Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Riley Company borrowed $22,000 on April 1, Year I from the Titan Bank. The note issued by Riley carried a one year term and

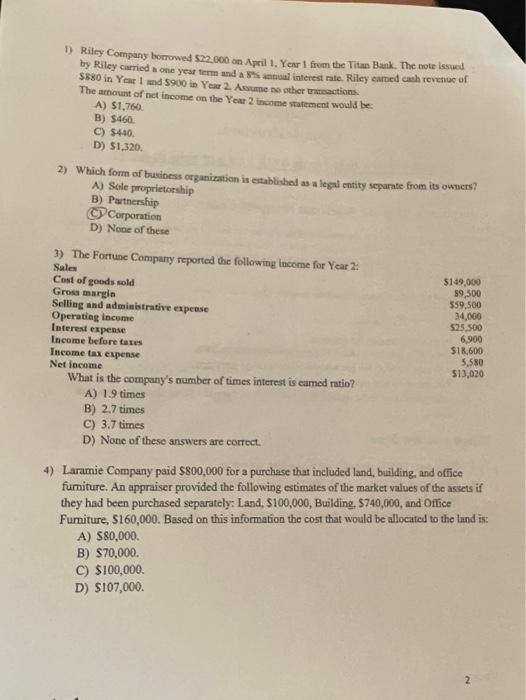

1) Riley Company borrowed $22,000 on April 1, Year I from the Titan Bank. The note issued by Riley carried a one year term and a 8% annual interest rate. Riley earned cash revenue of $880 in Year 1 and $900 in Year 2. Assume no other transactions. The amount of net income on the Year 2 income statement would be: A) $1,760. B) $460. C) $440. D) $1,320. 2) Which form of business organization is established as a legal entity separate from its owners? A) Sole proprietorship B) Partnership Corporation D) None of these 3) The Fortune Company reported the following income for Year 2: Sales Cost of goods sold Gross margin Selling and administrative expense Operating income Interest expense Income before taxes Income tax expense Net income What is the company's number of times interest is earned ratio? A) 1.9 times B) 2.7 times C) 3.7 times D) None of these answers are correct. $149,000 89,500 $59,500 B) $70,000. C) $100,000. D) $107,000. 34,000 $25,500 6,900 $18,600 5,580 $13,020 4) Laramie Company paid $800,000 for a purchase that included land, building, and office furniture. An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Land, $100,000, Building, $740,000, and Office Furniture, $160,000. Based on this information the cost that would be allocated to the land is: A) $80,000. 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started