Question

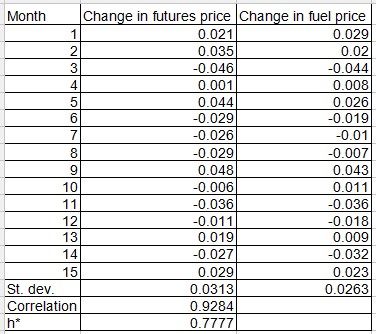

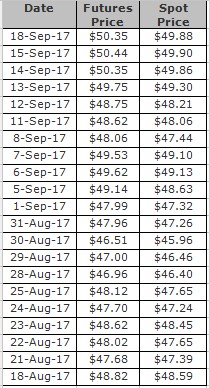

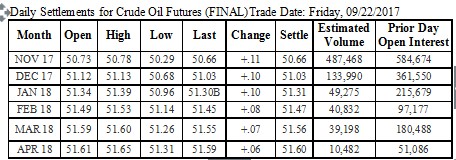

1. Shell Oil Refinery expects to pay for 100,000 barrel of crude oil at close of day on Friday, September 22nd. They want to hedge

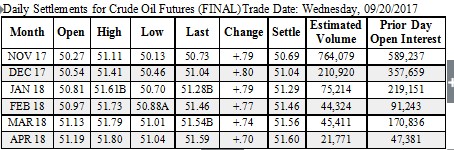

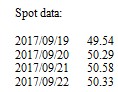

1. Shell Oil Refinery expects to pay for 100,000 barrel of crude oil at close of day on Friday, September 22nd. They want to hedge their position with crude oil futures. Assume that they enter into the position at close of day on Tuesday, September 19th. The size of one crude oil futures is 1,000 barrel. Futures and spot data is provided in the file HW2_data.doc. a. Describe the position they should enter (long or short, contract month). b. Compute the hedge ratio using data from HW2_data.xls file. c. How many contracts do they need to buy or sell? d. Document the price gain or loss every day that their position is open. e. What is the total cost after they have closed out their futures position, and made their payment? f. What is the effective cost per barrel?

9248691731689233 002 0 0 156149698 234042224 61979347 31122187 00000327 0097 123456789012345 dr sch

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started