Question

1. Seahawk is a stock with a variance of .045, a standard deviation of 0.212, and a beta of 0.75. What would you expect to

1. Seahawk is a stock with a variance of .045, a standard deviation of 0.212, and a beta of 0.75. What would you expect to happen to the stock price of Seahawk if the market goes down by 6%?

a. Seahawk falls by 3%

b. Seahawk falls by 4.5%

c. Seahawk falls by 6%

d. Seahawk goes up by 6%

e. Seahawk goes up by 3%

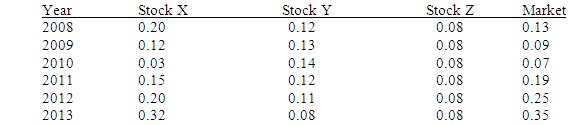

2. Annual returns for stocks X, Y, Z, and the Market are given below for the time period 2008 to 2013. From the information given in the table above, which of the following choices best describes the betas (b) of Stock X, Stock Y, and Stock Z

Select one:

a. Beta of X 0, Beta of Z = 0

b. Beta of X 0, Beta of Z

c. Beta of X

d. Beta of X > 0, Beta of Y

e. Beta of X > 0, Beta of Y > 0, Beta of Z = 0

397955 1100123 1-0 0 0 0 0 0 k234218 0 t000000 c023502 0210123 S-000000 890123 001111 e-000000 Y-222222

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started