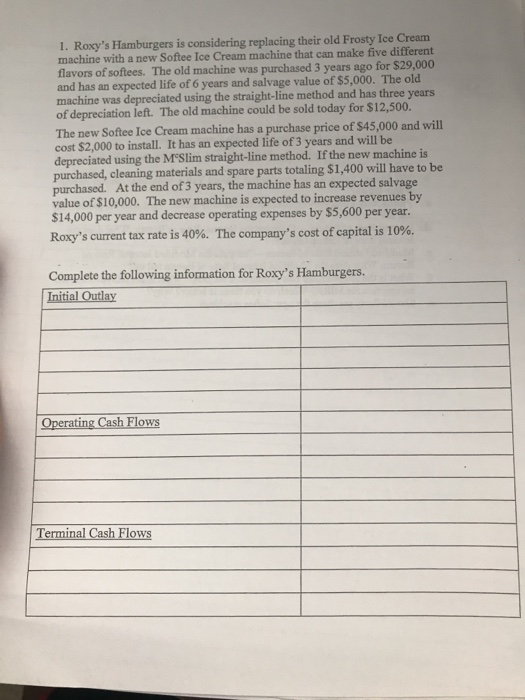

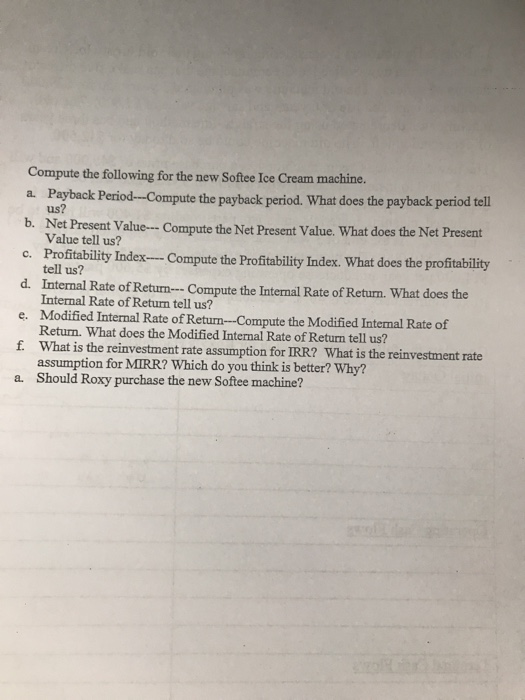

1. Roxy's Hamburgers is considering replacing their old Frosty Ice Cream machine with a new Softee Ice Cream machine that can make five different flavors of softees. The old machine was purchased 3 years ago for $29.000 and has an expected life of 6 years and salvage value of $5,000. The old machine was depreciated using the straight-line method and has three years of depreciation left. The old machine could be sold today for $12,500. The new Softee Ice Cream machine has a purchase price of $45,000 and will cost $2,000 to install. It has an expected life of 3 years and will be depreciated using the M'Slim straight-line method. If the new machine is purchased, cleaning materials and spare parts totaling $1,400 will have to be purchased. At the end of 3 years, the machine has an expected salvage value of $10,000. The new machine is expected to increase revenues by $14,000 per year and decrease operating expenses by $5,600 per year. Roxy's current tax rate is 40%. The company's cost of capital is 10%. Complete the following information for Roxy's Hamburgers. Initial Outlay T Operating Cash Flows Terminal Cash Flows Compute the following for the new Softee Ice Cream machine. a. Payback Period Compute the payback period. What does the payback period tell us? b. Net Present Value - Compute the Net Present Value. What does the Net Present Value tell us? c. Profitability Index ---- Compute the Profitability Index. What does the profitability tell us? d. Internal Rate of Retum--- Compute the Internal Rate of Return. What does the Internal Rate of Return tell us? e. Modified Internal Rate of Retum---Compute the Modified Intemal Rate of Return. What does the Modified Internal Rate of Return tell us? f. What is the reinvestment rate assumption for IRR? What is the reinvestment rate assumption for MIRR? Which do you think is better? Why? a. Should Roxy purchase the new Softee machine? 1. Roxy's Hamburgers is considering replacing their old Frosty Ice Cream machine with a new Softee Ice Cream machine that can make five different flavors of softees. The old machine was purchased 3 years ago for $29.000 and has an expected life of 6 years and salvage value of $5,000. The old machine was depreciated using the straight-line method and has three years of depreciation left. The old machine could be sold today for $12,500. The new Softee Ice Cream machine has a purchase price of $45,000 and will cost $2,000 to install. It has an expected life of 3 years and will be depreciated using the M'Slim straight-line method. If the new machine is purchased, cleaning materials and spare parts totaling $1,400 will have to be purchased. At the end of 3 years, the machine has an expected salvage value of $10,000. The new machine is expected to increase revenues by $14,000 per year and decrease operating expenses by $5,600 per year. Roxy's current tax rate is 40%. The company's cost of capital is 10%. Complete the following information for Roxy's Hamburgers. Initial Outlay T Operating Cash Flows Terminal Cash Flows Compute the following for the new Softee Ice Cream machine. a. Payback Period Compute the payback period. What does the payback period tell us? b. Net Present Value - Compute the Net Present Value. What does the Net Present Value tell us? c. Profitability Index ---- Compute the Profitability Index. What does the profitability tell us? d. Internal Rate of Retum--- Compute the Internal Rate of Return. What does the Internal Rate of Return tell us? e. Modified Internal Rate of Retum---Compute the Modified Intemal Rate of Return. What does the Modified Internal Rate of Return tell us? f. What is the reinvestment rate assumption for IRR? What is the reinvestment rate assumption for MIRR? Which do you think is better? Why? a. Should Roxy purchase the new Softee machine