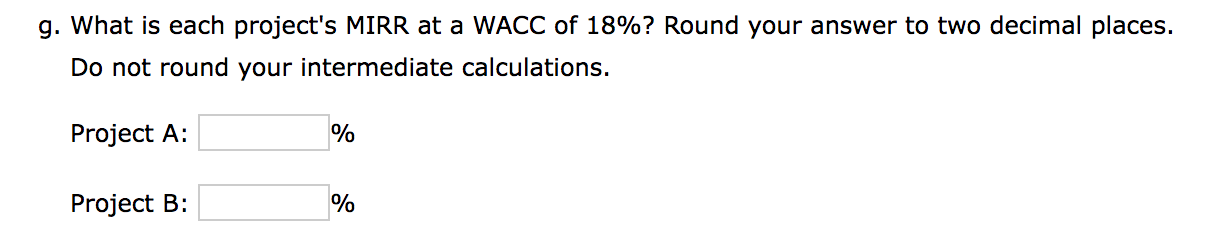

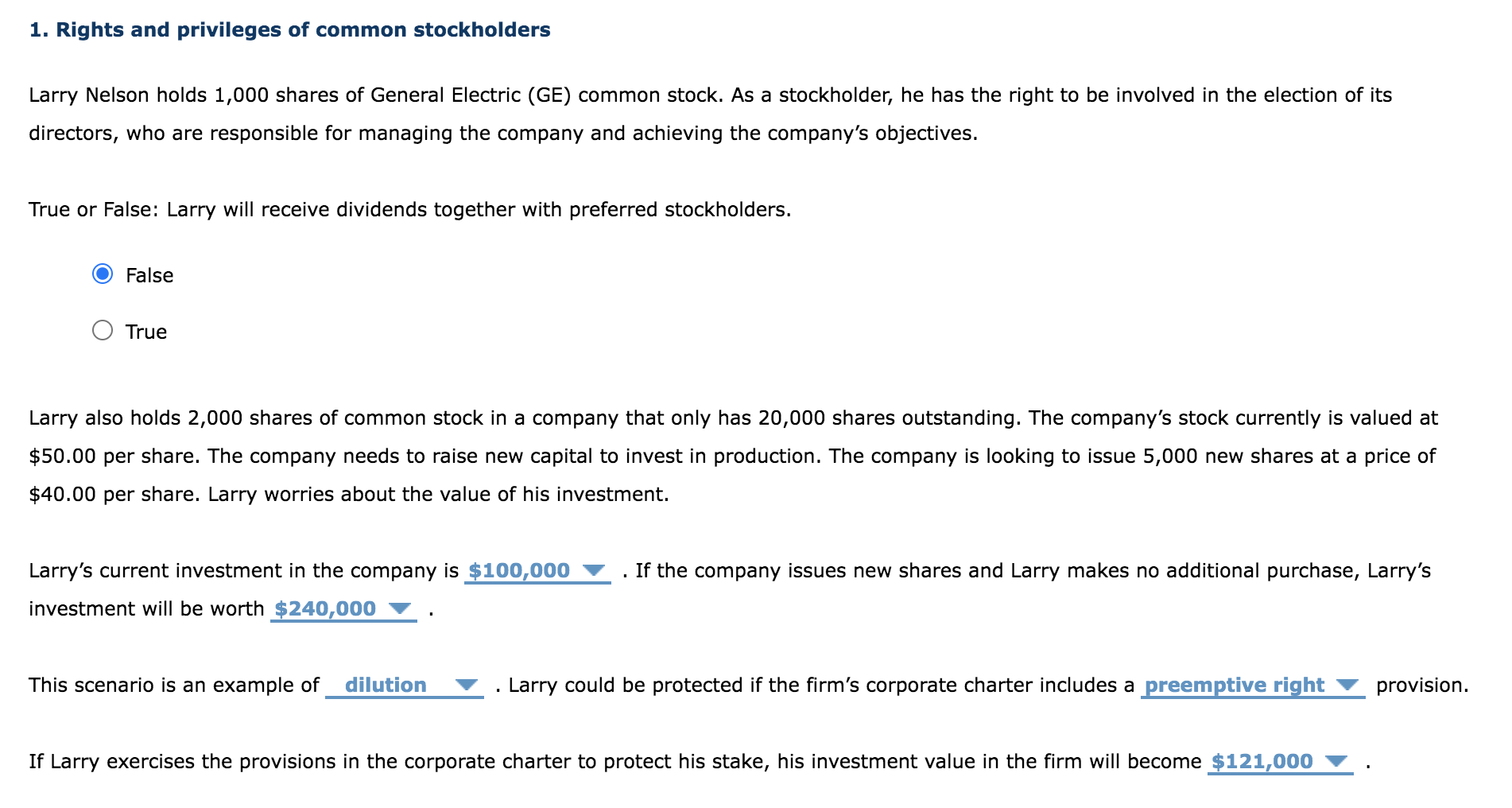

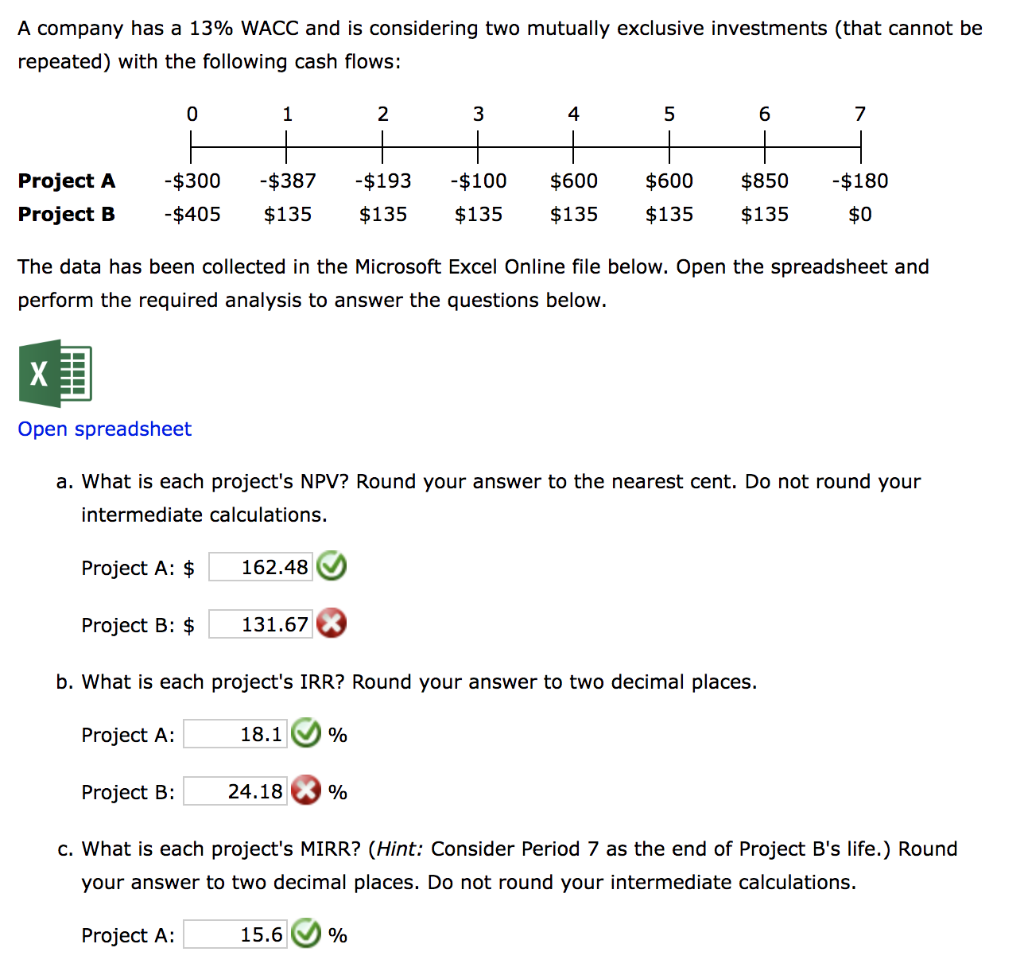

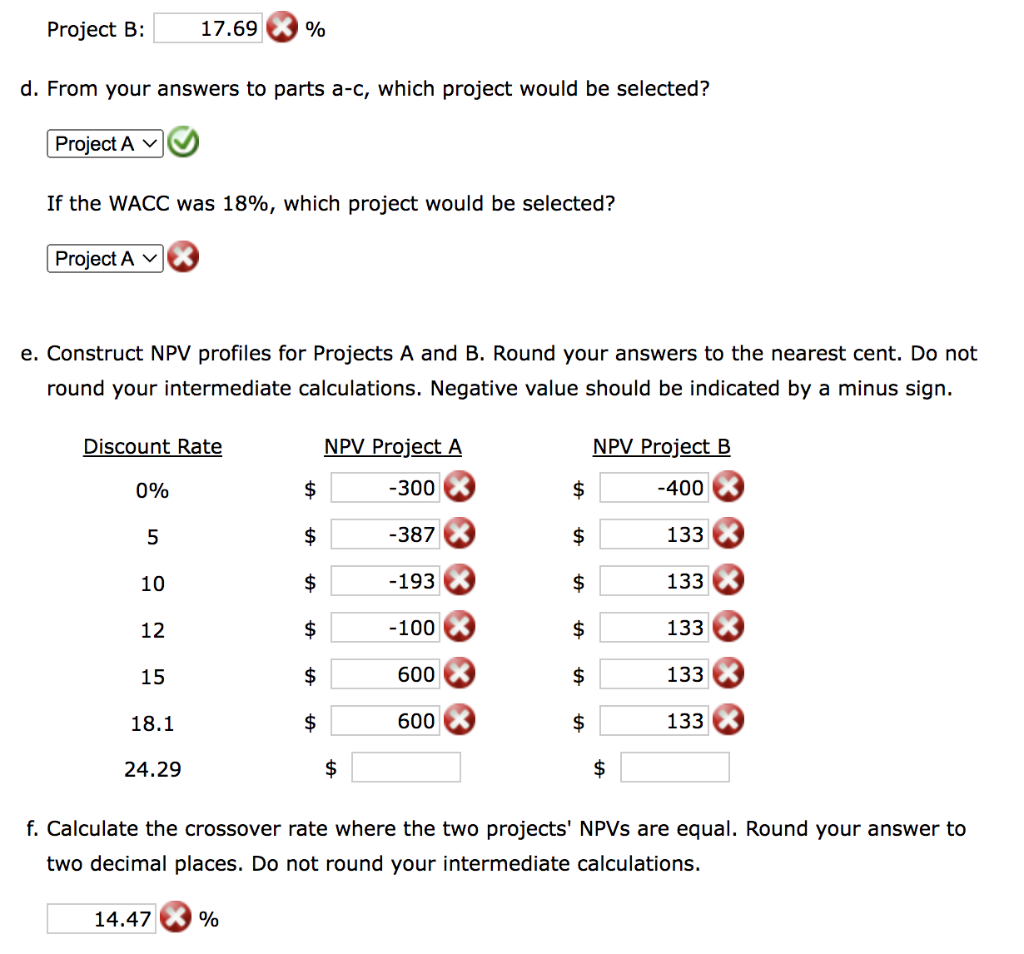

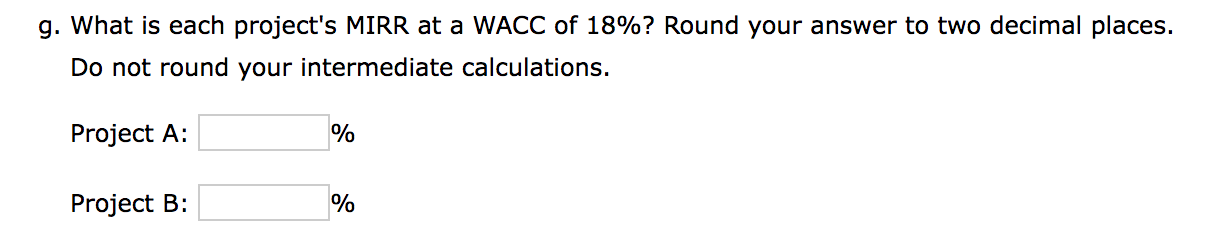

1. Rights and privileges of common stockholders Larry Nelson holds 1,000 shares of General Electric (GE) common stock. As a stockholder, he has the right to be involved in the election of its directors, who are responsible for managing the company and achieving the company's objectives. True or False: Larry will receive dividends together with preferred stockholders. False True Larry also holds 2,000 shares of common stock in a company that only has 20,000 shares outstanding. The company's stock currently is valued $50.00 per share. The company needs to raise new capital to invest in production. The company is looking to issue 5,000 new shares at a price of $40.00 per share. Larry worries about the value of his investment. Larry's current investment in the company is . If the company issues new shares and Larry makes no additional purchase, Larry's investment will be worth This scenario is an example of - Larry could be protected if the firm's corporate charter includes a provision If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will become A company has a 13% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A : $ Project B: $ b. What is each project's IRR? Round your answer to two decimal places. Project A: % Project B: % c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. Project A: % d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate calculations. Negative value should be indicated by a minus sign. f. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. Do not round your intermediate calculations. g. What is each project's MIRR at a WACC of 18% ? Round your answer to two decimal places. Do not round your intermediate calculations. Project A: % Project B: %