Question

1 Risks and Benefits of Investing in Small Stocks (100 points) The file Project 1.xls in the Projects folder contains the end-of-month prices

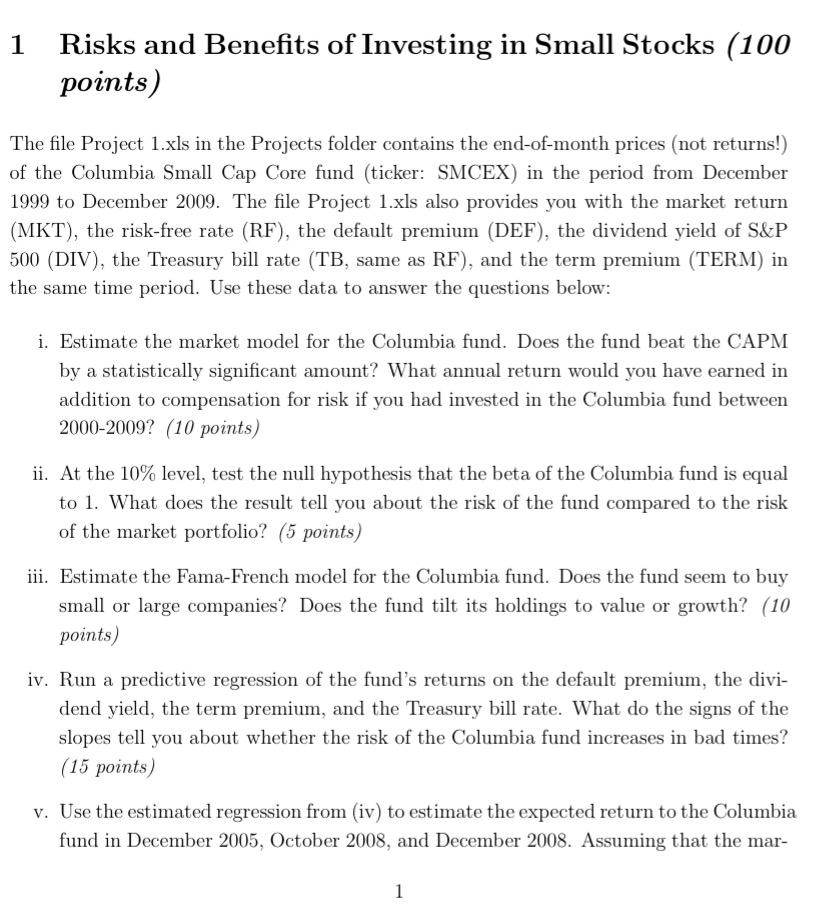

\ \ 1 Risks and Benefits of Investing in Small Stocks (100 points)\ The file Project 1.xls in the Projects folder contains the end-of-month prices (not returns!) of the Columbia Small Cap Core fund (ticker: SMCEX) in the period from December 1999 to December 2009. The file Project 1.xls also provides you with the market return (MKT), the risk-free rate (RF), the default premium (DEF), the dividend yield of S&P 500 (DIV), the Treasury bill rate (TB, same as RF), and the term premium (TERM) in the same time period. Use these data to answer the questions below:\ i. Estimate the market model for the Columbia fund. Does the fund beat the CAPM by a statistically significant amount? What annual return would you have earned in addition to compensation for risk if you had invested in the Columbia fund between 2000-2009? (10 points)\ ii. At the

10%level, test the null hypothesis that the beta of the Columbia fund is equal to 1 . What does the result tell you about the risk of the fund compared to the risk of the market portfolio? (5 points)\ iii. Estimate the Fama-French model for the Columbia fund. Does the fund seem to buy small or large companies? Does the fund tilt its holdings to value or growth? points)\ iv. Run a predictive regression of the fund's returns on the default premium, the dividend yield, the term premium, and the Treasury bill rate. What do the signs of the slopes tell you about whether the risk of the Columbia fund increases in bad times? (15 points)\ v. Use the estimated regression from (iv) to estimate the expected return to the Columbia fund in December 2005, October 2008, and December 2008. Assuming that the mar-\ 1\ \ 1 Risks and Benefits of Investing in Small Stocks (100 points)\ The file Project 1.xls in the Projects folder contains the end-of-month prices (not returns!) of the Columbia Small Cap Core fund (ticker: SMCEX) in the period from December 1999 to December 2009. The file Project 1.xls also provides you with the market return (MKT), the risk-free rate (RF), the default premium (DEF), the dividend yield of S&P 500 (DIV), the Treasury bill rate (TB, same as RF), and the term premium (TERM) in the same time period. Use these data to answer the questions below:\ i. Estimate the market model for the Columbia fund. Does the fund beat the CAPM by a statistically significant amount? What annual return would you have earned in addition to compensation for risk if you had invested in the Columbia fund between 2000-2009? (10 points)\ ii. At the

10%level, test the null hypothesis that the beta of the Columbia fund is equal to 1 . What does the result tell you about the risk of the fund compared to the risk of the market portfolio? (5 points)\ iii. Estimate the Fama-French model for the Columbia fund. Does the fund seem to buy small or large companies? Does the fund tilt its holdings to value or growth? points)\ iv. Run a predictive regression of the fund's returns on the default premium, the dividend yield, the term premium, and the Treasury bill rate. What do the signs of the slopes tell you about whether the risk of the Columbia fund increases in bad times? (15 points)\ v. Use the estimated regression from (iv) to estimate the expected return to the Columbia fund in December 2005, October 2008, and December 2008. Assuming that the mar-\ 1\

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started