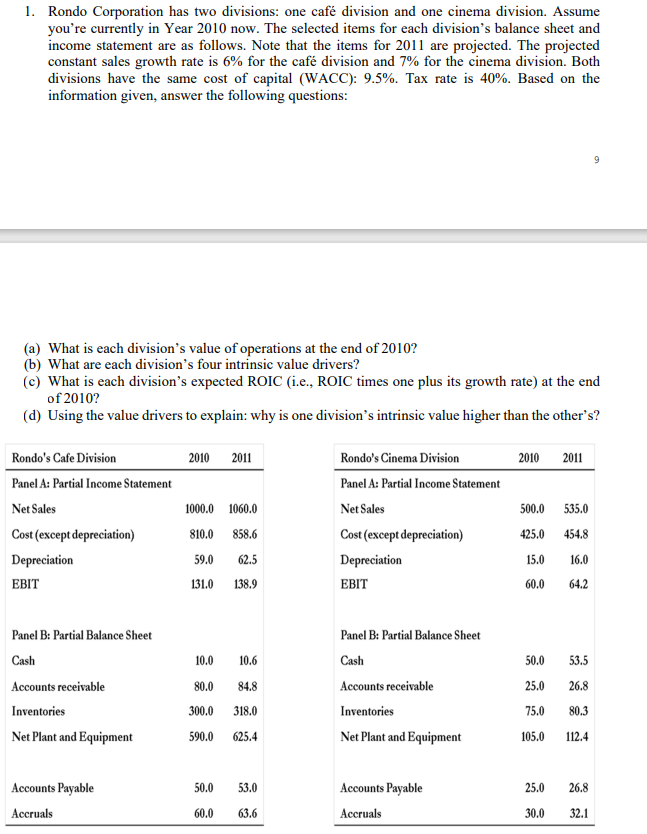

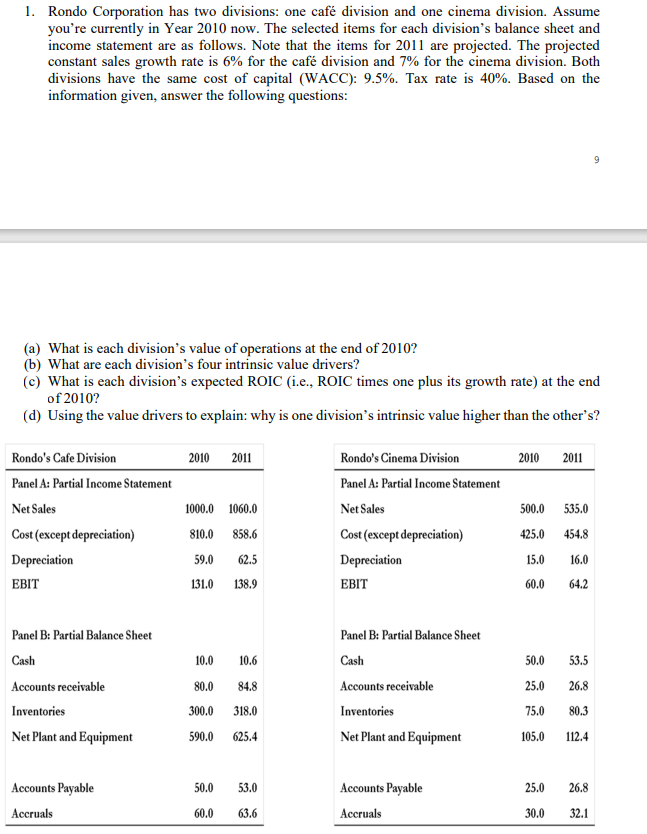

1. Rondo Corporation has two divisions: one caf division and one cinema division. Assume you're currently in Year 2010 now. The selected items for each division's balance sheet and income statement are as follows. Note that the items for 2011 are projected. The projected constant sales growth rate is 6% for the caf division and 7% for the cinema division. Both divisions have the same cost of capital (WACC): 9.5%. Tax rate is 40%. Based on the information given, answer the following questions: 9 (a) What is each division's value of operations at the end of 2010? (b) What are each division's four intrinsic value drivers? (c) What is each division's expected ROIC (i.e., ROIC times one plus its growth rate) at the end of 2010? (d) Using the value drivers to explain: why is one division's intrinsic value higher than the other's? 2010 2011 2010 2011 500.0 535.0 Rondo's Cafe Division Panel A: Partial Income Statement Net Sales Cost (except depreciation) Depreciation EBIT Rondo's Cinema Division Panel A: Partial Income Statement Net Sales Cost (except depreciation) Depreciation EBIT 425.0 1000.0 1060.0 810.0 858.6 59.0 62.5 131.0 138.9 454.8 15.0 16.0 60.0 64.2 10.0 10.6 50.0 53.5 Panel B: Partial Balance Sheet Cash Accounts receivable Inventories Net Plant and Equipment 84.8 Panel B: Partial Balance Sheet Cash Accounts receivable Inventories Net Plant and Equipment 25.0 80.0 300.0 26.8 318.0 75.0 80.3 590.0 625.4 105.0 112.4 50.0 53.0 25.0 26.8 Accounts Payable Accruals Accounts Payable Accruals 60.0 63.6 30.0 32.1 1. Rondo Corporation has two divisions: one caf division and one cinema division. Assume you're currently in Year 2010 now. The selected items for each division's balance sheet and income statement are as follows. Note that the items for 2011 are projected. The projected constant sales growth rate is 6% for the caf division and 7% for the cinema division. Both divisions have the same cost of capital (WACC): 9.5%. Tax rate is 40%. Based on the information given, answer the following questions: 9 (a) What is each division's value of operations at the end of 2010? (b) What are each division's four intrinsic value drivers? (c) What is each division's expected ROIC (i.e., ROIC times one plus its growth rate) at the end of 2010? (d) Using the value drivers to explain: why is one division's intrinsic value higher than the other's? 2010 2011 2010 2011 500.0 535.0 Rondo's Cafe Division Panel A: Partial Income Statement Net Sales Cost (except depreciation) Depreciation EBIT Rondo's Cinema Division Panel A: Partial Income Statement Net Sales Cost (except depreciation) Depreciation EBIT 425.0 1000.0 1060.0 810.0 858.6 59.0 62.5 131.0 138.9 454.8 15.0 16.0 60.0 64.2 10.0 10.6 50.0 53.5 Panel B: Partial Balance Sheet Cash Accounts receivable Inventories Net Plant and Equipment 84.8 Panel B: Partial Balance Sheet Cash Accounts receivable Inventories Net Plant and Equipment 25.0 80.0 300.0 26.8 318.0 75.0 80.3 590.0 625.4 105.0 112.4 50.0 53.0 25.0 26.8 Accounts Payable Accruals Accounts Payable Accruals 60.0 63.6 30.0 32.1