Question

1. Second Chance Bakery is a not-for-profit organization that employs formerly incarcerated individuals. In addition to its retail sales, the Bakery has a contract with

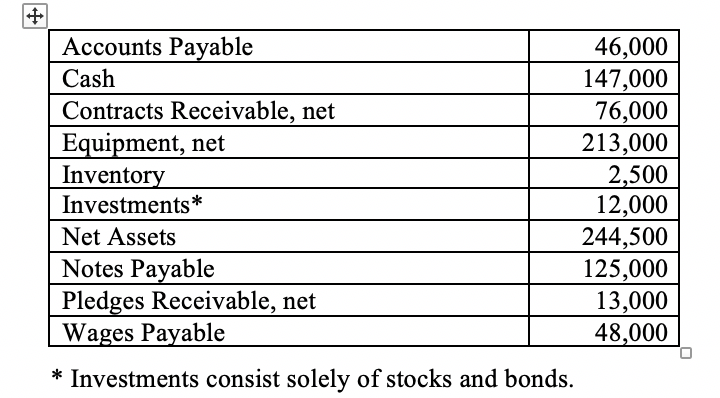

1. Second Chance Bakery is a not-for-profit organization that employs formerly incarcerated individuals. In addition to its retail sales, the Bakery has a contract with the city government to supply bread and desserts to the citys senior centers. The organization ended FY 2018 on December 31, 2018 with the following account balances (in alphabetical order):

Prepare a transactions worksheet, balance sheet, and activity statement for FY 2019 based on the following information.

Second Chance Bakery experienced the following financial events during FY 2019:

- On January 1, 2019, Second Chance Bakery borrowed $80,000 from a bank.

- On July 1, 2019, the Bakery used the $80,000 loan to buy new kitchen equipment. The equipment has an estimated useful life of 10 years and no salvage value. Equipment purchased in previous fiscal years depreciated by $23,000 in FY 2019.

- The Bakery earned and received $750,000 in retail sales revenue.

- The Bakery also earned city contract revenue of $1,080,000 in 2019 and 912,000 in FY 2018, spread evenly throughout the year. City contract revenue is received with a one-month lag.

- The Bakery earned $136,000 in donations in FY 2019, of which it collected $124,000 in cash. The organization also collected $13,000 in donations earned in the previous fiscal year and anticipates collecting any pledges that were outstanding at the end of FY 2019 in FY 2020.

- On January 1, 2019, the Bakery purchased $2,000 in stocks. The organizations investment portfolio was valued at $17,500 at the end of FY 2019, and the organization did not buy or sell any investments. (Hint: you must back out the unrealized gain or loss on investments.)

- The Bakerys employees earned a total of $1,352,000 in wages during FY 2019, up from $1,248,000 in FY 2018. The Bakery pays its employees weekly with a two-week lag.

- The Bakery ordered $26,500 in supplies each month. Supplies are used in the same month in which they are ordered, but are paid for with a two-month lag. In FY 2018, the Bakery ordered $23,000 in supplies each month.

- Occupancy costs (rent and utilities) totaled $25,000 per month and were paid timely (i.e. without a lag).

- The new bank loan, like the preexisting loan the Bakery had at the start of FY 2019, carries an annual interest rate of 4.5%. The Bakery made the required interest payment on both loans on December 31, 2019.

- On December 31, 2019, as required, the Bakery also repaid $40,000 in principal to the bank. Another $40,000 of principal is due in FY 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started