Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Several years ago, Westmont Corporation developed a comprehensive budgeting system for planning and control purposes. While departmental supervisors have been happy with the

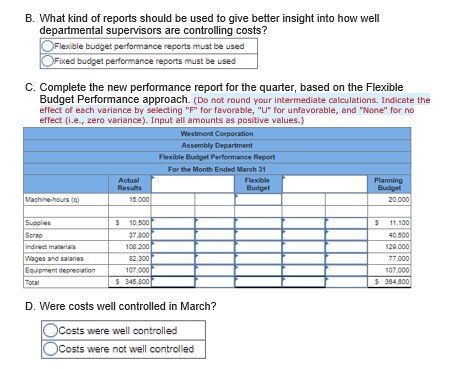

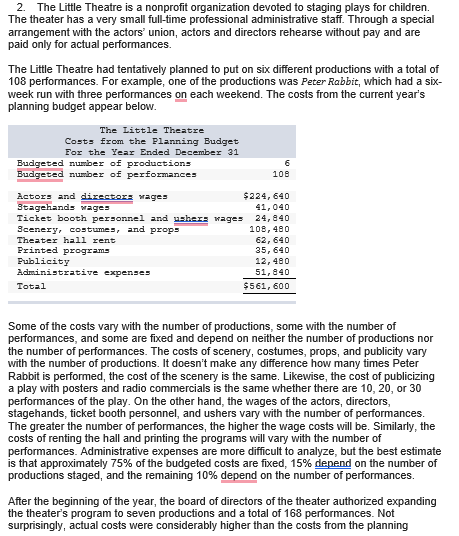

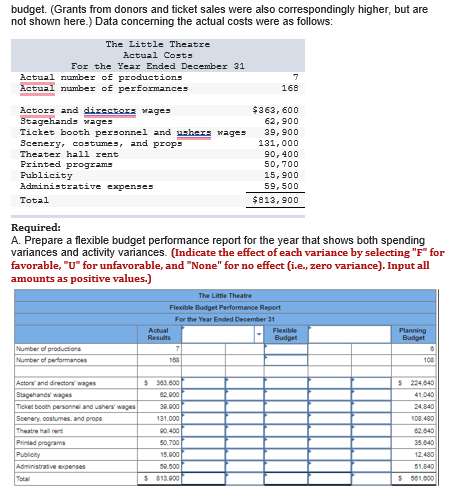

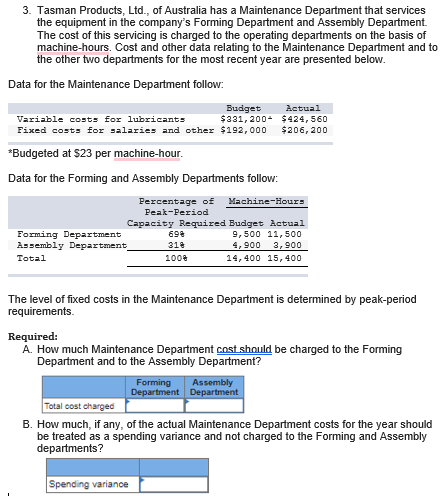

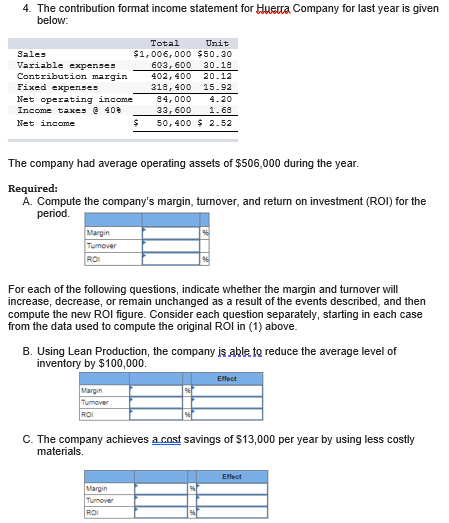

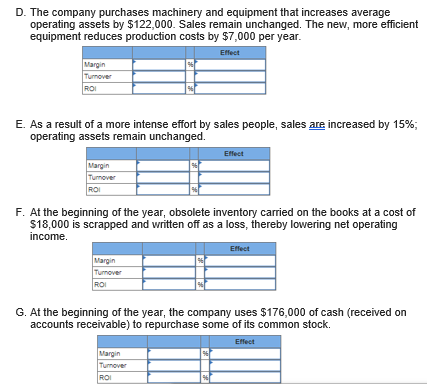

1. Several years ago, Westmont Corporation developed a comprehensive budgeting system for planning and control purposes. While departmental supervisors have been happy with the system, the factory manager has expressed considerable dissatisfaction with the information being generated by the system. A report for the company's Assembly Department for the month of March follows: Assembly Department Cost Report For the Month Ended March 31 Actual Results Planning Budget Variances Machine-hours Variable costs: Supplies Indirect materials Fixed costs: Wages and salaries Equipment depreciation Total cost 15,000 20,000 10,500 $ 11,100 $ 600 F 37,800 40,500 2,700 F 108,200 129,000 20,800 F 82,300 107,000 77,000 5,300 U 107,000 $ 345,800 $ 364,600 $18,800 F After receiving a copy of this cost report, the supervisor of the Assembly Department stated, "These reports are super. It makes me feel really good to see how well things are going in my department. I can't understand why those people upstairs complain so much about the reports." For the last several years, the company's marketing department has chronically failed to meet the sales goals expressed in the company's monthly budgets. Required: A. The company's president is uneasy about the cost reports, identify at least two reasons. Cost reports are ineffective since budgeted costs at one level of activity are compared to actual costs at another level of activity. Cost reports show whether fixed costs are controlled and do not show whether variable costs are controlled Cost reports are effective since budgeted costs at one level of activity are compared to actual costs at another level of activity. Cost reports show whether fixed costs and variable costs are controlled. B. What kind of reports should be used to give better insight into how well departmental supervisors are controlling costs? Flexible budget performance reports must be used Fixed budget performance reports must be used C. Complete the new performance report for the quarter, based on the Flexible Budget Performance approach. (Do not round your intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Westmont Corporation Assembly Department Actual Results Machine-hours (Q) 15,000 Supplies $10,500 Scrap 37.800 Indirect materials 108,200 Wages and salaries 82,300 Equipment depreciation 107.000 Total $ 345,800 Flexible Budget Performance Report For the Month Ended March 31 Flexible Budget Planning Budget 20,000 $ 11,100 40.500 129.000 77,000 107.000 D. Were costs well controlled in March? Costs were well controlled Costs were not well controlled $384,600 2. The Little Theatre is a nonprofit organization devoted to staging plays for children. The theater has a very small full-time professional administrative staff. Through a special arrangement with the actors' union, actors and directors rehearse without pay and are paid only for actual performances. The Little Theatre had tentatively planned to put on six different productions with a total of 108 performances. For example, one of the productions was Peter Rabbit, which had a six- week run with three performances on each weekend. The costs from the current year's planning budget appear below. The Little Theatre Costs from the Planning Budget For the Year Ended December 31 Budgeted number of productions Budgeted number of performances Actors and directors wages Stagehands wages Ticket booth personnel and ushers wages Scenery, costumes, and props Theater hall rent Printed programs Publicity Administrative expenses Total 108 6 $224,640 41,040 24,840 108,480 62,640 35, 640 12,480 51,840 $561,600 Some of the costs vary with the number of productions, some with the number of performances, and some are fixed and depend on neither the number of productions nor the number of performances. The costs of scenery, costumes, props, and publicity vary with the number of productions. It doesn't make any difference how many times Peter Rabbit is performed, the cost of the scenery is the same. Likewise, the cost of publicizing a play with posters and radio commercials is the same whether there are 10, 20, or 30 performances of the play. On the other hand, the wages of the actors, directors, stagehands, ticket booth personnel, and ushers vary with the number of performances. The greater the number of performances, the higher the wage costs will be. Similarly, the costs of renting the hall and printing the programs will vary with the number of performances. Administrative expenses are more difficult to analyze, but the best estimate is that approximately 75% of the budgeted costs are fixed, 15% depend on the number of productions staged, and the remaining 10% depend on the number of performances. After the beginning of the year, the board of directors of the theater authorized expanding the theater's program to seven productions and a total of 168 performances. Not surprisingly, actual costs were considerably higher than the costs from the planning budget. (Grants from donors and ticket sales were also correspondingly higher, but are not shown here.) Data concerning the actual costs were as follows: The Little Theatre Actual Costs For the Year Ended December 31 Actual number of productions 7 Actual number of performances Actors and directors wages Stagehands wages Ticket booth personnel and ushers wages Scenery, costumes, and props Theater hall rent Printed programs Administrative expenses Publicity Total Required: 168 $363,600 62,900 39,900 131,000 90,400 50,700 15,900 59,500 $813,900 A. Prepare a flexible budget performance report for the year that shows both spending variances and activity variances. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) The Little Theatre Flexible Budget Performance Report For the Year Ended December 31 Number of productions Actual Results 7 168 Flexible Planning Budget Budget Number of performances 108 Actors and directors wages $ 383.600 $224,640 Stagehands wages 82.900 Ticket booth personnel and ushers' wages 39.000 41,040 24,840 Scenery, costumes, and props 131,000 108,480 Theatre hall rent 90.400 62.640 Printed programs 50,700 35,640 Publicity 15,900 12,480 Administrative expenses 59.500 51,840 Total $ 813.900 $501.000 3. Tasman Products, Ltd., of Australia has a Maintenance Department that services the equipment in the company's Forming Department and Assembly Department. The cost of this servicing is charged to the operating departments on the basis of machine-hours. Cost and other data relating to the Maintenance Department and to the other two departments for the most recent year are presented below. Data for the Maintenance Department follow: Variable costs for lubricants Budget $331,200 Actual $424,560 Fixed costs for salaries and other $192,000 $206,200 *Budgeted at $23 per machine-hour. Data for the Forming and Assembly Departments follow: Forming Department Assembly Department, Total Percentage of Machine-Hours Peak-Period Capacity Required Budget Actual 698 318 9,500 11,500 100% 4,900 14,400 15,400 3,900 The level of fixed costs in the Maintenance Department is determined by peak-period requirements. Required: A. How much Maintenance Department cost should be charged to the Forming Department and to the Assembly Department? Forming Assembly Total cost charged Department Department B. How much, if any, of the actual Maintenance Department costs for the year should be treated as a spending variance and not charged to the Forming and Assembly departments? Spending variance 4. The contribution format income statement for Huerta Company for last year is given below: Sales Variable expenses Total Unit $1,006,000 $50.30 603,600 30.18 Contribution margin 402,400 20.12 318,400 15.92 Net operating income 84,000 4.20 33,600 1.68 Fixed expenses Income taxes @ 40% Net income 50,400 $ 2.52 The company had average operating assets of $506,000 during the year. Required: A. Compute the company's margin, turnover, and return on investment (ROI) for the period. Margin Turnover ROI For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. B. Using Lean Production, the company is able to reduce the average level of inventory by $100,000. Margin Turnover ROI Effect C. The company achieves a cost savings of $13,000 per year by using less costly materials. Margin Turnover ROI Effect D. The company purchases machinery and equipment that increases average operating assets by $122,000. Sales remain unchanged. The new, more efficient equipment reduces production costs by $7,000 per year. Margin Turnover ROI Effect E. As a result of a more intense effort by sales people, sales are increased by 15%; operating assets remain unchanged. Effect Margin Turnover ROI F. At the beginning of the year, obsolete inventory carried on the books at a cost of $18,000 is scrapped and written off as a loss, thereby lowering net operating income. Margin Turnover ROI Effect G. At the beginning of the year, the company uses $176,000 of cash (received on accounts receivable) to repurchase some of its common stock. Margin Turnover Effect ROI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started