Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Select two papers from the reading list below. 1 (1) Baker, M. and Wurgler, J., 2006. Investor sentiment and the cross - section of

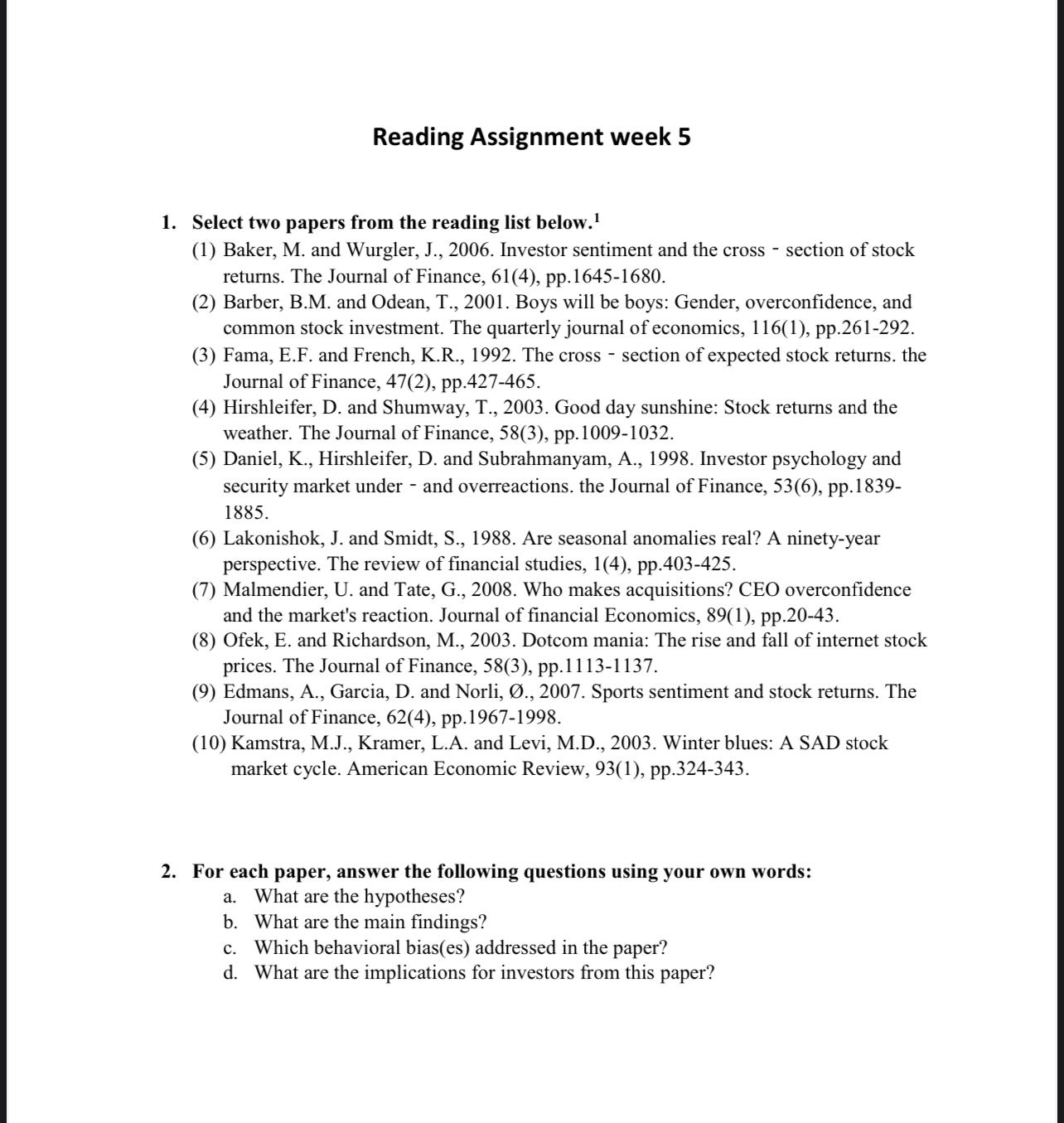

1. Select two papers from the reading list below. 1 (1) Baker, M. and Wurgler, J., 2006. Investor sentiment and the cross - section of stock returns. The Journal of Finance, 61(4), pp.1645-1680. (2) Barber, B.M. and Odean, T., 2001. Boys will be boys: Gender, overconfidence, and common stock investment. The quarterly journal of economics, 116(1), pp.261-292. (3) Fama, E.F. and French, K.R., 1992. The cross - section of expected stock returns. the Journal of Finance, 47(2), pp.427-465. (4) Hirshleifer, D. and Shumway, T., 2003. Good day sunshine: Stock returns and the weather. The Journal of Finance, 58(3), pp.1009-1032. (5) Daniel, K., Hirshleifer, D. and Subrahmanyam, A., 1998. Investor psychology and security market under - and overreactions. the Journal of Finance, 53(6), pp.18391885 . (6) Lakonishok, J. and Smidt, S., 1988. Are seasonal anomalies real? A ninety-year perspective. The review of financial studies, 1(4), pp.403-425. (7) Malmendier, U. and Tate, G., 2008. Who makes acquisitions? CEO overconfidence and the market's reaction. Journal of financial Economics, 89(1), pp.20-43. (8) Ofek, E. and Richardson, M., 2003. Dotcom mania: The rise and fall of internet stock prices. The Journal of Finance, 58(3), pp.1113-1137. (9) Edmans, A., Garcia, D. and Norli, ., 2007. Sports sentiment and stock returns. The Journal of Finance, 62(4), pp.1967-1998. (10) Kamstra, M.J., Kramer, L.A. and Levi, M.D., 2003. Winter blues: A SAD stock market cycle. American Economic Review, 93(1), pp.324-343. 2. For each paper, answer the following questions using your own words: a. What are the hypotheses? b. What are the main findings? c. Which behavioral bias(es) addressed in the paper? d. What are the implications for investors from this paper

1. Select two papers from the reading list below. 1 (1) Baker, M. and Wurgler, J., 2006. Investor sentiment and the cross - section of stock returns. The Journal of Finance, 61(4), pp.1645-1680. (2) Barber, B.M. and Odean, T., 2001. Boys will be boys: Gender, overconfidence, and common stock investment. The quarterly journal of economics, 116(1), pp.261-292. (3) Fama, E.F. and French, K.R., 1992. The cross - section of expected stock returns. the Journal of Finance, 47(2), pp.427-465. (4) Hirshleifer, D. and Shumway, T., 2003. Good day sunshine: Stock returns and the weather. The Journal of Finance, 58(3), pp.1009-1032. (5) Daniel, K., Hirshleifer, D. and Subrahmanyam, A., 1998. Investor psychology and security market under - and overreactions. the Journal of Finance, 53(6), pp.18391885 . (6) Lakonishok, J. and Smidt, S., 1988. Are seasonal anomalies real? A ninety-year perspective. The review of financial studies, 1(4), pp.403-425. (7) Malmendier, U. and Tate, G., 2008. Who makes acquisitions? CEO overconfidence and the market's reaction. Journal of financial Economics, 89(1), pp.20-43. (8) Ofek, E. and Richardson, M., 2003. Dotcom mania: The rise and fall of internet stock prices. The Journal of Finance, 58(3), pp.1113-1137. (9) Edmans, A., Garcia, D. and Norli, ., 2007. Sports sentiment and stock returns. The Journal of Finance, 62(4), pp.1967-1998. (10) Kamstra, M.J., Kramer, L.A. and Levi, M.D., 2003. Winter blues: A SAD stock market cycle. American Economic Review, 93(1), pp.324-343. 2. For each paper, answer the following questions using your own words: a. What are the hypotheses? b. What are the main findings? c. Which behavioral bias(es) addressed in the paper? d. What are the implications for investors from this paper Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started