Answered step by step

Verified Expert Solution

Question

1 Approved Answer

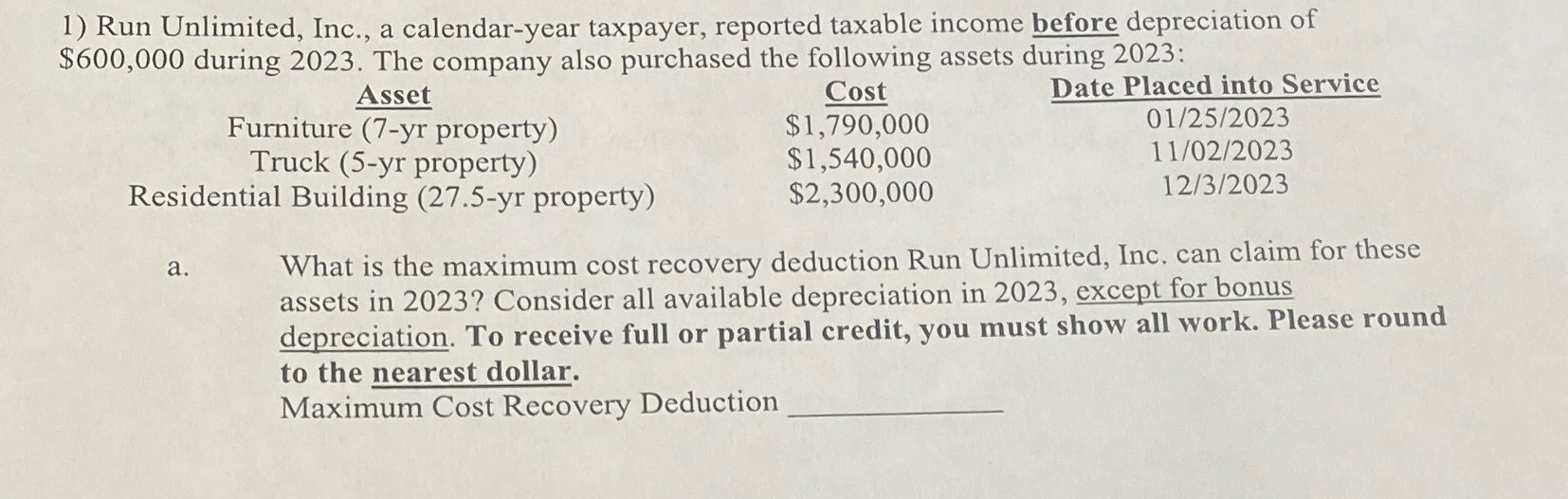

1) Run Unlimited, Inc., a calendar-year taxpayer, reported taxable income before depreciation of $600,000 during 2023. The company also purchased the following assets during

1) Run Unlimited, Inc., a calendar-year taxpayer, reported taxable income before depreciation of $600,000 during 2023. The company also purchased the following assets during 2023: Asset Furniture (7-yr property) Truck (5-yr property) Residential Building (27.5-yr property) a. Cost $1,790,000 $1,540,000 $2,300,000 Date Placed into Service 01/25/2023 11/02/2023 12/3/2023 What is the maximum cost recovery deduction Run Unlimited, Inc. can claim for these assets in 2023? Consider all available depreciation in 2023, except for bonus depreciation. To receive full or partial credit, you must show all work. Please round to the nearest dollar. Maximum Cost Recovery Deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the maximum cost recovery deduction for each asset we nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started