Question

1. Shareholders invested $25,000 cash to begin the business. 2. Sun Shine bought a copying machine for $1,500 cash. 3. Sun Shine sold copies

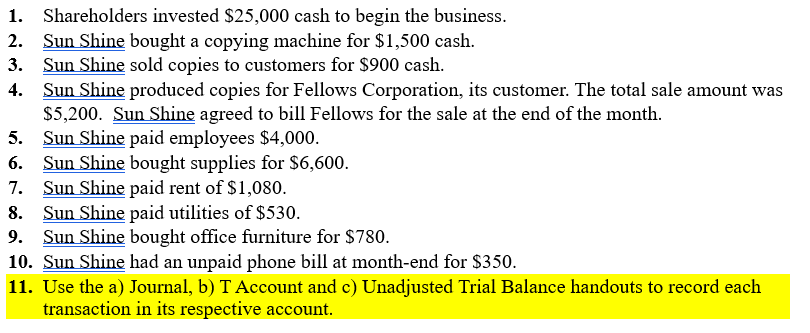

1. Shareholders invested $25,000 cash to begin the business. 2. Sun Shine bought a copying machine for $1,500 cash. 3. Sun Shine sold copies to customers for $900 cash. 4. Sun Shine produced copies for Fellows Corporation, its customer. The total sale amount was $5,200. Sun Shine agreed to bill Fellows for the sale at the end of the month. 5. Sun Shine paid employees $4,000. 6. Sun Shine bought supplies for $6,600. 7. Sun Shine paid rent of $1,080. 8. Sun Shine paid utilities of $530. 9. Sun Shine bought office furniture for $780. 10. Sun Shine had an unpaid phone bill at month-end for $350. 11. Use the a) Journal, b) T Account and c) Unadjusted Trial Balance handouts to record each transaction in its respective account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman

6th Edition

1618533118, 978-1618533111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App