Question

1. Rose Company is considering the purchase of a new piece of machinery. Information about the investment is as follows: Initial investment = $750,000 Useful

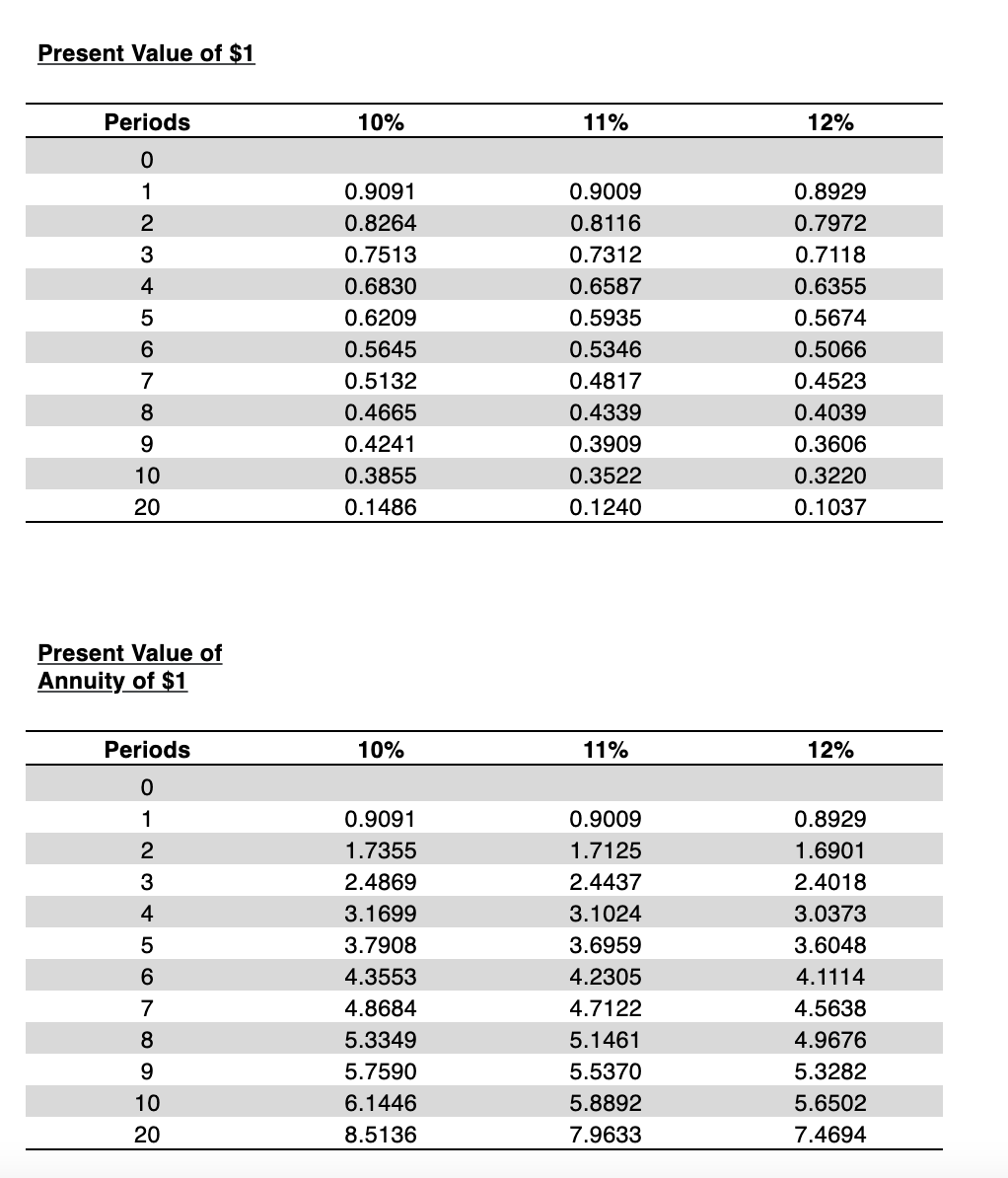

1. Rose Company is considering the purchase of a new piece of machinery. Information about the investment is as follows: Initial investment = $750,000 Useful life = 8 years Annual net income generated = $80,000 Salvage value = $40,000 Cost of capital = 12% The company uses straight-life depreciation. Annual net income is expected to be generated for each year in the machine's estimated useful life. What is the net present value? Present Value Factor Tables:

A. $397,408

B. $104,438.50

C. $854,438.50

D. $88,282.50

2. Kreutzmann Company has $2 million to invest in new projects.

A: Initial invest = $425,000; PV of cash flows = $475,000

B: Initial invest = $745,000; PV of cash flows = $675,000

C: Initial invest = $700,000; PV of cash flows = $925,000

D: Initial invest = $300,000; PV of cash flows = $415,000

What is the first project the company should take on based on the profitability index?

Project A

Project B

Project C

Project D

3.

Further Company manufactures marble bathroom counter tops. Its standard cost information for last year is as follows:

Direct materials standard quantity = 6 square feet of marble per counter top

Direct materials standard price = $20 per square feet of marble

The company produced and sold 775 counter tops last year. The company actually used 5,000 square feet of marble last year, and the total actual cost of marble was $122,500.

What is the company's direct materials quantity variance?

A. $7,000 unfavorable

B. $22,500 unfavorable

C. $7,000 favorable

D. $22,500 favorable

4.

Lesh Company has a direct labor standard of 15 hours per unit of output. Each employee has a standard wage rate of $14 per hour. During March, employees actually worked 13,100 hours. The direct labor price variance for the month was $9,170 Favorable.

What was the total actual cost of payroll for the month?

A. $36,000

B. $25,000

C. $209,000

D. $47,000

Present Value of $1 Periods 10% 11% 12% 0 1 2 3 4 5 6 7 8 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.1486 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 0.4817 0.4339 0.3909 0.3522 0.1240 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.1037 9 10 20 Present Value of Annuity of $1 Periods 10% 11% 12% 0 1 2 3 4 5 6 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 8.5136 0.9009 1.7125 2.4437 3.1024 3.6959 4.2305 4.7122 5.1461 5.5370 5.8892 7.9633 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 7.4694 7 8 9 10 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started