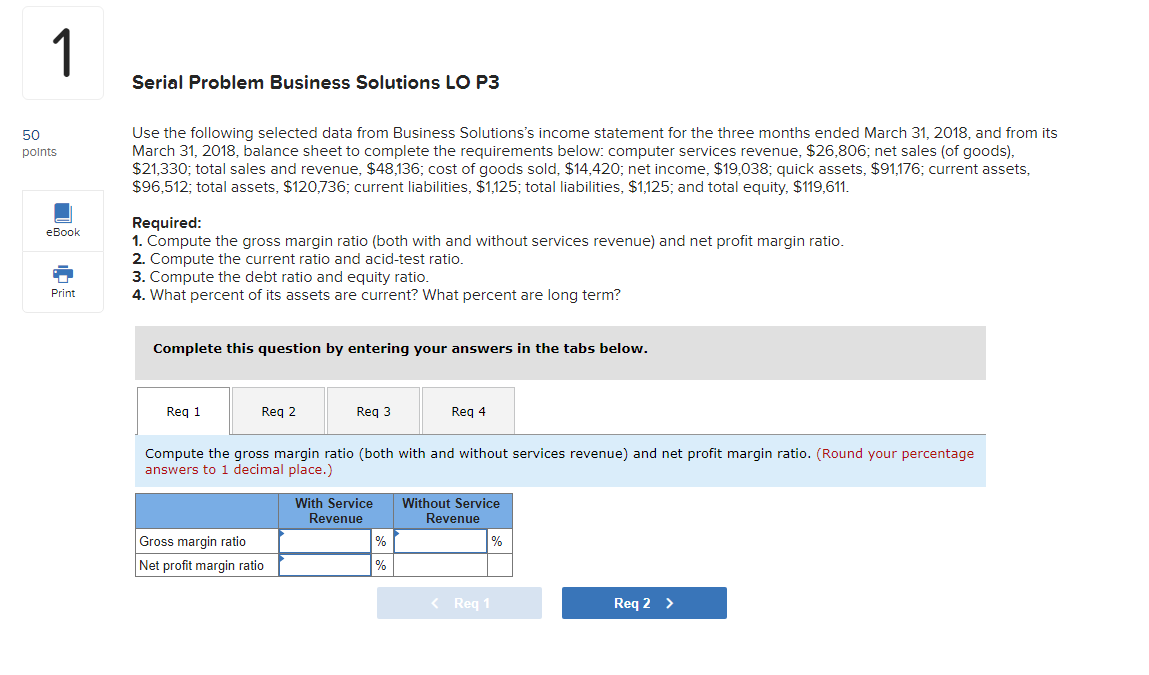

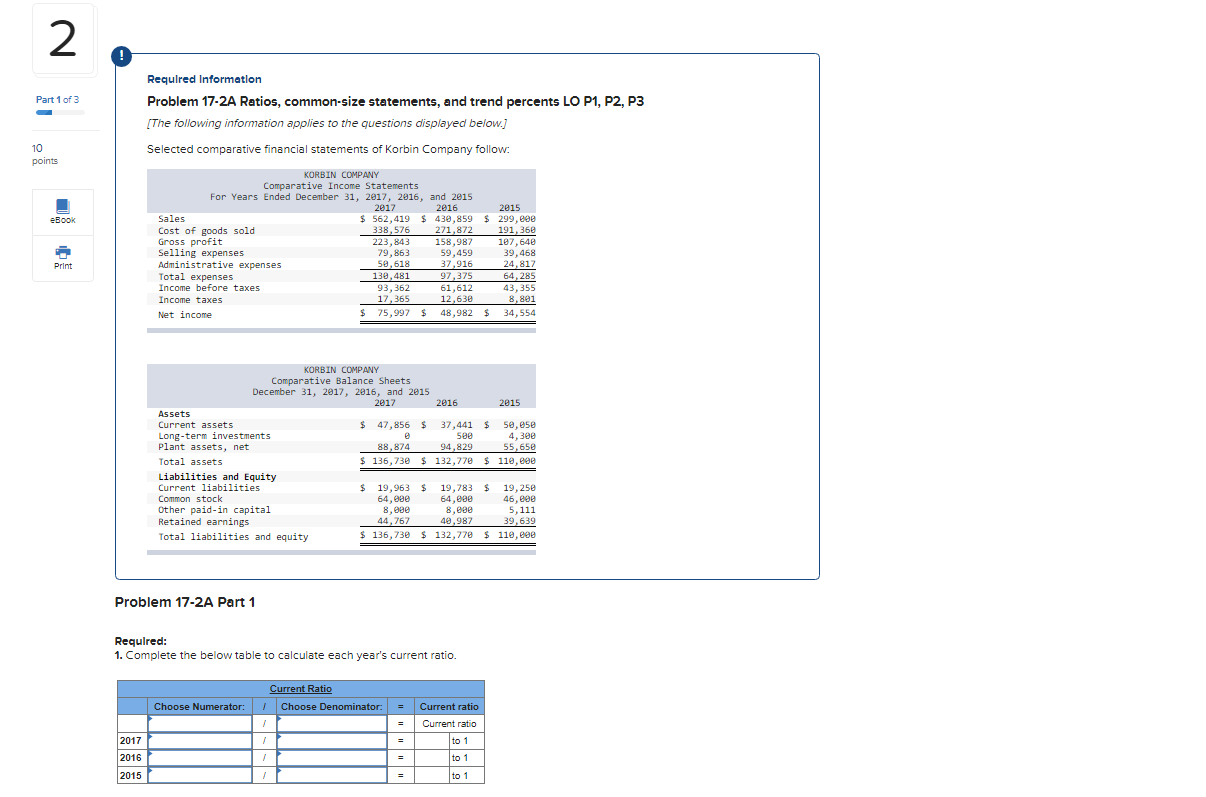

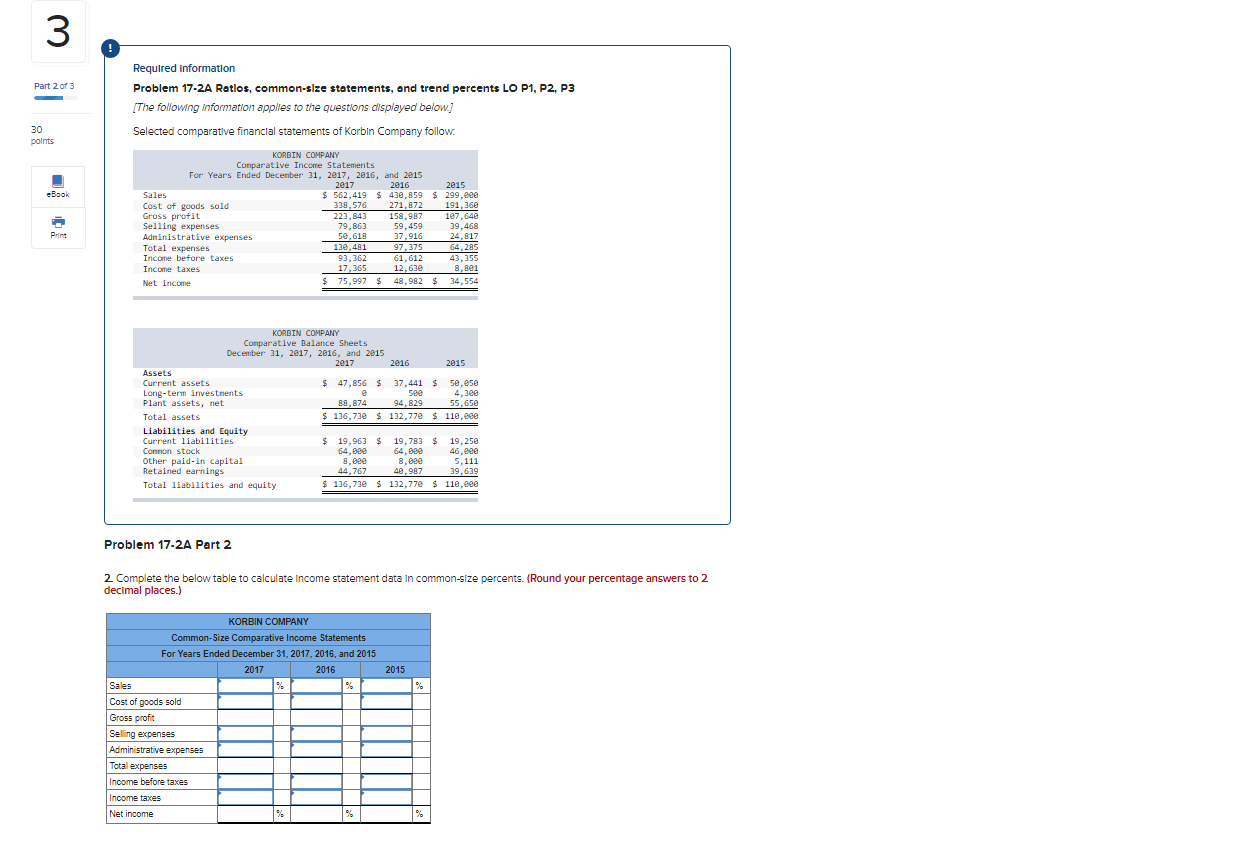

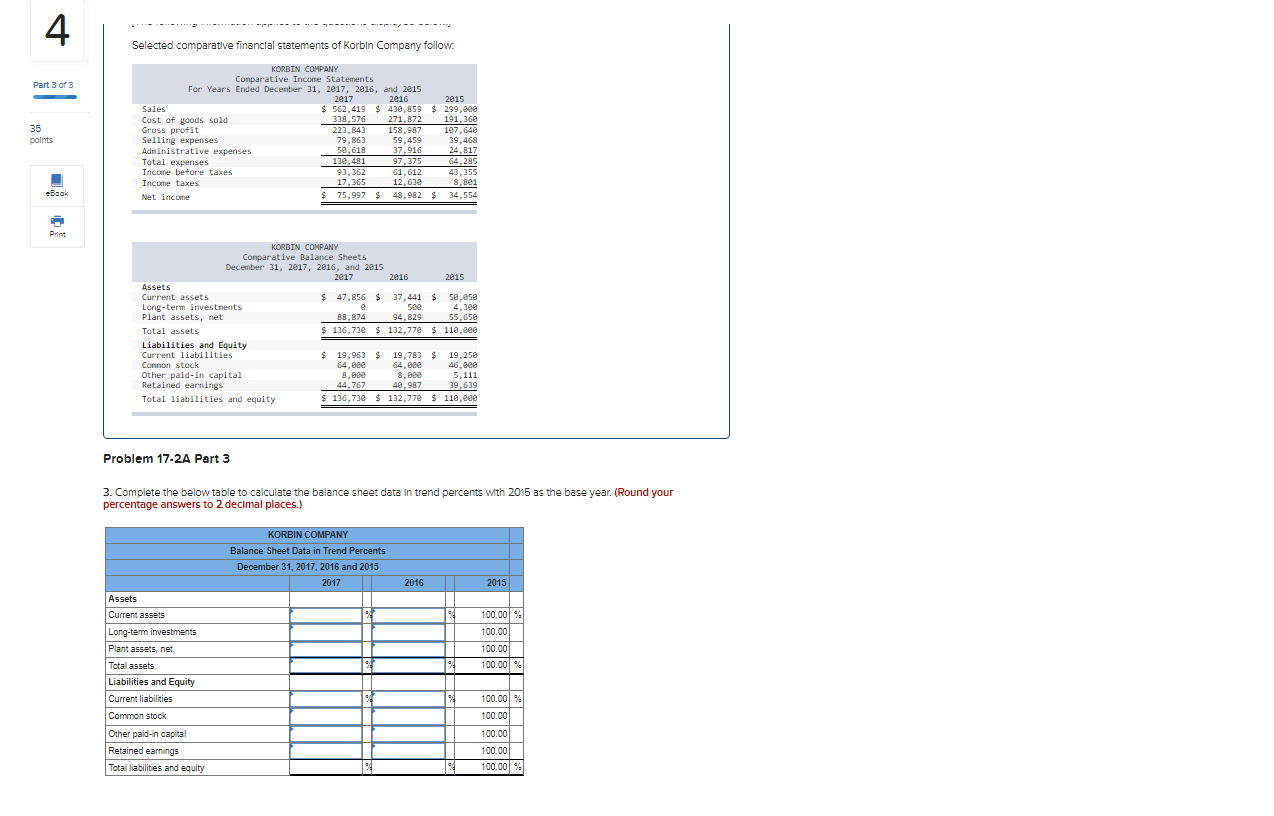

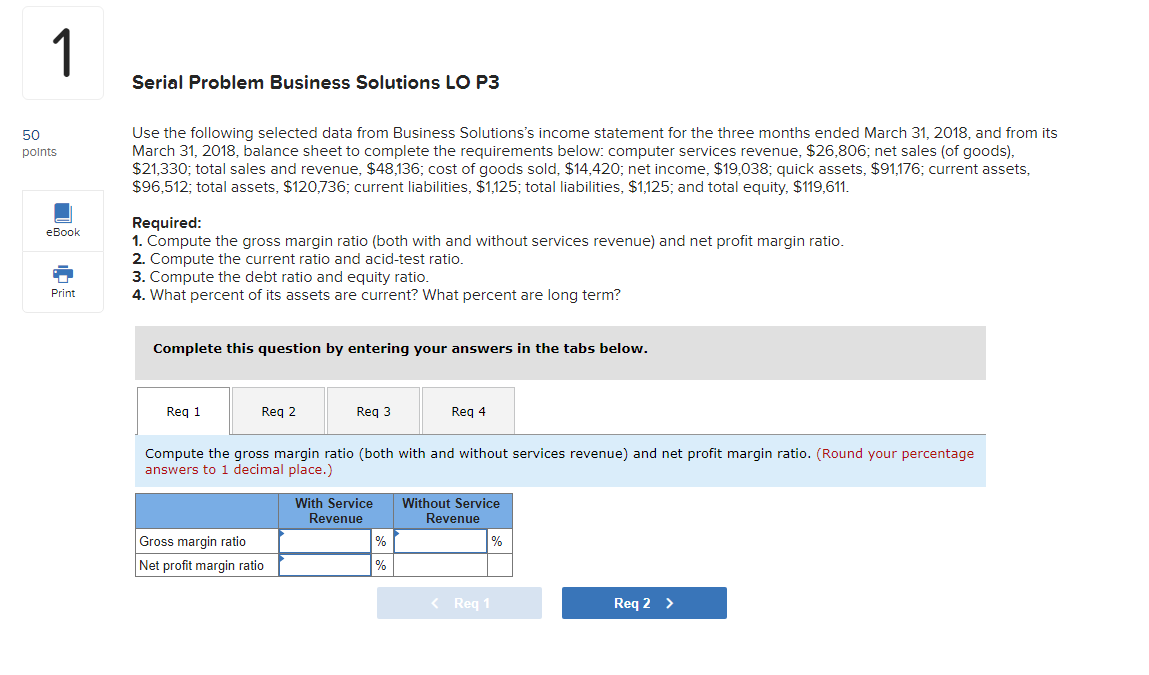

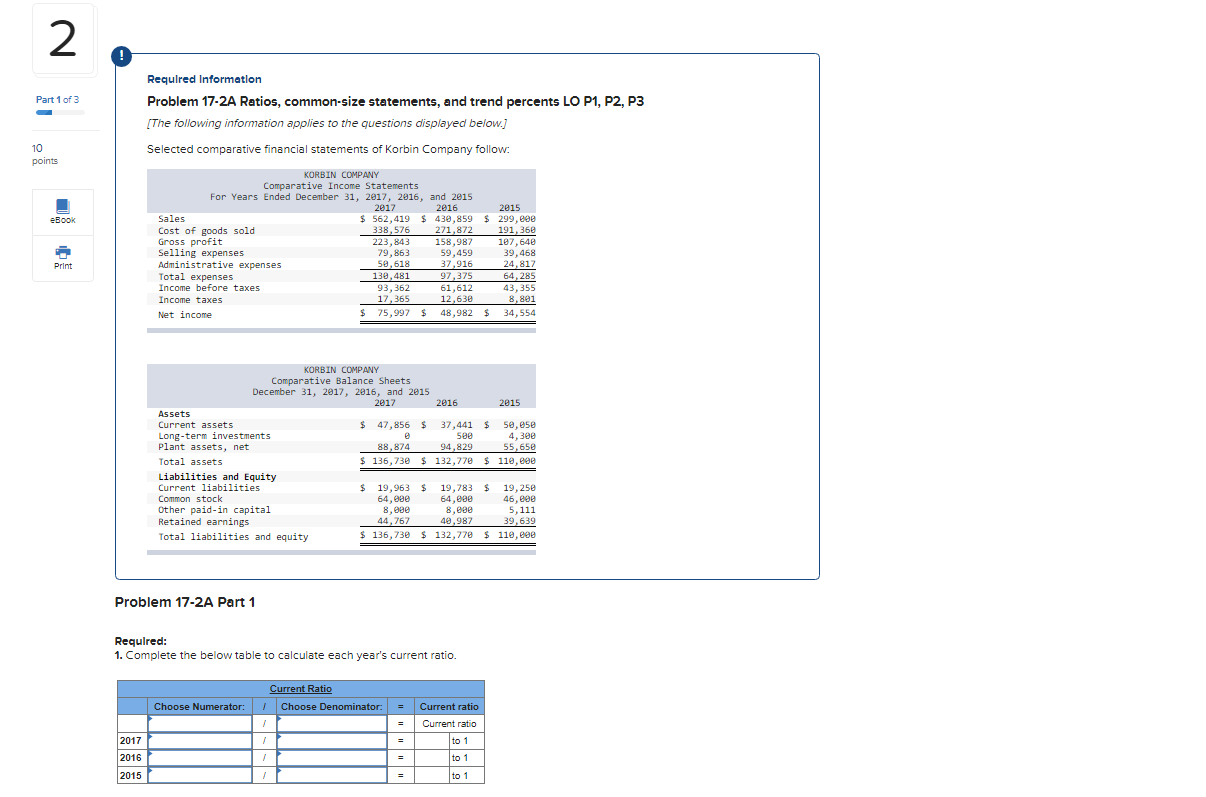

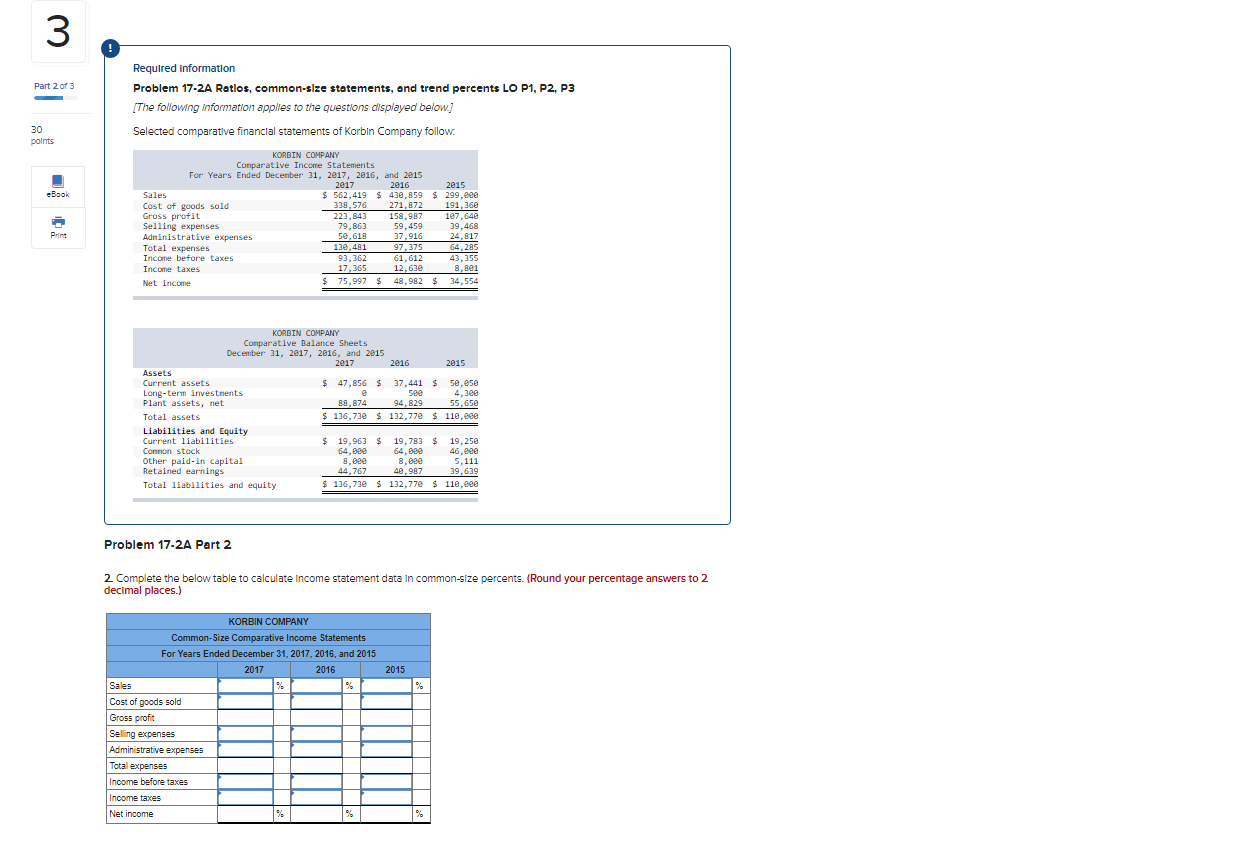

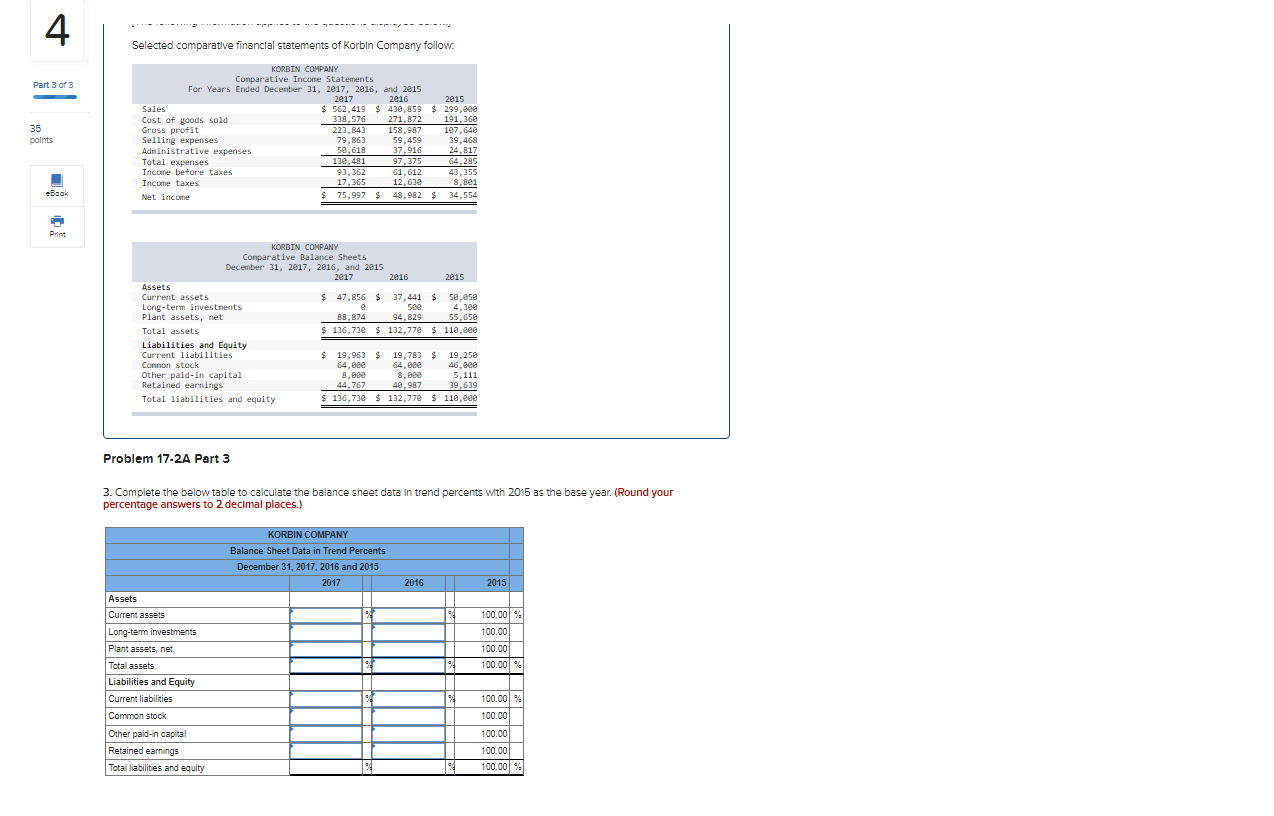

1 Serial Problem Business Solutions LO P3 50 points Use the following selected data from Business Solutions's income statement for the three months ended March 31, 2018, and from its March 31, 2018, balance sheet to complete the requirements below: computer services revenue, $26,806, net sales (of goods), $21,330; total sales and revenue, $48,136; cost of goods sold, $14,420; net income, $19,038; quick assets, $91,176; current assets, $96,512; total assets, $120,736, current liabilities, $1,125; total liabilities, $1,125, and total equity, $119,611. eBook Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Print Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req3 Reg 4 Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. (Round your percentage answers to 1 decimal place.) With Service Revenue % Without Service Revenue % Gross margin ratio Net profit margin ratio % 2 Part 1 of 3 Required Information Problem 17-2A Ratios, common-size statements, and trend percents LO P1, P2, P3 [The following information applies to the questions displayed below.] 10 points Selected comparative financial statements of Korbin Company follow: - eBook KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 2015 Sales $ 562,419 $430,859 $ 299,800 Cost of goods sold 338,576 271,872 191, 360 Gross profit 223,843 158,987 107,640 Selling expenses 79,863 59,459 39,468 Administrative expenses 50,618 37,916 Total expenses 138,481 97,375 64,285 Income before taxes 93,362 61,612 43,355 Income taxes 17,365 12,630 8,881 Net income $ 75,997 $ 48,982 $ 34,554 Print 24,817 KORBIN COMPANY Comparative Balance Sheets December 31, 2017, 2016, and 2015 2017 2016 2015 Assets Current assets $ 47,856 $ 37,441 $ 50,650 Long-term investments 500 4,300 Plant assets, net 88,874 94,829 55,650 Total assets $ 136,730 $ 132,770 $ 110,000 Liabilities and Equity Current liabilities $ 19,963 $ 19,783 $ 19, 250 Common stock 64,099 64,000 46,00 Other paid-in capital 8,080 8,888 5,111 Retained earnings 44,767 40.987 39,639 Total liabilities and equity $ 136,730 $ 132,770 $ 110,000 Problem 17-2A Part 1 Requlred: 1. Complete the below table to calculate each year's current ratio Choose Numerator: Current Ratio Choose Denominator: 1 Current ratio Current ratio = 2017 1 = to 1 / = to 1 2016 2015 1 = to 1 3 Part 2 of 3 Required information Problem 17-2A Ratlos, common-size statements, and trend percents LO P1, P2, P3 [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. 30 points eBook KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 2015 Sales $ 562,419 $ 438,859 $ 299, eee Cost of goods sold 338,576 271,872 191,36 Grss profit 223,843 158,987 107,648 Selling expenses 79,863 59,459 39,468 Administrative expenses 50,618 37,916 24,817 Total expenses 138,481 97,375 64,285 Income before taxes 93,362 61.612 43,355 Income taxes 17,365 12,630 8,881 Net income $ 75,997 $ 48,982 $ 34,554 Print KORBIN COMPANY Comparative Balance Sheets December 31, 2017, 2016, and 2015 2017 2016 2015 Assets Current assets $ 47,856 $ 37,441 $ 50,050 Long-term investments e 50e 4,300 Plant assets, net 88,874 94,829 55,65 Total assets $ 136,730 $ 132,779 $ 118,eee Liabilities and Equity Current liabilities $ 19,963 $ 19,783 $ 19,250 Connon stock 64.ee 64,689 46,600 Other paid-in capital 8,888 8,000 5,111 Retained earnings 44,767 48,987 39,639 Total liabilities and equity $ 136,730 $ 132,770 $ 118,eee Problem 17-2A Part 2 2 Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 2015 KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 Sales % Cost of goods sold Gross profit Seling expenses Administrative expenses Total Total expenses Income before taxes Income taxes Net income % 4 Selected comparative financial statements of Korbin Company follow. Part 3 of 3 35 points KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 2015 Sales $ 562,419 $ 438,859 $ 299, eee Cost of goods sold 338,576 271,872 191, 360 Gross profit 223,843 158,987 Selling expenses 79,863 59,459 39,468 Administrative expenses 50,618 37,916 24,817 Total expenses 130,481 97,375 64,285 Income before taxes 93, 362 61,612 43,355 Income taxes 17,365 12,630 8.801 Net income $ 75,997 $ 48,982 $ 34,554 107,648 eBook Print KORBIN COMPANY Comparative Balance Sheets December 31, 2017, 2016, and 2015 2017 2016 2015 Assets Current assets $ 47,856 $ 37,441 $ 58,650 Long-term investments e 560 4,300 Plant assets, net 88,874 94,829 55,650 Total assets $ 136,730 $ 132,770 $ 110,eee Liabilities and Equity Current liabilities $ 19,963 $ 19,783 $ 19,250 Connon stock 64,880 64,680 46,eee Other paid-in capital 8,888 8,888 5,111 Retained earnings 44,767 40,987 39,639 Total liabilities and equity 136,730 $ 132,770 $ 110,000 Problem 17-2A Part 3 3. Complete the below table to calculate the balance sheet data in trend percents with 2015 as the base year. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2017, 2016 and 2015 2017 2016 2015 Assets 944 100.00 % 100.00 100.00 191 12 100.00% Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity d 100.00 % 100.00 100.00 100.00 100.00 %