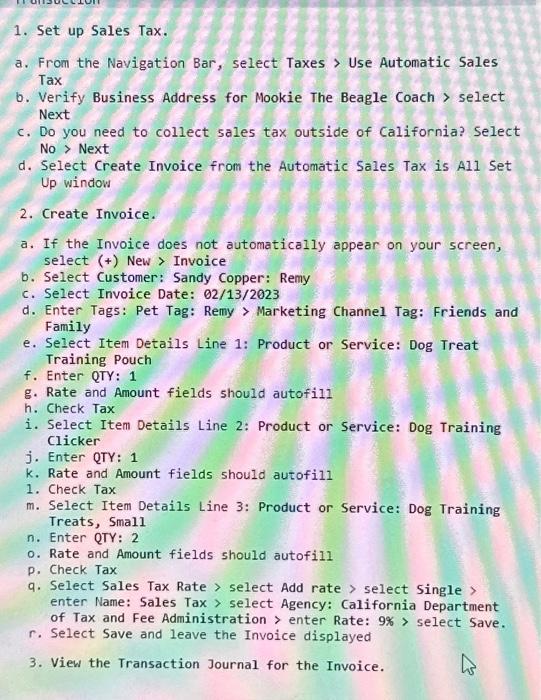

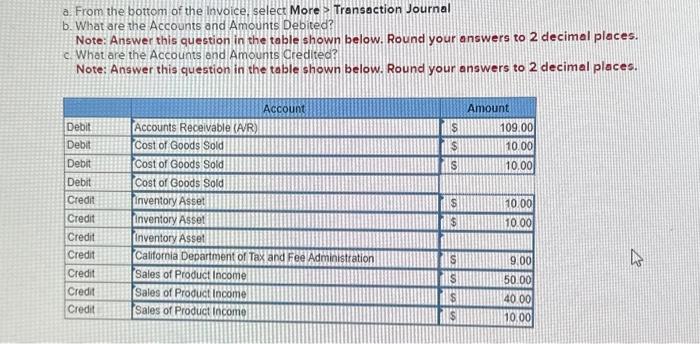

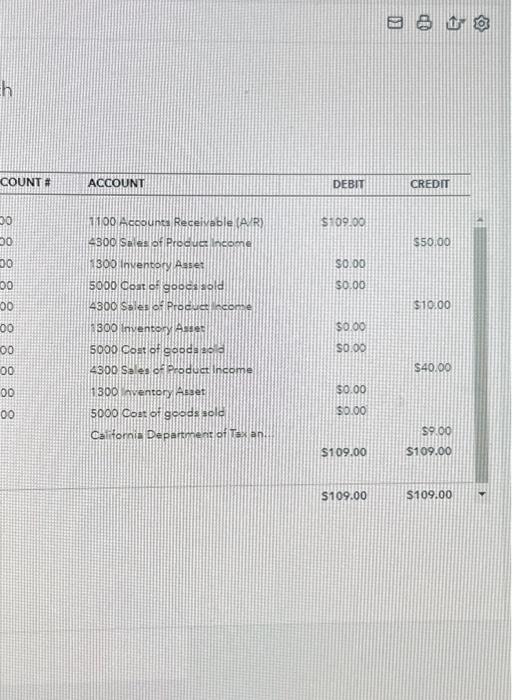

1. Set up Sales Tax. a. From the Navigation Bar, select Taxes > Use Automatic Sales Tax b. Verify Business Address for Mookie The Beagle Coach > select Next c. Do you need to collect sales tax outside of California? Select No > Next d. Select Create Invoice from the Automatic Sales Tax is All Set Up window 2. Create Invoice. a. If the Invoice does not automatically appear on your screen, select (+) New > Invoice b. Select Customer: Sandy Copper: Remy c. Select Invoice Date: 02/13/2023 d. Enter Tags: Pet Tag: Remy > Marketing Channel Tag: Friends and Family e. Select Item Details Line 1: Product or Service: Dog Treat Training Pouch f. Enter QTY: 1 g. Rate and Amount fields should autofill h. Check Tax i. Select Item Details Line 2: Product or Service: Dog Training Clicker j. Enter QTY: 1 k. Rate and Amount fields should autofill 1. Check Tax m. Select Item Details Line 3: Product or Service: Dog Training Treats, Small n. Enter QTY: 2 . Rate and Amount fields should autofill p. Check Tax q. Select Sales Tax Rate > select Add rate > select Single > enter Name: Sales Tax > select Agency: California Department of Tax and Fee Administration > enter Rate: 9% > select Save. r. Select Save and leave the Invoice displayed 3. View the Transaction Journal for the Invoice. a. From the bottom of the Invoice, select More? Transaction Journal b. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. c. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. ( 1100 Accounc3 Receivable (A,R) 5:09.00 4300isales of Procues income $50.00 roo inventory Asse: 50.00 4300\$siesofrrode peomel $10.00 300 imentory Awese $000 5000 cost of 9000139=50.00 4300 Sales of pioduct income 540.00 1300 mentor Aseser $50.00 500000ot goods 400d30.00 Calitornia Departnent of tok an 159.00 $109.00$109.00 $109.00$109.00 1. Set up Sales Tax. a. From the Navigation Bar, select Taxes > Use Automatic Sales Tax b. Verify Business Address for Mookie The Beagle Coach > select Next c. Do you need to collect sales tax outside of California? Select No > Next d. Select Create Invoice from the Automatic Sales Tax is All Set Up window 2. Create Invoice. a. If the Invoice does not automatically appear on your screen, select (+) New > Invoice b. Select Customer: Sandy Copper: Remy c. Select Invoice Date: 02/13/2023 d. Enter Tags: Pet Tag: Remy > Marketing Channel Tag: Friends and Family e. Select Item Details Line 1: Product or Service: Dog Treat Training Pouch f. Enter QTY: 1 g. Rate and Amount fields should autofill h. Check Tax i. Select Item Details Line 2: Product or Service: Dog Training Clicker j. Enter QTY: 1 k. Rate and Amount fields should autofill 1. Check Tax m. Select Item Details Line 3: Product or Service: Dog Training Treats, Small n. Enter QTY: 2 . Rate and Amount fields should autofill p. Check Tax q. Select Sales Tax Rate > select Add rate > select Single > enter Name: Sales Tax > select Agency: California Department of Tax and Fee Administration > enter Rate: 9% > select Save. r. Select Save and leave the Invoice displayed 3. View the Transaction Journal for the Invoice. a. From the bottom of the Invoice, select More? Transaction Journal b. What are the Accounts and Amounts Debited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. c. What are the Accounts and Amounts Credited? Note: Answer this question in the table shown below. Round your answers to 2 decimal places. ( 1100 Accounc3 Receivable (A,R) 5:09.00 4300isales of Procues income $50.00 roo inventory Asse: 50.00 4300\$siesofrrode peomel $10.00 300 imentory Awese $000 5000 cost of 9000139=50.00 4300 Sales of pioduct income 540.00 1300 mentor Aseser $50.00 500000ot goods 400d30.00 Calitornia Departnent of tok an 159.00 $109.00$109.00 $109.00$109.00