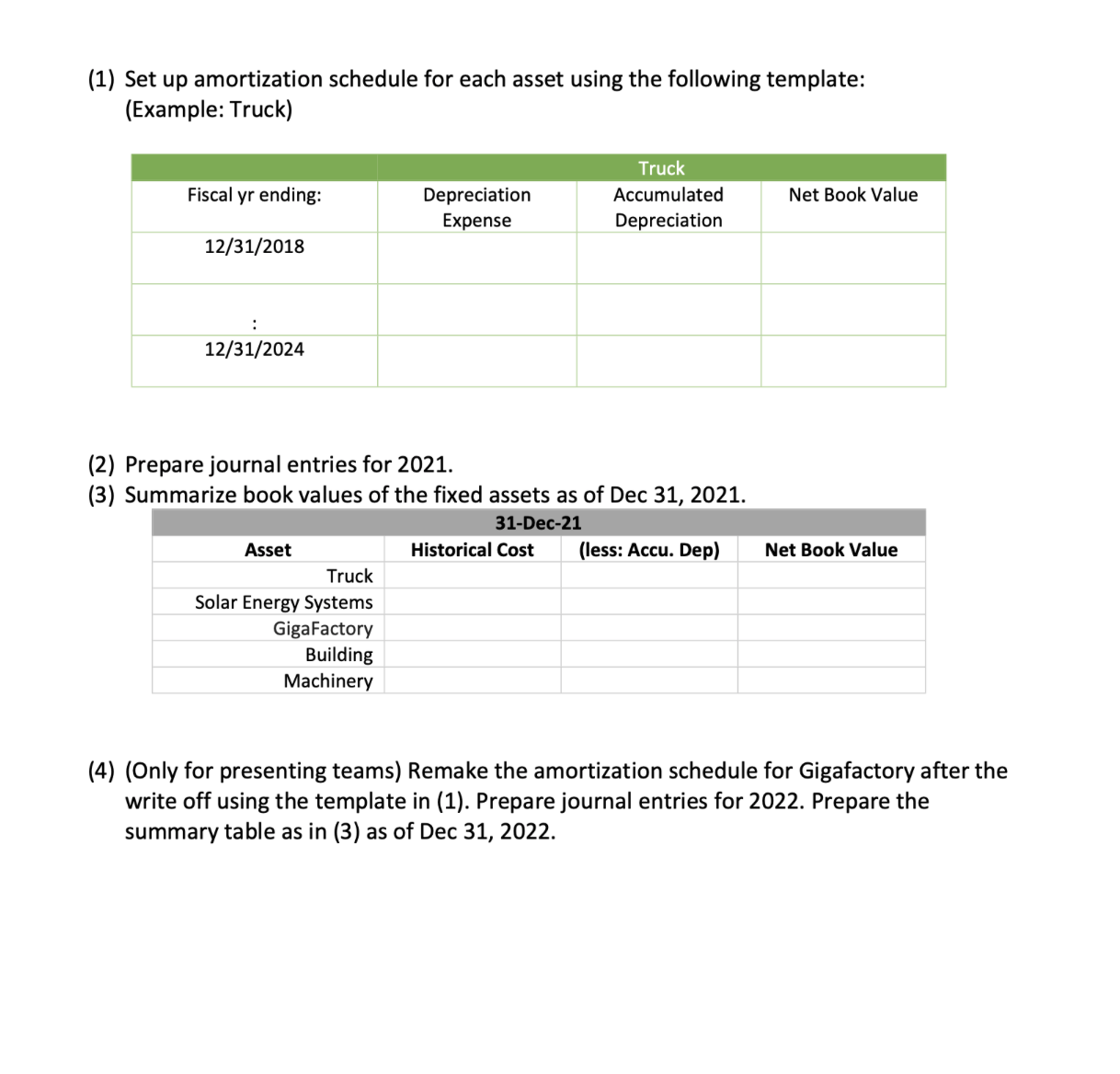

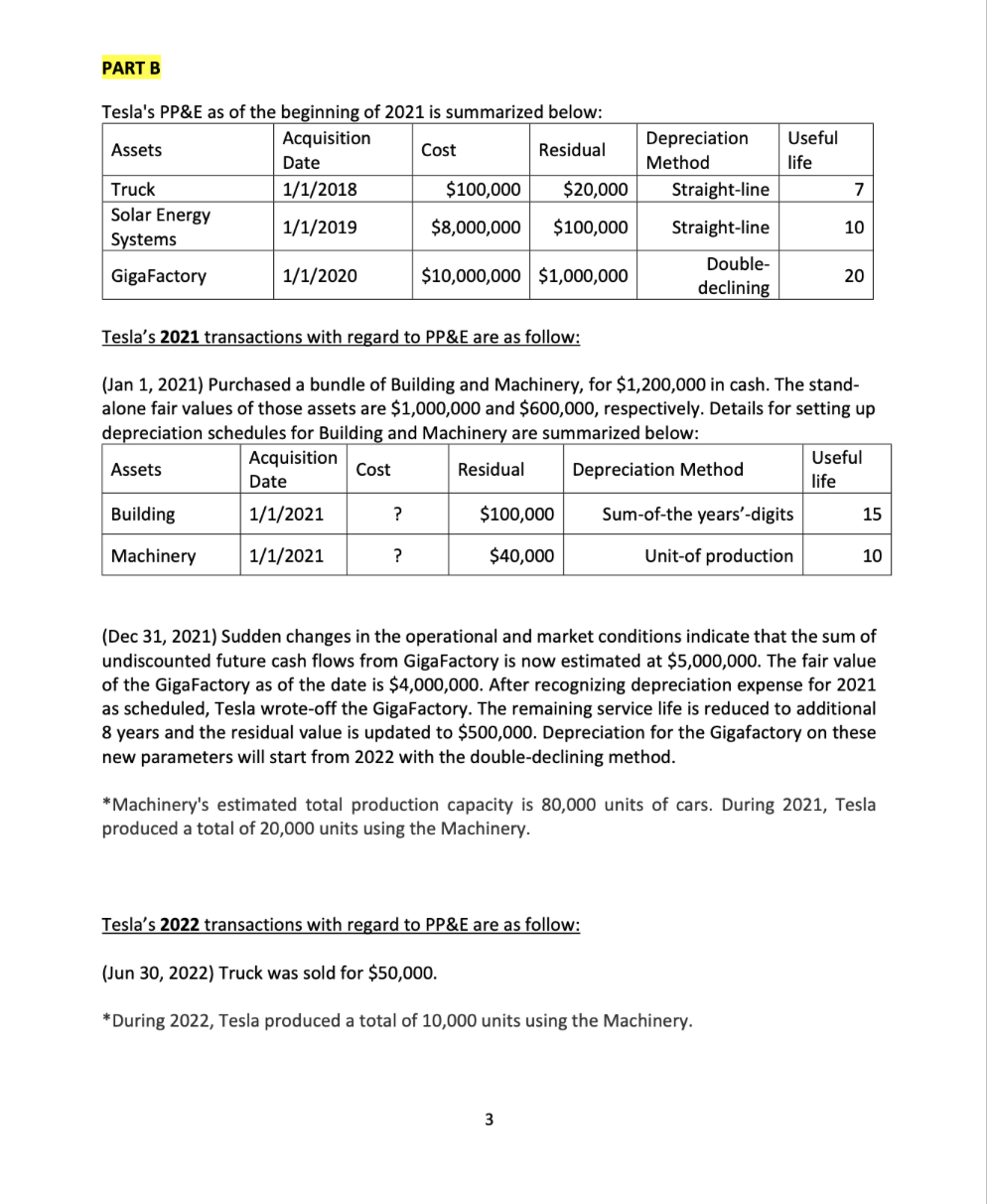

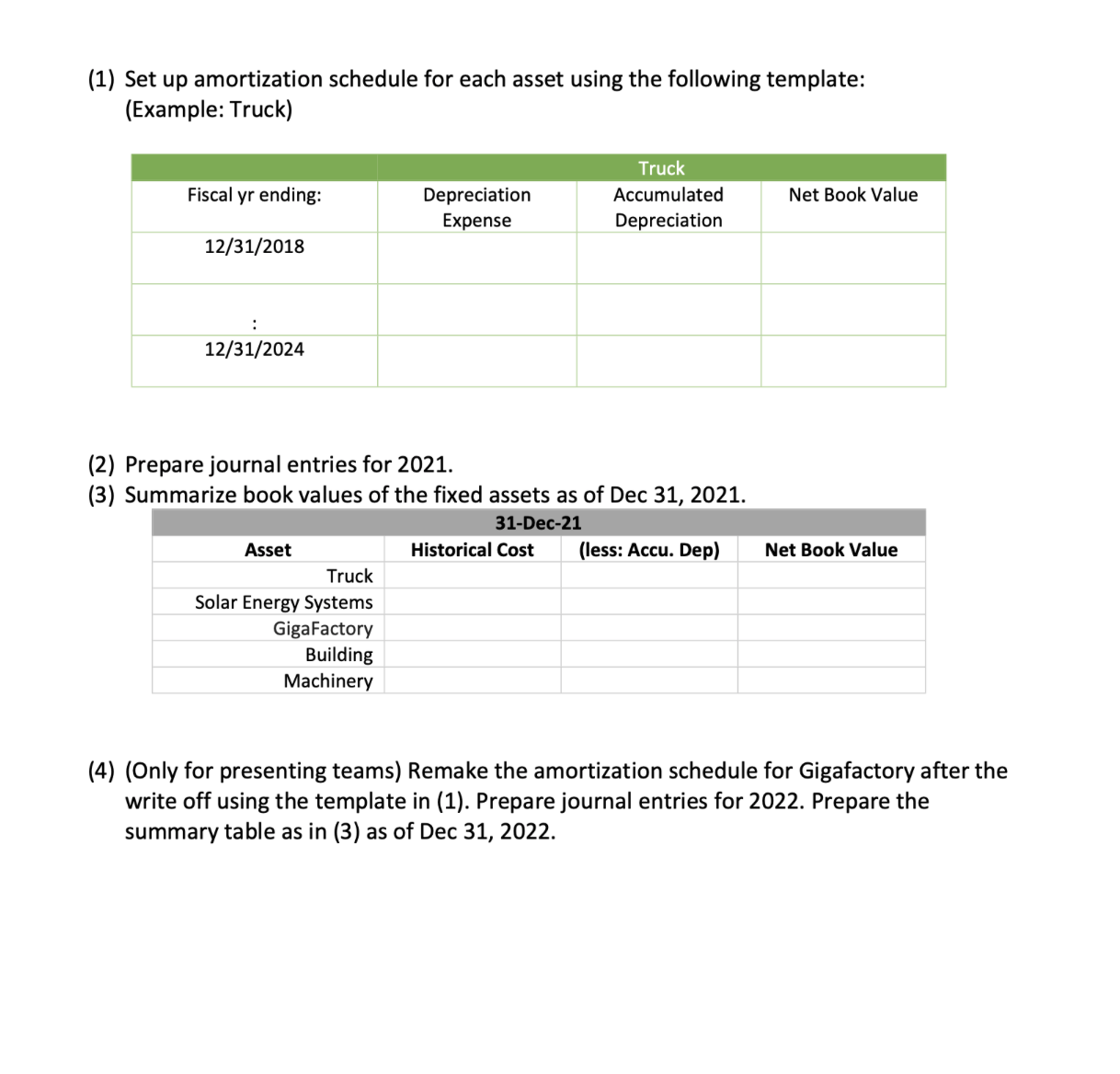

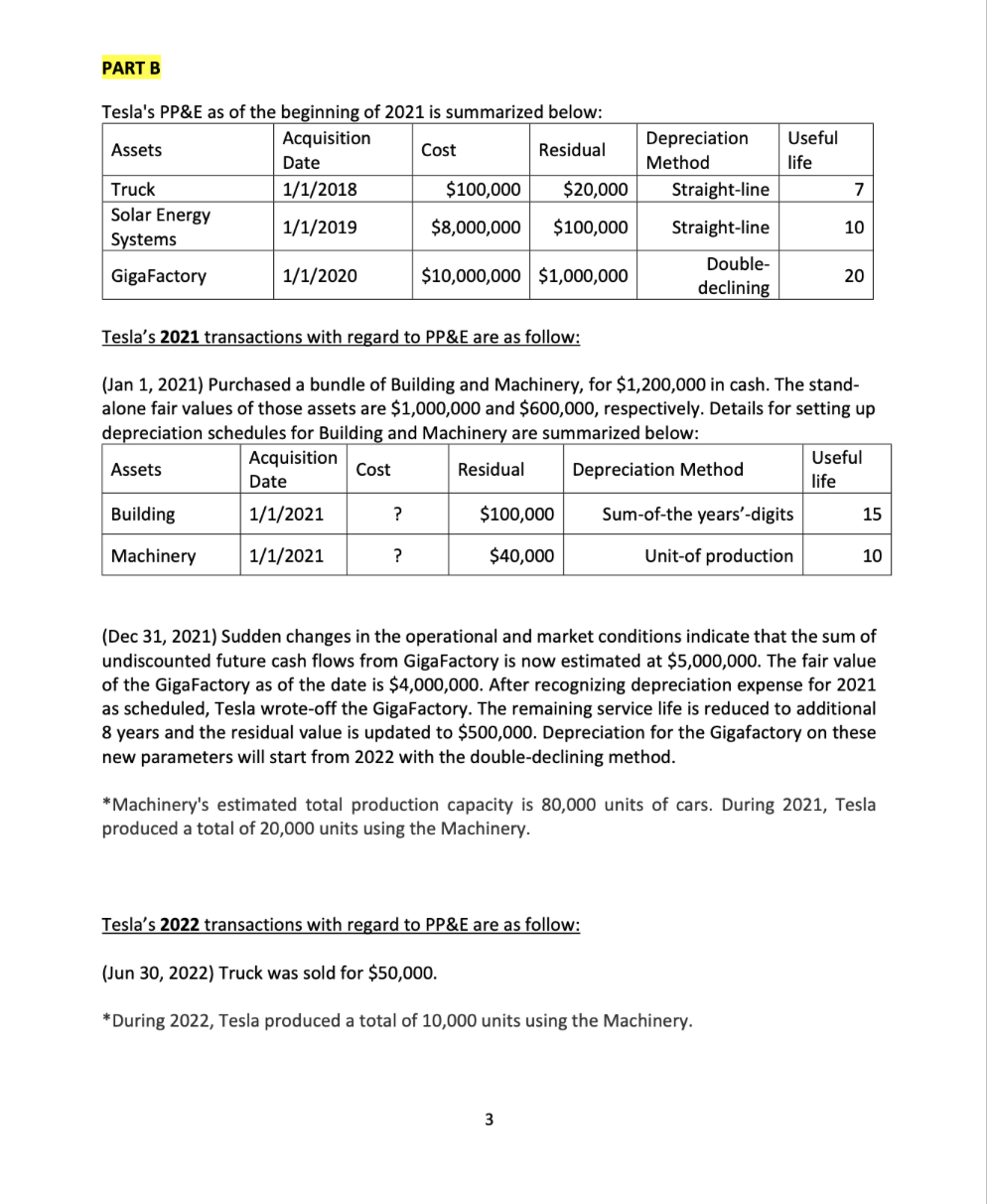

(1) Set up amortization schedule for each asset using the following template: (Example: Truck) Fiscal yr ending: Truck Accumulated Depreciation Depreciation Expense Net Book Value 12/31/2018 12/31/2024 Net Book Value (2) Prepare journal entries for 2021. (3) Summarize book values of the fixed assets as of Dec 31, 2021. 31-Dec-21 Asset Historical Cost (less: Accu. Dep) Truck Solar Energy Systems Gigafactory Building Machinery (4) (Only for presenting teams) Remake the amortization schedule for Gigafactory after the write off using the template in (1). Prepare journal entries for 2022. Prepare the summary table as in (3) as of Dec 31, 2022. PART B Tesla's PP&E as of the beginning of 2021 is summarized below: Acquisition Assets Cost Residual Date Truck 1/1/2018 $100,000 $20,000 Solar Energy 1/1/2019 $8,000,000 $100,000 Systems Depreciation Method Straight-line Useful life 7 Straight-line 10 Gigafactory 1/1/2020 $10,000,000 $1,000,000 Double- declining 20 Tesla's 2021 transactions with regard to PP&E are as follow: (Jan 1, 2021) Purchased a bundle of Building and Machinery, for $1,200,000 in cash. The stand- alone fair values of those assets are $1,000,000 and $600,000, respectively. Details for setting up depreciation schedules for Building and Machinery are summarized below: Acquisition Useful Assets Cost Residual Depreciation Method Date life Building 1/1/2021 ? $100,000 Sum-of-the years'-digits 15 Machinery 1/1/2021 ? $40,000 Unit-of production 10 (Dec 31, 2021) Sudden changes in the operational and market conditions indicate that the sum of undiscounted future cash flows from Gigafactory is now estimated at $5,000,000. The fair value of the Giga Factory as of the date is $4,000,000. After recognizing depreciation expense for 2021 as scheduled, Tesla wrote-off the Gigafactory. The remaining service life is reduced to additional 8 years and the residual value is updated to $500,000. Depreciation for the Gigafactory on these new parameters will start from 2022 with the double-declining method. * Machinery's estimated total production capacity is 80,000 units of cars. During 2021, Tesla produced a total of 20,000 units using the Machinery. Tesla's 2022 transactions with regard to PP&E are as follow: (Jun 30, 2022) Truck was sold for $50,000. *During 2022, Tesla produced a total of 10,000 units using the Machinery. 3 (1) Set up amortization schedule for each asset using the following template: (Example: Truck) Fiscal yr ending: Truck Accumulated Depreciation Depreciation Expense Net Book Value 12/31/2018 12/31/2024 Net Book Value (2) Prepare journal entries for 2021. (3) Summarize book values of the fixed assets as of Dec 31, 2021. 31-Dec-21 Asset Historical Cost (less: Accu. Dep) Truck Solar Energy Systems Gigafactory Building Machinery (4) (Only for presenting teams) Remake the amortization schedule for Gigafactory after the write off using the template in (1). Prepare journal entries for 2022. Prepare the summary table as in (3) as of Dec 31, 2022. PART B Tesla's PP&E as of the beginning of 2021 is summarized below: Acquisition Assets Cost Residual Date Truck 1/1/2018 $100,000 $20,000 Solar Energy 1/1/2019 $8,000,000 $100,000 Systems Depreciation Method Straight-line Useful life 7 Straight-line 10 Gigafactory 1/1/2020 $10,000,000 $1,000,000 Double- declining 20 Tesla's 2021 transactions with regard to PP&E are as follow: (Jan 1, 2021) Purchased a bundle of Building and Machinery, for $1,200,000 in cash. The stand- alone fair values of those assets are $1,000,000 and $600,000, respectively. Details for setting up depreciation schedules for Building and Machinery are summarized below: Acquisition Useful Assets Cost Residual Depreciation Method Date life Building 1/1/2021 ? $100,000 Sum-of-the years'-digits 15 Machinery 1/1/2021 ? $40,000 Unit-of production 10 (Dec 31, 2021) Sudden changes in the operational and market conditions indicate that the sum of undiscounted future cash flows from Gigafactory is now estimated at $5,000,000. The fair value of the Giga Factory as of the date is $4,000,000. After recognizing depreciation expense for 2021 as scheduled, Tesla wrote-off the Gigafactory. The remaining service life is reduced to additional 8 years and the residual value is updated to $500,000. Depreciation for the Gigafactory on these new parameters will start from 2022 with the double-declining method. * Machinery's estimated total production capacity is 80,000 units of cars. During 2021, Tesla produced a total of 20,000 units using the Machinery. Tesla's 2022 transactions with regard to PP&E are as follow: (Jun 30, 2022) Truck was sold for $50,000. *During 2022, Tesla produced a total of 10,000 units using the Machinery. 3